On-chain Analysis: RWA Protocols

2022's market downturn has set the stage for a 2023 revival with real-world assets at the forefront. Which RWA categories and protocols are leading the way? Find out here!

Note: This analysis is supported by our Real-World Assets Protocols dashboard.

The dashboard aims to look at 11 Real-World assets projects, divided accordingly into 4 subsections as follows:

Security Tokens/Secondary Market: INX Token - $INX

Real Estate: Propy - $PRO, Elysia - $EL

Tokenization/Securitization: Centrifuge - $wCFG

Private Credit: Maple - $MPL, Truefi - $TRU, Clearpool - $CPOOL, Goldfinch - $GFI, Creditcoin - $CTC, Defactor - $FACTR, Polytrade - $TRADE

The Context

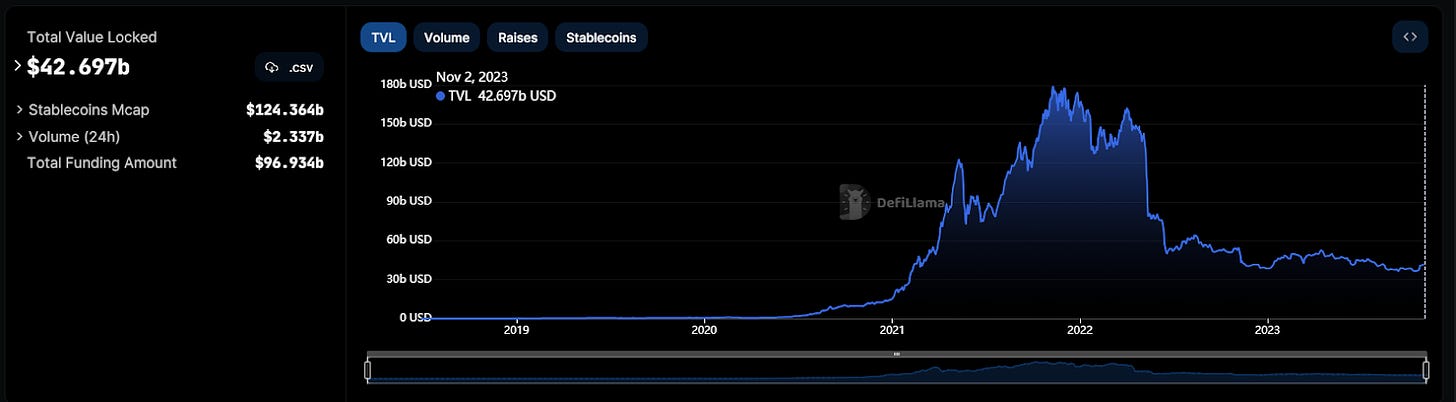

In 2021, DeFi left a huge impact on the cryptocurrency world. By November of that year, the total value locked (TVL) in DeFi had reached an all-time high of $179.17 billion.

However, throughout 2022, widely uncontrollable events from the fall of Luna and FTX quickly instigated a significant drop in the TVL. A lot of tokens associated with DeFi at the time were designed with poor economics, implicating inflationary pressures that resulted in a more than 90% instant value drop.

DeFi yields have also decreased significantly. The easy days of earning high yields in DeFi are over, and most DeFi yields are now nearly the same as those in traditional finance (TradFi). As assessing the pros and cons between TradFi and DeFi bears minimal importance, investors have started moving their money out of DeFi in search of better risk-to-reward opportunities.

This shift has sparked discussions in the DeFi industry with some investors believing that DeFi will truly become valuable when it's tied to real-world assets (RWA). Not to overlook the notion that institutional investment in crypto through RWA is poised to introduce a new, stable, and impactful flow of resources to the market. Although this idea has been around for a while, 2023 is the year when real-world assets start gaining significant attention.

Keeping this scenario in view, the following article will focus on exploring and assessing which Real-World Asset (RWA) category stands out as the most prominent currently.

What do Real-World Assets in Crypto Mean?

