Weekly Report: July 4 - July 10 2022

The bear market continues as interest rates go up and projects' pockets run dry. Read on for this week's market updates and latest headlines!

1. Market Recap: Bitcoin’s First Bullish Week In Some Time Ends Abruptly; Crypto Woes Imitate Those of Traditional Finance

CoinDesk – July 11, 2022 at 7:28am EST

Over the weekend, Bitcoin ($BTC) reversed its nearly week-long rally that saw its price increase from just above $20K to over $22K, now dropping dangerously close to the $20K threshold that investors have dangled from for weeks.

As of Friday this past week, Bitcoin’s price and the larger cryptos by market capitalization were looking sprightly, with $BTC trading at $22,490.54 at its peak on Friday morning, a 14% increase since this past Monday.

This reprieve likely results from the latest Employment Situation Summary jobs report from the US Bureau of Labor Statistics, which showed a surprisingly strong increase in overall employment, with 372,000 new jobs created in June. Numbers like these are far higher than what typically would be expected of a recession, which likely served to alleviate some investors’ risk-averse mentalities.

However, analysts certainly weren’t impressed by last week’s short rally of 17% since the beginning of July, as $BTC still sits below its 200-week average. Additionally, Friday saw a rather large sell-off in both equities and crypto, meaning capitulation still stands rather tall in this market.

The weekend bolstered this skepticism, as the price of $BTC quickly slid back toward $20,000. Many analysts have landed on $17K as the next market support level.

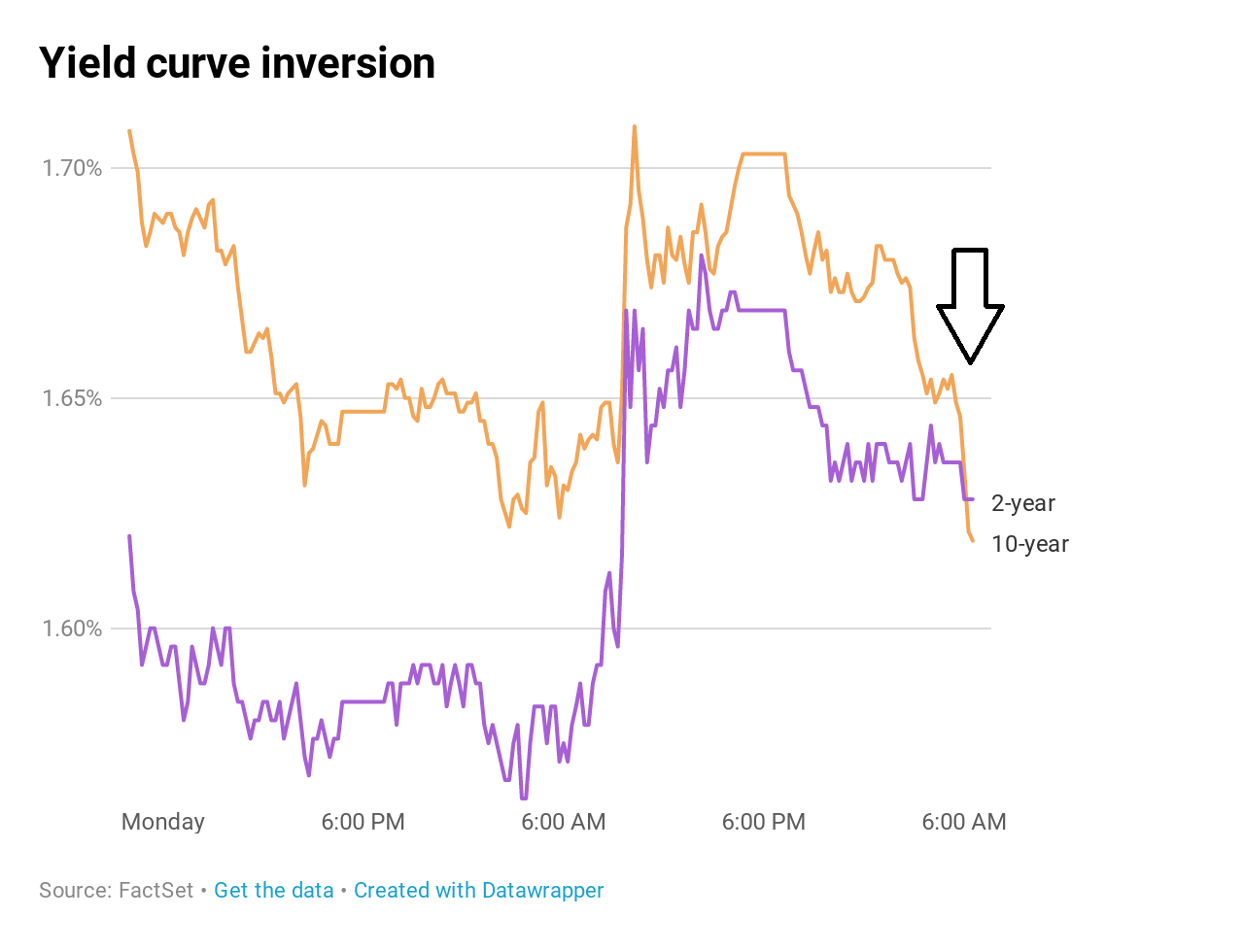

Indubitably, it is not crypto alone that is weathering the storm. A number of other macroeconomic factors certainly point toward a future recession, even if the jobs market is strong. One such factor is the Treasury Yield, which inverted this week, leaving 2-year bonds with a greater yield than 10-year bonds. In simple terms, the inversion of these expected yields means that investors expect longer-term rates to decline, which means that banks will lend less money, resulting in an overall slowdown in economic activity – definitely the makings of a recession.

