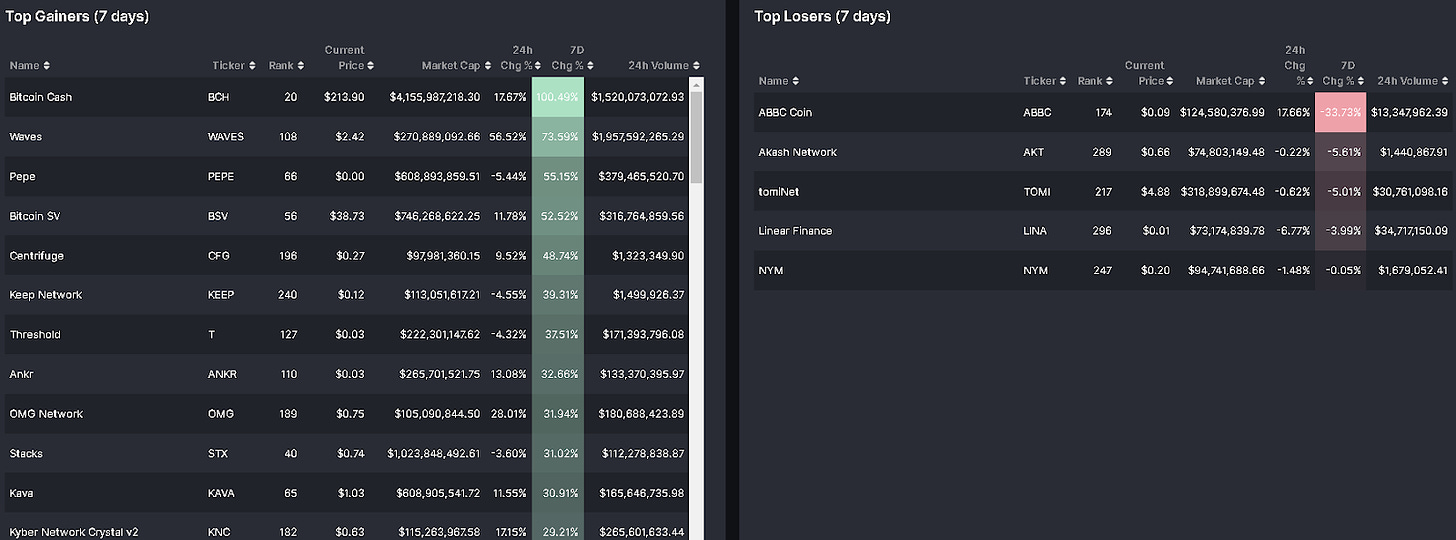

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Top performers (7D)

BitcoinCash - $BCH: +100%

Price as of time of writing: BCH/USD - $213.9

Bitcoin Cash was born in 2017 as a result of a disagreement within the Bitcoin community about a proposed update called SegWit, which aimed to double Bitcoin's block size to 2MB. Besides expanding the block size to 8MB, Bitcoin Cash focuses on payment by offering very low transaction fees.

The listing of the token alongside Bitcoin (BTC), Ether (ETH), and Litecoin (LTC) on EDX, the exchange supported by Fidelity, Schwab, and Citadel, has caused a surge in $BCH.

Waves - $WAVES: +73.59%

Price as of time of writing: WAVES/USD - $2.42

Waves is a Proof of Stake blockchain (PoS) designed to enable users to create and launch custom crypto tokens and exchange, and trade cryptocurrencies.

On June 23, DWF Labs, a well-known crypto investment firm, committed 500K $WAVES during the launch of Waves Dao, which served as a motivation for the price increase.

BitcoinSV - $BSV: +52.52%

Price as of time of writing: BSV/USD - $38.73

Bitcoin SV is a fork from Bitcoin Cash (BCH) blockchain in 2018, with a larger block size (128MB), which allows for faster processing speeds of over 50,000 transactions per second (TPS).

The increase in the price of BSV may be attributed to the upward movement of $BTC and $BCH prices last week.