Simply put, they are tangible and intangible assets from the real world that are tokenized and represented on a blockchain. RWAs can include investments in real estate, commodities, artwork, valuable metals, government bonds, or credit.

For a better understanding of what Real-World Assets are, read our “What's New in Crypto: Tokenization of Real World Assets (RWA)” article.

On-chain Analysis

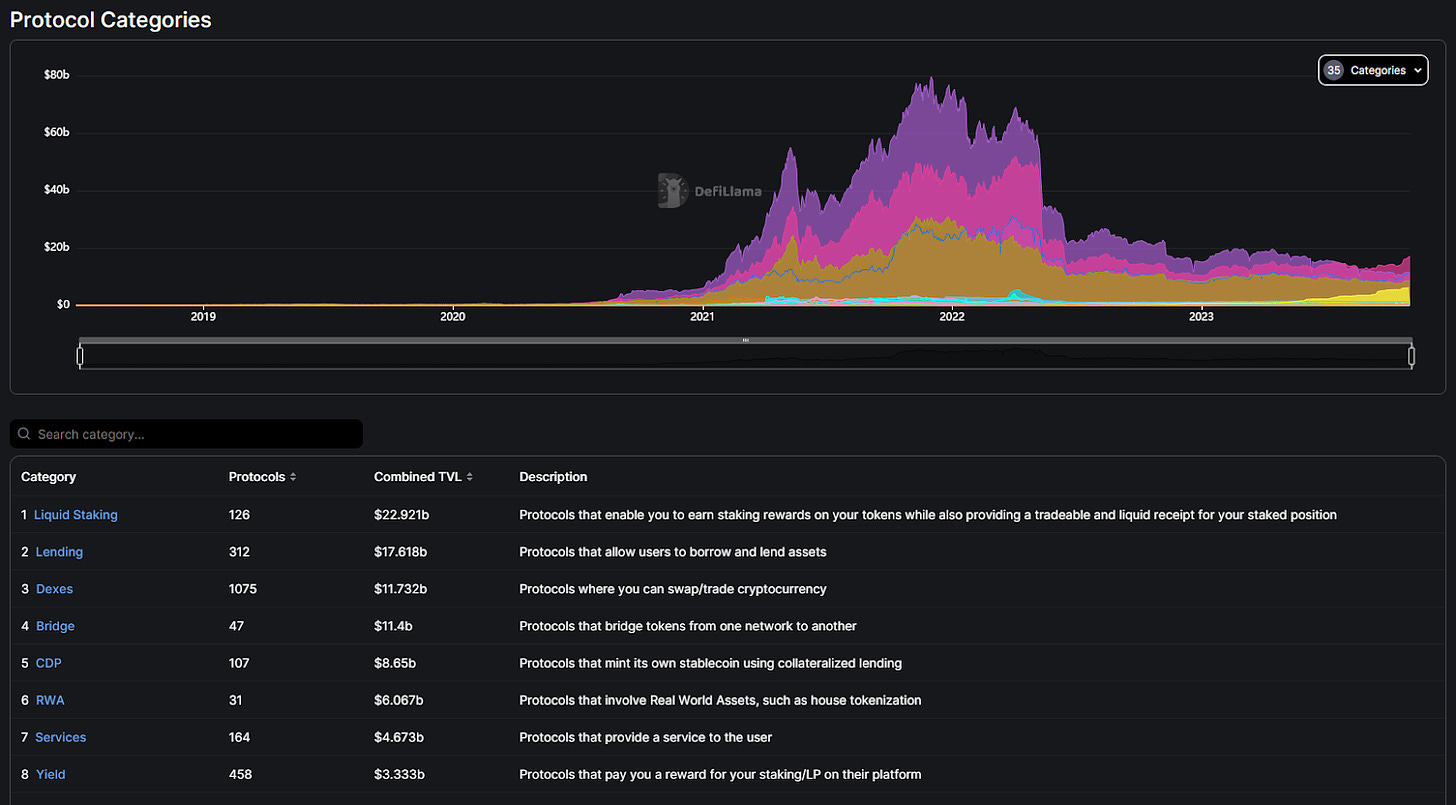

The RWA market is gaining traction in DeFi, currently ranking as the 6th largest sector, up from 10th since June 2023. It's worth noting that the data might be understated because not all protocols are included, and data availability can vary when tokenization occurs on private blockchains.

