On-chain Analysis: Modular Economics (Part 2)

In this final installment of the Modular Economics series, we're zooming into the frameworks of Polygon zkEVM and zkSync Era.

Polygon zkEVM

Polygon zkEVM is a decentralized Ethereum Layer 2 scalability solution that uses cryptographic zero-knowledge proofs to offer validity and quick finality to off-chain transaction computation, also known as a ZK-Rollup.

zkEVM stands for zero-knowledge Ethereum Virtual Machine. It is a new technology that allows Ethereum smart contracts to be executed off-chain, while still maintaining the security of the Ethereum blockchain. This makes it possible to achieve much higher throughput and lower gas fees than it is possible on Ethereum's mainnet.

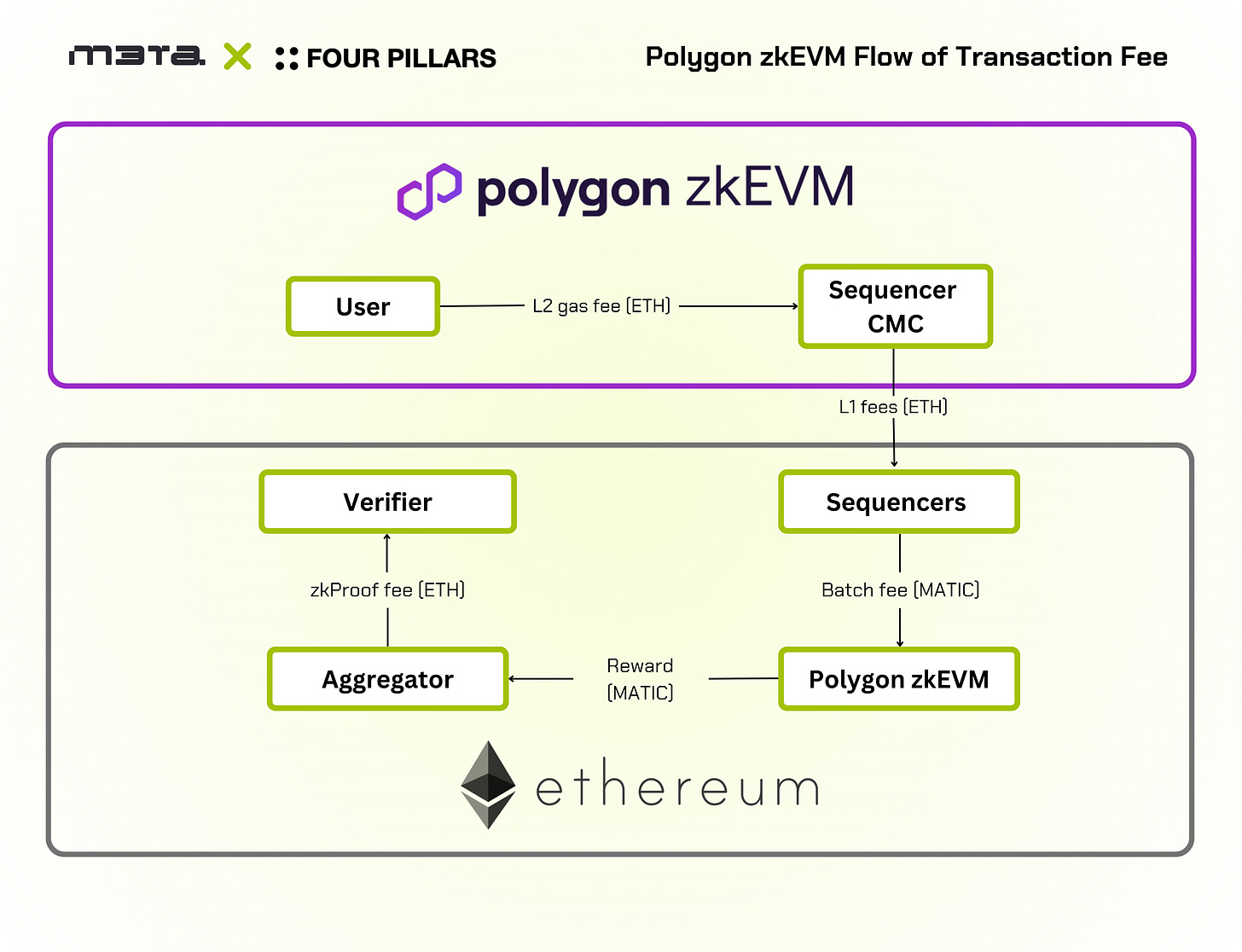

It's made up of three parts: the Sequencer (which arranges transactions), the Aggregator (which checks them), and a special contract (PolygonZkEVM.sol):

The Sequencer organizes these transactions and sends them to the contract.

The Aggregator uses something called ZK proofs to make sure the transactions are good to go.

Unlike other L2s, Polygon zkEVM employs a two-token incentive structure (MATIC and ETH). As a result, the profitability of both sequencers and aggregators is affected by the exchange rate between MATIC and ETH.

