Liquid Staking Tokens (LST) to The Battle Field

Behind the recent rise of BCH and its fork gang was surprisingly the Korean crypto market. How are ETF application and FTX's debt clearance going? Follow through with M3TA!

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

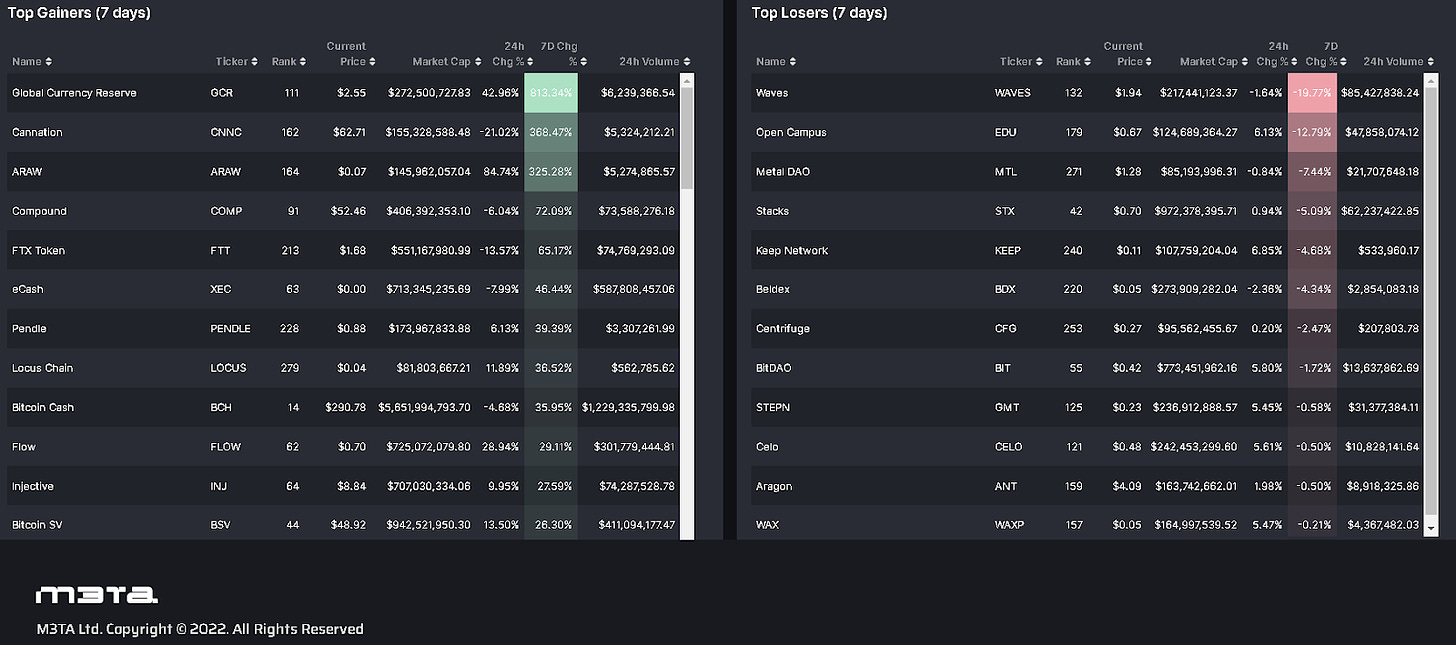

Top performers (7D)

Compound - $COMP: +72.09%

Price as of time of writing: COMP/USD - $52.46

Compound, an Ethereum-powered lending and borrowing protocol, utilizes algorithmic mechanisms to determine interest rates by analyzing the activity within its liquidity pools.

