Yield Guild Games Made a Comeback

Is GameFi really dead? We believe not, especially considering YGG's recent launch of new quests for gamers.

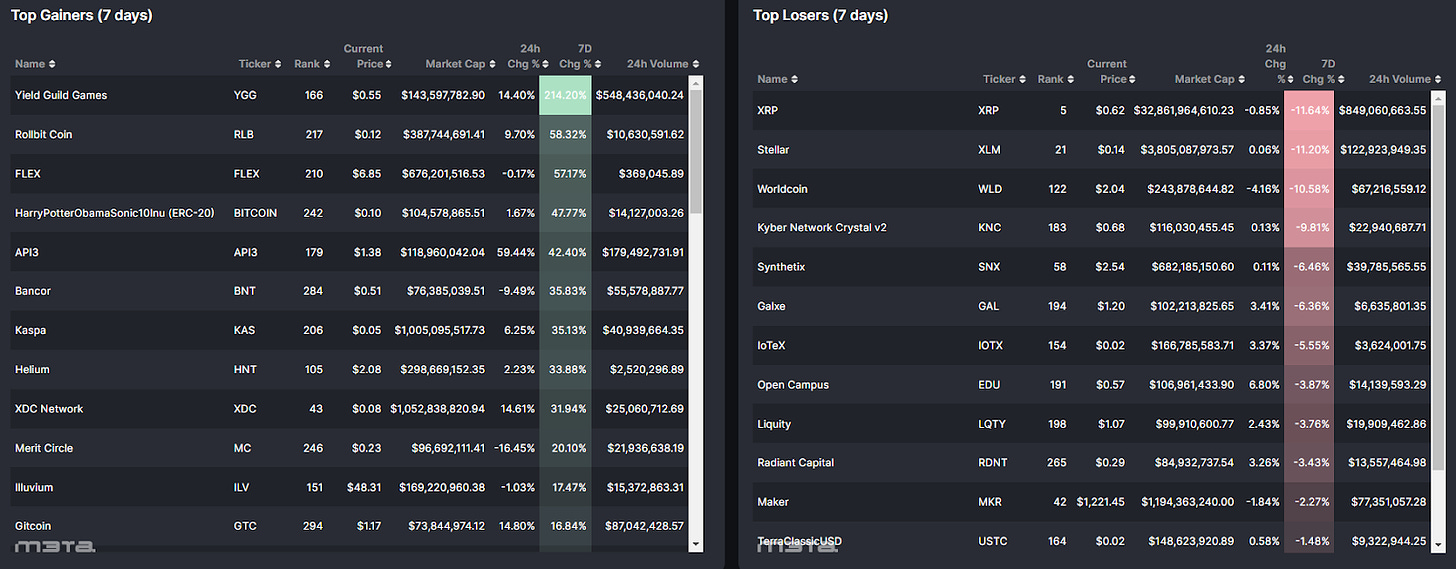

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Top performers (7D)

YieldGuildGames - $YGG: +214.2%

Price as of time of writing: YGG/USD - $0.55

Yield Guild Games (YGG) is a blockchain gaming guild centered on play-to-earn games, connecting global blockchain gamers and investors. Their mission is to create a supportive community that fosters growth and exploration in the NFT gaming realm.

The introduction of Guild Advancement Program (GAP) season 4 and the token's listing on Binance Future serve as catalysts for the growth in value of the token.

RollbitCoin - $RLB: +58.32%

Price as of time of writing: RLB/USD - $0.12

Rollbit serves as a hub for lotteries and various betting options, alongside offering Futures trading with leverage reaching up to 1000x for over 20 prominent trading pairs. Those participating in the lottery commit a specific quantity of RLB tokens, earning them 20% of Rollbit casino's revenue as incentives.

The value of RLB surged dramatically following a tweet by Rollbit's co-founder about an upcoming significant release scheduled for the following week.

CoinFlex - $FLEX: +57.17%

Price as of time of writing: FLEX/USD - $6.85

CoinFLEX (Coin Futures and Lending Exchange) is a cryptocurrency exchange that focuses on futures and perpetual contracts. Unlike other exchanges that offer spot trading, CoinFLEX also offers an Automated Market Maker (AMM+) feature that allows users to earn yield without dedicating much time or effort to actively trade.

