Unraveling the Mechanics of SuperWalk M2E Game: An On-chain Analysis (Part 2)

Gain insights into how SuperWalk has successfully attracted new participants and maintained stability within its coins, even amidst a challenging year in the crypto finance industry.

Metrics

This report focuses on assessing the impact of newly developed features and improvements within the SuperWalk ecosystem, utilizing a comprehensive range of data points. By looking at User Analytics metrics, as well as evaluating the performances of NFTs and Tokens, we aim to provide a concise yet informative analysis of the SuperWalk platform.

The purpose of this analysis is to provide a high-level overview of the SuperWalk platform in a straightforward and succinct manner, placing particular emphasis on its latest advancements.

Data as of May 22, 2023

Data is sourced from Public On-chain data and trusted Third Party

TL;DR at M3TA Report: The Current State of SuperWalk.

Our previous Report for SuperWalk can be viewed here as well.

If you spot any issue with this Research article, please let us know here.

Analysis

User Expansion

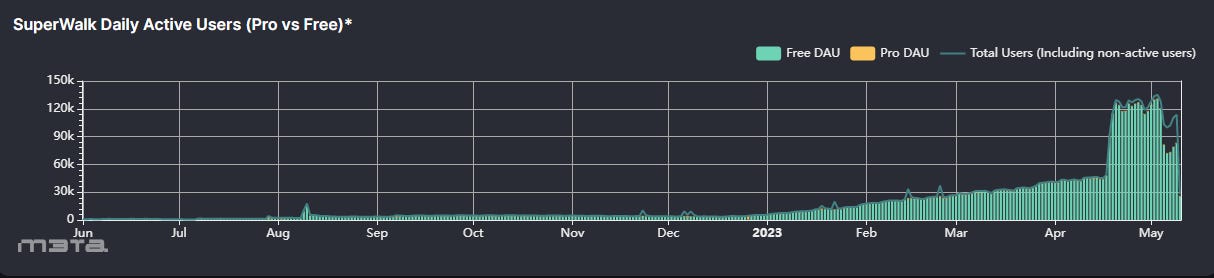

During the initial months of 2023, there was a notable surge of new users joining the SuperWalk ecosystem. On specific dates, the system registered over 100K daily active users (DAU). Despite the dip in DAU in May, however, the general pattern continues to show an upward trajectory, suggesting consistent expansion and outreach of the SuperWalk app.

Not only more users were joining the ecosystem during the first few months of 2023, the data also shows a higher number of engagements per player in the game. This can be seen via the increasing number of “Average Time Spent on the App” as displayed in the graph below.

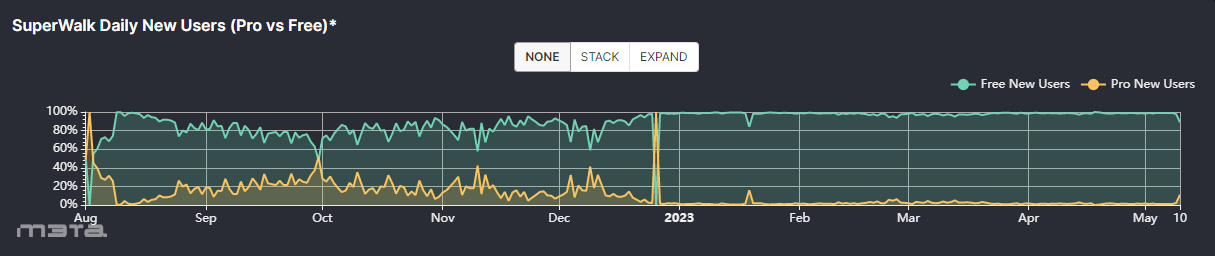

It is, however, worth mentioning that a significant portion of SuperWalk's player community consists of Free Players. These individuals exclusively participate in the game's Basic Mode without possessing any in-game tokens or NFTs.

On the other hand, Pro Players, who hold in-game tokens and NFTs, constitute a relatively small percentage of the overall player population, ranging from one percent to three percent.

It seems that the next pivotal phase for SuperWalk could involve successfully advertising the Pro Mode to their current user base.

