Shaping the Proof of Stake Future: Liquid Staking and the Emergence of Restaking

Despite predictions of decline, Liquid Staking is thriving in the evolving DeFi landscape thanks to 'restaking' LSD-Fi protocols.

Famed for offering a low-entry staking solution without the standard 32 ETH threshold, Liquid Staking isn't just about staking. It’s a ticket to an exciting DeFi playground where users can amplify their yields beyond ordinary staking returns.

While many anticipated its wane post-Shapella, the advent of 'restaking' LSD-Fi protocols breathed new life into it. Liquid Staking isn’t just surviving; it’s thriving, solidifying its position in the ever-evolving DeFi landscape.

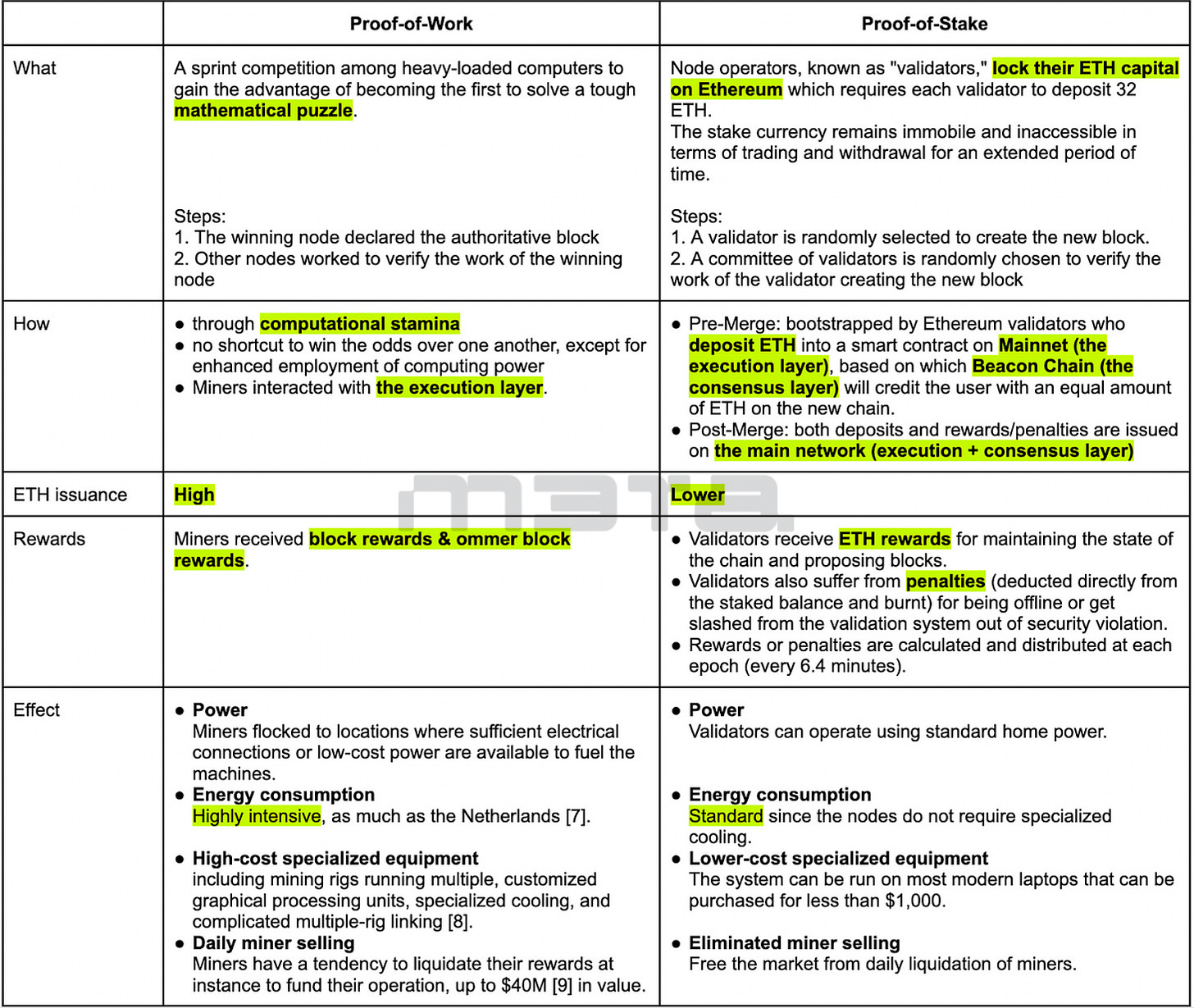

Consensus Mechanism: Proof of Stake

In the decentralized world of blockchain, where many maintain copies and contribute to its upkeep, there is a need for consensus, a common ground to validate and order transactions. Proof of Stake (PoS), the ‘chameleon’ of consensus mechanisms, despite not being the first, has a compelling $271.11B (1) market cap (as of June 16), accounting for ~26% of the $1.05T across the crypto market.

Through PoS, participants stake a particular cryptocurrency, locking it away in a digital wallet to support the network's operations, much like contributing to a shared coffer for the community's greater good.