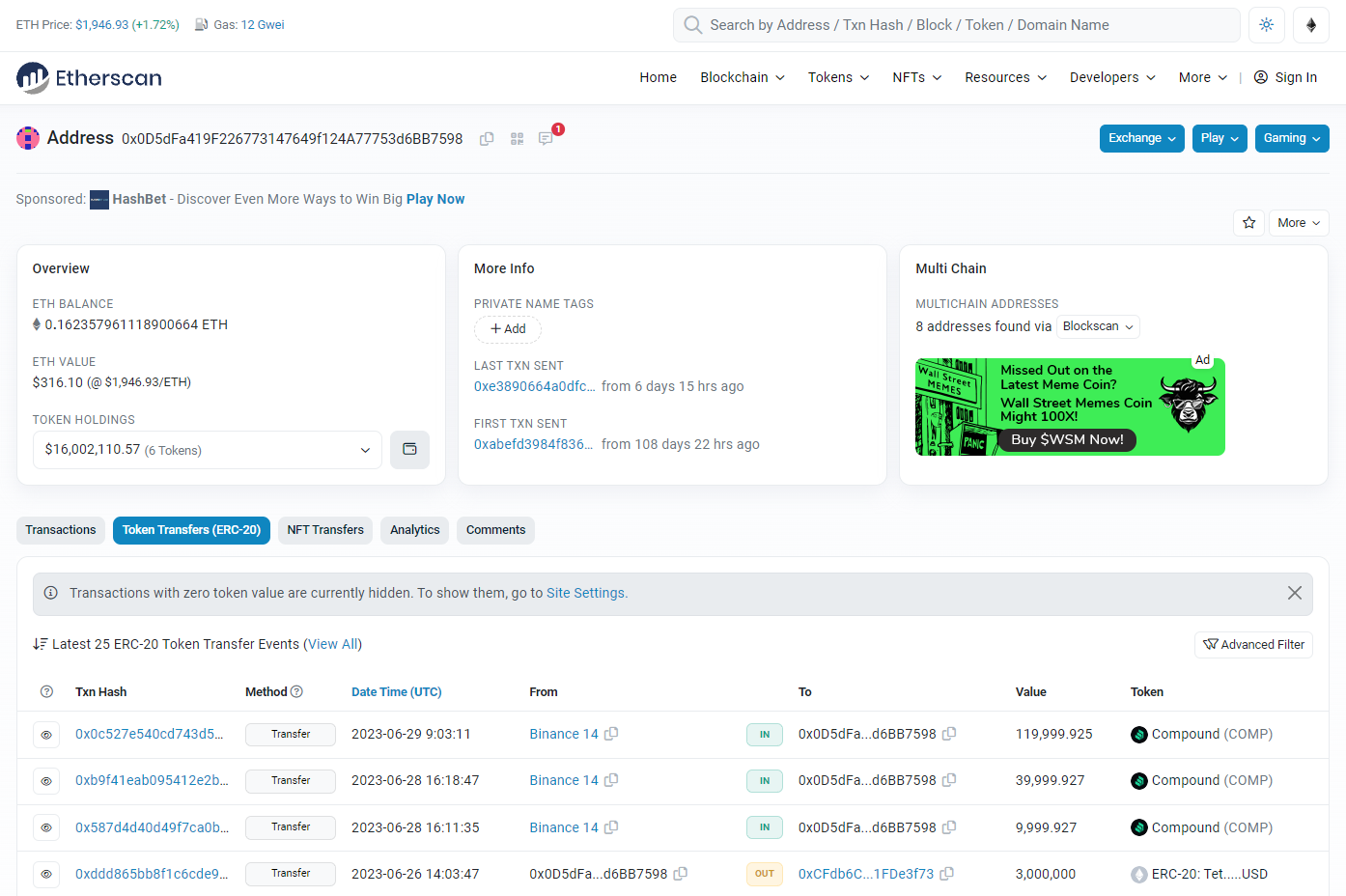

The price surge could be attributed to whale/institutional accumulation on Binance, as evidenced by the withdrawal of approximately 170k $COMP from the exchange to their wallet.

FTX Token - $FTT: +65.17%

Price as of time of writing: FTT/USD - $1.68

FTX is a centralized exchange founded by Sam Bankman that experienced bankruptcy since November 2022 due to multiple instances of mismanagement of customer deposits and reckless use of funds. FTX is now under a new management board.

The token witnessed a significant surge as FTX engaged in initial talks with investors to revive FTX.com, potentially leading to rebranding and the resumption of operations. Currently, $7 billion in liquid assets have been recovered, however, they are still facing a shortfall of $1.7 billion out of the total $8.7 billion required to repay customers.

