Riding the FUD Wave: Crypto Exploit and the Tug-of-War of Stablecoin Stability

DeFi prevails as the market lynchpin with FUD of Hashflow ripped off, USDT depegged on Curve. What’s more?

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Top performers (7D)

Linear - $LINA: +40.11%

Price as of time of writing: LINA/USD - $0.013

Linear Finance is a decentralized, cross-chain platform that aims to bring traditional financial derivatives to the blockchain. It provides a framework for creating, trading, and managing synthetic assets, including tokenized versions of traditional financial instruments such as stocks, commodities, and indices.

The project supports synthetic assets or LINA tokens as collateral on the ERC-20 chain compatible with EVM to mint ℓUSD (Liquid asset).

The $LINA chart has shown a bullish trend since the beginning of 2023, with consistently higher peaks. Additionally, as a Hong Kong-based company, Linear has garnered attention amidst the recent trends in Hong Kong.

Akash - $AKT: +37.81%

Price as of time of writing: AKT/USD - $0.7

Akash Network is a decentralized marketplace for cloud computing that offers a speedy, efficient, and cost-effective solution for deploying dApps.

Akash will soon launch its Akash GPU Testnet on June 20, 2023. This testnet enables participants to engage in testing the world's first open-source cloud designed specifically for open-source GPUs and AI. People can share their computer's graphics cards (GPUs), set rules for how they work (deployment specifications), use these cards to test AI programs, and then check how well these GPUs are performing by comparing their work to a standard measure (benchmark).

The recent increase in AKT price could be attributed to the upcoming Akash GPU Testnet and the news of ByteDance (TikTok) placing a $1 billion order for GPUs this year.

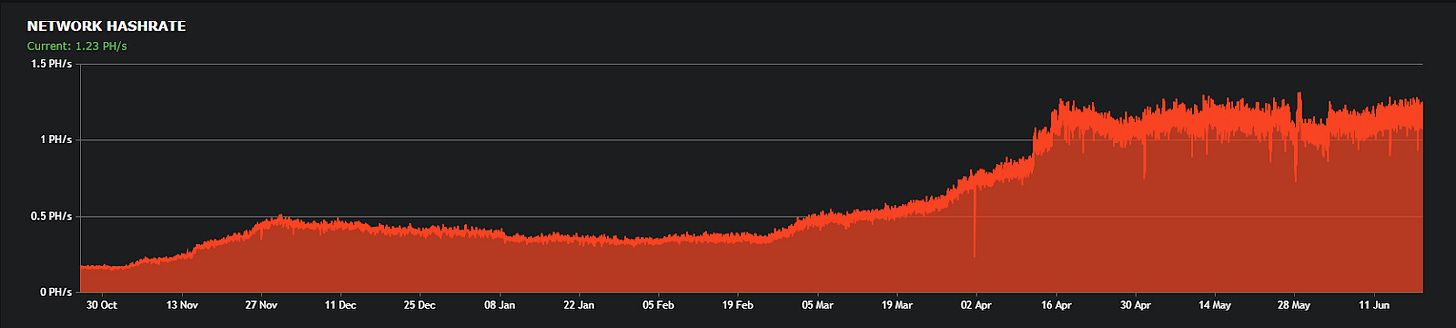

Kaspa - $KAS: +36.17%

Price as of time of writing: KAS/USD - $0.02

Kaspa is a PoW cryptocurrency that uses the GHOSTDAG protocol, whose way of working could be loosely compared to sharding. Thanks to GHOSTDAG protocol, transactions can take place concurrently across different chains, unlike traditional blockchains which usually facilitate one by one.

ViaBTC's launch of the $KAS mining pool on May 31, 2023, has brought attention to Kaspa as one of the top proof-of-work (PoW) projects. Users mining in the KAS pool are offered the advantage of mining with zero fees for a month. This incentive is likely to attract a considerable number of miners, resulting in an increase in hashrate and difficulty. The surge in price may be attributed to miners driving up the price in order to cash out their earnings.

Vega Protocol - $VEGA: +30.8%

Price as of time of writing: VEGA/USD - $1.54

Vega Protocol provides the derivatives scaling layer for Web3. It is a custom-built proof-of-stake blockchain, which makes it possible to trade derivatives on a decentralized network.