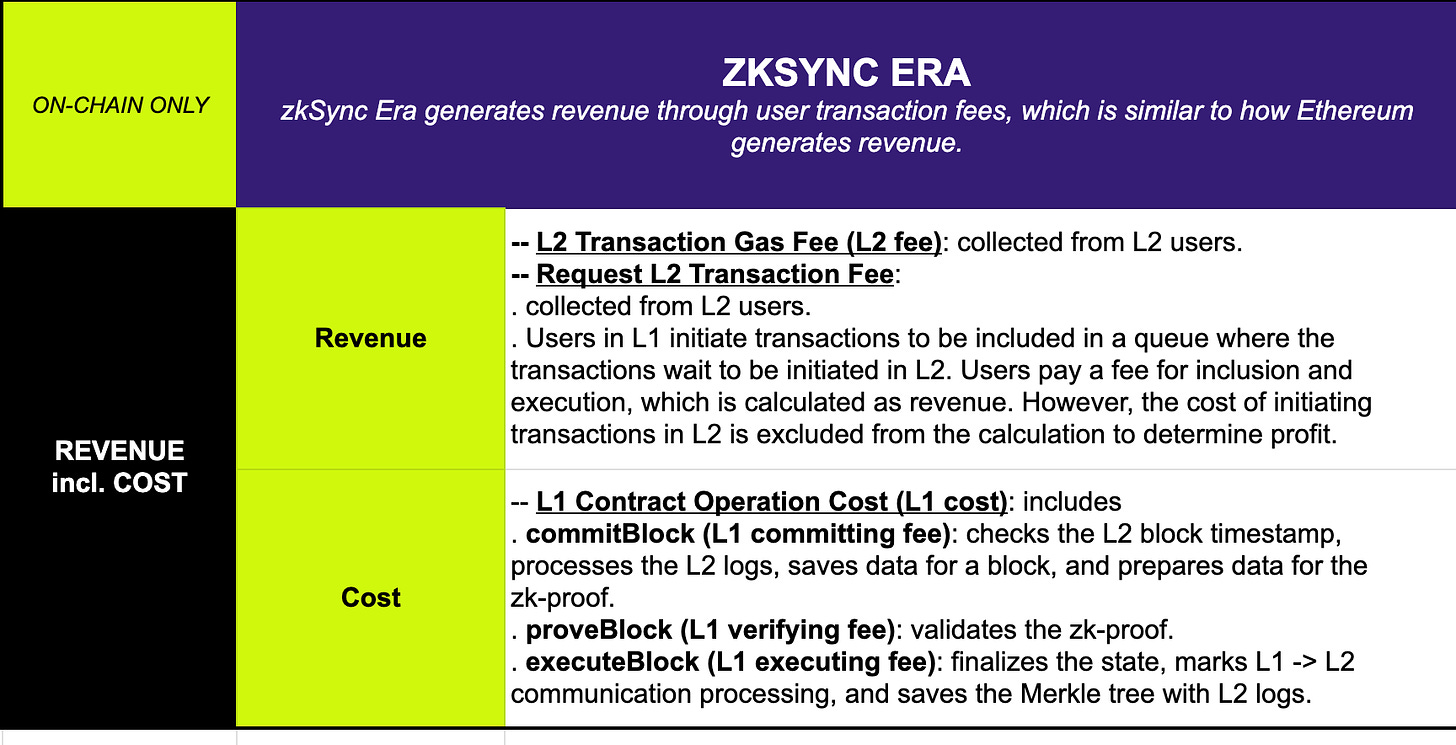

If we dive deeper into how Sequencers and Aggregators make their earnings, the following table would give a good sum-up.

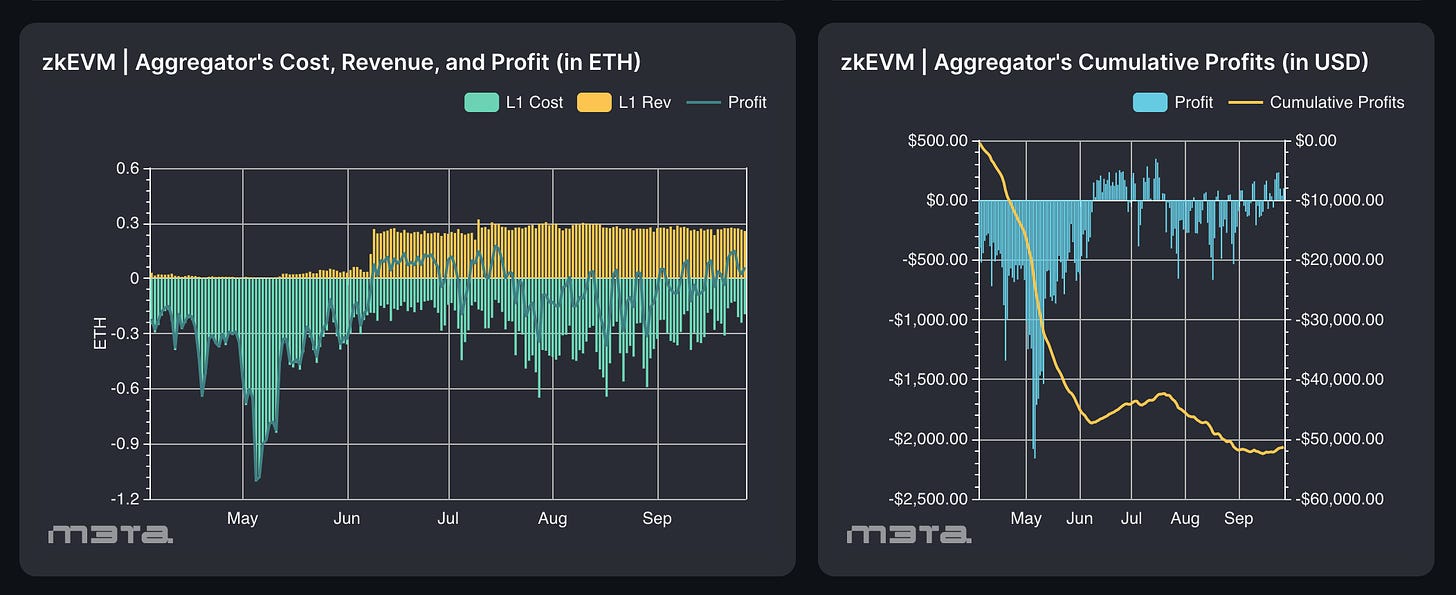

The economic dynamics for the Aggregator in the zkEVM ecosystem present a unique challenge due to the intertwined relationship between MATIC and ETH. Specifically, while the Aggregator earns rewards in MATIC, it incurs Layer 1 aggregation fees in ETH. This exposes it to the fluctuations of the MATIC-ETH exchange rate. In fact, over 180 days, the Aggregator was profitable only about 20% of the time, resulting in a net loss of over $50,000 due to this volatility. The trend is taking a turnaround though.