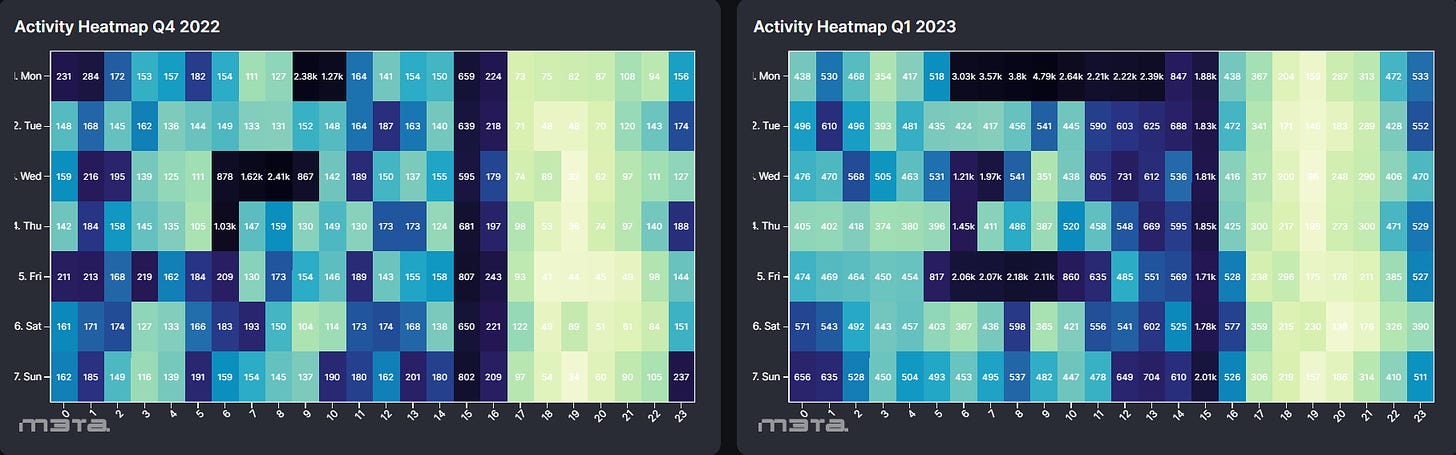

Looking at the activity Heatmap between Q4 2022 and Q1 2023, we can see that not only 2023 demonstrated heightened levels of engagement, but the new year also showcases a diverse distribution of activity throughout various hours of the day and days of the week.

This trend strongly indicates the presence of new players from different time zones, highlighting the game's expanding global reach.

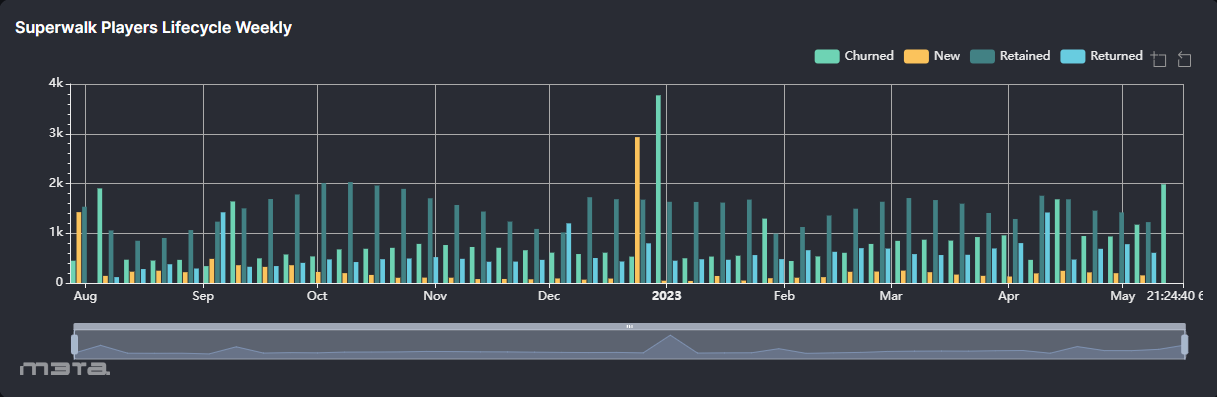

Finally, as a fitness game that revolves around routine commuting and exercise activities, SuperWalk has consistently demonstrated an impressive ability to retain its dedicated Pro Players. This is evident in the on-chain data which indicates a high level of Retained and Returned players over time.

