U.S. Debt Ceiling Impasse: A Threat and an Opportunity

Brace yourself for the U.S. debt ceiling crisis and discover how Bitcoin might ride the storm as a safe haven investment. Don't miss out!

This AI-assisted article does not constitute financial advice. Always conduct your own research and consult with a professional before making investment decisions.

M3TA researcher conducts market investigation every week. Consider following us on Twitter for the fastest TL;DR update.

Introduction

The United States government is currently in a precarious position, if not has been so for a while. But this time, it is at risk of defaulting on its financial obligations as early as June 1, according to Treasury Secretary Janet Yellen.

This potential economic crisis is due to the debt ceiling, a legislative limit set by Congress on the total amount of money the U.S. government can borrow by issuing bonds. The situation is of such gravity that it could potentially impact not only the U.S. economy but also the global financial landscape.

While this impending crisis paints a grim picture for traditional financial markets, it has sparked a burning question that stirs the curiosity of many: how will this economic turbulence play out for the burgeoning world of cryptocurrencies?

The Past has Spent - The Present has… hmm… a Headache

The debt ceiling, to be clear, is not a reflection of future government expenditures. Rather, it is related to money that has already been spent due to laws Congress has previously enacted.

The money loaned to the US government comes from these 02 broad categories of creditors:

Public Debt: This is the portion of the debt that is held by the public, including individuals, corporations, state or local governments, Federal Reserve Banks (the largest creditor), and foreign governments (China, Japan, United Kingdom, Brazil, and Ireland (as of 2021)).

Intra-governmental Holdings: This refers to the portion of the federal debt owed to more than 230 federal agencies. The largest of these are the Social Security Trust Funds and the Civil Service Retirement and Disability Fund.

To put it in perspective, imagine a household setting a budget for their monthly expenses and then deciding not to pay the credit card bill related to those expenses. In essence, refusing to increase the debt limit is akin to this hypothetical household refusing to pay for expenditures it has already incurred.

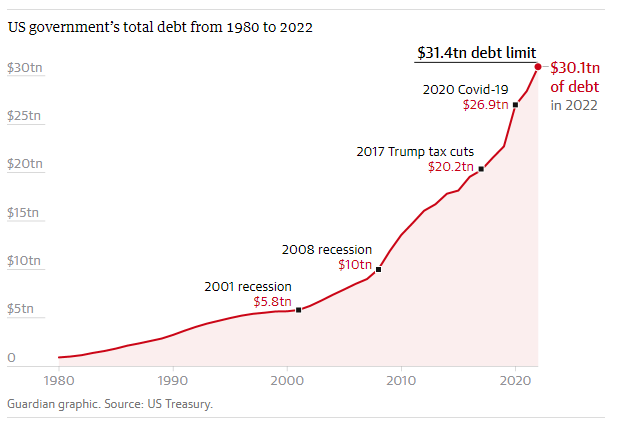

Congress has increased or suspended this borrowing limit 78 times since 1960 to prevent the U.S. government from defaulting. However, it remains a contentious political issue, with different administrations often clashing over the need to raise the limit.

The issue is further complicated by the fact that a significant portion of the debt accumulated is a result of laws passed under former presidents. Thus, slashing current spending would not resolve the problem.

The consequences of the U.S. government not being able to pay its bills are severe. Payments to certain pension funds could be suspended, soldiers and federal workers could see their pay withheld or cut, and interest payments could be delayed.

In the worst-case scenario, the U.S. could default on its debts, an event that has never happened and whose consequences are unpredictable but undoubtedly dire.

Should this scenario come to pass, the repercussions for ordinary Americans and the global economy could be severe. Unemployment could rise, inflation could increase, and the U.S. dollar could fall. A weakened U.S. economy could have a knock-on effect on the world economy, and personal investment portfolios could take a significant hit.

#BitcoinIsHereToStayBaby Party

While this situation is alarming, it also presents an unexpected opportunity. One of the beneficiaries of this uncertainty could be Bitcoin, the decentralized digital currency.