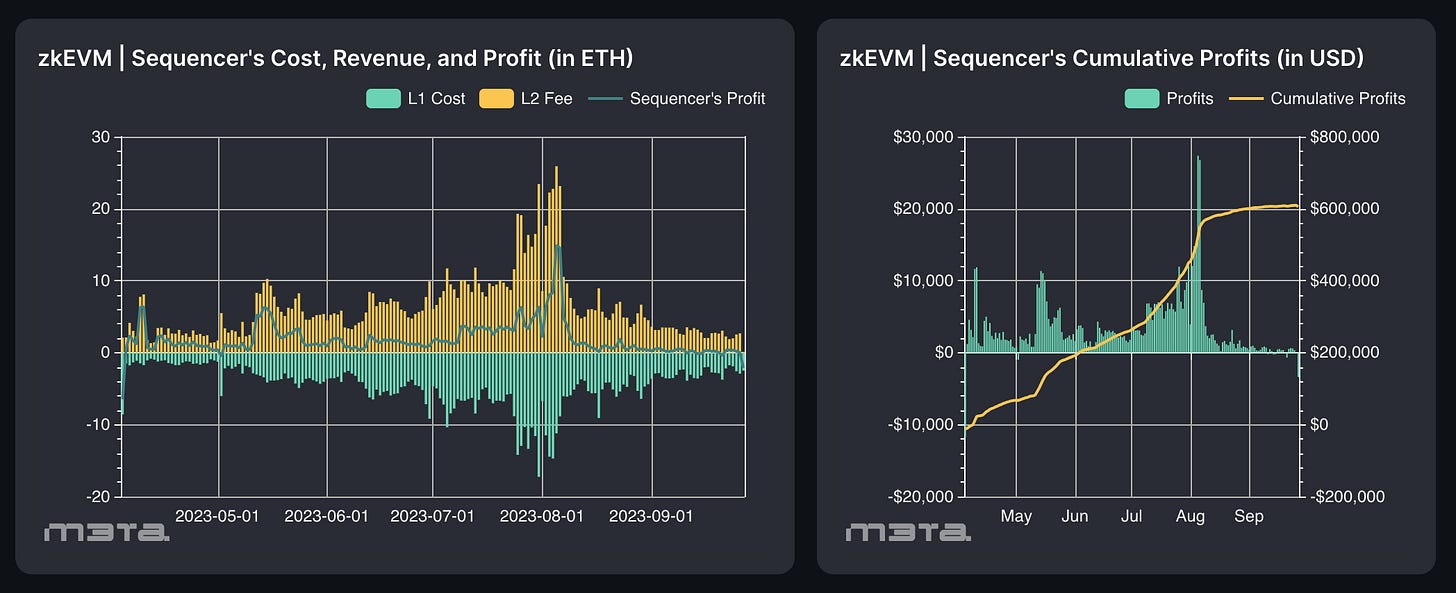

In the same six-month period, the Sequencer has consistently shown robust profitability. By September 13, its cumulative earnings reached an impressive $612,230. Projecting this over a year gives an estimated annualized profit of around $1.2 million. It's worth noting that the Sequencer's profit model is insulated from the volatility of the MATIC-ETH exchange rate. This is because the Sequencer's economic activities are denominated entirely in ETH, both in terms of earnings and expenditures. But the exponential growth has shown signs of faltering since August.