Nevertheless, this rise in the sector's ranking demonstrates the growing adoption of RWA protocols.

The Sector’s Potential

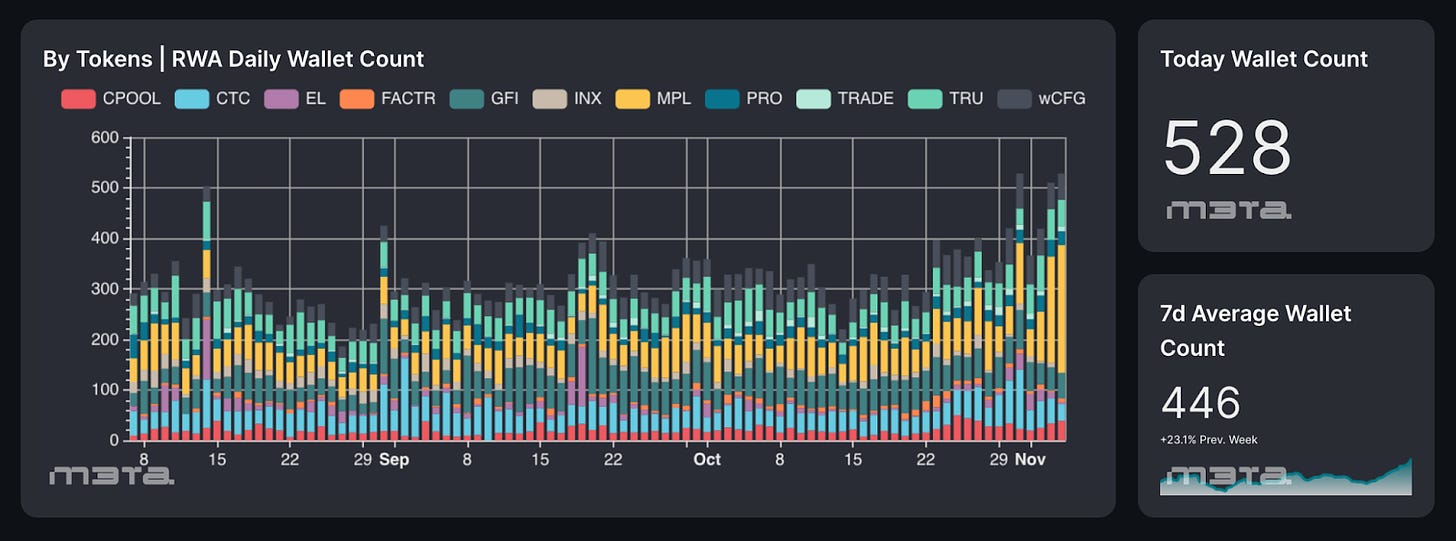

RWA daily active wallets have steadily increased with the latest 7D average count of 446 active wallets per week.

