Ripple Beats SEC in Court: XRP is not a Security

Sure, we've got a journey ahead of us when it comes to regulatory clarity for crypto, but Ripple’s victory was a great stride forward. Even the market has painted the town ‘green’ to celebrate!

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Top performers (7D)

Ripple - $XRP: +51.55%

Price as of time of writing: XRP/USD - $0.71

Ripple develops a cross-border payment system which is adopted by several Central Bank Digital Currencies (CBDC) in different countries. Currently, Ripple has three main products:

RippleNet: A global network of banks and payment providers using Ripple's technology.

XRP Ledger: A public decentralized blockchain.

RippleX: Empowering XRP developers with infrastructure, tools, and support for advancing digital economy solutions.

XRP Ledger currently uses the XRP consensus protocol, a centralized solution that improves transaction completion time.

After a two-year lawsuit between the Securities and Exchange Commission (SEC) and the native token XRP, a judge in New York declared on Jul 14, 2023 that XRP is not a security.

Compound - $COMP: +41.09%

Price as of time of writing: COMP/USD - $76.1

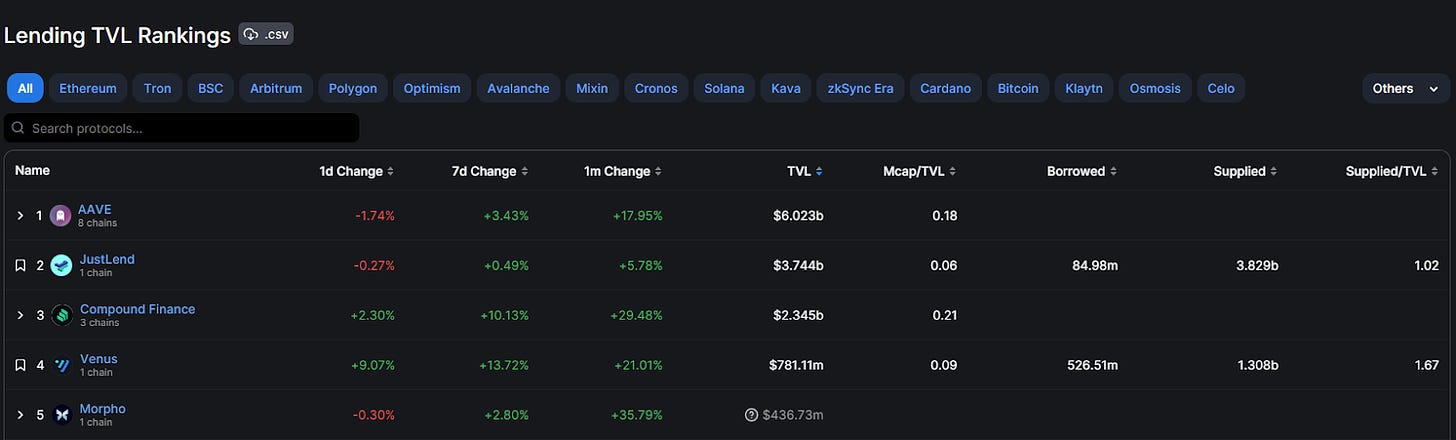

Compound, an Ethereum-powered lending and borrowing protocol, utilizes algorithms to determine interest rates by analyzing the activity within its liquidity pools.

Compound recently implemented an update to embrace a ‘non-custodial DeFi model’, a model allowing users to have complete control over their assets. This update introduced Encumber, a feature that enables users to detach their token ownership from the ability to transfer them.

It is currently among the Top 3 platforms in terms of Total Value Locked (TVL) for lending, following JustLend DAO and AAVE.

Synthetix - $SNX: +34.62%

Price as of time of writing: SNX/USD - $2.81

Synthetix is a lending and borrowing protocol that allows users to collateralize and mint synthetic assets (tokens represent real-word assets) on the Ethereum and Optimism networks.

On July 14th, the protocol announced that liquidity on Synthetix will be integrated with Infinex. Infinex is a UX-focused perpetual CEX and eliminates the requirement of a crypto wallet by adopting a username/password flow and storing users' private keys in users’ browsers. Infinex does not have its own token, but the exchange will use SNX. Infinex utilizes deposited stablecoins as margin and lends users sUSD, Synthetix's stablecoin, for trading.

Additionally, Synthetix is also progressing towards its Version 3 (V3). The new version will incentivize LP providers with more fee rewards by allowing them to lend their assets not only to Synthetix's LP pools, but also to other derivatives markets.

Liquity - $LQTY: +33.22%

Price as of time of writing: LQTY/USD - $1.21

Liquity is a lending and borrowing protocol on the Ethereum blockchain. It allows users to create a dollar-pegged stablecoin called LUSD, which is used in the Liquity protocol and backed by Ethereum for loans with a 110% collateral ratio..

The protocol recently announced its plan to upgrade to Version 2, with a focus on introducing LST (Liquid Staking Token) collateral into the system.