There has been a sustained increase in $FLEX price over the past several months.

API3 - $API: +42.40%

Price as of time of writing: API/USD - $1.38

API3 is a platform that enables blockchain-based decentralized applications (dApps) to access blockchain-external, real-world data and services via application programming interfaces (APIs).

Despite no major project announcements or partnership news, the token's price has surged, possibly linked to API3's high short interest. While API3's decentralized API oracle network holds promise, there haven't been new fundamental developments justifying the current rally.

Bancor - $BNT: +35.83%

Price as of time of writing: BNT/USD - $0.51

Bancor serves as an on-chain liquidity protocol, facilitating decentralized and automated exchanges on Ethereum and various other blockchains.

One of its products, Carbon, a decentralized exchange, was introduced in early May 2023, featuring notable elements like Strategies trading and limit orders.

Notably, since August 4th, Bancor's trading volume and transaction count have notably risen, resulting in an abrupt spike in the token's value.

Top losers (7D)

Ripple - $XRP: -11.64%

Price as of time of writing: XRP/USD - $0.62

Ripple is an open-source, permissionless, and decentralized technology that serves as a payment settlement system and currency exchange network, capable of processing global transactions. Ripple also supports countries in launching Central Bank Digital Currencies (CBDCs).

XRP was among the Top Performers 4 weeks ago.

Stellar - $XLM: -11.20%

Price as of time of writing: XLM/USD - $0.14

Stellar is a blockchain based on the Ripple platform, known as an open network that allows the movement and storage of tokens on the Stellar network. Half of the tokenized treasury products were found to be issued on Stellar with a lot of TradFi institutions choosing Stellar instead of Ethereum, according to Our Network #176.

Worldcoin - $WLD: -10.58%

Price as of time of writing: WLD/USD - $2.04

Worldcoin, backed by OpenAI's CEO Sam Altman, envisions a global identity and financial network accessible to everyone. They utilize Orb, a scanning device for iris recognition, to establish unique identities and distinguish real individuals from bots. Incentives in the form of $WLD are given to those who undergo this process, ensuring authenticity in an AI-driven era.

WLD was among the top performer last week.

Kyber Network Crystal v2 - $KNC: -9.81%

Price as of time of writing: KNC/USD - $0.68

Kyber Network is a multi-chain hub of liquidity protocols that aggregates liquidity from various sources to provide secure and instant transactions on any decentralized application (DApp). The main goal of Kyber Network is to enable DeFi dApps, decentralized exchanges (DEXs) and other user-friendly access to deep liquidity pools that provide the best rates.

KNC was among the top performer last week.

Synthetix - $SNX: -6.46%

Price as of time of writing: SNX/USD - $2.54

Synthetix is a lending and borrowing protocol that allows users to collateralize and mint synthetic assets (tokens represent real-word assets) on the Ethereum and Optimism networks.

SNX was among the Top Performers 4 weeks ago.

These tokens are undergoing price decreases as a corrective step in response to a recent surge in prices over the past few weeks.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

ADP Employment Change - a monthly report of economic data that tracks nonfarm private employment in the U.S.

In the month of July, private employers expanded their workforce by 324,000 jobs.

Average Hourly Earnings - measures average hourly earnings for all employees on US private nonfarm payrolls

The MoM average hourly earnings are 0.4% above the anticipated 0.3%, while the YoY average hourly earnings are 4.4% higher than the expected 4.2%.

Nonfarm Payroll - measures the change in the number of people employed during the previous month, excluding the farming industry, non-profit organizations and active military.

Nonfarm payroll however, 187k is lower than the expectation of 200k

The consensus among economists is that the U.S. job market is indeed showing signs of cooling off. Nevertheless, there remains uncertainty about whether the Fed will opt for an interest rate hike. Further indicators are needed before reaching a conclusion.

