Weekly Report: June 20 - June 26, 2022

New developments from Coinbase, a new smartphone from Solana, and yet another multi-million dollar hack. Read on for this week's market updates and latest headlines!

1. Cryptos’ Descent Slows, BTC Stabilizing at $20K

CoinDesk – June 24, 2022 at 3:34am EST

After what seemed like a tumbling market collapse over the past week, crypto-assets stabilized somewhat on Thursday, following volatile trading on Wednesday, when Bitcoin ($BTC) fell below its $20,000 support level and other altcoins followed suit. Thursday afternoon saw $BTC return to $20,900, recuperating from a 24-hour low of $19,764, and Ether ($ETH) saw its most significant increase in some time, up by 5.5% to over $1,100.

Stocks also rose on Thursday, with the S&P 500 up 1% and the tech-heavier Nasdaq up 1.5%, indicating a subtle improvement in risk-oriented investment sentiment. Altcoins followed, many benefitting throughout the day from this overall market recovery. $MATIC, Polygon’s native token, stood out from the crowd, increasing 19% within the 24 hours following Polygon’s improved privacy features for its network’s decentralized autonomous organizations (DAOs). $ATOM, Cosmos’ native token, gained 12% following an announcement from DeFi exchange dYdX stating its intention to build its own blockchain, opting for Cosmos' interoperable network over Ethereum.

The $20,000 support level of $BTC is a critical one for the market to observe over the coming days and weeks. Analysts postulate that if the price of bitcoin declines further, prices could fall as low as $10,000, harkening back to the previous major market declines in 2013, when $BTC fell by 85%, and in 2017, when it dropped by 84%.

Crypto exchanges, most of all, will be affected by declining prices in the near future. Riyad Carey, an analyst at crypto data firm Kaiko warns:

“As prices remain low, volumes decrease, hedge funds unwind and fees compress, exchanges will be put to the test. Those that have enough volume and spent responsibly through the bull market will likely be able to weather the storm, while those that played fast and loose with risky staking products and investments may go under if they aren’t acquired or bailed out by FTX or Alameda.”

2. Coinbase Launches First Crypto Derivative Product Targeting Retailers

CoinDesk – June 24, 2022 at 11:41pm EST

Coinbase Derivatives Exchange, formerly FairX, is launching its first crypto derivatives product known as Nano Bitcoin Futures (BIT) on June 27th. Coinbase Derivatives Exchange, which is regulated by the Commodity Futures Trading Commission (CFTC), is also expecting regulatory approval on its own futures commission merchant (FCM) license to offer margined futures contracts for its clients.

Currently, the crypto derivatives market is valued at $3 trillion globally, allowing for high potential growth through product development. While the expected launch arrives at a highly volatile time for the crypto market, having witnessed crashes from massive DeFi projects like Terra Luna and Celsius, the new futures division of Coinbase could grow substantially after the bear market ends from this new endeavor.

This growth would result, in part, due to the fact that futures contracts are smaller in size and are aimed at retail participation. According to the statement released by Coinbase Derivatives Exchange:

“At 1/100th of the size of a Bitcoin, [futures contracts] requires less upfront capital than traditional futures products and creates a real opportunity for significant expansion of retail participation in US-regulated crypto futures markets.”

These innovations and advances within the futures markets don’t come without opposition. Recently, a senior Dutch financial regulator stated that crypto derivatives needed to be restricted in the wholesale market, for fear of market manipulation and criminal activity.

Despite these concerns, large institutions such as Goldman Sachs and JPMorgan have already begun trading crypto derivatives contracts, allowing their clients to trade the volatility within the market and ensure themselves against the potential downside.

Coinbase purchased FairX earlier in 2022 to launch its derivatives products. FairX itself was launched as an independent futures exchange platform in May 2021. BIT Futures will be available for trading through many brokerage intermediaries including retail brokers EdgeClear, Ironbeam, Ninja Trader, and more.

3. Solana Introduces Its Own Handheld Device, Saga Phone

CoinDesk – June 25, 2022 at 1:22am EST

Solana has taken a step further to bring crypto closer to the mainstream, this time in the form of a smartphone.

Solana CEO, Anatoly Yakovenko, yesterday introduced a mobile device called “Saga” - the first mobile phone explicitly built for web3 users. Saga is an Android device with built-in Web3 and crypto features like an encrypted crypto wallet, the “Solana Mobile Stack (SMS)”, and a dApp store with flagship applications like Solana Pay.

Unlike the famous Apple Store on iOS, Saga’s dApp marketplace won't take any “extractive fees” from the applications they facilitate, according to the founder of Solana - Anatoly Yakovenko.

The first web3 phone, naturally, comes with special NFTs for early bidders of the device that are known collectively as the “Saga Pass.” This NFT is a “community passport”, whose “long-term vision… is for the early adopters and developers to govern and influence the direction of the platform”.

The Saga will be available to purchase for $1000. Interested customers can pre-order it with a $100 deposit on their official website: https://solanamobile.com/. The Solana team plans to ship the first Saga phone in Q1 next year.