Additionally, the Federal Reserve isn’t slowing down its interest rate hikes in an effort to slow down inflation. According to the Fed chair, Jerome H. Powell, central bankers seem to have landed on another 75 basis point increase like there was in June. This 0.75% increase would land the Fed’s current interest rates of around 1.5% to 1.75% closer to its estimated goal of 2.5%, at which there would be some significant economic stagnation.

In crypto land, bitcoin miners are beginning to capitulate in the face of poor price performance and increasingly limited operational funding. One of the largest miners, Core Scientific ($CORZ) announced a sale of over 7000 $BTC last month. And – while it needs no mention – crypto lending platforms have been through the wringer. Luna, 3AC, Celsius, and Voyager are all losing collectively billions of dollars, which is certainly adding to the doom-and-gloom outlook in the industry.

Overall, it seems more true than ever that cryptos’ return to glory will have to wait for the world to recover from inflation and its effects on the global economy in the months following.

2. Voyager Digital Files for Bankruptcy

Reuters – July 6, 2022 at 4:51pm EST

Crypto lender Voyager Digital has filed for Chapter 11 bankruptcy protection, otherwise known as “reorganization” bankruptcy, which allows Voyager to reorganize its debts and pay off its creditors while maintaining day-to-day operations. This policy facilitates the newly reorganized company to recover the business.

Voyager Digital’s bankruptcy comes just days after Voyager had implemented a temporary pause on trading, deposit, withdrawal, and loyalty reward activity for its customers on the platform. This freeze was enacted because the crypto-focused hedge fund failed to make its required payments on a loan worth more than $650M.

CEO of Voyager, Stephen Ehrlich, said in a tweet “We strongly believe in the future of the industry, but the prolonged volatility in the crypto markets and the default of Three Arrows Capital require us to take this decisive action.”

To reimburse its customers, Voyager plans to pay a combination of its own crypto assets, funds recovered from Three Arrows Capital, shares in its newly reorganized company, and Voyager tokens for customers with crypto assets in Voyager. On the other hand, customers with cash receive the right to access those funds after completing the legal processes.

The Voyager’s filing reveals more than 100,000 creditors and lists assets and liabilities between $1B and $10B. Regarding Voyager, the lenders’ spokesman said that the total value of its holding crypto assets worth $1.3B and $110M in cash permits the organization to maintain daily businesses during bankruptcy. In addition, $350M of cash held on behalf of customers sits in an account with Metropolitan Commercial Bank.

However, if Voyager does not settle its troubles soon, it could face a conversion toward a Chapter 7 bankruptcy, which would result in the liquidation of all its assets for cash. Therefore, Voyager has stated that it is trying to discuss all available remedies and take legal actions to recover the lost funds from Three Arrows.

3. Celsius Repay Their BTC Loans in Full, With a Twist

Since the beginning of July, although customer withdrawals have since ceased, Celsius has gradually begun to pay off its debts from various platforms.

Yesterday, on the 7th of July, Celsius fully repaid its loan with MakerDAO, taking out more than 22,000 $BTC of collateral in the process. Celsius moved these funds into an intermediary wallet before transferring the entirety of the wallet’s contents to FTX exchange. This included:

24,462.63 $WBTC ~ $533 million

4,000,000 $ZRX ~ $1.2 million

1,280,908 $BNT ~ $0.65 million

2,915 $COMP ~ $0.14 million

The motivation behind these token maneuvers remains unclear at the time of writing. There is also no practical way of tracking whether Celsius will sell all of these assets on the open market via FTX. In the case that they do, investors may experience some ripple effects from a large sell order.

On the topic of Celsius’s clutter, they have recently removed the “No Fees” declaration regarding customer withdrawals from their website, suggesting that clients might have to shoulder a fee to pull their funds out of the Celsius platform. Of course, this is given that the withdrawal feature will be active again one day.

4. Solana Labs and Multicoin Accused of Security Violation by Investors

CoinDesk – July 8, 2022 at 12:00am

Last week, a class-action lawsuit was filed in a California federal court against key players in the Solana (SOL) ecosystem. The lawsuit, filed by California resident Mark Young, accused the members of illegally profiting from SOL.

According to the lawsuit, SOL is described as a highly centralized cryptocurrency and system, which benefits its insider circle at the cost of the community and retail traders. In addition, it also deems SOL as an unregistered security. Young had alleged in his complaint that the creation and distribution of SOL met the three tenets of the Howey Test, a U.S Supreme Court precedent used as a barometer for identifying if a sale is a security or not. The filing stated:

“Purchasers who bought SOL securities have invested money or given valuable services to a common enterprise, Solana. These purchasers have a reasonable expectation of profit based upon the efforts of the promoters, Solana Labs and the Solana Foundation, to build a blockchain network that will rival Bitcoin and Ethereum and become the accepted framework for transactions on the blockchain”

Young had pointed toward Solana Labs filing a Form D with the U.S Securities and Exchange Commission, noting that the company was selling “future rights” to around 80 million SOL. Additionally, Multicoin, a crypto venture capital firm that had invested heavily in Solana, offloaded millions worth of SOL into retail. This came after its relentless promotion of Solana in spite of apparent blockchain issues and lawsuit allegations. The alleged dump from Multicoin had passed through FalconX, a crypto trading platform.

References

https://blockworks.co/wp-content/uploads/2021/11/Screen-Shot-2021-11-16-at-10.41.28-AM.png

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.