USDT Depegged. Again.

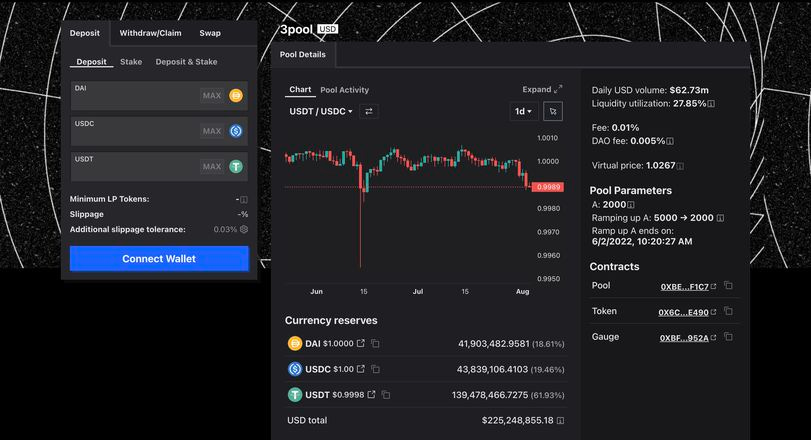

A series of events from August 2 to 9 tied Huobi, Binance and Curve to Tether and their stablecoin USDT, leaving the value of the coin straying away from the $1 dollar peg for a week.

USDT is infamously known for its recurring depegging issues. It seems like every few months, the same incident resurfaces. It has become so frequent that people no longer ask if the depegging really occurred, but instead wonder, "What now?"

This article will unfold the events that caused USDT to lose its peg this time and examine the role of each party in this seemingly un-stable upheaval.

Tether CTO Cites Unfairness on the Race of USDT, USDC and FDUSD

Tethers (USDT) are digital tokens linked to real-world currencies. Created on Bitcoin's blockchain via Omni Layer, each tether represents a fiat unit held by HongKong-based Tether Limited. Tethers can be exchanged for the underlying fiat or its Bitcoin spot value as per Tether Limited's terms.

On Aug 4, the Chief Technology Officer (CTO) of Tether expressed certain dissatisfaction towards the mounting competition from rival stablecoins such as $USDC and $FDUSD which is anchored in Hong Kong. This candid declaration set the stage for the subsequent turn of events that would shake the foundation of Tether's pegging mechanism.