Synapse - $SYN: +29.45%

Price as of time of writing: SYN/USD - $0.81

Synapse is a stable swap cross-chain bridge protocol that allows users to convert stablecoin assets across 15 blockchains compatible with Ethereum Virtual Machine (EVM). Synapse integrates Optimistic-rollup technology, which makes the bridge cheaper and capable of handling higher transaction volumes compared to similar products on the Ethereum blockchain.

Top losers (7D)

Verge - $XVG: -22.64%

Price as of time of writing: XVG/USD - $0.01

Verge offers user-friendly software that allows people to make secure payments using blockchain technology. They have created a payment app called Vergepay, which includes the Tor network to protect the privacy and enhance the speed of Bitcoin transactions.

XVG was leading the Top Performers 2 weeks ago.

Ecash - $XEC: -15.28%

Price as of time of writing: XEC/USD - $0.00003078

ECash is a fork of Bitcoin Cash ABC (BCHA), a derivative of Bitcoin and Bitcoin Cash.

XEC was among the Top Performers 3 weeks ago.

Bitcoin SV - $BSV: -12.3%

Price as of time of writing: BSV/USD - $37.09

Bitcoin SV is a fork from Bitcoin Cash (BCH) blockchain in 2018 with a larger block size (128MB). This allows for faster processing speeds of over 50,000 transactions per second (TPS).

BSV was among the Top Performers 4 weeks ago.

StorJ - $STORJ: -10.35%

Price as of time of writing: STORJ/USD - $0.31

Storj is a decentralized cloud storage platform. It uses a network of decentralized nodes to store user data. Individuals or organizations who want to store their data on the network need to provide STORJ tokens as payment to the nodes.

Waves - $WAVES: -7.7%

Price as of time of writing: WAVES/USD - $1.98

Waves is a Proof of Stake blockchain (PoS) designed to enable users to create and launch custom crypto tokens and exchange, and trade cryptocurrencies.

Despite the positive performance of Ripple, these tokens still experienced a price decrease last week. This decline can be attributed to the significant surge in token prices in the preceding weeks, prompting investors to capitalize on their gains. Consequently, the prices took a downward turn.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Consumer Price Index (CPI) - which measures the price of consumer goods and how they're trending; a rise in PPI correlates with a higher inflation and consumers' hesitation to spend money

In June, the consumer price index experienced a 0.2% increase, marking a 3% rise compared to the same period last year. This is the lowest uptick in CPI since March 2021.

The core CPI also showed a 0.2% increase, but recorded a higher rise of 4.8% when compared to the previous year.

Producer Price Index (PPI) - which measures the average prices received by producers for their goods and services; a rise in PPI correlates with a higher inflation and consumers' hesitation to spend money

June producer price index (PPI) for final demand increased by 0.1%, lower than expected of 0.2%.

The core PPI increased by 0.1%, matching expectation.

During the forthcoming policy meeting in late July, it is anticipated that the Federal Reserve will raise borrowing costs by an additional 25 basis points. Forecasts indicate a probability of over 96% for the central bank to implement a rate hike during the gathering.

Micro

Binance - Jul 10, 2023

Binance Launchpad introduces its 32nd token sale for Arkham (ARKM) at a $2.5 million hard cap.

The Launchpad provides users with the chance to obtain up to 300,000 ARKM tokens (maximum $15,000).

Arkham is a company specializing in blockchain intelligence, and they have developed a platform that offers insights into the real-world entities and individuals involved in cryptocurrency market activities.

They recently launched Intel Exchange that runs by the ‘intel-to-earn’ model, which sparks controversy over the objective between ‘transparency' and ‘privacy'.