Staking ETH Directly on Beacon Chain

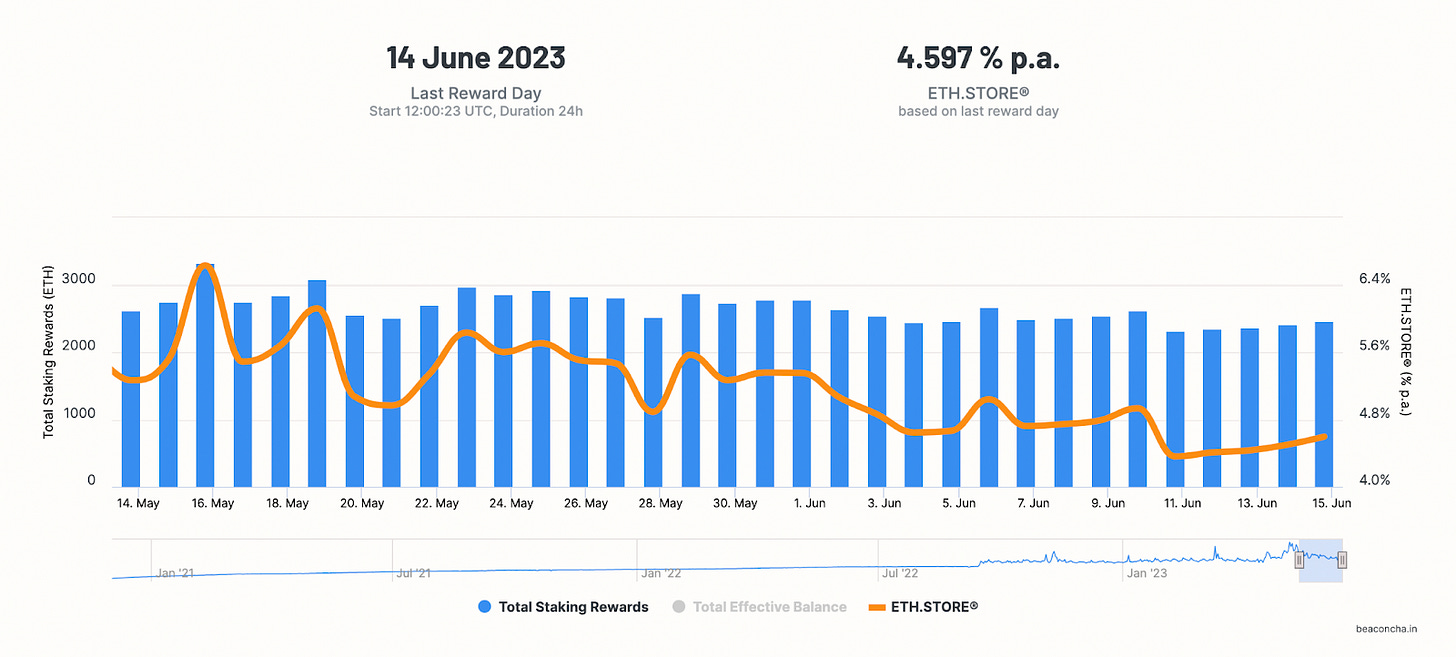

However, staking isn't always convenient, as it makes your funds inaccessible for a set period. Take Ethereum for instance, a network shifting from Proof of Work (PoW) to PoS. To stake on Ethereum, you lock up a minimum of 32 ETH and are rewarded with an average 4.6% APR (Figure 2), but during this period, your ETH is as good as frozen.

APR and APY are both measures used to express the interest or yield on financial investments. APR considers only the simple interest rate, assuming that interest is not reinvested or compounded. APY, which stands for Annual Percentage Yield, accounts for the effects of compounding on the investment or savings.