Adam Cochran Reveals Discrepancies Pointing to Huobi's Insolvency

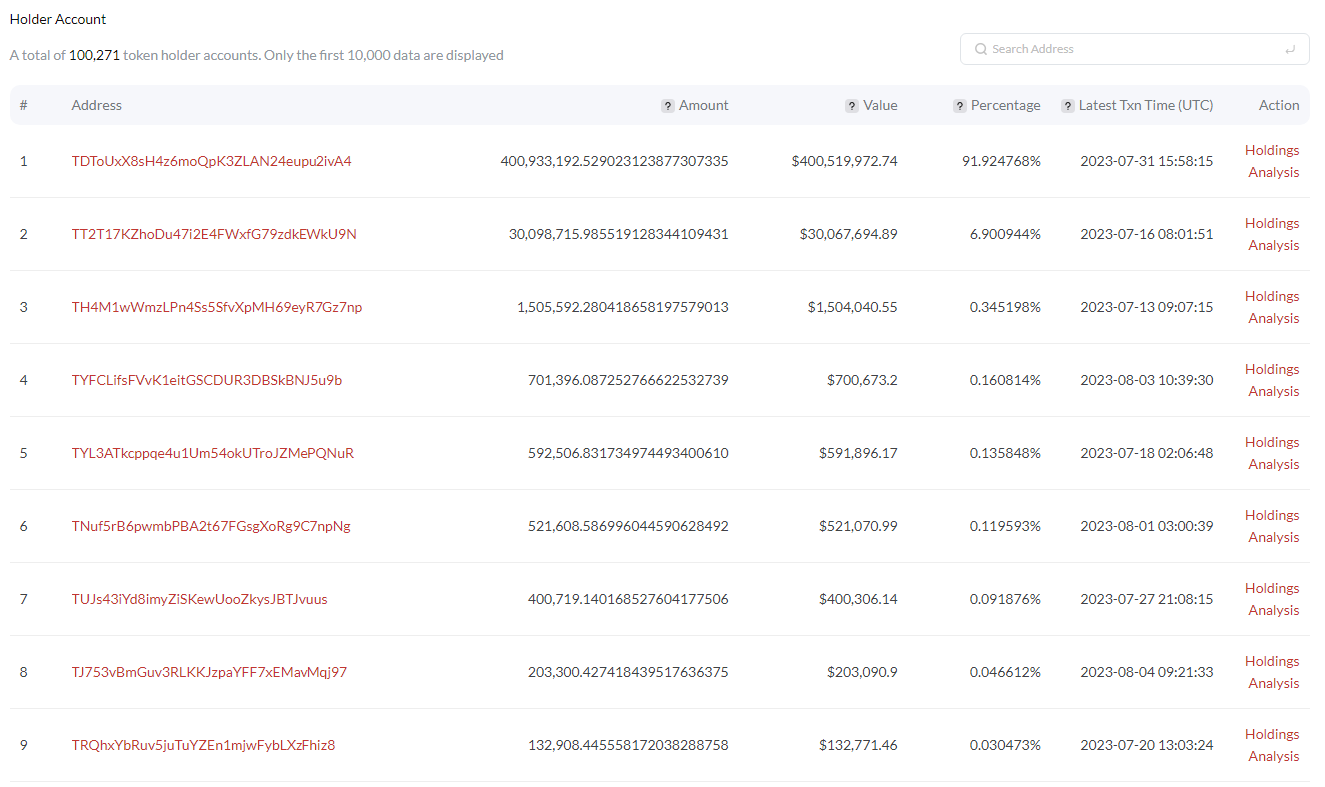

On August 6, Adam Cochran, a crypto researcher, uncovered some conflicting numbers between DefiLlama and Huobi’s website, pointing to possible insolvency issues with Huobi.

Cochran's meticulous analysis discussed several critical elements:

There was a consistent decline of USDT in Huobi over the preceding weeks.

Justin Sun, Advisor and Stakeholder of Huobi, launched stUSDT

Justin Sun introduced stUSDT, asserting it is USDT backed by government bonds with a 4.29% yield. Despite the website reporting 351,380 stakers, Tron's data showed 98% was owned by Sun or Huobi. This likely stems from the fact that when USDT is converted to stUSDT, it is channeled to a specific Huobi deposit address. No redemptions linked to bond purchases for yield were noted, either.

