On-chain Analysis: TON - The Open Network

Once developed by Telegram, now open-sourced and mostly secured by validators, The Open Network has the potential to represent the future of Web 3.0. Here's the M3TA's on-chain analysis of TON.

Abstract

The Open Network (TON) is a revolutionary blockchain platform designed to meet the needs of billions of users. Its main objective is to provide a highly efficient, secure, and scalable infrastructure that is as user-friendly as possible.

The TON blockchain operates on a multi-blockchain architecture that comprises a master chain, multiple working blockchains, and sharding protocols. TON has employed Proof-of-Stake (PoS) as its primary mechanism to achieve consensus since May 2022.

Seeing the almost limitless influence of TON on the sustainability of Web 3.0, M3TA has decided to join the TON ecosystem as a data analytics dApp that provides accurate and easy-to-understand specialized fundamental analysis for the growing TON community.

Simply speaking, we make data analytics about TON and for TON: M3TA dApp on TON.

Access the link above or find us in the Explorer Category.

In this article, we will provide an in-depth analysis of the TON blockchain, which will be viewed under different segments:

User Analysis

Inflation Analysis

Top Wallet Group Analysis

A side-by-side comparison between TON and SOLANA, in the form of a bonus tweet

All the data used for analysis is sourced from tontech.io, a leading provider of data and analytics for TON.

With this comprehensive analysis, readers will be able to get a clear understanding of TON's architecture and capabilities, and how it compares to other blockchain platforms.

TL;DR at M3TA TON - The Open Network Dashboard.

WHAT IS TON?

In 2017, the concept of the Telegram Open Network project began to materialize, eventually resulting in the creation of TON. The project has since evolved and is now known as The Open Network, with a new team spearheading its development. However, the Durov brothers' technology remains at the core of the platform.

As outlined in the TON whitepaper, the Durov brothers wanted to create a blockchain-based decentralized platform that can combine features of both blockchain and distributed database technologies.

The TON blockchain employs a unique architecture that includes a master chain and up to 2^92 accompanying blockchains, or "shards", each capable of processing a large number of transactions in parallel.

The platform also incorporates features such as smart contracts, instant hypercube routing, and a unique protocol for value transfer known as the "TVM" (TON Virtual Machine). The goal of this technology is to provide a highly scalable and secure infrastructure for a wide range of decentralized applications, from micropayments and peer-to-peer messaging to file storage and decentralized VPN services.