Rising NFT Demands

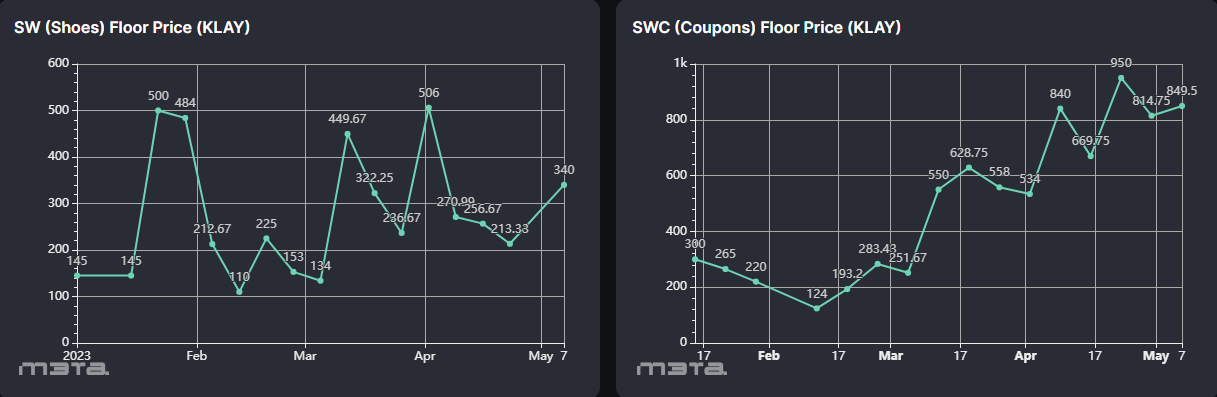

In sync with the expanding user base, both NFTs within the SuperWalk ecosystem, namely SW (Shoes) and SWC (Coupons), have experienced a notable surge in their floor prices throughout the year 2023.

At the outset of the year, SW (Shoes) commanded a floor price of 145 $KLAY. However, as the months unfolded and May arrived, its floor price had doubled, reaching the impressive range of 340 $KLAY per NFT.

Comparatively, the SWC (Coupons) NFT has exhibited an even more remarkable ascent in value. Starting from approximately 300 $KLAY in January 2023, its price has skyrocketed to surpass 800 KLAY at the time of writing in May. Moreover, the SWC NFT also boasts greater price stability when contrasted with its counterpart, the Shoes NFT.

The floor price is a pivotal metric in NFT analysis, often acting as an indicator of the relative forces of demand and supply over time. Hence, the consistent growth observed in the floor prices of SuperWalk's NFTs serves as a positive affirmation of the game's burgeoning traction, attesting to its increasing popularity among enthusiasts and investors alike.