Micro

Frax Finance Proposal - Aug 1, 2023

The Frax Protocol's FRAX v3 RWA asset strategy involves holding secure cash deposits and low-risk cash-equivalent assets, such as reverse repo contracts (financial transactions between two parties) and treasury bills, as it seeks to offer a decentralized stablecoin with better stability.

Why Frax needs RWAs (risk-weighted assets)

Risk-weighted assets represent the capital reserves a bank is required to maintain to safeguard against potential losses.

These are calculated by multiplying an asset's value by a risk weight based on its perceived riskiness – like a loan to a government-backed entity having low risk weight and one to a small business having higher risk weight.

Risk-weighted assets enable diverse applications:

DeFi lending platforms can determine necessary capital reserves for default protection.

DeFi derivatives exchanges can calculate user-required margin.

DeFi asset management firms can assess investment portfolio risk.

FinresPBC as a RWA Partner

FinresPBC, a public benefit corporation, collaborates with Lead Bank and similar institutions to hold secure assets for Frax Protocol, including FDIC-insured savings, stablecoins like Paxos USDP and Circle USDC, and US Treasury bills.

Aside from Frax Finance, other DeFi projects leveraging risk-weighted assets can also enhance regulation and investors' confidence, thereby boosting mainstream investor appeal.

SEC - Aug 1, 2023

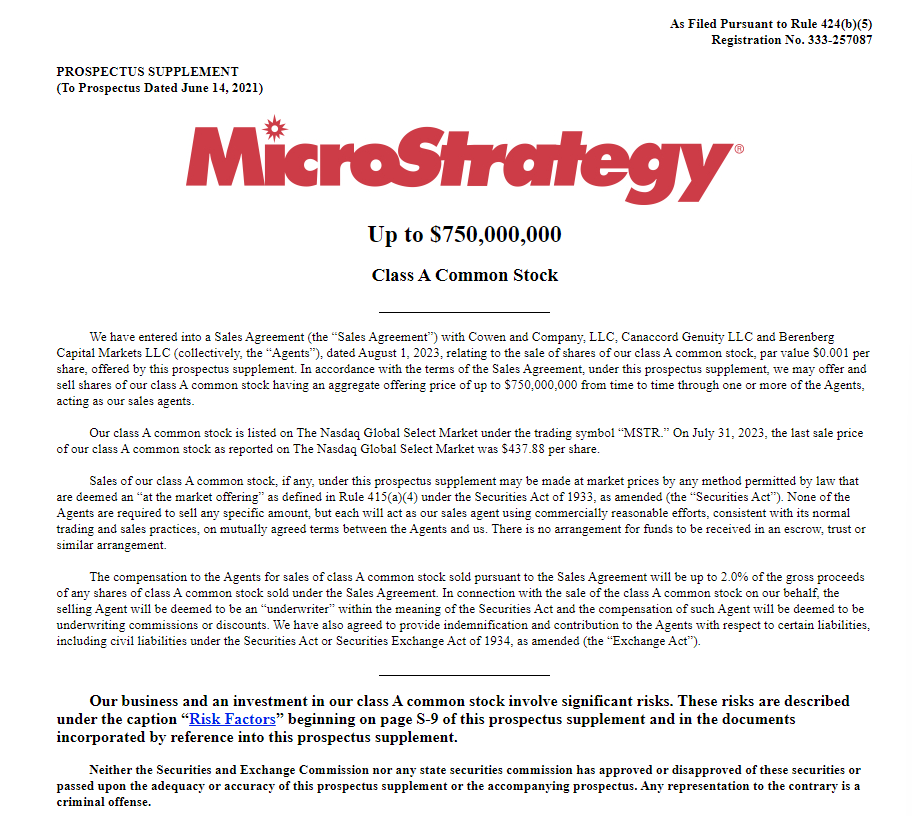

On August 1, 2023, MicroStrategy held 152,800 BTC and revealed plans to acquire more through a $750M stock sale, which subsequently drove BTC to reach $30k.

M3TA Telegram - Aug 3, 2023

Nifty’s, an NFT-powered experience platform with high-profile backers like Mark Cuban and Joe Lubin, is shutting down.

Despite hosting NFTs of popular franchises and celebrities like "The Matrix," "Game of Thrones," LeBron James, and Looney Tunes characters, the platform's discontinuation was announced.