TON ECOSYSTEM ANALYSIS

1. User Analysis

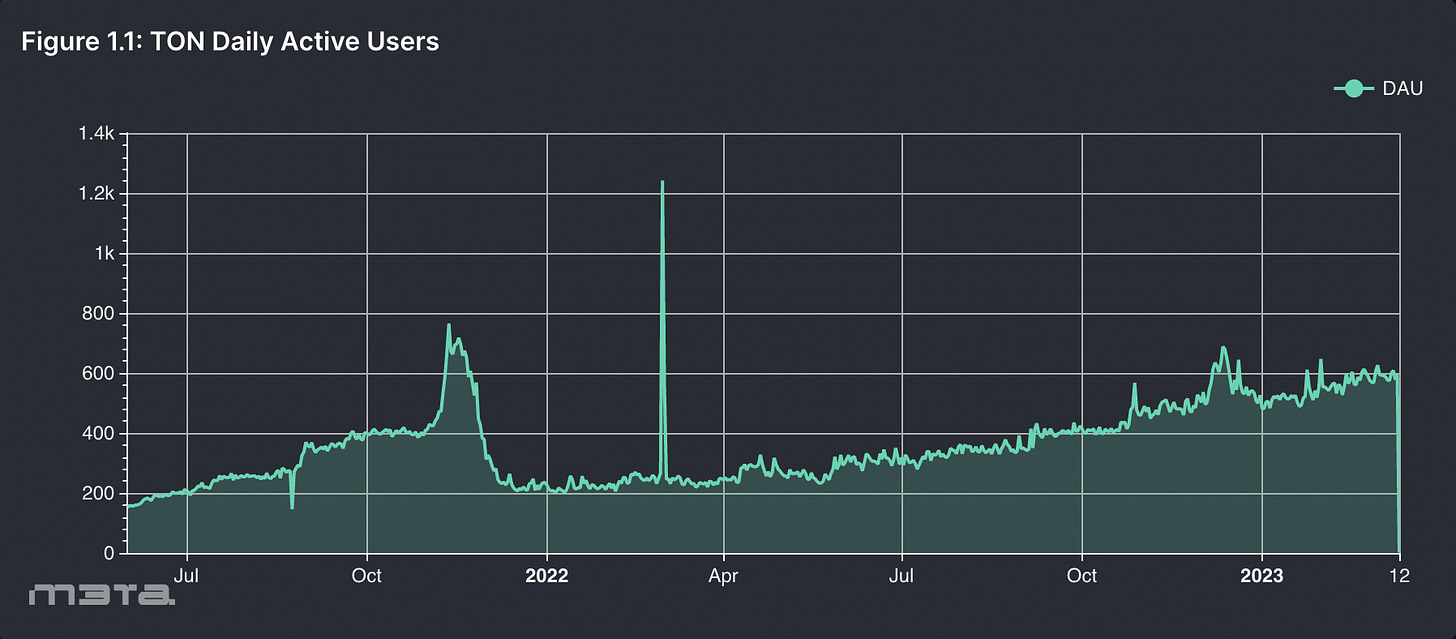

As per the data in Figure 1.1, in November 2021, the TON blockchain experienced a significant surge in daily active users, which many attribute to the platform's first announcement of integration with Telegram. This announcement ignited the curiosity of investors, resulting in a substantial increase in daily active users. However, after a few weeks, the hype died down, and the number of daily active users declined.

In February 2022, TON underwent a significant change, with the TON token, previously known as $TONcoin, changing its ticker to $TON. This move prompted many investors to question whether TON had made any significant upgrades or improvements to its platform. Nevertheless, this change managed to draw the attention of investors, resulting in a boost in marketing events and other activities designed to attract investors to the platform.

Since then, TON has continued to focus on improving its platform and attracting new users. The platform has launched several new features and upgrades, including enhanced security measures and improved user interfaces. These efforts have paid off, with the platform seeing a steady increase in daily active users and a growing community of investors who are excited about TON's potential.

The Transaction Per Second (TPS) is a crucial metric that determines the upper limit of transactions that a blockchain can handle within one second. It serves as an important performance and scalability indicator for any network.

TON (Telegram Open Network) stands out as a high-performing blockchain that offers exceptional TPS without having to sacrifice top-notch security. TON's impressive TPS is due to its support for workchains and dynamic sharding.

According to the TON’s website, the system can potentially handle a maximum of 2^32 workchains, with each workchain being subdivided into up to 2^60 shard chains. This architecture enables seamless cross-shard and cross-chain communication, allowing TON to process millions of transactions per second.

For comparison, Ethereum's mainnet can handle 10-15 TPS, Bitcoin's maximum TPS is 7 while Arbitrum can process up to 40,000 TPS. However, TON's capability to facilitate millions of transactions per second sets it apart as an outstanding performer in the blockchain space.

As the TON network is still in the process of gaining momentum, the current average TPS per day remains around the threshold of 1.5 TPS (Figure 1.2).

In the TON ecosystem, the number of user addresses has continuously increased from approximately 80K to over 2M at the present (Figure 1.3), showcasing its remarkable growth. Unique wallets within the TON ecosystem increased by over 11 times from 173K to 1.93M by December 2022, within the span of just 12 months.

The monthly growth rate peaked at 44% in early 2022 before dropping to around 10% by January 2023 (Figure 1.3). Particularly, there were two most notable waves of wallet growth observed in May-July and November 2022, respectively (Figure 1.4).

The initial surge in new wallets can be attributed to 04 main off-chain commotions:

the introduction of the $250M TONcoin Fund, which provided financing, incubation, and grants for TON-based projects

the listing of TON token on many CEX platforms such as OKX, CoinEx, FTX, BitMart, and MEXC, which played a significant role in attracting new investors to register wallets

the transition of the TON blockchain from Proof-of-Work to Proof-of-Stake in May 2022.

In June, TON held a series of contests, secured a listing on BitoPro, and launched a new service that enabled users to create their tokens with just one click, attracting even more users.

During the second wave of wallet growth in November, TON was listed on Bidget and Bybit, which contributed to the expansion of the ecosystem's user base.

Moreover, the TON ecosystem experienced further growth due to the Christmas NFT Contest, which offered a remixed carol by UK dance act Star.One (who recently remixed the song "2 Step" for Ed Sheeran) as a reward.

Since its inception, the trading volume on the TON blockchain has experienced exponential growth on a monthly basis. In the early stages, the volume was at $4B, which has now surged to a staggering $14B in 2022 (Figure 1.5). The peak was reached in November 2022 at $15.7B, which is a remarkable achievement.