GRND & WALK Tokens

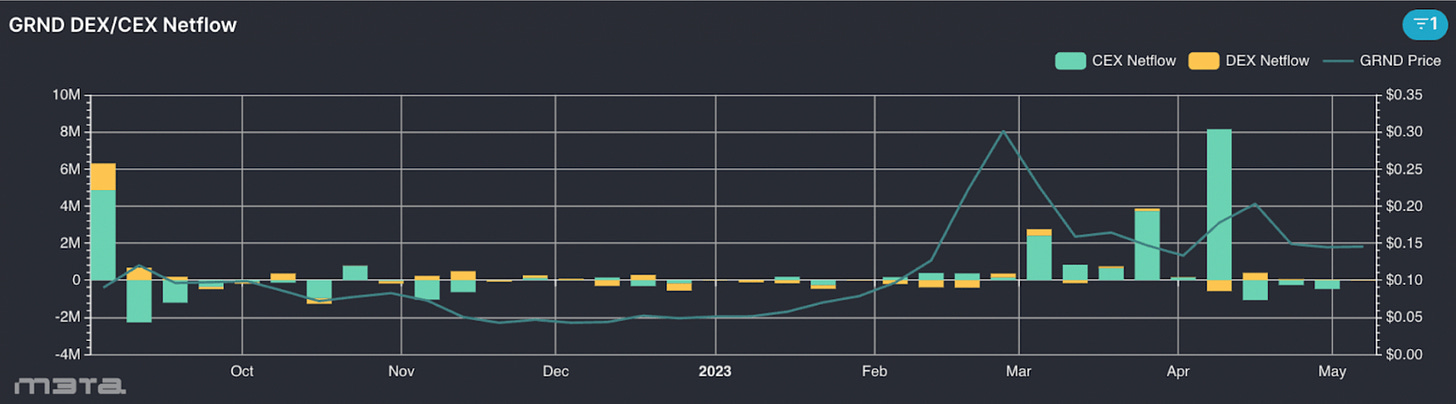

Upon initial examination, a gradual decline in token prices for both WALK and GRND tokens becomes apparent throughout the year 2022.

However, a significant shift occurred in 2023, as both prices embarked on an upward trajectory, culminating in a remarkable spike in the GRND token's value, reaching its peak during February of the same year.

This notable price performance can be attributed not only to the burgeoning demand from new cohorts of customers but also to the efficacy of the token's Staking and Burning mechanism.

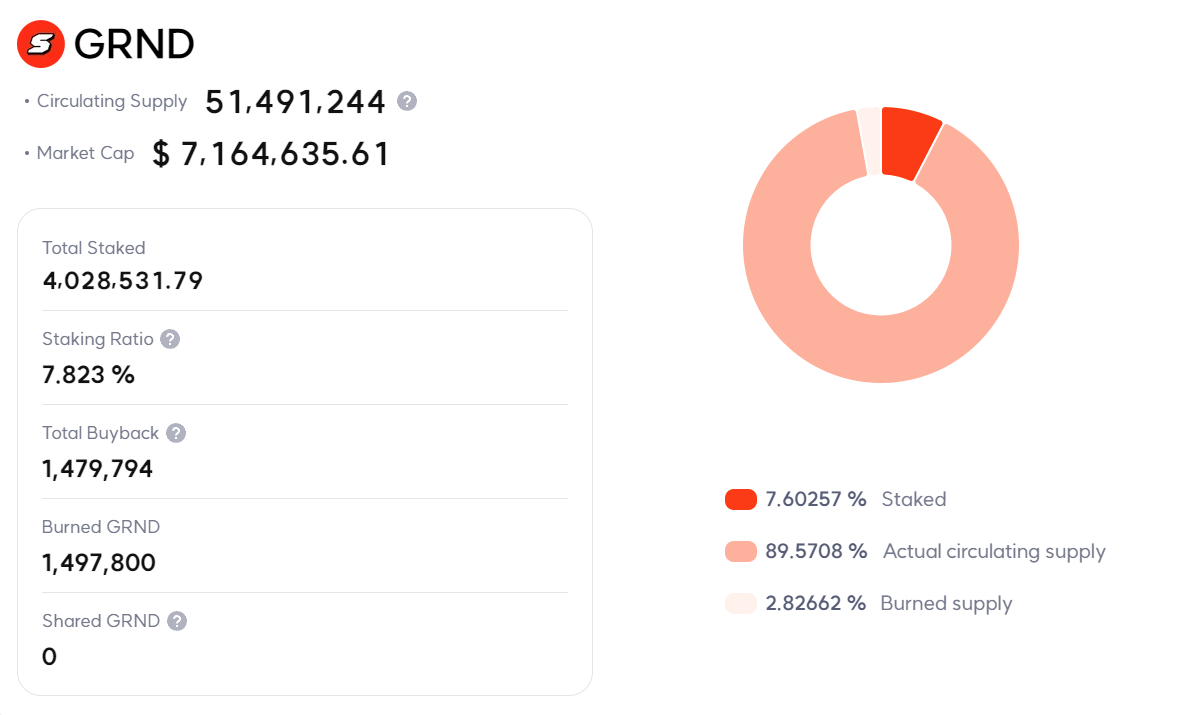

An analysis on the GRND staking wallet reveals that nearly 4M tokens have been staked since the launch of this feature. Consequently, this quantity represents 6.9% of GRND tokens effectively removed from circulation.