Centrifuge - $CFG: +48.74%

Price as of time of writing: CFG/USD - $0.27

Centrifuge is a DeFi lending protocol on Polkadot blockchain making credit accessible to small businesses while offering stable yields to investors by opening liquidity to traditional finance. Its dApp, Tinlake, is a marketplace for tokenized real-world assets, enabling companies to use NFTs as collateral for loans and access funds from individual investors, and linking users to liquidity pools on Ethereum.

The value of CFG has increased because Centrifuge Chain is about to launch its first pool. CFG rewards will be available on Tinlake pools and potentially on the Centrifuge Chain pool as well.

Keep Network - $KEEP: +39.31%

Price as of time of writing: KEEP/USD - $0.12

Keep is a network for storing and encrypting personal data on a public blockchain. These pieces of private data are stored in off-chain containers for enhanced privacy.

tBTC is a decentralized bridge that connects Bitcoin and Ethereum. It utilizes the Threshold Network, a merger of Keep Network and NuCypher.

$KEEP price increased as Threshold Network launched tBTC on Optimism and Velodrome.

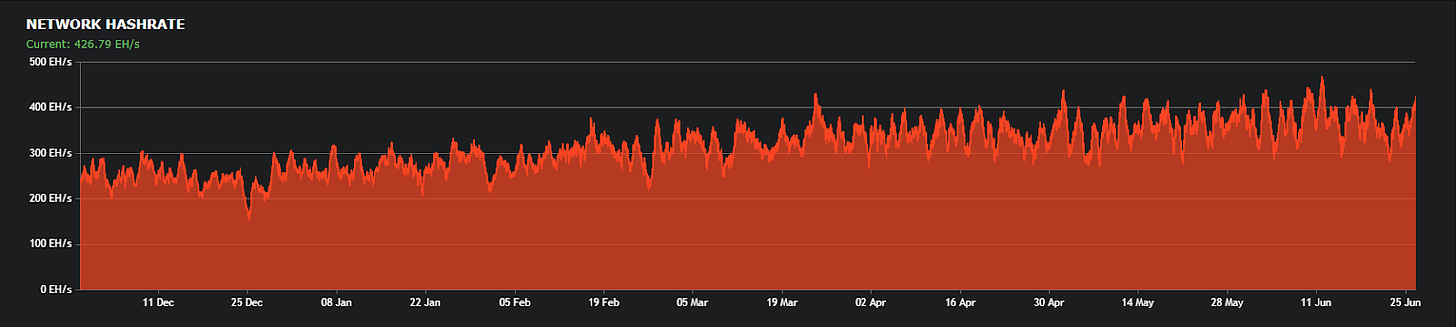

The flow of money into Bitcoin, the hashrate, and difficulty have not shown signs of cooling down, indicating that miners are still actively involved in proof-of-work (PoW). BTC related projects such as Bitcoin Cash, BitcoinSV and Keep Network benefit the most from this trend.

Top losers (7D)

tomiNet - $TOMI: -4.88%

Price as of time of writing: TOMI/USD - $0.48

tomi is a web3 company that leverages decentralized Domain Name Service (DNS), including high-performance computing technology, a multi-chain wallet, and a unique browser to enhance the decentralization of digital assets and cloud services. Their ultimate goal is to establish a web3 internet infrastructure that optimizes decentralization.

BTC saw a notable price increase last week after BlackRock filed for a Spot Bitcoin ETF with the SEC. As a result, there were very few losers this week.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Initial Jobless Claims - measures the number of individuals who filed for unemployment insurance for the first time during the past week.

US jobless claims for the week ending June 17 stayed at 264,000, matching the previous week's level.

Micro

Decrypt - Jun 20, 2023

ETFs, or exchange-traded funds, are funds that trade on exchanges and track specific indexes.

Bitcoin ETF is a type of investment on the traditional exchange that tracks the price of Bitcoin.

BlackRock, a $9.5 trillion asset manager, made a significant move into the crypto space last week, filing for a Bitcoin ETF with the SEC to facilitate public access to a Web3 product.