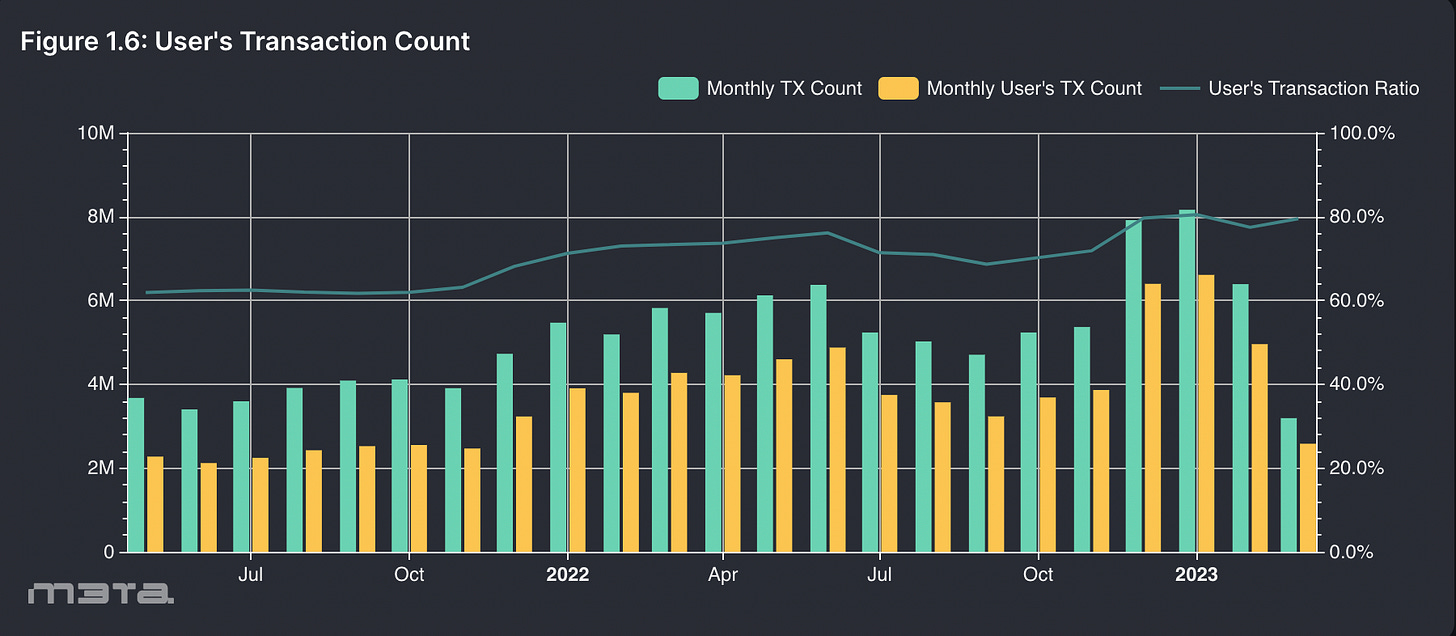

Although the number of transactions on the TON blockchain ranged from approximately 4M to 6M before December 2022 and January 2023, it broke out to 8M during those months (Figure 1.6). This growth reflected the increasing popularity of TON among users.

The TON blockchain's user transaction percentage has consistently remained above 60% throughout its existence and currently stands at around 80% (Figure 1.6). This statistic suggests that TON has a vibrant community with substantial levels of user engagement.

Overall, our analysis shows that the TON ecosystem has demonstrated strong growth with a vibrant user base, making it a promising platform for trading and other blockchain activities.