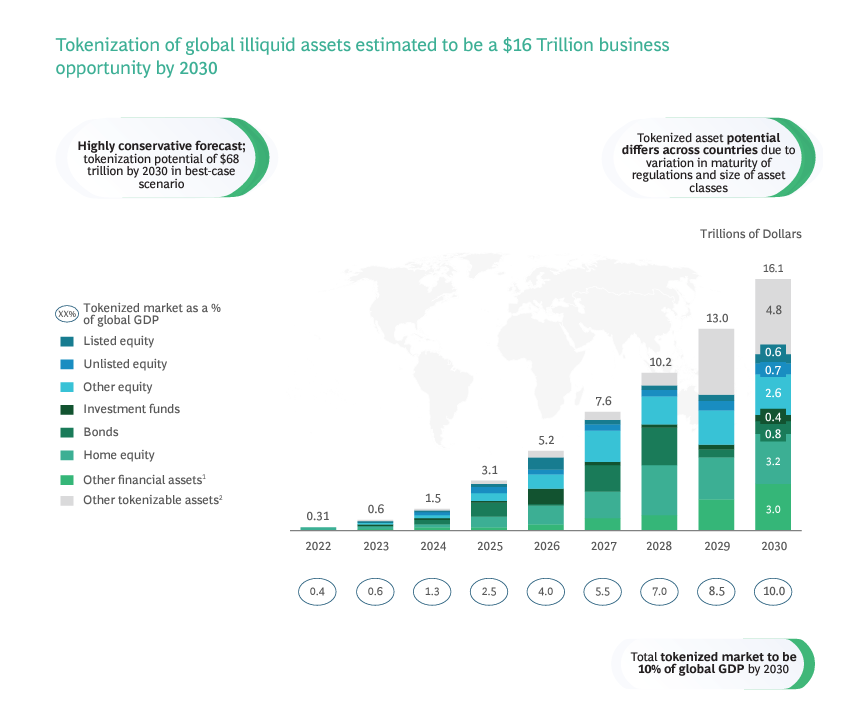

Looking ahead, the tokenized asset market includes both on-chain asset tokenization and traditional asset fractionalization like ETFs, real estate and natural resource investment trusts has been projected to reach $16.1 trillion by 2030.

Given the total global asset value at $900T, capturing even a small percentage of this market could be a game-changer for the blockchain industry. That's why the future of RWAs looks more promising than ever.

The Current Leading Trend: Lending & Private Credit

We've chosen 11 real-world asset projects and grouped them into four categories:

Security Tokens / Secondary Market

Security tokens represent ownership or future asset benefits and follow stricter regulatory rules compared to ICOs. They are not traded on typical stock exchanges and require an Alternative Trading System (ATS) license to host trading.

Real Estate

Real estate is one of the most attractive yet challenging assets to tokenize. It covers physical assets like houses, offices, and land. Investors find the real estate sector appealing because it offers opportunities for passive income, like rental earnings and partial ownership, making it a lucrative asset class.

Tokenization / Securitization

Clarity around this field is lacking and may well remain, unless authorities lay down explicit guidelines and cease using this haziness to pursue litigation against certain exchanges.

For the sake of this analysis, a general idea of tokenization simply means converting RWAs into digital tokens that can be stored, managed, and traded on a blockchain. RWAs can include a wide range of assets, such as real estate, fine art, commodities, and financial instruments.

On the other hand, securitization is a process that involves pooling assets together and then issuing securities that represent ownership in the pool. Securitization can be used to tokenize RWAs, which can make them more accessible to a wider range of investors and improve their liquidity.

Private Credit

Private credit loans involve lending from non-bank institutions, which has gained momentum due to heightened bank regulations since the 2008 financial crisis. This trend has further accelerated in the current economic climate, especially given recent bank failures. Private credit solutions offer advantages for both borrowers and lenders. Borrowers benefit from enhanced flexibility compared to traditional bank loans, while lenders gain interest rate protection through variable rates, a feature not found in fixed-rate options.