The price of $VEGA has experienced a surge following the launch of their trading and market-making functionality on the Alpha Mainnet.

Galxe - $GAL: +24.71%

Price as of time of writing: GAL/USD - $1.19

Galxe is a Web3 credential data network that facilitates on-chain credential tracking for Web3 developers and projects. As the 30th project on Binance Launchpool since its launch on April 20, 2022. In short, Galxe enables users to engage with other projects and earn evidence of interaction through NFTs, points, rewards, or airdrops.

The price increase is a result of a rebound from a previous week of altcoin declines.

Top losers (7D)

Ripple - $XRP: -5.59%

Price as of time of writing: XRP/USD - $0.48

Ripple is an open-source, permissionless, and decentralized technology that serves as a payment settlement system and currency exchange network, capable of processing global transactions. Ripple also supports countries in launching Central Bank Digital Currencies (CBDCs).

XDC Network - $XDC: -3.55%

Price as of time of writing: XDC/USD - $0.01

XDC Network is an open-source blockchain protocol designed for enterprise use. It is EVM-compatible and enables enforceable smart contracts. With its ability to tokenize real-world assets and financial instruments, it has the potential to revolutionize and decentralize the trade finance industry.

Last week, BTC experienced a recovery following a recent dip, which explains why these tokens did not decrease significantly in value.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Consumer Price Index (CPI) - which measures the price of consumer goods and how they're trending; a rise in PPI correlates with a higher inflation and consumers' hesitation to spend money

The Consumer Price Index (CPI) rose by 0.1% in May, slightly lower than the expected 0.2%. The 12-month change declined to 4.0% from April's 4.9%.

The core CPI met expectations, with a 4% increase in core CPI on a monthly basis and a 5.3% increase on a yearly basis.

Producer Price Index (PPI) - which measures the average prices received by producers for their goods and services; a rise in PPI correlates with a higher inflation and consumers' hesitation to spend money

PPI for final demand increased by 1.1% on a yearly basis, lower than April's 2.3% rise and below the expected 1.5%.

The annual Core PPI rose by 2.8%, slightly below the market expectation of 2.9%. On a monthly basis, the PPI declined by 0.3% while the Core PPI increased by 0.2%.

Interest rate - a key indicator of the economy as it affects the cost of borrowing and lending money. A higher interest rate indicates that borrowing money is more expensive, while a lower interest rate indicates that borrowing is more affordable.

The Federal Reserve left interest rates unchanged at 5.00%-5.25% range.

Retail Sales - which track consumer demand for finished goods over time by measuring purchases of durable and non-durable goods.

US retail sales in May 2023 showed an unexpected 0.3% increase compared to the previous month, surpassing expectations of a 0.1% decline.

The U.S. central bank announced that it will temporarily stop increasing interest rates after doing so consistently for over a year. However, it also indicated that it plans to implement two more rate hikes in the future. Additionally, the bank raised its prediction for the target rate of the Federal funds rate to 5.6%, which is 50 basis points higher than what was forecast in March.

Micro

CoinDesk - June 19, 2023

A Hong Kong lawmaker - Johnny Ng, invited global virtual asset trading operators, including Coinbase, to register in the region.

This invitation comes amidst the U.S. crackdown on crypto exchanges like Binance and Coinbase, both facing lawsuits from the SEC for alleged violations of securities laws.

Coinbase has expressed consideration of moving out of the U.S. due to regulatory uncertainty, while actively pursuing expansion in Abu Dhabi, Canada, and awaiting a full license in Singapore.

Despite the possibility of leaving the U.S., Coinbase remains committed to representing the industry and advocating for regulatory clarity in the country.