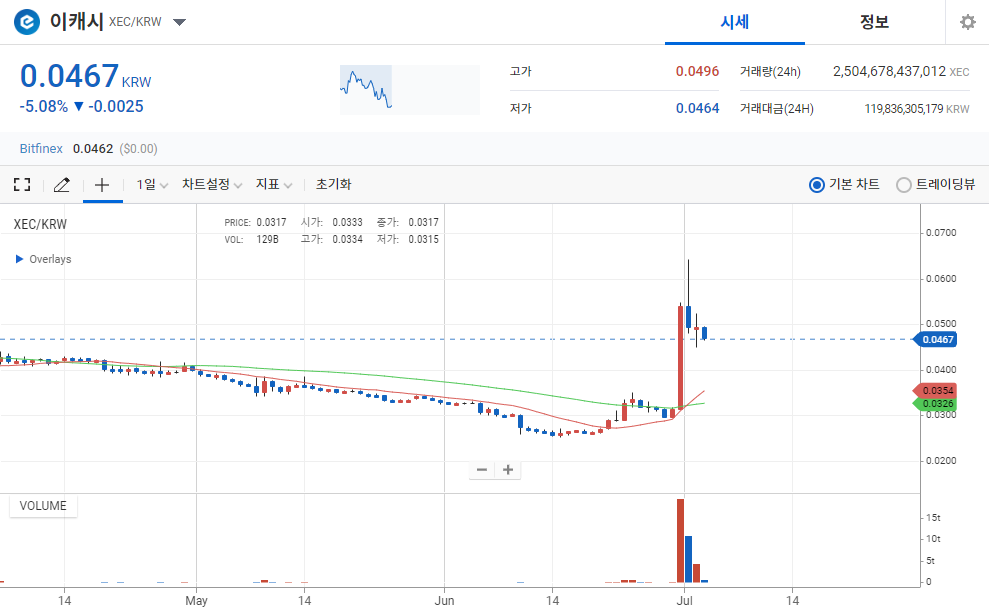

ECash - $XEC: +46.44%

Price as of time of writing: XEC/USD - $0.000036

ECash is a fork of Bitcoin Cash ABC (BCHA), a derivative of Bitcoin and Bitcoin Cash. It maintains the security mechanism known as Proof of Work (PoW) but aims to introduce an additional method called "Avalanche consensus" (no relation to AVAX) based on Proof of Stake (PoS). This new consensus approach allows for increased compatibility with EVM servers and boosts transaction speed by increasing the block size to 1TB.

XEC surges in response to Bitcoin Cash's recent increase. In addition, South Korean investors show significant interest, with $266 million in 24-hour trading volume. Upbit's XEC/KRW pair contributed $206 million, accounting for 77% of the trading volume.

Pendle - $PENDLE: +39.39%

Price as of time of writing: PENDLE/USD - $0.88

Pendle is an LSDfi platform that operates on both Ethereum and Arbitrum chains. The platform offers two modes, basic and advanced for users, known as buying assets at a discount by locking assets with sufficient “maturity”. In addition, Pendle has implemented a ve(3,3) mechanism, leading to a competitive situation between Equilibria Finance (EQB) and Penpie (PNP), where both are incentivized to outdo the other, often described as a 'bribe war'.

The price of $PENDLE experienced a surge due to anticipatory buying. On July 3rd, Binance's announcement of listing PENDLE on their platform contributed to this surge.

Locus Chain - $LOCUS: +36.52%

Price as of time of writing: LOCUS/USD - $0.04

Locus Chain is a Layer 1 blockchain that integrates with other industries such as AI, Smart City, and Gaming that require processing large-scale data. Locus is developed by the Bloom Technology team, with CEO Sang Yoon Lee, who has also been appointed as the Vice Chairman of the Korea Blockchain Association.

The token surge could be attributed to Locus's recent partnership announcement with Creta, a web3 gaming platform.

Top losers (7D)

Waves Blockchain - $WAVES: -19.77%

Price as of time of writing: TOMI/USD - $1.94

Waves is a Proof of Stake blockchain (PoS) designed to enable users to create and launch custom crypto tokens and exchange, and trade cryptocurrencies.