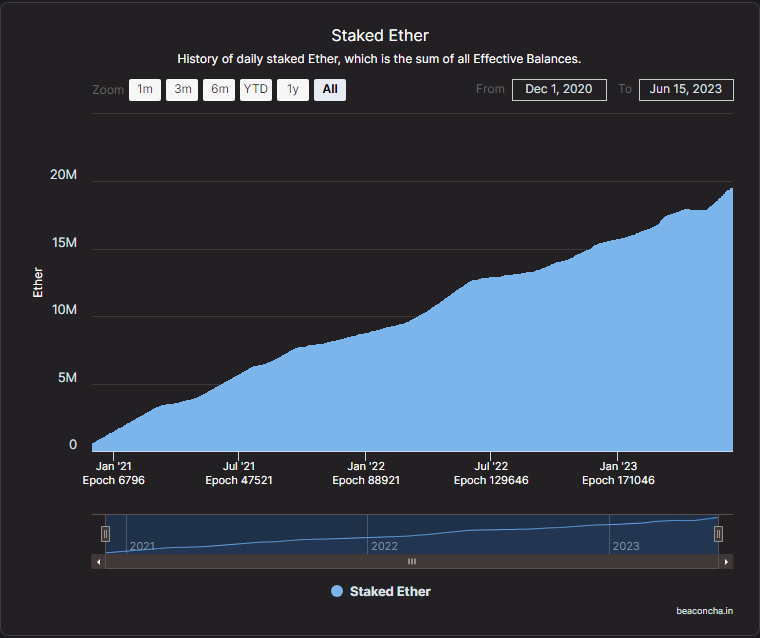

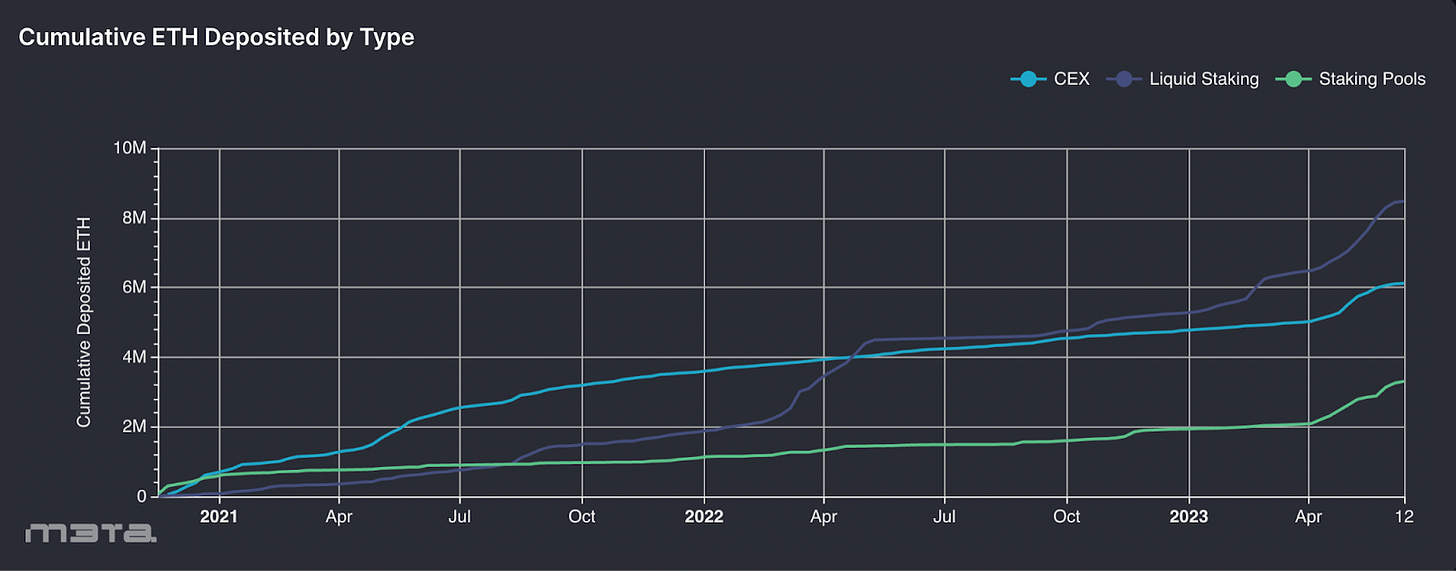

As depicted in the Figure 3, the growing number ETH locked within the Ethereum ecosystem is a testament to the continued trust and reliability placed in ETH as a valuable asset, even after the Shapella Upgrade, which has started allowing stakers to withdraw their reward ETH in epoch since April 2023.

Liquid Staking