Despite facing regulatory uncertainty and volatility, Bitcoin has shown resilience in the face of economic instability and has been touted as 'Digital Gold,' a safe haven in times of financial turmoil.

To cite a compelling example, let's turn the clock back to 2020. Amid an atmosphere of profound economic uncertainty, Bitcoin made an extraordinary surge, catapulting from a value of $7,200 to $28,000 within the span of the year. This momentum did not wane and by November 9, 2021, Bitcoin had reached an unprecedented high of $67,600.

During this same period, traditional markets were grappling with the severe economic repercussions of the Covid-19 pandemic, searching for ways to mitigate the damage and stimulate recovery. The adopted strategy largely centered on an expansion of the money supply and the implementation of extensive easing programs.

It's crucial to note that this was not confined to the U.S. alone. The economic aftershocks of the pandemic and the subsequent monetary policy responses reverberated across the globe, leaving indelible marks on economies worldwide.

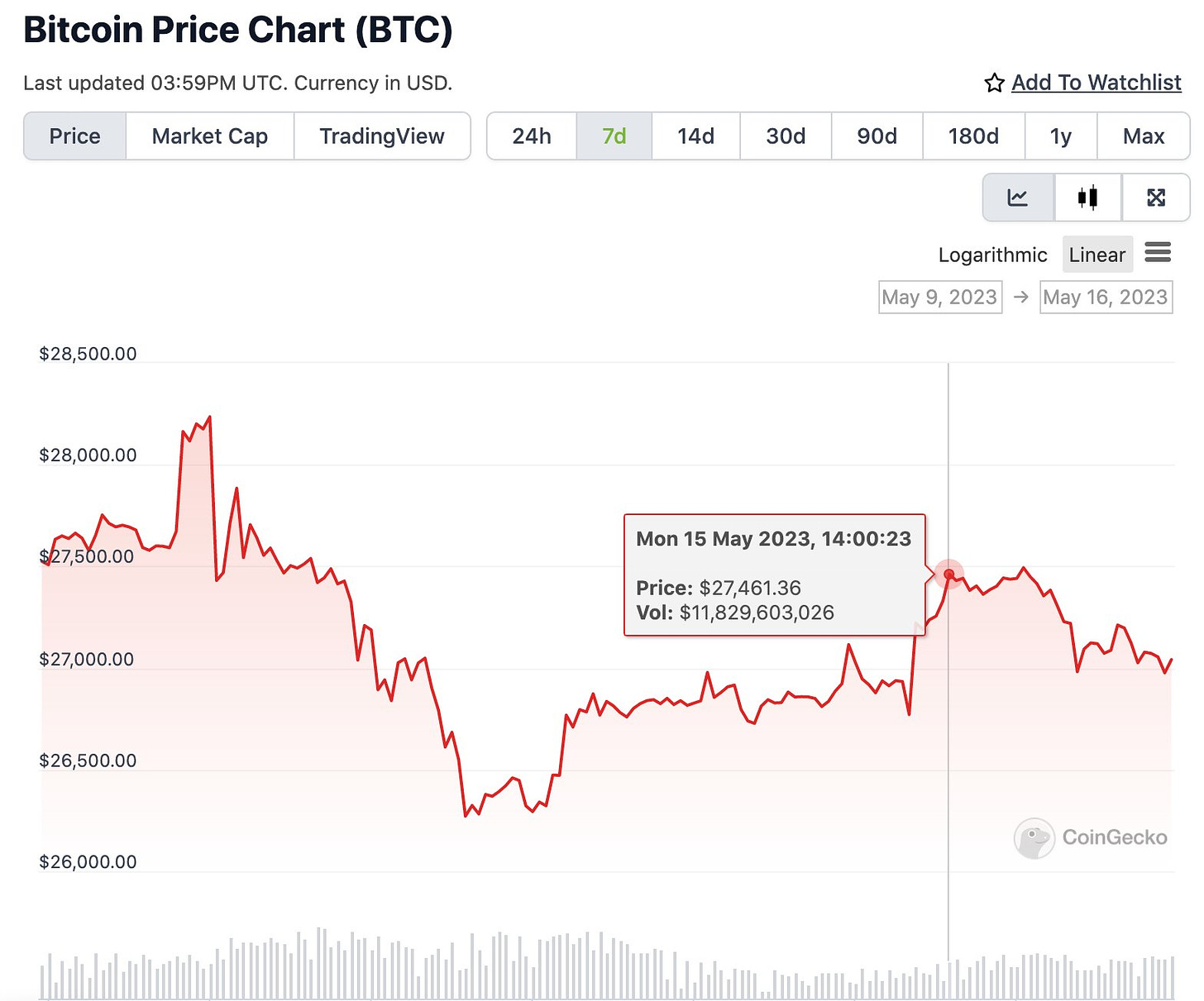

Indeed, Bitcoin has already shown signs of benefiting from the debt ceiling crisis. As news about the debt ceiling began raising investor concern, Bitcoin experienced a rebound earlier this week.

This response suggests that investors are looking at Bitcoin as a potential hedge against traditional financial markets during times of economic instability.

BTC vs Global Currency | BTC vs GOLD

According to Delphi Digital, opponents of Bitcoin often cite a couple of key weaknesses when arguing against its adoption.

The first is its limited transactional throughput, as it currently lacks the capacity to handle the trillions of transactions processed by the U.S. dollar.

The second is its notorious volatility, which can make potential investors wary of parking their funds in an asset that might significantly fluctuate in two-digit percentage.

However, these arguments tend to overlook some of Bitcoin's most powerful strengths, aspects in which it distinctly outperforms traditional currencies like the U.S. dollar:

Decentralization: Unlike the U.S. dollar, which is subject to regulations and monetary policies stipulated by governmental agencies and central banks, Bitcoin operates on a decentralized network.

Fixed Supply: Bitcoin has a predetermined supply, with the number of new coins halved roughly every four years. This is in stark contrast to traditional currencies, which have theoretically infinite supplies as governments can print more money.

Digital Native: Bitcoin is a digitally native asset, meaning it is inherently portable and encrypted, offering enhanced security and convenience.