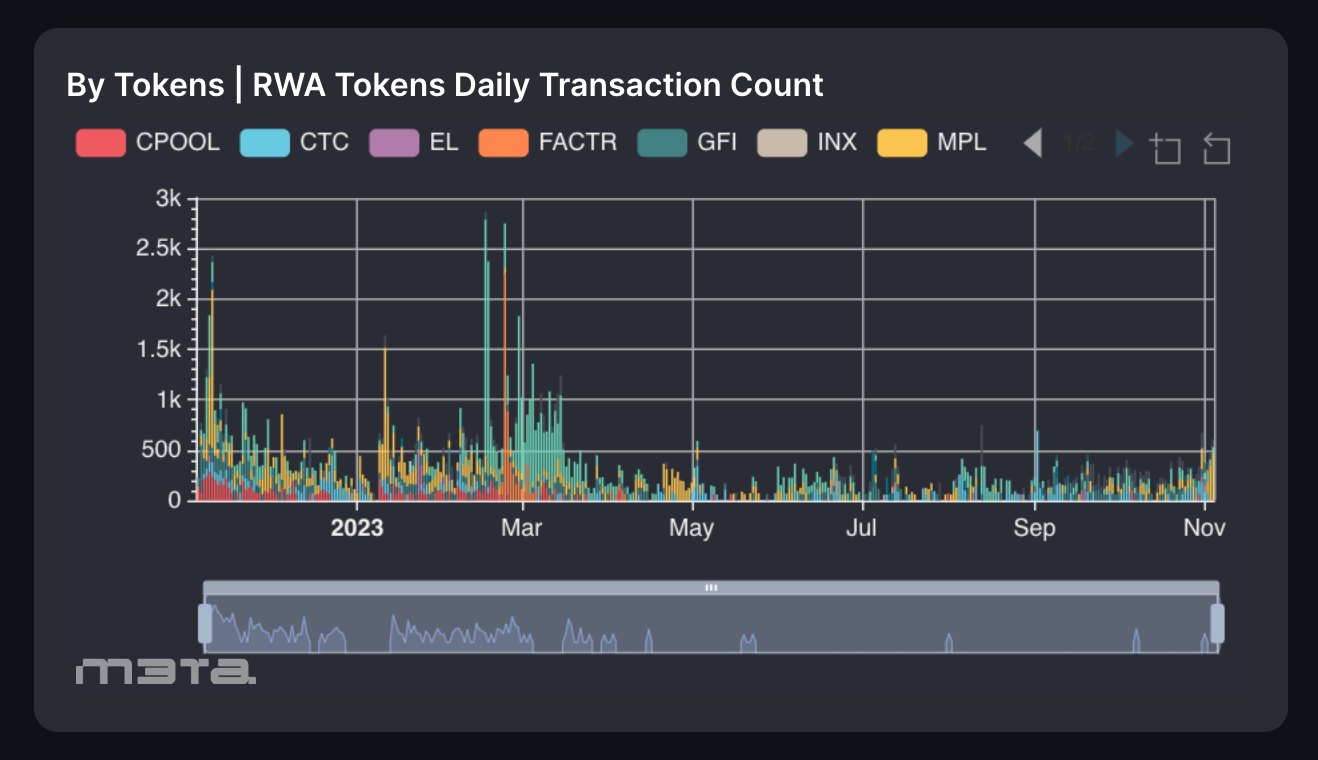

Out of the 11 projects under consideration, Maple ($MPL), Goldfinch ($GFI), TrueFi (TRU), and Creditcoin ($CTC) stand out due to their consistently high daily wallet counts (Figure 4), which serves as a strong indicator of robust user engagement and activity within their respective ecosystems. This trend suggests that users are showing a particular inclination toward platforms within the lending and private credit sphere.

