The Trend of L1 Migrating to L2

More L1 blockchains are opting to transform into Layer 2 (L2), embracing Ethereum's benefits: security, liquidity, and cost efficiency. Some even shift from being 'Ethereum killers.

The (Un)Challenged Throne of Ethereum

The term "Ethereum killers" have been frequently used to describe L1 blockchain networks that aim to challenge Ethereum's dominance from different angles. Before Ethereum’s co-founder Vitalik Buterin released any roadmap for Ethereum upgrade last November, the $25.2B house of several dApps was deemed expensive and un-scalable.

That's why a lot of protocols have made this their purpose of existence: to lower the fees, to increase rewards, and to be able to handle more transactions than Ethereum can in a shorter time. Some prominent potential “Ethereum Killers" can be named:

Polkadot

Smart contracts are run on smaller, separate blockchains that operate alongside the main Polkadot chain, called “parachains", instead of relying on the main chain like Ethereum.

→ This means reduced load on the main chain which can lead to lower fees, more diverse rewards since each parachain can have its own token, and more time-efficient with parallel processing.

Yet, Polkadot's SCP (smart contract platform) score is not particularly impressive, and adoption seems to be lacking.

Avalanche

Utilizing the Snow family of consensus protocols and a directed acyclic graph (DAG), Avalanche allows for a dynamic network with validators entering and leaving without disrupting consensus, and groups transactions for swift consensus with minimal communication overhead.

→ This, coupled with its ability to achieve finality in less than a second and handle an average of 4500 transactions per second, leads to lower fees, more diverse rewards, and improved scalability compared to Ethereum (before The Merge upgrade).

However, being an Ethereum fork, C-Chain may encounter similar scaling challenges as Ethereum without significant updates, hindering its ability to catch up with Ethereum in the long run.

Keep track of Avalanche's daily footprint at our Avalanche: Monitoring Report.

Solana

Solana's architecture is based on Proof of History (PoH) - a proof for verifying order and passage of time between events. PoH is used to encode trustless passage of time into a ledger, which when used alongside a consensus algorithm such as Proof of Stake (PoS), can reduce messaging overhead in a Byzantine Fault Tolerant replicated state machine, resulting in sub-second finality times.

While Solana's Proof of History (PoH) architecture promises speed, its uptime reliability is questionable. The network has faced multiple disruptions, including a significant 18-hour outage in February 2023.

Celo

Another contender is Celo, an EVM-compatible ReFi blockchain renowned for its carbon-negative global payment infrastructure tailored towards mobile users. The project with 110 validators first set out to offer 2 solutions.

To make sending payments as easy as sending a text message by allowing users to use their friends' phone numbers as public keys.

To introduce a stable-value cryptocurrency, achieved by adjusting the supply of this token based on its demand, and by having a reserve of variable-value assets underneath.

But the edge that sets Celo apart lies in the “Prosperity for All” motto that defines their founders' work, and the vibrant ReFi BUIDLer community they have been able to cultivate.

Simply speaking, ReFi or Regenerative Finance projects are often built on the principles of decentralized finance (DeFi), but with an added focus on social and environmental impact. Some initiatives could include prioritizing loans for sustainable projects, or blockchain-based carbon credit marketplaces. Working towards similar goals, the community on Celo is striving to achieve their environmental impact, recently with surging appeal towards gamification; specifically the 2 approaches: Play4Impact and Impact2Earn.

Play4Impact (applied by Wildchain dApp), designs engaging games to boost impact, like wildlife conservation.

Impact2Earn uses game mechanics for economic outcomes, such as earning tokens or getting discounts on purchasing or utilizing products that have a positive impact.

The environmental impact, while crucial, often takes a backseat when compared to economic benefits. This is a challenge that Celo, like many other environmentally-focused projects, faces. It's not enough to build a carbon-negative payment infrastructure or to gamify conservation efforts. These initiatives need to be coupled with tangible economic incentives that can compete with the likes of Ethereum. This is perhaps why Celo, despite its unique offerings and noble mission, hasn't quite broken into the mainstream crypto consciousness.