WAVES experiences a price decline as investors capitalize on the previous surge and take their profits.

Open Campus - $EDU: -12.79%

Price as of time of writing: EDU/USD - $0.67

Open Campus Protocol is a community-led Web3 educational platform that aims to tokenize global educational content. It allows creators of educational content to earn money and provides an alternative education system for those who want to learn.

Since its initial token release, the value of the token has consistently declined, resulting in a lack of positive sentiment towards purchasing it.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Gross Domestic Product (GDP) - a measure of the total monetary value of all final goods and services produced within a country during a specified time period.

US Q1 2023 GDP exceeds expectations, growing at 2% instead of the projected 1.3%.

Personal Consumption Expenditures Price Index (PCE) - measure how much people in the US are paying for goods and services.

Core PCE index shows a 0.3% monthly increase, meeting estimates, while the annual year-over-year increase stands at 4.6%, slightly below expectations.

Fed said they expected a minimum of two additional quarter-point interest rate increases by year-end.

Micro

EuroGamer - Jun 29, 2023

Ubisoft announces its first Web3 game, Champions Tactics: Grimoria Chronicles, to be launched on the Oasys blockchain.

A specialized blockchain for games, Oasys blockchain was established in February 2022 and is supported by companies like Bandai Namco, Sega, Ubisoft, and Square Enix.

Champions Tactics: Grimoria Chronicles is described as a "PvP tactical RPG experimental game" currently in development for PC.

CoinTelegraph - Jul 02, 2023

In a podcast on Jun 29, Ethereum founder Vitalik Buterin revealed he is only staking a small fraction of his ETH due to the requirement of a multisig setup. However, he finds the process of setting up multi-signature wallets too complex.

He also discussed the EigenLayer protocol and stated that it could cause "centralization risks". This protocol allows Ethereum validators stakers to "re-stake" their assets onto other emerging networks.

News Highlight

Decrypt - Jun 30, 2023

The U.S. Securities and Exchange Commission (SEC) returned recent spot Bitcoin ETF applications, including those from BlackRock and Fidelity Investments, deeming them not “sufficiently clear or comprehensive.”

The SEC believes that Bitcoin ETF applicants have not provided sufficient details on their plans to manage a "surveillance-sharing agreement."

The surveillance-sharing agreement is designed to prevent fraud and manipulation by ensuring that the fund issuer monitors market trading activity, clearing activity, and customer identity.

However, the SEC has expressed that all Bitcoin ETF applications have been inadequate in addressing this requirement so far.

Despite the SEC's skepticism regarding a Bitcoin ETF, HSBC in Hong Kong has granted investors access to BTC and ETH ETFs as of June 26.

CoinDesk - Jul 02, 2023

Poly Network, a cross-chain interoperability protocol, was exploited, affecting 57 assets on 10 blockchains.

Attackers exploited a smart contract function in PolyNetwork's bridge tool, allowing them to issue tokens worth billions of dollars.

The attackers manipulated the bridge to issue tokens on one network that didn't actually exist, resulting in the creation of billions of tokens, including 24 billion BUSD and BNB on the Metis blockchain, 999 trillion SHIB on the Heco blockchain, and millions of other tokens on networks like Avalanche and Polygon

The total value of the tokens held by the attackers' wallet was over $42 billion immediately after the attack.

Poly Network has contacted exchanges & law enforcement, seeking cooperation from the attacker to return assets & avoid legal consequences. Urged projects to withdraw liquidity, users to expedite withdrawals & unlock LP tokens.

Digital Asset - Jun 30, 2023

Prosecutors initiate a full-scale forced investigation on WeMade, a KOSDAQ-listed gaming company and WEMIX token market maker.

This is the first search and seizure for WeMade, separate from a previous investigation related to WEMIX controversy.

The investigation follows a complaint filed by WEMIX investors against WeMade and CEO Jang Hyun-guk on charges of fraud, embezzlement, and breach of trust.

WeMade has been involved in controversies, including liquidation without notifying WEMIX users and false disclosure of distribution volume.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.