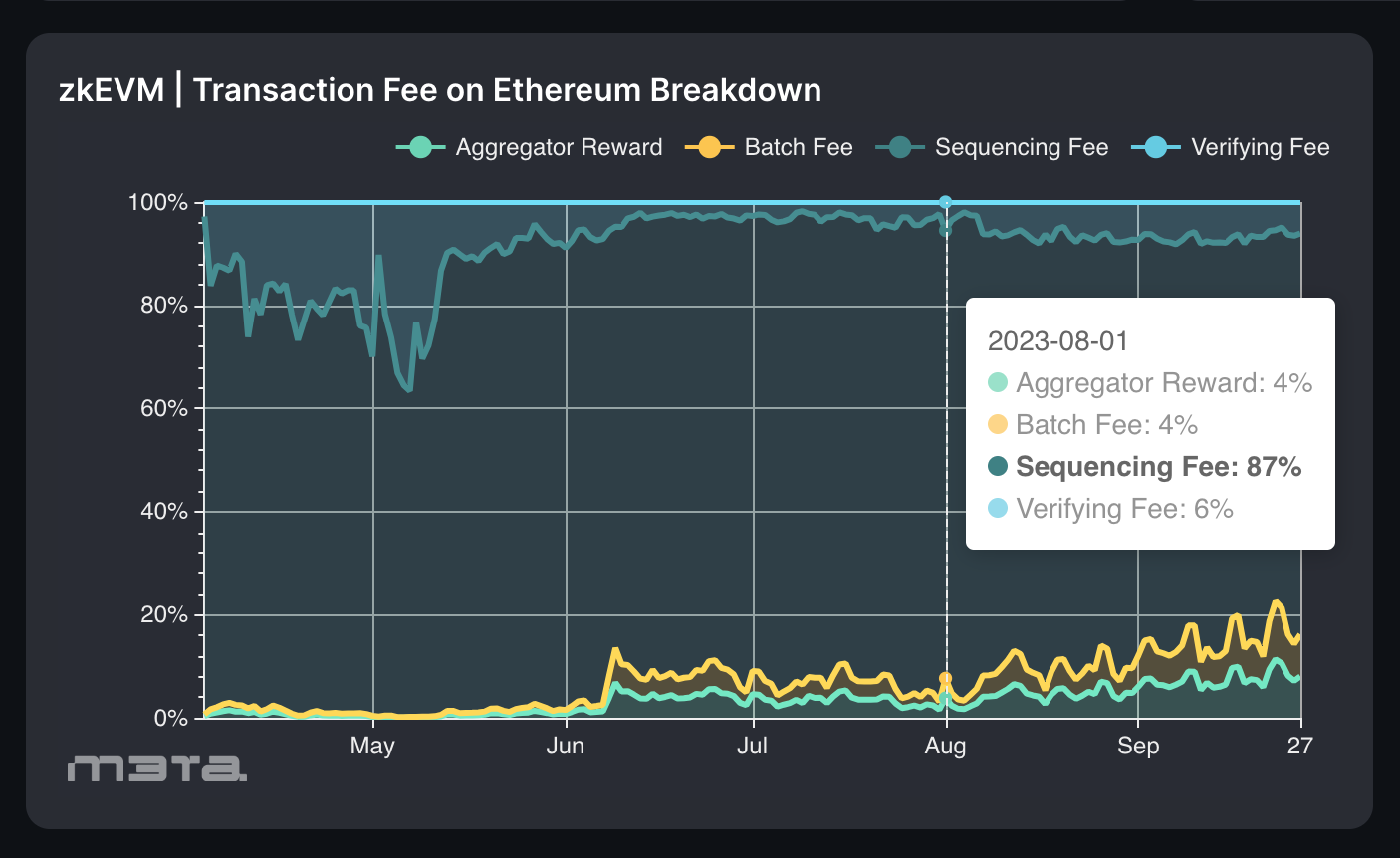

Even though Sequencers are making profits at present, past on-chain data shows that they have been spending the most for their job, as Sequencing Fee consistently takes the lead in the fee package on Ethereum. This means that to become a Sequencer, you should probably be ready to invest a hefty sum before anticipating any return.