Celo community has also just passed the proposal to migrate their L1 blockchain back to its home root as Ethereum's Layer 2.

Polygon Scaling: from Independent Sidechain to ZK-Heavy Roll-up and Validium

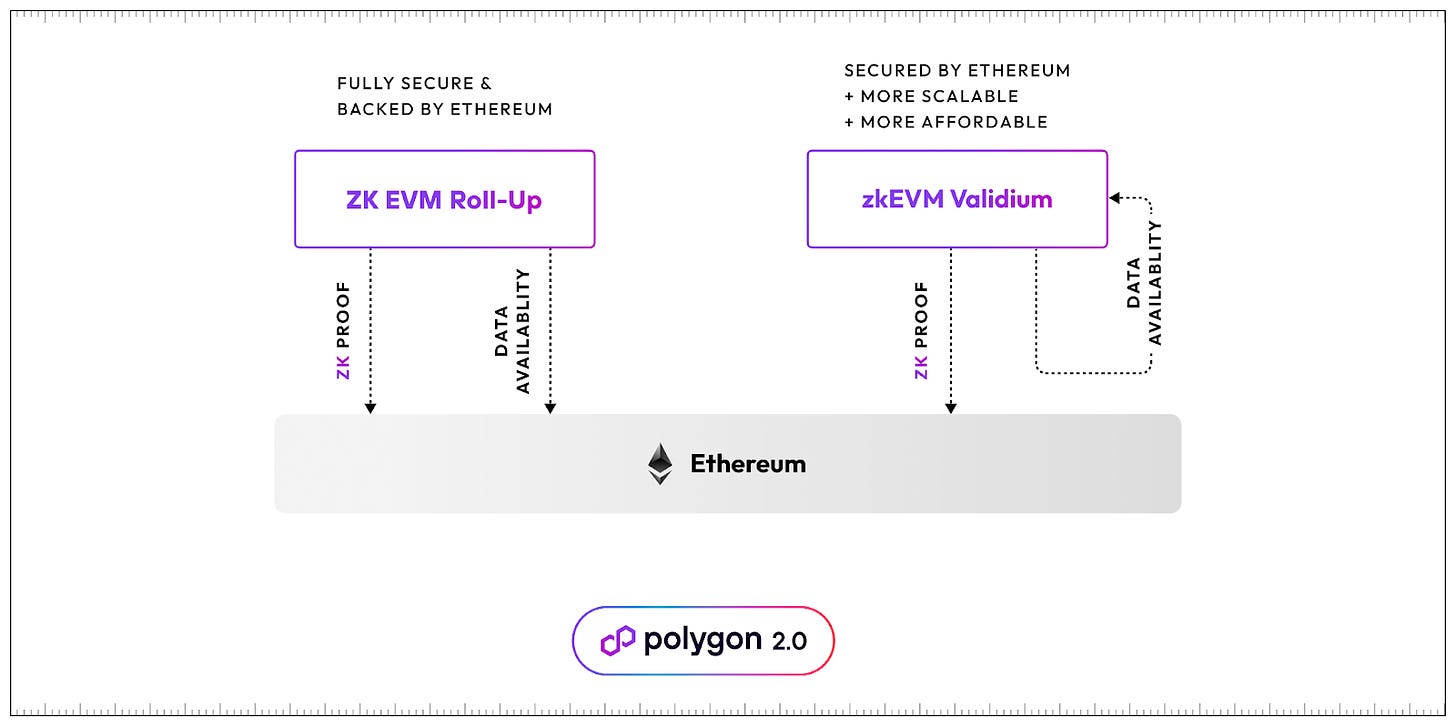

Before Celo, another leading platform for dApp building, or as it likes to claims ‘the Value Layer of the Internet', Polygon has also revealed their close-to-Ethereum scaling visions in Polygon 2.0: Polygon zkEVM as a Rollup and Polygon zkEVM as a Validium (currently known as Polygon PoS).

Read more about the definition of ZK, EVM and ZKEVM in this article we wrote for our FactBlock partner.