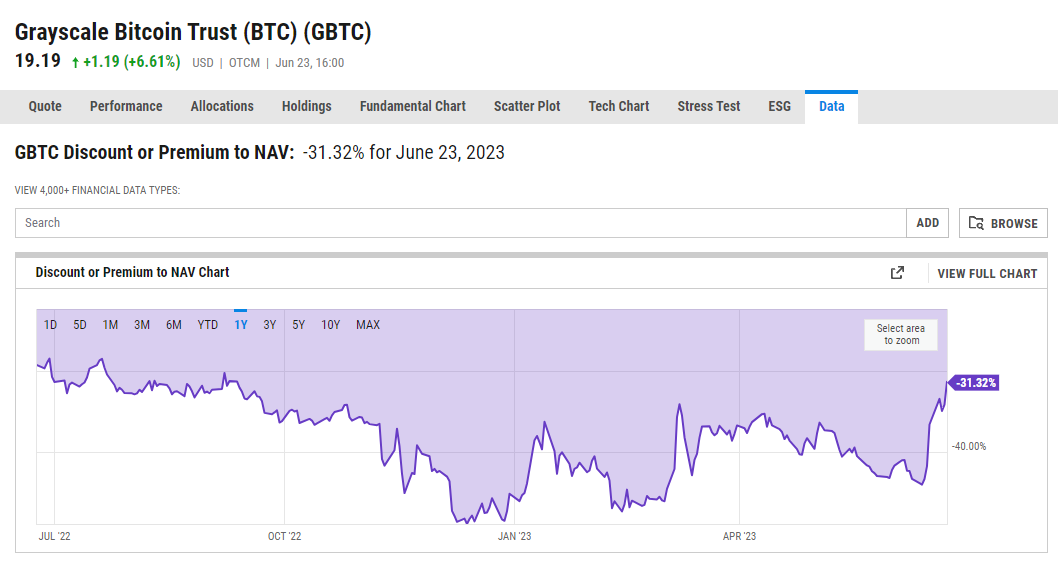

The precursor Grayscale's Bitcoin Trust (GBTC) experienced a surge of over 12% in share prices following the news.

The "GBTC Discount” hit a monthly low of -31.32%. The indicator measures how much GBTC shares are undervalued compared to the actual Bitcoin they represent. As the number decreases, it could be seen as a bullish signal because this suggests that investors are willing to pay more for GBTC shares, potentially due to optimistic expectations for Bitcoin's price.

Grayscale has been seeking approval for a Bitcoin ETF since 2016, facing rejections and initiating legal actions against the SEC.

Despite the SEC's historically strict stance on cryptocurrencies, BlackRock's application has boosted investor sentiment towards GBTC.

On Jun 21, 2023, WisdomTree, Invesco and Valkyrie also joined BlackRock in spot BTC ETF application.

On Jun 23, 2023, the SEC has approved the launch of the first leveraged #Bitcoin futures ETF in the US.

The news propelled the price of BTC to surpass $31,000 on June 23.

CoinDesk - Jun 19, 2023

BNB Chain has released the opBNB testnet, an EVM-compatible blockchain based on Optimism's OP Stack.

The opBNB testnet aims to achieve speeds of 4,000 TPS at a cost of 0.005 U.S. cents per transaction.

Testnets simulate real-world blockchain usage for developers to test applications before deploying on the mainnet.

OP Stack is the open-source software foundation for blockchains like Optimism.

Network congestion and high fees are common issues in blockchains.

Porting a network to a Layer 2 blockchain can reduce congestion and lower transaction costs by batching multiple transactions.

opBNB's EVM-compatible platform enables developers to create open ecosystems, migrate applications to BSC, and expand their user base.

M3TA_Analytics - Jun 21, 2023

The Proposed Change:

Increase the maximum validator balance to address operational efficiency and reward compounding.

Pros: Enhanced interest returns for solo validators, potential decrease in minimum staking amount.

Cons: Potential inflation and centralization with a larger validator set.

For answers to why this proposal comes up at discussion, read our summary tweet here.

News Highlight

Three Arrows Capital (3AC) Founders Launch New Venture Capital Fund Following Bankruptcy

CoinDesk - Jun 22, 2023

Three Arrows Capital (3AC) announces a surprise comeback as a venture capital firm.

OPNX, a platform aiding users hit by crypto bankruptcy, co-founded by CoinFLEX executives and 3AC members, is partnering with 3AC Ventures.

The partnership announcement with 3AC Ventures generated mixed reactions from the crypto community, including involvement from Arthur Hayes, Co-Founder of BitMEX and Twitter influencer LilMoonLambo.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.