Enter the concept of Liquid Staking, a brainchild of the pioneering Lido, designed to counter traditional staking's limitations. It's the equivalent of staking with the added freedom to trade or use your stake as collateral in DeFi.

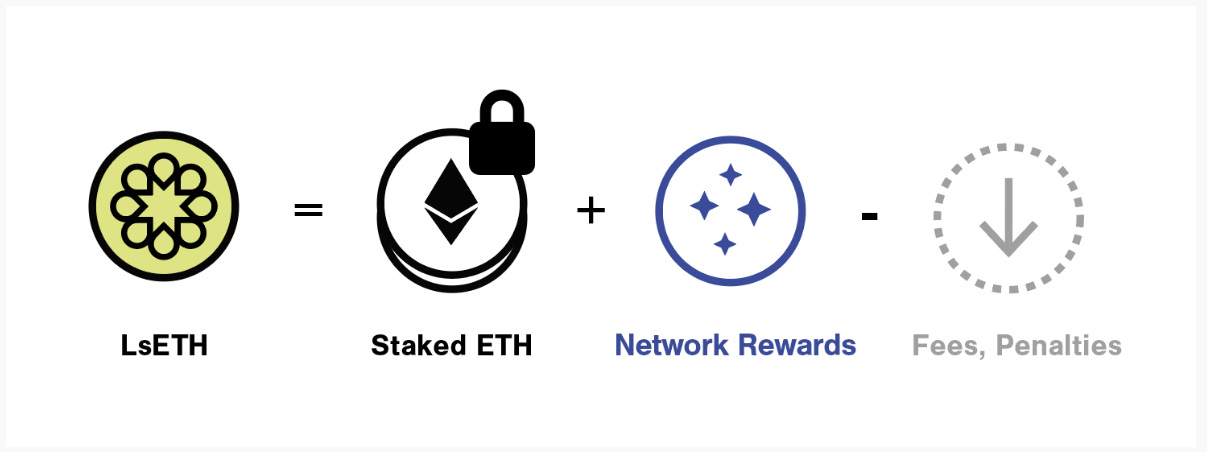

When you stake, you receive a liquid staking token (LST) that signifies your stake in the network, like a token of trust that can be exchanged or employed elsewhere (i.e. LP pools) to maximize potential.