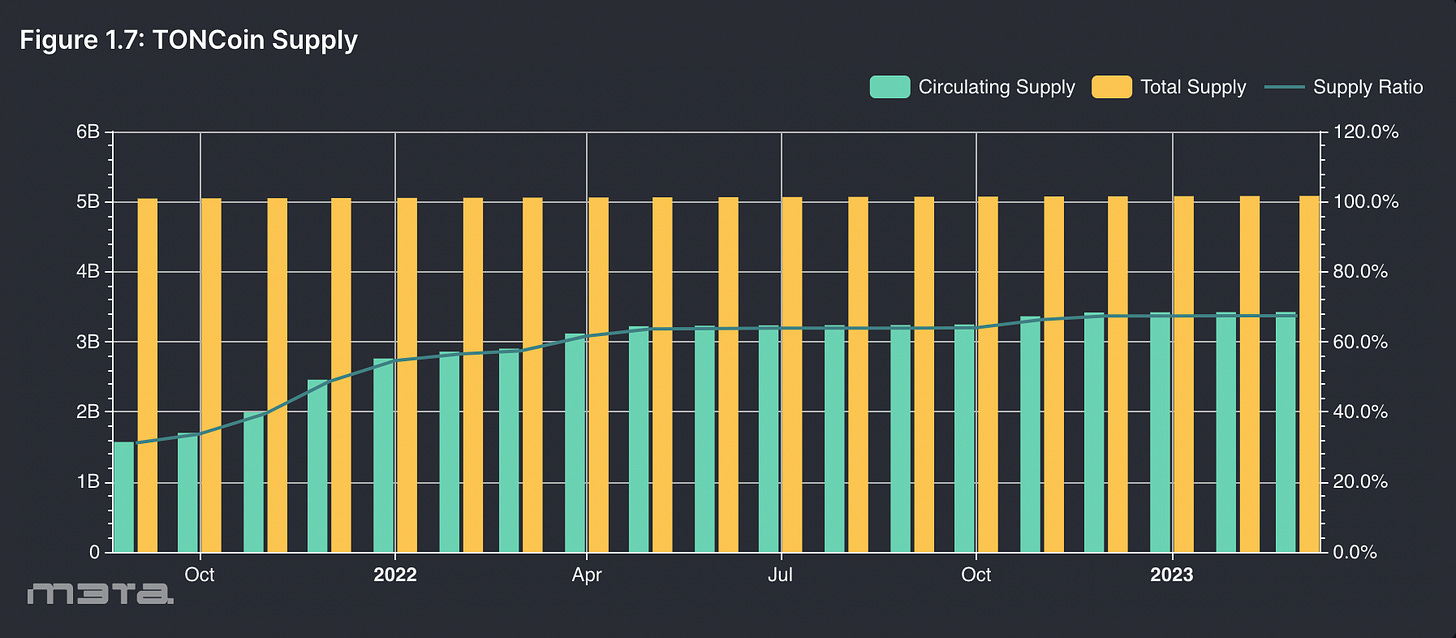

Between July 2021 and May 2022 (Figure 1.7), the circulating supply of TON tokens witnessed a significant increase, resulting in an overall supply of approximately $3.4B. Since then, the circulating supply has stabilized, indicating a more predictable market.

The current circulating supply accounts for 67.4% of the total TON token supply, which indicates that there are still a large number of TON tokens yet to be released.

As followed on-chain, a substantial proportion of the current circulating supply of TON tokens, roughly 1.08 billion TON (~21.3% of the total supply and ~31.6% of the circulating supply), is held by inactive miners.

For the list of inactive wallets, please refer to Figure 1.9 table in TON - The Open Network Dashboard.

In response to this, the TON community has proposed a measure to lock up a significant portion of these tokens in circulation for the next four years. On February 23, the proposal was accepted with more than three quarters of validators having voted in favor.

This strategic move could potentially lead to a surge in the price of $TON, as the reduced circulating supply would likely increase demand from investors. As far as inflation is concerned, this decision has a significant impact on the token inflation rate as well, as these tokens are not being actively traded or used within the network.

2. Inflation Analysis

Inflation of a token is a metric usually sought after by investors who wish to assess the possible trajectory of that token's price.

Inflation is calculated within a specific window of time, say, a year:

Inflation = (The number of tokens to be supplied in the next year) / (The number of tokens having been supplied this year)

Mirroring the formula above, we found that $TON inflation rate sits at a rate of 0.6% annually, which is incredibly lower than the inflation rate of other popular crypto protocols in the market (Figure 2.1).

It's important to note that inflation in itself has a compound effect over time. This leads to the fact that small differences in inflation rates can cause significant disparities in the number of tokens in circulation and ultimately affect the prices of these assets.

The compound effect is also reflected on the inflation gap between two assets. If the gap is already large at the moment, the gap will grow exponentially within the next few years (given that inflation rates remain the same over that period).

To demonstrate our point, we take the current inflation rate of a few protocols and stretch them in a 5-year time horizon, with the assumption that the current inflation rates stay the same over the period.

In this model, it was found that while the circulating supply of $TON remains relatively stable over the next five years, tokens like $Avax or $Near will have more than twice the number of tokens in circulation, potentially exerting immense downward pressure on their prices.