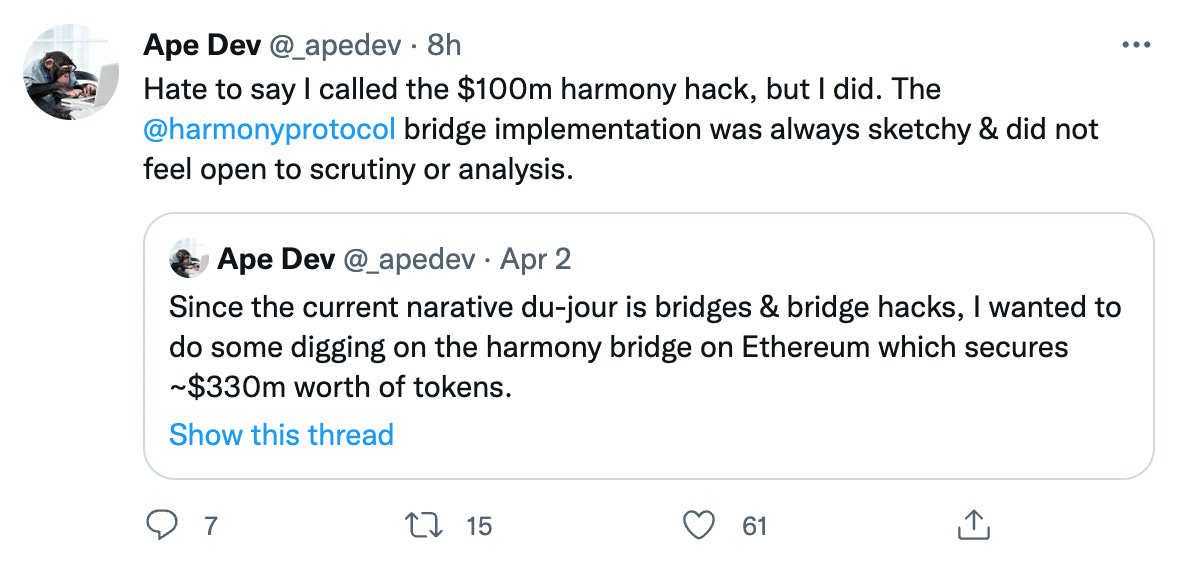

4. Approximately $100M Stolen From Harmony’s ($ONE) Horizon Bridge

CoinDesk – June 24, 2022 at 11:29pm EST

The Harmony Protocol, a project with less than $300M in market cap, was hacked for ⅓ of its value on June 23rd.

According to the thief’s wallet identified on Etherscan, nearly $100M worth of funds were extracted from one of Harmony’s bridges late at night on June 23rd. The compromised bridge called “Horizon” was home to:

41.2 million worth of USDC

12.3 million worth of BTC

26.1 million worth of other stablecoins

Millions more in the following currencies: AGG, FXS, SUSHI, AAVE and WETH

The hack itself was over within 18 minutes. After the heist, the hacker transferred the stolen funds to two other wallets and began to convert the majority of the funds into $ETH using the Uniswap DEX. At the time of writing, the hacker’s wallet holds 85,867 Ether, worth more than $99 million at the current market price.

This hack was executed in a very similar fashion to numerous other crypto exploits in the past. According to speculators, the mechanism of this hack is akin to the infamous Ronin hack a few months ago that drained $625M worth of assets from Axie Infinity, by which the hacker managed to take control over a few wallets that governed the minting and burning of funds on the bridge. Thereafter, they were able to drain the deposited assets in those wallets without having to burn the coordinating assets on Harmony’s blockchain.

Ronin was criticized early on in its scandal for becoming susceptible to attack with only 5 out of 9 validators compromised. In the case of Harmony, it only took two compromised validators for the hacker to gain control. The native token of the protocol, $ONE, has dropped more than 10% since yesterday as a response to the news.

5. Cristiano Ronaldo Partners with Binance for New NFT Projects

Binance – June 23, 2022 at 8:53pm

Binance has announced that it has officially signed with the Portuguese soccer extraordinaire Cristiano Ronaldo to launch his multi-year NFT project. According to the terms of this agreement, Binance will create an exclusive NFT project for Ronaldo and promote his image on web3 platforms, which are being developed and assisted by the Binance team.

Namely, the NFTs will be released for sale every year exclusively on the Binance NFT platform. The initial collection is expected to be published later this year. The cost of the partnership between the Manchester United player and Binance has not been revealed.

Ronaldo’s addition to Binance’s lineup of celebrity-focused partnerships is a massive one, given the soccer legend’s diehard following. Being the face of many franchises across various sectors, including those with Nike, Herbalife TAG Heuer, and his own flagship brand CR7, it signals a huge shift of Web3 native brands toward the mainstream market.

Notably, the World Cup 2022 is just around the corner. Binance’s partnership with Ronaldo could indicate greater intentions on the marketing side of Binance to approach mass audiences with its products and platform.

6. dYdX Moves to Cosmos for its V4 Blockchain

CoinTelegraph – June 22, 2022

In the world of DeFi, the deployment of independent blockchains is an endeavor not commonly undertaken by projects. However, crypto derivatives platform dYdX intends to stand apart from the crowd, pioneering a different approach in its development. On June 23rd, the dYdX development team announced its migration from StarkWare, an L2 blockchain native to Ethereum, to become a standalone Cosmos-based blockchain.

According to the announcement made by the core team at dYdX, there were a number of primary concerns regarding Ethereum, noting in particular that centralization and performance issues influenced their decision. According to them, Cosmos’ improved decentralization and performance fit the vision of dYdX and its development better. Naturally, they have eliminated all liquidity from its existing pool on StarkWare.

The dYdX chain will be built using the Cosmos SDK and Tendermint Proof-of-Stake consensus protocol. These technologies are part of the Cosmos ecosystem, which helps the derivative DEX to interconnect to the application-specific blockchains within the Cosmos network.

In its latest V4 update, dYdX implements requirements that all validators of the dYdX chain will maintain the responsibilities of ensuring consensus, off-chain order book matching, deposits, transfers, withdrawals, and price oracles. Additionally, users will not need to pay gas fees to trade, similar to many CEXs. Fees will be distributed to validators and stakers.

According to the dYdX V4 blog, this change reflects their intention to offer a long-term competitive product experience with centralized exchanges. Before dYdX, Compound was one of the first DeFi projects to build out its own independent blockchain.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.