In May, the company was actively developing a new product and seeking capital, but the plans didn't materialize effectively.

As part of the transition, a significant portion of its digital assets has been shifted to the Polygon blockchain to ensure compatibility with major NFT marketplaces like OpenSea.

News Highlight

M3TA Telegram - Aug 1, 2023

$BALD, a memecoin, was launched on layer 2 Base on July 30 and rapidly gained popularity, achieving a $100 million market cap and $25 million liquidity within 2 days.

In the initial hours following its debut, $BALD experienced a bullish trajectory, thanks to a huge injection of liquidity, including a staggering 6,700 $ETH amounting to $12.5 million. This created a surge in demand that sent the coin's price soaring.

However, like any rollercoaster ride, the ascent had to reach its peak eventually. As liquidity injections came to a halt, the price of $BALD encountered a period of stagnation, followed by a 90-degree decline.

Just as investors began to brace for impact, a twist in the narrative unfolded. The deployer, seemingly undeterred, resumed their bidding on $BALD, triggering an unexpected price doubling that breathed fresh life into the coin.

The plot took an intriguing turn when the deployer made a daring move—swiftly withdrawing all liquidity. The deployer earned a remarkable 3,048 ETH, equivalent to a staggering $5.7 million.

For some, $BALD turned into a bitter lesson, causing them to lose a considerable portion of their investments.

Adding to the intrigue, the rug pull occurred on LeetSwap, Base's biggest DEX. At the same time, LeetSwap also alleged their own exploitation.

CoinDesk - Aug 1, 2023

Founder Michael Egorov's $168 million lending position at Curve Finance representing about 34% of CRV's total market cap faced high risk of liquidation following a weekend exploit of $61M.

CRV's price dropped over 20% due to the exploit, pushing Egorov closer to potential liquidation levels.

Curve already suffered a $70 million asset exploit and a drop in locked assets from $3.2 billion to $1.6 billion.

Egorov's potential liquidation could impact other DeFi lending protocols and CRV's price due to their interconnected nature.

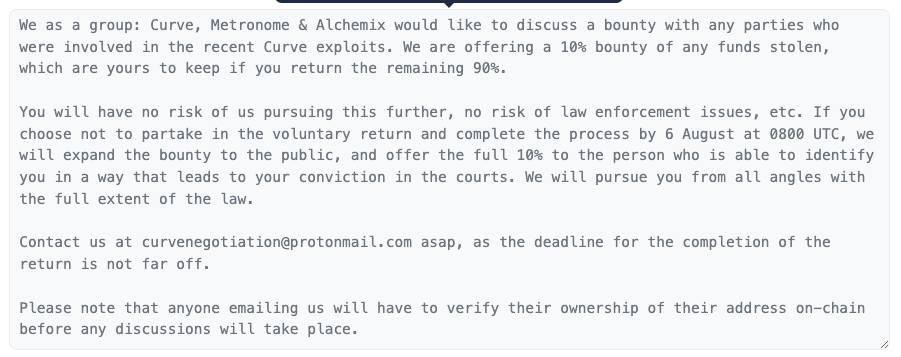

On August 4, the exploiter returned ~$10M of ether (ETH) and alETH to Alchemix's multisignature wallet in multiple transactions with a note.

Curve responded by acknowledging the message and proposed a deal to the hacker: they offered 10% of the exploited funds in exchange for returning 90% of the total amount. If the hacker refused, Curve warned of involving law enforcement.

However, the exploiter didn't return all funds within the deadline. Curve has now widened the bounty to the public, offering 10% of the remaining exploited funds for discovering the exploiter.

CoinDesk - Aug 4, 2023

Polygon leveled accusations against Matter Labs, alleging the unattributed copying of its open-source code in the updated Boojum, incorporating portions from Polygon's "Plonky2" software library.

Polygon emphasized that open-source licenses mandate proper acknowledgment of code origin, asserting that unattributed code pasting is detrimental to the ecosystem.

In response, Matter Labs refuted the claims, asserting that the code in question was attributed on the first line of the respective file.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.