Huobi’s Asset Discrepancy

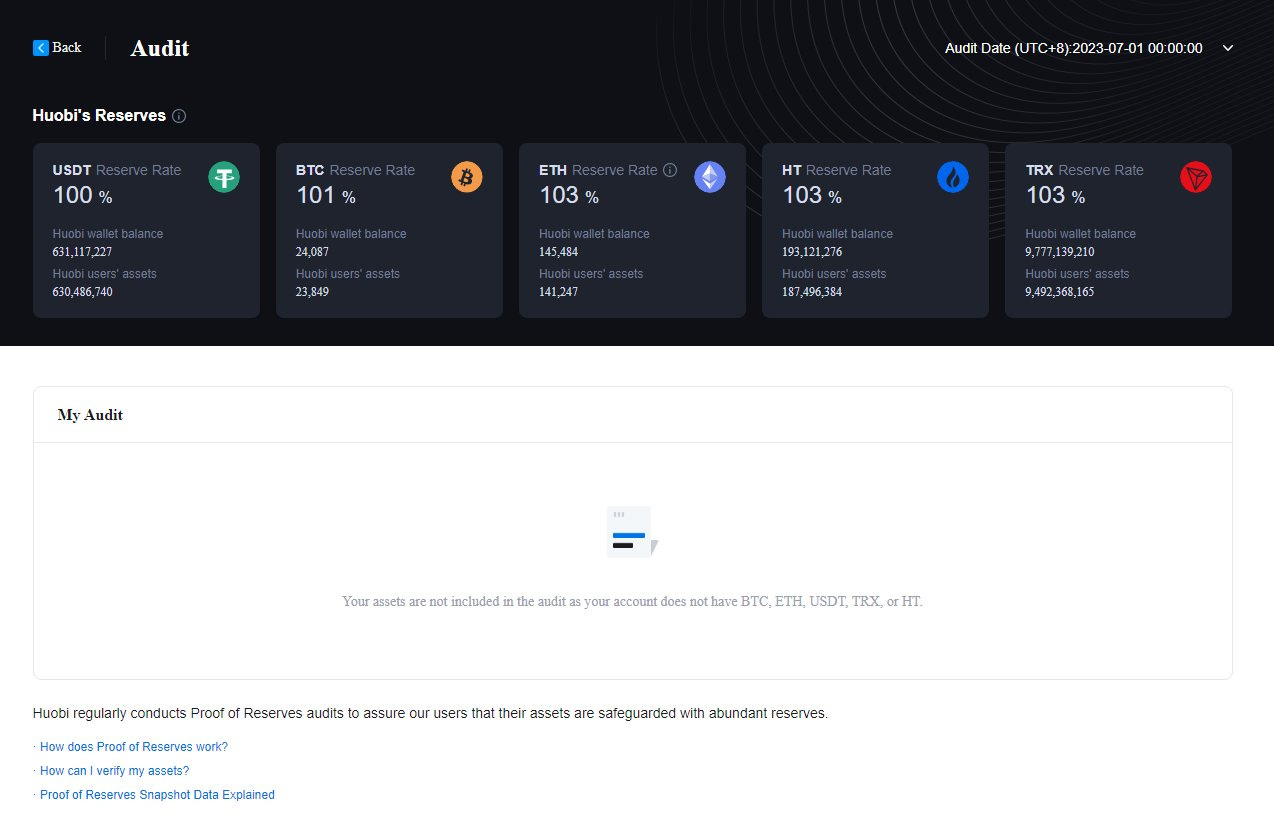

Huobi's "Merkle Tree Audit" showed users holding $630M in #USDT, but only $90M was actually present, and the audit hadn't been updated since the previous month. Adam Cochran theorized that Sun was diverting the deposited USDT to bolster his other #DeFi projects, offering enticing yields to encourage more deposits into Huobi.

While users believed they had 141,000 ETH on Huobi, Sun seemed to possess only half of that, all converted into stETH. Even when considering the funds Sun redirected from Huobi to his #DeFi ventures, he appeared to cover just half of Huobi's total commitments. The only asset they seemed solid in was BTC. This pattern suggested that, much like with Poloniex, Sun was treating Huobi as a personal treasury, capitalizing on user deposits.

Binance USDT Sell-off on Curve

Upon hearing about the investigation of Huobi/Tron employees related to Huobi's actions, Binance began selling USDT on Curve to mitigate risk, worsening the USDT depegging.

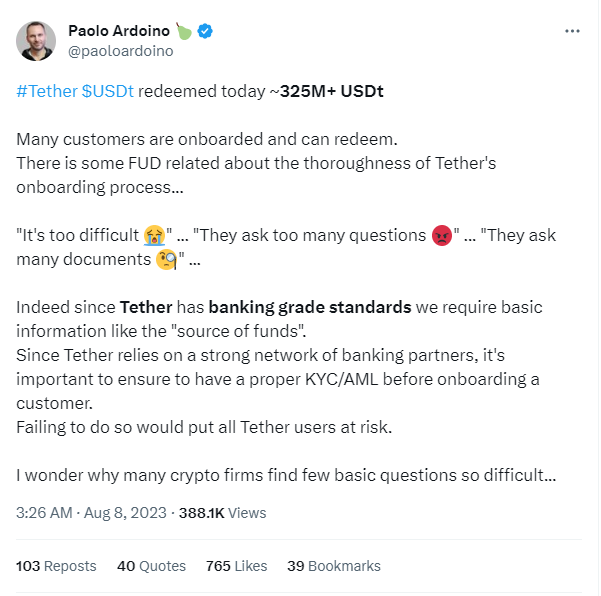

325M USDT Redemption

On August 8, Tether's CTO announced the redemption of 325 million USDT.

However, this announcement came with question from users. Questions arose concerning Tether's ability to efficiently process sizable redemptions, particularly given their historical claims that they can process up to billions in days, now 325M is something to announce.

Redemption ensures that the stablecoin remains pegged to its underlying asset and provides a mechanism for users to exit the system and convert their stablecoin holdings back into the underlying asset.

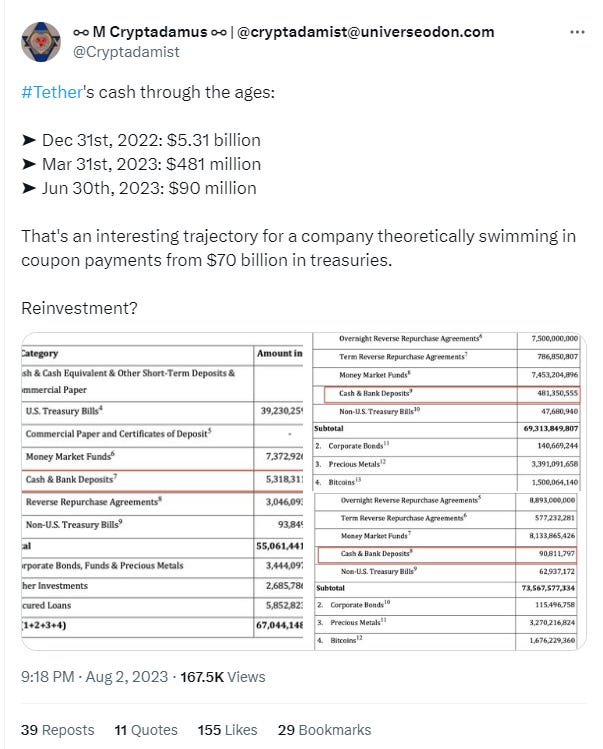

This comes when Tether's cash situation isn't looking good on paper.