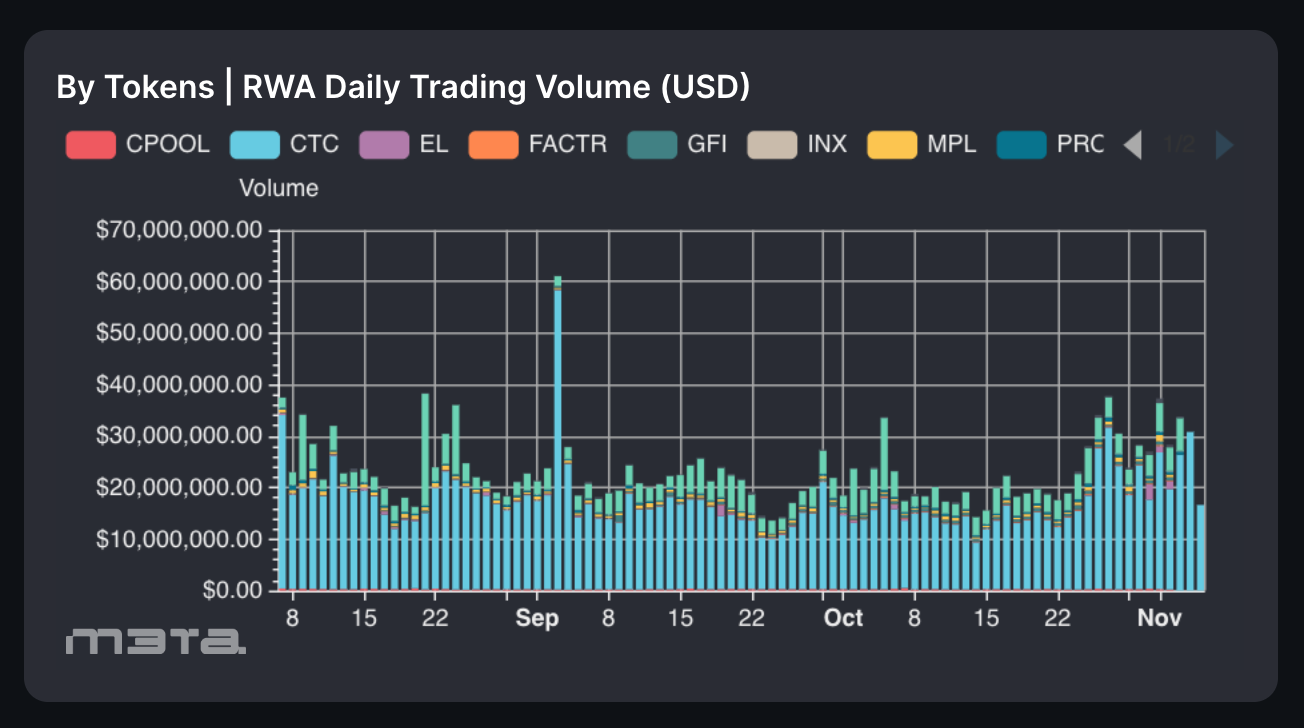

Maple and TrueFi first emerged as the leaders in the realm of on-chain private credit loans, boasting substantial total loans during the first half of 2022. Both projects crossed the $500M mark, with TrueFi securing $542.6M and Maple amassing an impressive $882M in total loans. These figures were a testament to the robust growth of the DeFi lending sector at the time.

However, as the cryptocurrency market took a downturn during the latter half of 2022, the active loans for both Maple and TrueFi witnessed a dramatic decline, shrinking by approximately 90%. This downturn could be attributed to the prevailing bear market conditions, which posed challenges for various crypto companies. Many such enterprises struggled to weather the storm, leading to a contraction in their lending activities.

Fast forward to the beginning of 2023 till Oct, and we observe a noteworthy resurgence in the on-chain private credit lending market. The value of these loans experienced a remarkable increase, surging by $210 million during this timeframe. Significantly, a substantial portion of this growth can be directly attributed to Centrifuge, whose active outstanding loans swelled by $154 million.

Centrifuge's impressive performance highlights its pivotal role in driving the expansion of the on-chain private credit lending market, especially in the face of the challenging market conditions observed in the current year. This resurgence in the private credit lending market signifies a renewed interest and trust in the DeFi sector, indicating its resilience and capacity for growth, even in the face of market volatility.

Conclusion

The ascent of the RWA sector in DeFi from the 10th to the 6th position, despite potential data underrepresentation, speaks volumes about the accelerating integration of RWAs in blockchain ecosystems. Our analysis has illuminated the sector's resilience and adaptability, especially in lending and private credit, which are shaping up to be the bulwarks of RWA.

In parallel, a surge of innovation is sweeping through the DeFi sphere as prominent entities such as Aave, Centrifuge, Circle, Coinbase, Base, Credix, Goldfinch, and RWA.xyz join forces under the Tokenized Asset Coalition (TAC), bridging traditional assets with blockchain. While tokenized assets may currently represent a sliver of the global asset value, their projected expansion to $16.1 trillion by 2030 hints at a transformative period ahead for blockchain adoption, making the RWA sector one of the most promising frontiers in DeFi.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.