Let's delve into Alluvial as an example, where staking ETH grants you LsETH, a representation of your staked ETH and any network rewards earned. This token can be traded or used as collateral in any LST supported DeFi, empowering users to maximize the potential of their staked assets. Alluvial will give a speech on the concept of Liquid Staking and its innovation soon at KBW 2023.

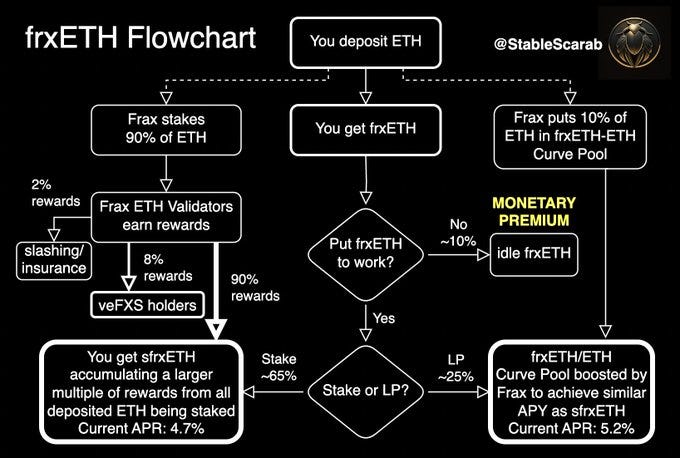

Typically, the APR for Liquid Staking Derivatives (LSD) should not exceed the APR of the Beacon Chain (Figure 5), as LSD projects usually take back a portion of the rewards for profits. However, Frax Finance has recently carved out a lucrative niche for itself while preserving a competitive Annual Percentage Rate (APR) via its unique Frax Ether (frxETH) approach.

In the Frax Finance framework, users deposit ETH and receive frxETH as a token of their contribution. Instead of solely staking, Frax Finance puts 90% of the deposited ETH towards staking and the remaining 10% towards farming within the frxETH-ETH Curve Pool. This balanced strategy amplifies its returns. For investors, this offers a flexible avenue - they can choose to stake, provide liquidity with frxETH, or explore both simultaneously, enabling them to reap the benefits of the high APR.

Although the Liquid Staking market has since gotten more and more crowded with other protocols desiring to share the pie, the alpha Lido managed to sow a good seed and has since maintained its market dominance.