1. Rollup and Validium

Roll-up is a Layer 2 scaling solution that performs computation and storage of smart contract data off-chain. It can help Layer 1 like Ethereum scale thanks to the aggregation of multiple off-chain transactions into a single batch and then generates a cryptographic proof, which is posted to the main chain.

The main chain doesn't need to compute every individual transaction, but only needs to verify the correctness of the proof. This reduces the load on the main chain, leading to lower transaction fees and faster transaction times, while still leveraging the security of the main chain, unlike a sidechain, which does not inherit the security of Layer 1.

Unlike Sidechains, which rely on validators to execute transactions, Validium uses zero-knowledge proofs to guarantee and verify the validity of transactions executed and stored off-chain. Validium can process ~9,000 transactions per second, significantly more than Ethereum's ~15.

Unlike Rollups and Sidechains, Validium only posts the validity proof, not the actual transaction data, back to Ethereum. This process operates by deploying a verifier smart contract on Ethereum. The Validium then submits validity proofs to this contract. These validity proofs, which are zero-knowledge proofs, carry the results of the transactions, but they do not include the actual transaction data.

In short:

Security-wise: Roll-up > Validium > Sidechain

Speed-wise: Validium > Roll-up > Sidechain

Cost-wise: Sidechain > Roll-up > Validium

2. Polygon zkEVM Roll-up

Receiving the community's approval, the older brother Polygon zkEVM Roll-up Mainnet was deployed on March 27, 2023, realizing 2 notable solutions:

Polygon zkEVM offers true EVM-equivalence, allowing Ethereum to scale without compromising its existing ecosystem. It has passed 100% of the Ethereum test vectors applicable to a zkEVM, setting the gold standard for EVM-equivalence.

Despite being EVM-equivalent, Polygon zkEVM doesn't compromise on performance. It's becoming faster and more cost-effective. Proof times for a batch of hundreds of transactions are nearing two minutes, promising increased throughputs soon. Proof costs for a large batch of transactions are as low as $0.06, making simple transfers cost less than $0.001.

3. Polygon zkEVM Validium

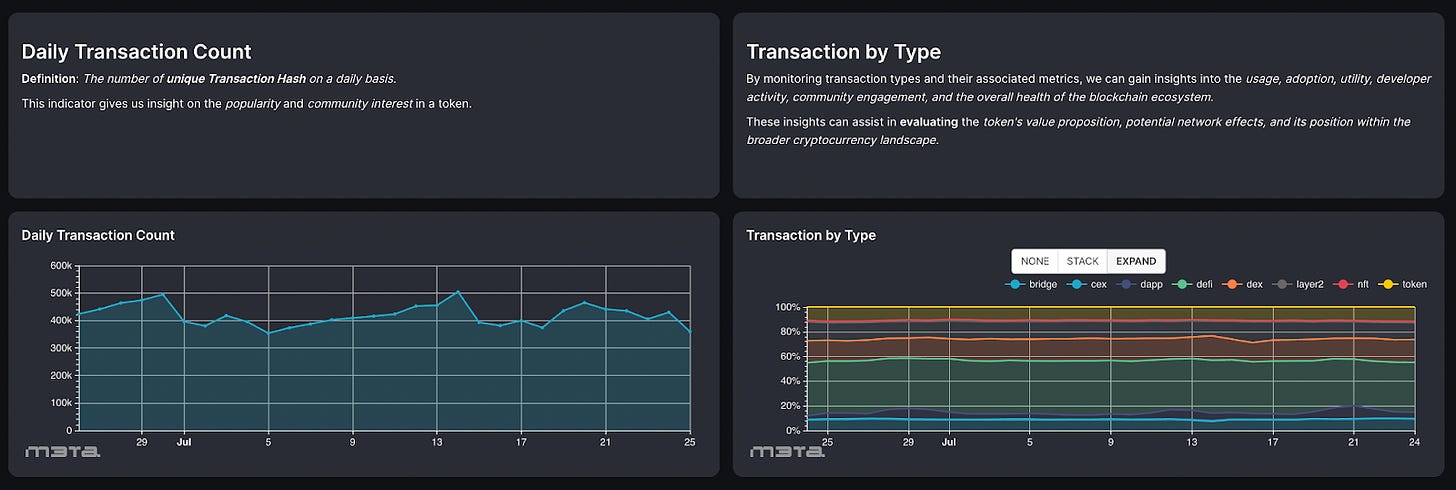

With approximately $966M assets locked and roughly 2.5 million transactions per day, it is no doubt Polygon PoS is one of the most important and relevant narratives in the future crypto development.