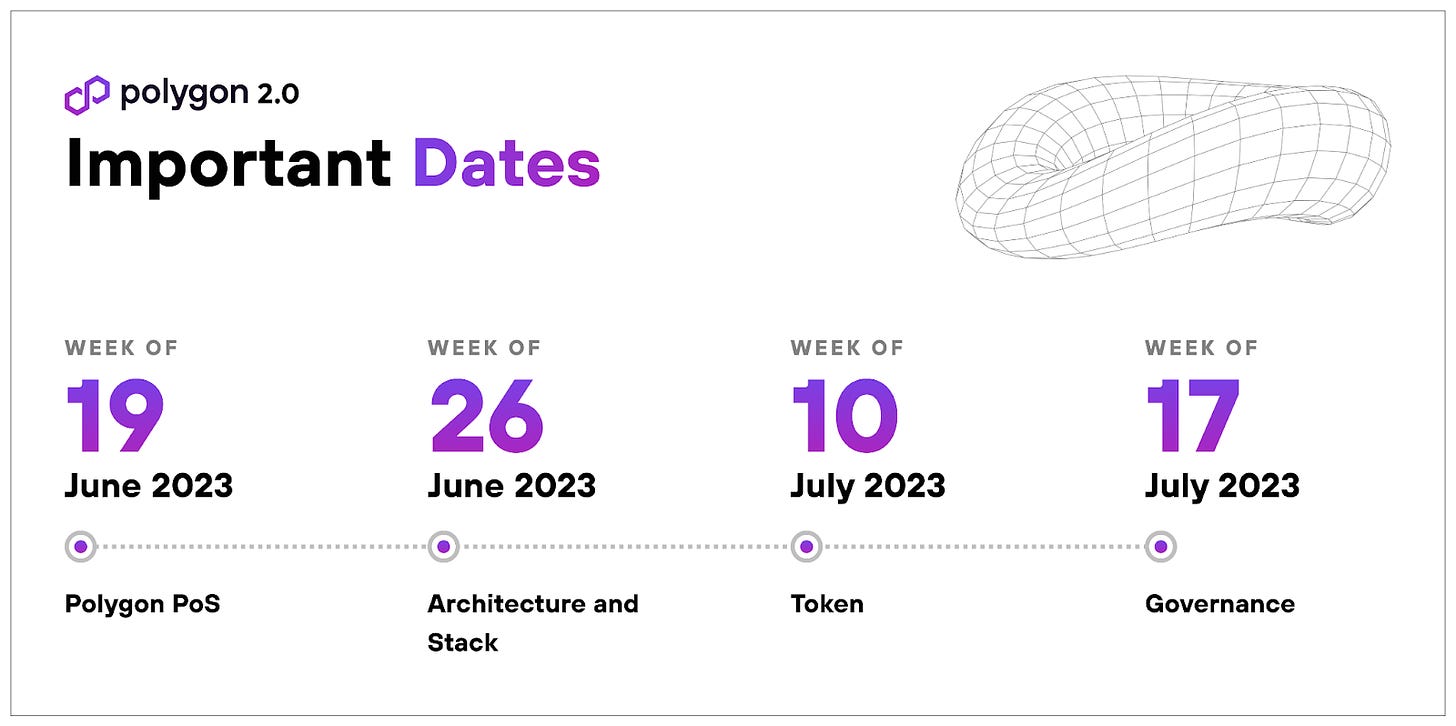

Polygon - June 12, 2023

Polygon 2.0 will be ‘developed and deployed outside US’.

Polygon 2.0 aims to address Ethereum's scalability issues without compromising liquidity and security by introducing zk-powered Layer-2 chains interconnected by a cross-chain coordination mechanism.

The goal is to establish Ethereum as the base value layer for Web3 by implementing new consensus algorithm, architecture, stack, token, and governance.

Users will have access to multiple chains and seamless cross-chain interactions similar to browsing websites on the traditional internet.

The Defiant - June 17, 2023

On June 17, EigenLayer announced the deployment of the Stage-1 EigenLayer protocol on Ethereum Mainnet

Users can deposit liquid staking tokens (LSTs), currently supported stETH, rETH, and cbETH, into the protocol or set up an EigenPod for native restaking of ETH.

EigenLayer allows Ethereum stakers to validate third-party services for additional yield while earning staking rewards.

Liquid staking pools are capped at 3,200 tokens each, and individual deposits are limited to 32 tokens per transaction.

Creation of new EigenPods (the contract that a staker must set their Ethereum validators' withdrawal credentials to) will pause once native staking surpasses 9,600 ETH, and withdrawal requests have a seven-day delay before execution.