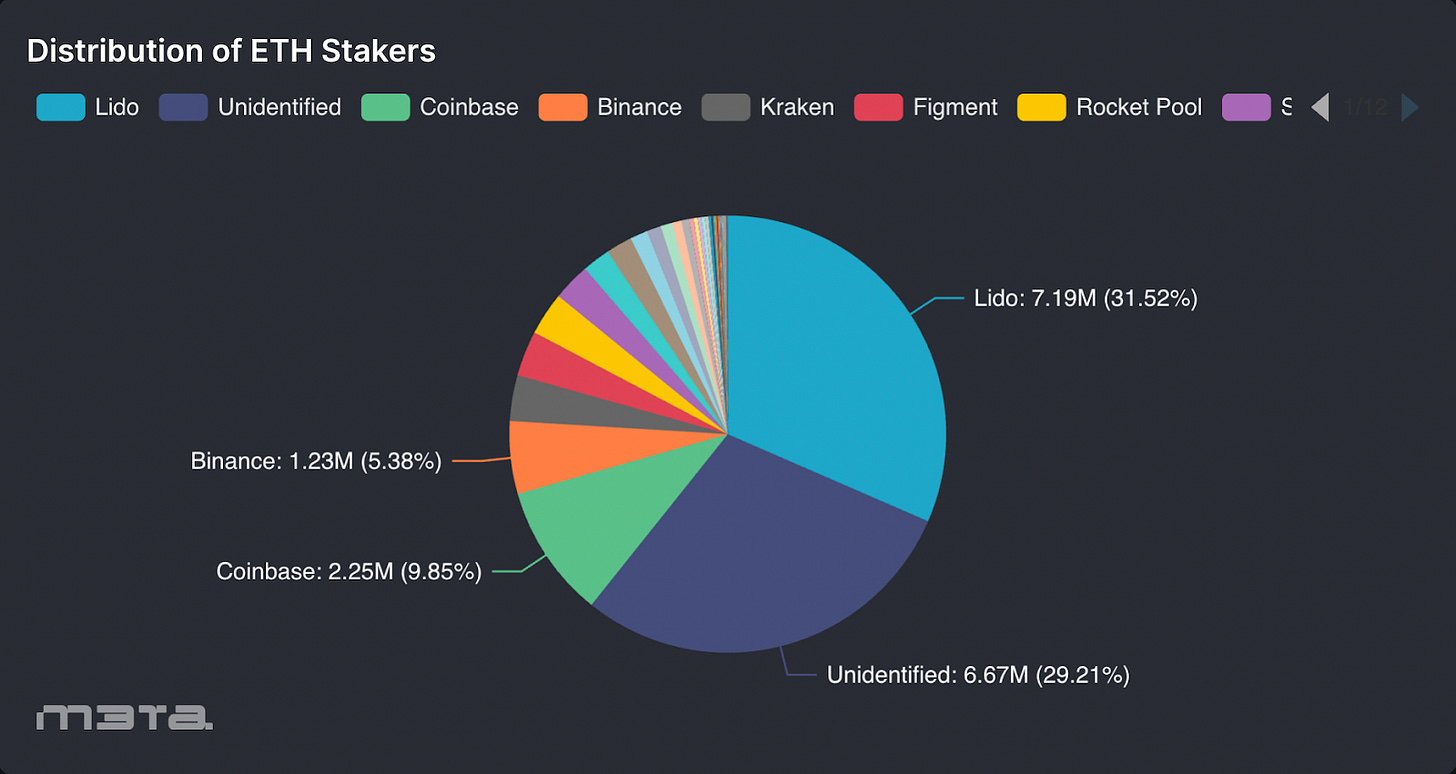

Reacting to this market dominance is the concern about centralization in Liquid Staking (2) if Lido or any other LSD platform continues holding a significant market share in ETH staking, which is almost a third now (Figure 7). A centralized attack could target entities like Lido, leading to network disruptions and security breaches.

However, dissenting voices (3) argue that concerns about over-centralization might be unfounded as staking providers, like Lido, have robust infrastructure and fail-safe measures. Additionally, Lido's use of 21 (4) validators showcases a level of transparency that most centralized exchanges do not offer. On the other hand, there are other significant staker entities like CEXes that may have even less alignment (5) with Ethereum's success and the principle of "decentralization."

As a result, there were 99.81% (6) votes against self-limiting deposits in June 2022.

Why is Liquid Staking important?

The growing popularity of Liquid Staking can be attributed to its various benefits including:

Double Rewards

Beyond securing rewards through staking, investors have the potential to reap further profits from various avenues, including yield farming, liquidity pools, lending, and derivatives.Enhance Security

In Proof-of-stake networks like Ethereum, security is paramount. The more ETH that is staked, the stronger and more secure the network becomes.

Restaking: A Derivation from the Regular Liquid Staking

Eigen Layer, in its innovative stride, has introduced the concept of Restaking (7) before the recent launch of their mainnet on June 15, 2023. This fresh approach seeks to mend the issues associated with fragmented trust networks.

Restaking offers ETH stakers an opportunity to reinvest, or "restake," their native ETH or Liquid Staking Token (LST) ETH using a separate smart contract. The protocol extends the capability of stakers to dedicate the same capital towards additional slashing risk, thereby providing extra security to new applications or middleware that form part of the Eigen Layer ecosystem.