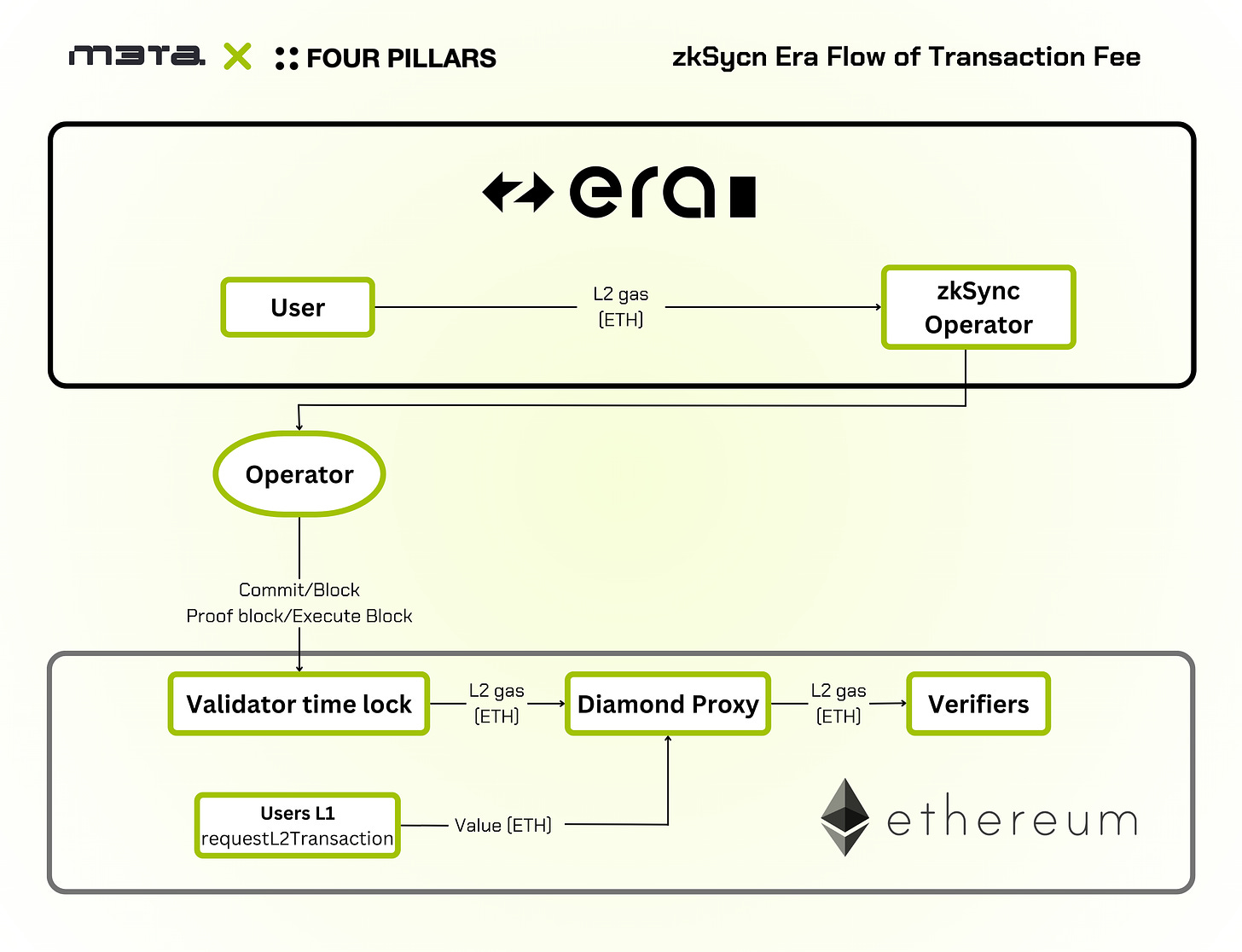

zkSync Era

zkSync Era is a layer-2 scaling solution for Ethereum that utilizes the ZK-rollup technology. It is designed to be user-friendly and secure, while also providing high throughput and low fees.

zkSync Era is still under development, but it has already achieved some impressive results. In tests, it has been able to process up to 2,000 transactions per second (TPS) with fees of just a few cents. It is also fully compatible with Ethereum's EVM, so developers can easily deploy their existing dApps to zkSync Era.