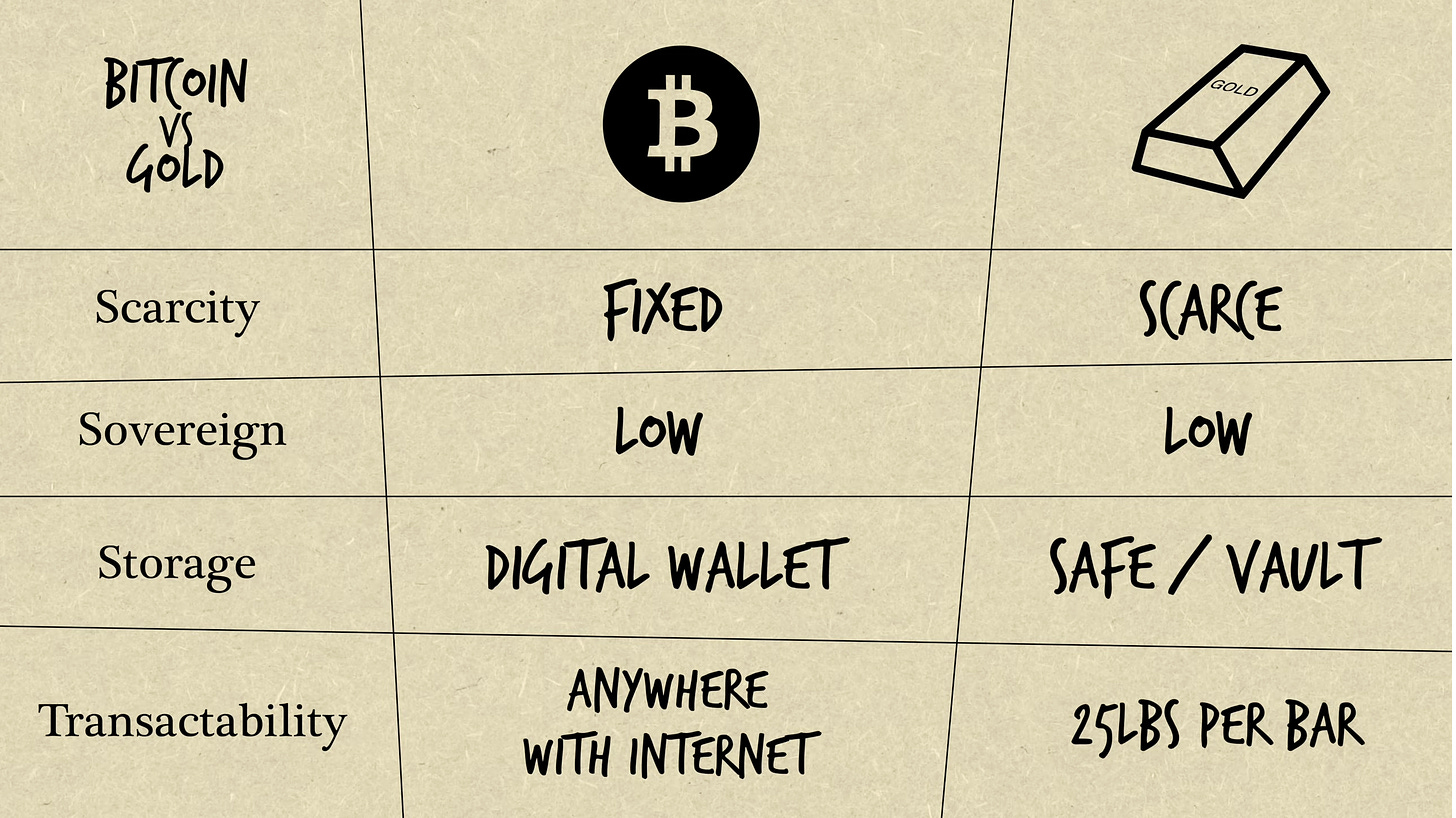

Addressing the criticism of volatility, it's worth noting that gold, an asset that has been a store of value for thousands of years, is also subject to significant price fluctuations.

Bitcoin shares several key characteristics with gold, including its limited supply and its independence from sovereign control. Yet, it outperforms gold in areas such as ease of transport and storage, and its potential to serve as the foundation for a new digital economy.

Despite most economies moving away from the gold standard, central banks around the world still maintain substantial gold reserves. This fact underscores the enduring value of trustless, durable assets that operate outside of state control.

While currencies like the U.S. dollar face the risk of losing their dominant positions due to institutional instability, Bitcoin's strength is rooted in its decentralized network.

This structure not only makes it resistant to single points of failure but also allows it to serve as a foundation for expansive financial ecosystems, such as the Lightning Network and decentralized finance.

Thus, despite its perceived weaknesses, Bitcoin's unique attributes position it as a compelling alternative in the evolving landscape of global finance.

As the deadline for the debt ceiling approaches, investors might find it prudent to consider the potential benefits of adding Bitcoin to their portfolio. Of course, like all investments, Bitcoin carries its own set of risks, including regulatory risk and market volatility.

However, its performance in the face of economic uncertainty highlights its potential as a hedge against traditional market instability.

Conclusion

In conclusion, while the debt ceiling crisis represents a significant challenge for the U.S. economy, it also offers an opportunity for those willing to explore alternative investment options. As the U.S. navigates this difficult economic landscape, Bitcoin may prove to be a silver lining in an otherwise cloudy financial forecast.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.