Importantly, stakers are granted the choice to selectively decide the projects they wish to restake and safeguard, providing them a sense of control over their risk profiles. As a form of gratitude, the projects provide incentives to the restakers, acknowledging the critical role they play in upholding network security.

LSD State Post Shapella Upgrade

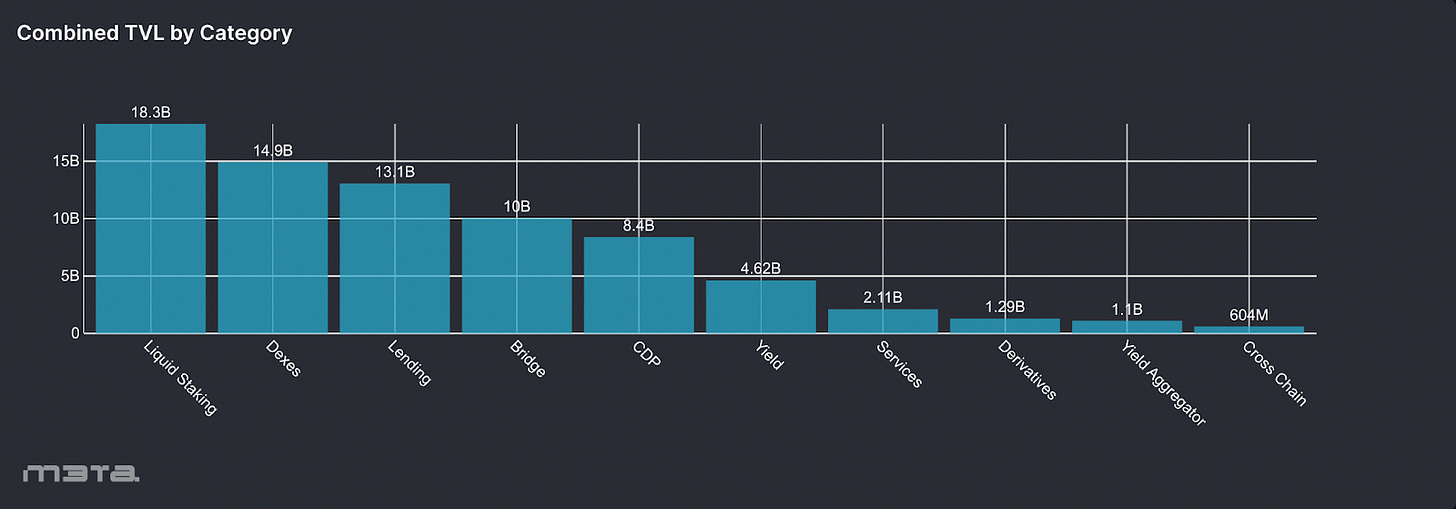

Following the Shanghai (Shapella) Upgrade, there has been a surge in staked ETH, impacting the cumulative ETH deposit within the Liquid Staking ecosystem and making Liquid Staking a preferred method, even overshadowing DEXes in Total Value Locked (TVL) since April this year.

Conclusion

The blockchain realm continues to evolve and adapt, seeking better solutions to existing challenges. The offerings of PoS, the rise of Liquid Staking, and the advent of Restaking, are all exciting manifestations of this evolution.

With this continued growth, the principle of decentralization stands firm, acting as a guardrail for the industry. As we continue to witness more innovations and the democratization of the blockchain ecosystem, it is crucial to embrace change, understand the risks involved, and appreciate the myriad opportunities that these new advancements present.

Reference

CryptoSlate, Proof of Stake (PoS) Cryptocurrencies

HackMD, The Risks of LSD

Twitter, @adamscochran on Twitter, May 28, 2022

Twitter, @BarryFried1 on Twitter, May 24, 2022

Twitter, @Fiskantes on Twitter, May 31, 2022

Snapshot, 0xDbBC...1CB6 on snapshot

EigenLayer Docs, Intro to EigenLayer

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.