The TON blockchain has seen a significant increase in the amount of $TON being staked over time, indicating a growing user base that has strong confidence in the platform's long-term development.

This continues to dwell on despite the decrease in monthly yield, which suggests that users are not just looking for a quick profit, but are willing to invest in the future of the project.

One reason for the increase in staked $TON is the growth of the validator system. The number of validators has risen steadily from 85 at the beginning stage of the project to the current 266, providing a more secure and decentralized ecosystem for users.

The TON blockchain's validator system stands out as highly robust compared to other blockchain ecosystems such as BSC, Near, Atom, Fantom, and Aptos (Figure 1.13). This is pretty impressive since TON is a relatively new network compared to its more established counterparts like Atom, Near, and BSC.

As more validators join the network, the security and decentralization of the TON blockchain become stronger, making it a more attractive option for users who want to ensure the safety of their investments.

One of the primary benefits of the TON blockchain's numerous validators is their ability to effectively thwart 51% of attacks, which is a standard hacking method that can cripple low-validator blockchains. With such a high level of decentralization and security, the dependability of the TON blockchain is proven.

The cost to run a validator node on TON is approximately $23K (~10K $TON as of time of writing), which is considerably lower than the staking requirements on other blockchains. This could be the most critical associated factor for the bustling scene of TON validators.

For instance, it costs 3 times as much to run a node on NEAR and almost 135 times more for BSC (Figure 1.14). The low staking threshold requirement certainly makes it a more appealing option for small-time validating operators who do not have a lot of capital to invest upfront.

This design feature also means that the blockchain favors small-team or even individual validators to safeguard its network, which sustainably improves the decentralization aspect of the TON blockchain. With that said, TON distinctly stands out among hundreds of other chains with its core value proposition concentrating on decentralization and security.

3. Top Wallet Group Analysis

With such a wide selection of services offered to the public, TON’s comprehensive money flow when observed on-chain is quite chaotic. That’s why for the sake of analysis clarity, we have filtered out 8 distinctive groups that these top wallets fall into.

Among these 8 subsets, we noticed that only Centralized Exchanges, Bridges, Marketplace, and Services facilitated the most transactions. Therefore, these services inherently become our subject of focus for top wallet analysis.

The transfer of $TON from centralized exchanges to users' addresses is known as money INFLOW.

Upon observation, users of OKX account for the most $TON transfers from a CEX (as seen in Figure 2.1.2).

The data in Figure 2.1.4 indicates that a significantly higher amount of $TON is transferred from CEXs to the TON ecosystem than the amount transferred out of it, resulting in a substantial inflow compared to the outflow.

For more INFLOW and OUTFLOW wallet tables and charts, refer to TON - The Open Network Dashboard

Of all 20 bridges available on the TON blockchain that our data were able to crawl, ETH bridge seemed to be the most used gateway with more than half of the top wallet transaction volume.

Of all 18 marketplaces associated with the TON blockchain, Fragment - an auction dApp operated on TON - took over the top wallets' trading volume with the runner up is OTC marketplace.

Fragment is a decentralized marketplace developed by Telegram for trading Telegram usernames in the username.t.me format. All usernames traded on the platform are represented as collectibles on the TON blockchain, ensuring that their ownership will never be disputed, and transactions cannot be reversed.

Interested buyers can bid on usernames with a minimum of 4 characters on the Fragment website, while existing username owners can put their names up for auction with a minimum bid of 10,000 TONcoin.

TON services range from TON Foundation and staking pools, among others. Volume-wise, TON Ecosystem Reserve receives a commanding amount of trading volume, dominating over other TON services.

The TON blockchain features a unique smart contract called TON Reserve, which allows any user to invest in TONcoin to support the project's tokenomics.

By increasing the amount of money invested in the TON Reserve, the exchange rate becomes more stable and the overall ecosystem improves.

The Durov brothers allocated 52% of the funds to the Reserve Fund, aiming to safeguard the cryptocurrency from speculative trading and provide resources for the ecosystem's development.

4. TON vs Solana Analysis

Read more on our Twitter:

Follow us if you find the thread helpful!

Conclusion

In conclusion, TON's focus on improving its platform and attracting new users has paid off with a steadily increasing daily active user count and a growing community of investors. Additionally, TON's low inflation rate of only 0.6% annually and robust validator system make it an attractive option for users who value decentralization and security. While still a relatively new ecosystem, TON has shown strong potential to compete with established networks like Solana.

Until the next dashboard!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.