To better grasp how zkSync Sequencers generate their income, the table that follows offers a detailed breakdown.

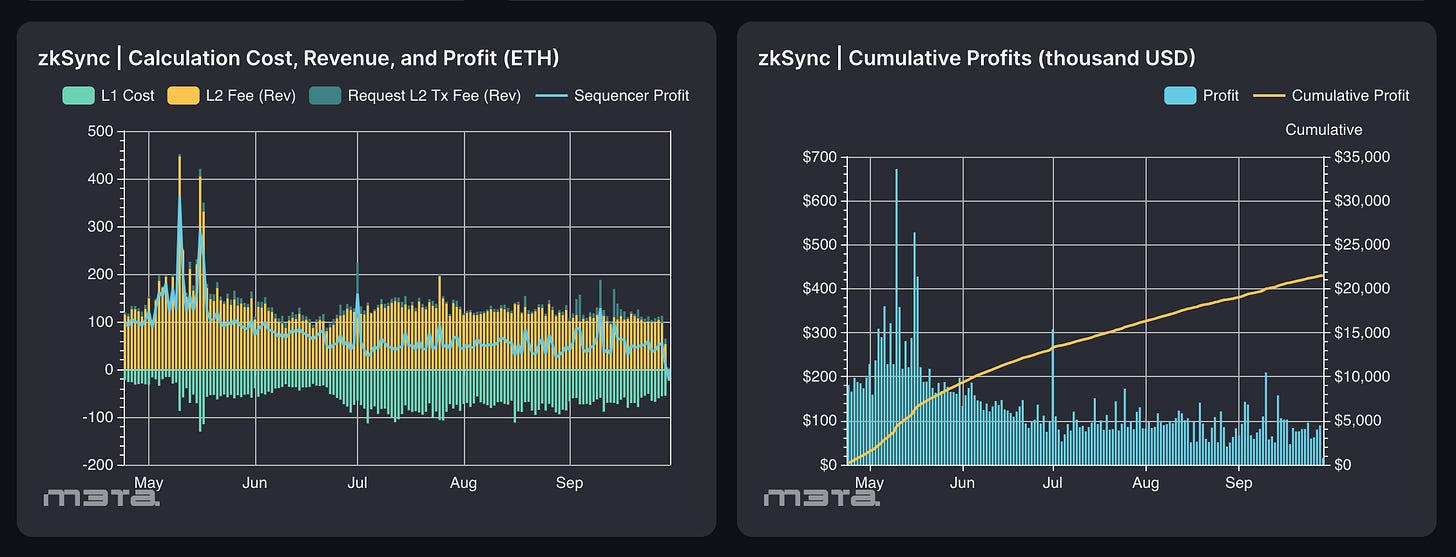

Except for the hype of all things ‘zk’ in May when Sequencers seem to enjoy making the most out of it with up to 350 ETH in daily profit, an average day of a Sequencer would look at a decent 50 ETH to 100 ETH. This might have made Sequencers on zkSync Era significantly more profitable than those on Optimism and Polygon zkEVM.

There's no indication that their profit growth is letting up either.

Conclusion

There you have it. All 3 rollup models broken down to the very last profitable and non-profitable dollar. The numbers lean towards zkSync for those contemplating an Ethereum-centric Sequencer role. But remember, this is a 'Not Financial Advice / Do Your Own Research' piece, so tread with caution and diligence. We hope this sheds some light on your considerations.

Until the next dashboard!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.