Theory r/ USDT's Dominance

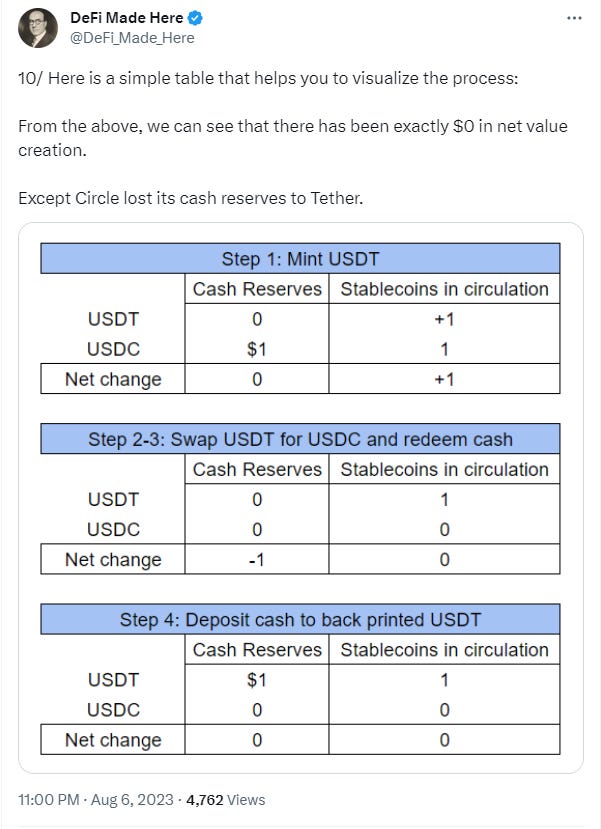

There's a theory surfaced by the crypto analyst @DeFi_Made_Here as to how USDT can maintain their dominance amid the frequent FUD and #USDC just could not keep up. The simplified steps are:

Step 1 - Mint USDT: Creating (minting) new USDT increases its supply. If this is done without proper backing (i.e., without the equivalent amount in USD in reserve), it artificially inflates the amount of USDT in circulation.

Step 2 - Swap USDT for USDC: By swapping the newly minted USDT for USDC, there's an increased demand for USDC and an increased supply of USDT in the market. This could potentially push the price of USDC above $1, making it slightly overvalued.

Step 3 - Cash out USDC: Converting USDC to actual USD cash means that the USDC is taken out of circulation and redeemed for its underlying value. This could lead to a decrease in the amount of USDC in circulation, potentially affecting its liquidity.

Step 4 - Deposit cash to back printed USDT: By using the cash obtained from cashing out USDC to back the previously minted USDT, the USDT now appears to be fully backed and legitimate, even though it was initially minted without proper backing.

Step 5 - Print more USDT with new cash: With the cash from the USDC redemption now in reserve, even more USDT can be minted, further increasing its supply.

Step 6 - Repeat: Continuously repeating this cycle can lead to an artificial inflation of USDT's supply while potentially draining the reserves of USDC. Over time, this could undermine confidence in USDC as its reserves are continuously cashed out, while USDT's supply keeps increasing without a genuine demand driving it.

However, executing this purported strategy posed challenges against the backdrop of intensifying scrutiny and the demand for transparency. That's why when there's a FUD affecting USDT, the cash flow will inherently go from USDT to USDC on Curve. After that, USDC can be redeemed at Circle.

Conclusion

There you have it - the complexities surrounding USDT's recurring depegging issues and its competitive landscape. Key revelations include Huobi's potential insolvency, discrepancies in its reported USDT holdings, and the strategic maneuvers involving USDT and USDC. Additionally, Tether's recent redemption announcement amidst these controversies further raises questions about its liquidity and operational transparency. Although Binance's decision to offload USDT on Curve in response to these revelations caused the immediate depegging, but it was all of those events above combined that have sent a broader industry apprehension.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.