The Defiant - Jul 13, 2023

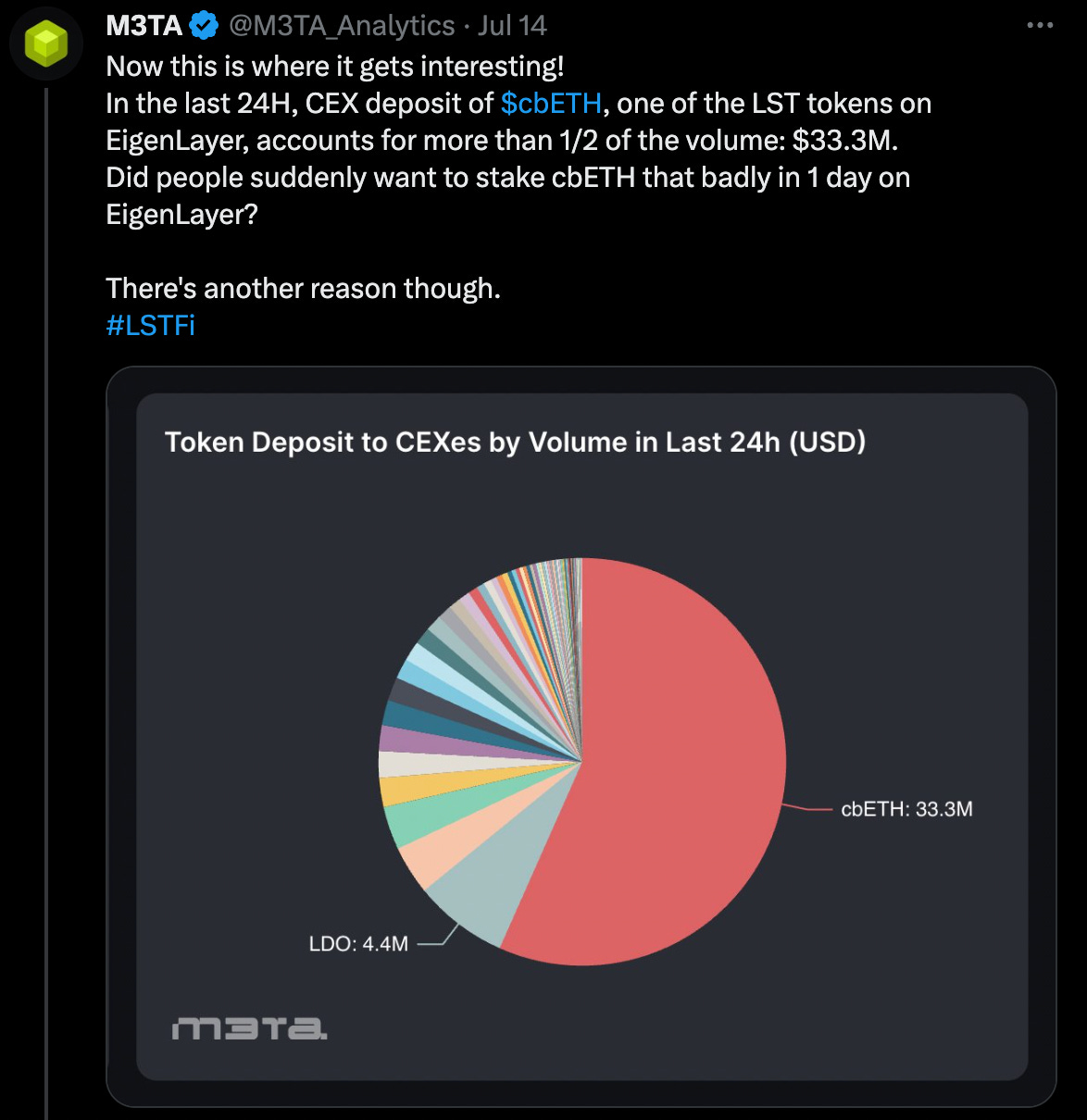

The EigenLayer protocol, a specially crafted protocol enabling users to restake ETH and LST (Liquid Staking Token) for enhanced security in applications beyond the Ethereum blockchain, has captured the interest of crypto investors.

Notably, they have recently increased the maximum limit for global LST deposits in the protocol, raising it from 9,600 to 30,000 staked ETH.

Responding swiftly to the overwhelming demand, EigenLayer further elevated the limit to 45,000 tokens in less than one hour.

We also noticed in 24H after the cap raise, $cbETH accounted for the largest CEX deposit volume. Follow our investigation on this tweet.

News Highlight

CoinDesk - Jul 13, 2023

Polygon founders and researchers proposed an upgrade to replace the MATIC token with POL on the Polygon network.

The upgrade would allow POL to function as a single token for all Polygon-based networks, including the main blockchain, the zkEVM network, and supernets.

Validators on the network would be able to support multiple chains using a single token if the proposal is accepted.

Holders have the opportunity to become validators and receive rewards, but with two significant enhancements: validators can validate multiple chains, and chains can offer multiple roles and corresponding rewards.

POL token holders can use it to vote on governance proposals for decentralized applications on Polygon, and all rewards will be distributed in POL.

Decrypt - Jul 16, 2023

BlackRock, Invesco, Wisdom Tree, Bitwise, Valkyrie, Fidelity and ARK Invest have filed for spot Bitcoin ETFs.

BlackRock revised its application after the SEC signaled that it was lacking a "surveillance sharing" clause involving Coinbase.

BlackRock's application will be published in the Federal Register, triggering a 21-day public comment period during which any member of the public can submit their thoughts, concerns, or support for the application. After this period, SEC will review these comments as part of their decision-making process.

Four other applications related to the Cboe BZX Exchange, including Wise Origin Bitcoin Trust, WisdomTree Bitcoin Trust, VanEck Bitcoin Trust, and Invesco Galaxy Bitcoin ETF, have also entered a three-week comment period.

Decrypt - Jul 17, 2023

XRP, the cryptocurrency powering Ripple's payments ecosystem, experienced ~100% surge in less than an hour following a judge's ruling in the SEC case against Ripple Labs.

The judge determined that programmatic sales of XRP do not meet the criteria for securities, while institutional sales of XRP do classify the coin as a security.

This ruling potentially establishes a new framework where the manner of cryptocurrency sales, as well as associated marketing and messaging, can determine its classification as a security.

Brad Garlinghouse, the CEO of Ripple Labs, expressed his satisfaction with the decision in a tweet, stating that they had been confident in their compliance with the law and are grateful for the support received.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.