The protocol exhibited a transparent commitment to augmenting the staking balance of GRND by maintaining a high Annual Percentage Yield (APY) within its staking pool. Currently, investors are offered an enticing APY of 66.12%, thereby incentivizing increased participation and engagement in the token's staking mechanism.

In addition to the Staking mechanism, burning GRND is another tool employed by the team to control the circulating supply of the token. The dynamic burning scheme takes into account multiple factors to ensure optimal results.

As outlined in a blog post by the SuperWalk team, the GRND burning process considers not only the current level of user activities, which naturally scales with the growing user base, but also incorporates the GRND price into account.

This latter aspect of the burning formula ensures that fewer tokens are burned when the price is higher, while a larger quantity of tokens is burned when the price is lower. Thus, the burning mechanism effectively functions as a "price suspension", acting as a safeguard to sustain the long-term value of the token.

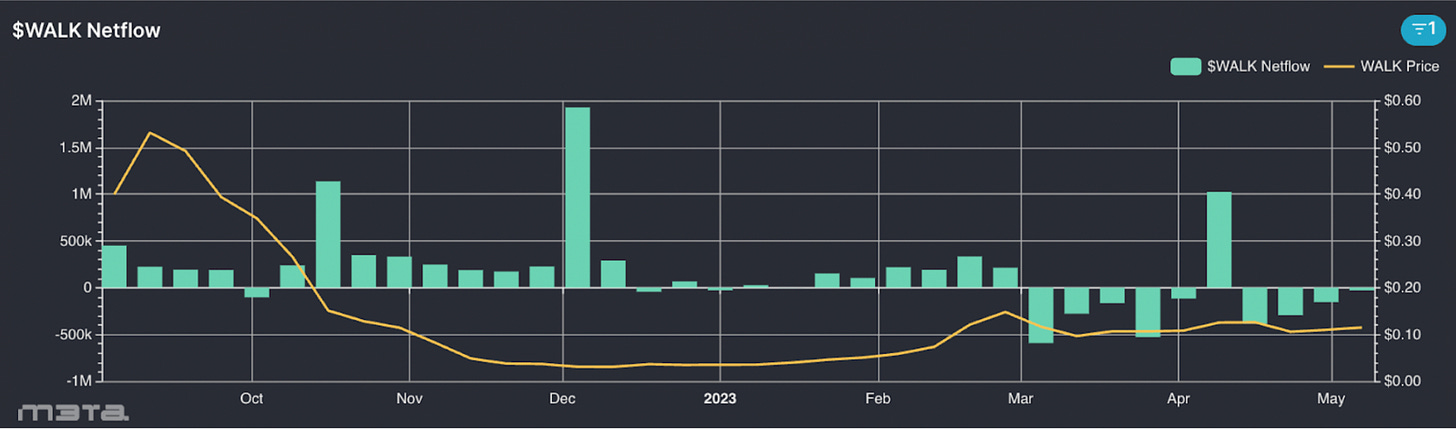

The reward token, WALK, exhibits a similar price trajectory to its counterpart, GRND.

Following a period of decline throughout 2022, WALK tokens experienced a resurgence in value starting in 2023. Notably, during GRND's period of price appreciation, it faced significant selling pressure, whereas WALK endured comparatively less selling pressure.

This observation positions the WALK token as appearing less volatile than GRND, contributing to a perception of stability within its price movement.

Conclusion

In the face of challenging market conditions experienced throughout 2022, SuperWalk has demonstrated commendable resilience by implementing a series of strategic measures within its ecosystem. By introducing new and innovative features, expanding into specific markets, and sustaining the price of its NFTs and Tokens, these strategic initiatives have not only allowed SuperWalk to weather the storm of market challenges but have also positioned the company as a promising contender within the P&E industry.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This website, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.