News Highlight

BE(in)CRYPTO - June 15, 2023

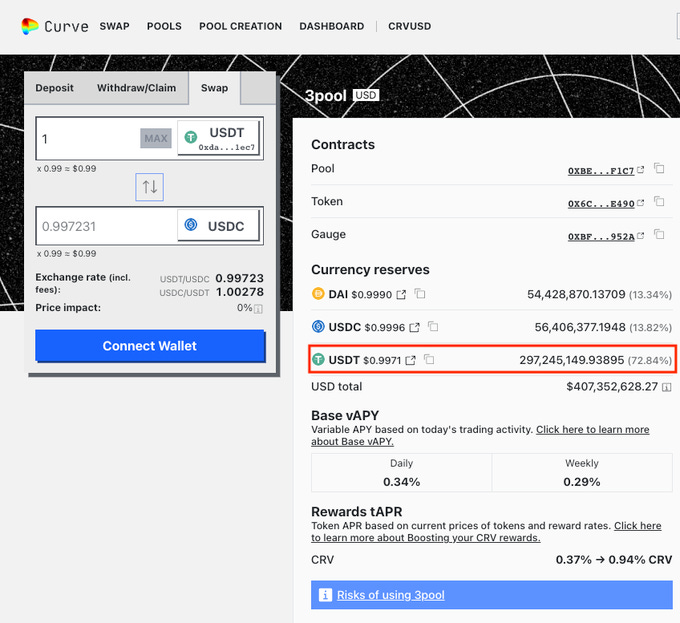

On June 15, Tether’s USDT has been destabilizing and has lost its $1 peg.

With USDT weightage at around 73.8%, traders are increasingly selling USDT for DAI or USDC.

CZSamSun was suspected to be the main cause of the depegging

CZSamSun borrowed 31.5 million USDT and exchanged it for USDC, causing a slight deviation in USDT's value.

The borrowed sum was converted to USDC using the 1inch Network, with 17,000 ETH and 14,000 stETH as collateral.

Deposits of $10 million and $21 million were made to Aave v2 and v3, respectively.

A USDT loan of 12 million was taken from v3 and deposited into v2.

Another address (0xd2...0701) mortgaged 52,200 stETH through Aave v2 and borrowed 50 million USDC using the USDT/USDC price difference.

Tether CTO Reassures

Tether's CTO reassured the crypto community on Twitter, stating that the depeg scare is not a concern and Tether is prepared to redeem any amount.

CryptoSlate - June 15, 2023

On June 15, Hashflow reported that approximately $600,000 of funds were affected, but did not explicitly confirm an attack.

Hashflow DEX was unaffected by the exploit.

The attack was initially reported by PeckShield as an "approve-related issue" resulting in $400,000 worth of ETH and ARB being stolen.

PeckShield identified the attacker as a white hat hacker, ‘morally aware bad devs’ (let's put it this way), and highlighted the presence of a recovery function in the hacker's contract.

Hashflow has 2 recovery options: one for total funds and the other donates 10% to the white hat hacker

Later that day, the whitehat verified the contract of withdrawal. Users could call recover or recoverWithDonate functions by passing the token as a parameter.

Hashflow endorsed the hacker's recovery contract and provided instructions for users to revoke token allowances and use the recovery function.

CoinTelegraph - June 16, 2023

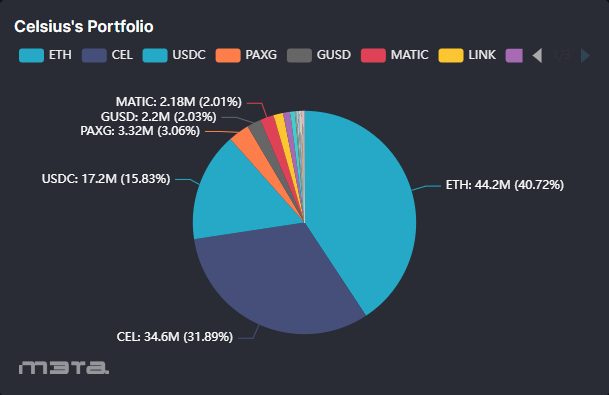

Celsius has revised its bankruptcy filing and is awaiting approval from a New York bankruptcy court after being acquired by the Fahrenheit crypto consortium.

The revised plan involves converting all customer altcoins to Bitcoin and ETH starting from July 1, except for "Custody and Withhold accounts."

The reorganization plan suggests handling claims from retail borrowers by offsetting their losses against any profits they have made in a specific year.

The restructuring proposal by Celsius may face opposition from borrowers who claim that Celsius is demanding loan repayment without fulfilling contractual obligations, such as returning collateral.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.