That's why it makes sense now to scale the chain up because Validiums hold advantages over Sidechains in two crucial areas:

Scalability: Rollups and Sidechains have their scalability capped by the data bandwidth of the Ethereum Mainnet. By decreasing the data load on Ethereum, Validiums significantly enhance Ethereum's throughput.

Security: Validiums employ validity proofs, providing them with superior security assurances compared to sidechains.

If approved, the transition will take place by Q1 2024.

4. Why Two Different Chains?

Tradeoffs and priorities. Simple as that.

To provide top-tier security, ideal for high-value DeFi applications where safety is paramount, Polygon zkEVM rollup comes with a tradeoff of marginally increased fees and restricted throughput.

Meanwhile, the compromise with Validiums is the necessity to guarantee the availability of transaction data outside Ethereum, which can pose difficulties. However, Polygon PoS already has a robust validator set of over 100 validators with around $1B staked, providing a secure and dependable assurance for data availability. Therefore, the upgraded Polygon PoS (zkEVM validium) would be more ideal for applications like Web3 gaming and micro DeFi that need high transaction volume and low fees, rather than high security.

Bottom line is they coexist, and together, they make up a stronger version of Polygon, made possible by Ethereum Virtual Machine (EVM) and ZK Power.

Perspectives on the Motivations for L1 Migration to Ethereum as an L2 Solution

In an interview at EthCC Paris, CTO of cLabs discussed the reasons for Celo's transition to L2 from L1. Here are the key points he highlighted:

Building a vast ecosystem like Ethereum is challenging for a single company.

Being an L2 allows seamless communication with other L2s on Ethereum without the need for trust.

Joining Layer 2 provides Celo with shared security from Ethereum's network while maintaining its unique features, such as paying for gas with tokens and sending value to phone numbers.

Layer 2 is part of Ethereum's scaling roadmap.

The roll-up approach offers enhanced security compared to client-based bridges or sharding-based strategies.

The integration will facilitate native bridges to Ethereum, allowing trustless communication across different L2s within the Ethereum network. Such interoperability will enhance the user experience by enabling seamless interactions between various decentralized applications (DApps) and protocols.

If You Can't Beat'em, Join'em!

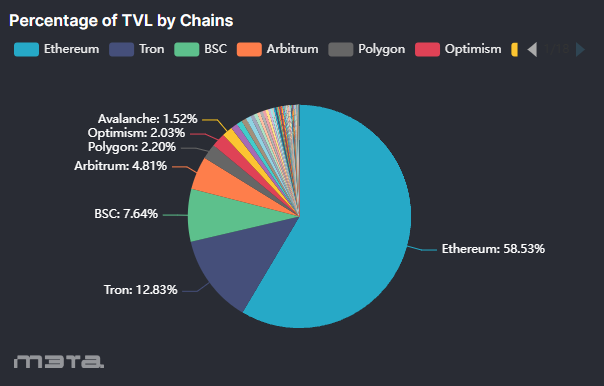

Despite the emergence of various Layer 1 networks positioning themselves as potential "Ethereum killers," Ethereum has demonstrated remarkable resilience. The Total Value Locked (TVL) in Ethereum accounts for a significant proportion, 58% of all blockchain networks, making it highly improbable for Ethereum to be completely replaced. While Ethereum's leading position might face challenges, its absolute demise appears unlikely.

Given these realities, L1 projects might find it more advantageous to be an L2 in Ethereum rather than compete against it. Embracing Ethereum allows projects to tap into existing network effects, benefit from a supportive community, and leverage an established ecosystem rather than struggling to carve out a small piece of the pie in the L1 market.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.