On-chain Analysis: Modular Economics (Part 1)

We've teamed up with Four Pillars for an in-depth look at Modular blockchain. Using Optimism as an example, we dissect the economics of L2 solutions - a domain that hasn't got much research attention.

Co-research Introduction

In a first-of-its-kind initiative, we are honored to join hands with Four Pillars, a vanguard in Korean and global blockchain research, for their avant-garde Modular Odyssey series. This research, a pioneering endeavor in its own right, is set to redefine our understanding of Modular Blockchain, emphasizing its scalability, security, and adaptability.

From the four pivotal segments that Four Pillars has meticulously curated - Rollup, Rollup as a Service (RaaS), Sequencing, and Data Availability, M3TA sets out to build a comprehensive dashboard featuring Optimism, Polygon zkEVM, and zkSync data - the three most prominent rollup models as of now, meanwhile contributing to the core research on the cost, revenue and profit structure of rollup and RaaS dynamics.

This research is co-authored by Clara from M3TA Analytics (data-centric) and Xpara from Four Pillars (research-centric), and edited by M3TA Analytics’s Content team.

About Clara: Clara is a dedicated blockchain researcher who delves into the multifaceted world of blockchain technology, exploring layer-1 and layer-2 solutions, decentralized applications, and the fascinating overlap between blockchain and artificial intelligence. Her keen analytical skills have played a pivotal role in conducting comprehensive research, enabling her to dissect complex datasets and distill meaningful conclusions.

About Xpara: Xpara is an immensely passionate researcher who advocates for app-specific blockchains in web3 product development, emphasizing seamless interoperability with general blockchains and web2. He conducts his research with clarity and directness, always pushing boundaries and ensuring thoroughness.

Modular Blockchain

Note: This part is inspired by the ‘Difference between Modular &Monolithic Frameworks, and Issues Related with Rollups’ article penned by Steve from Four Pillars for KBW 2023.

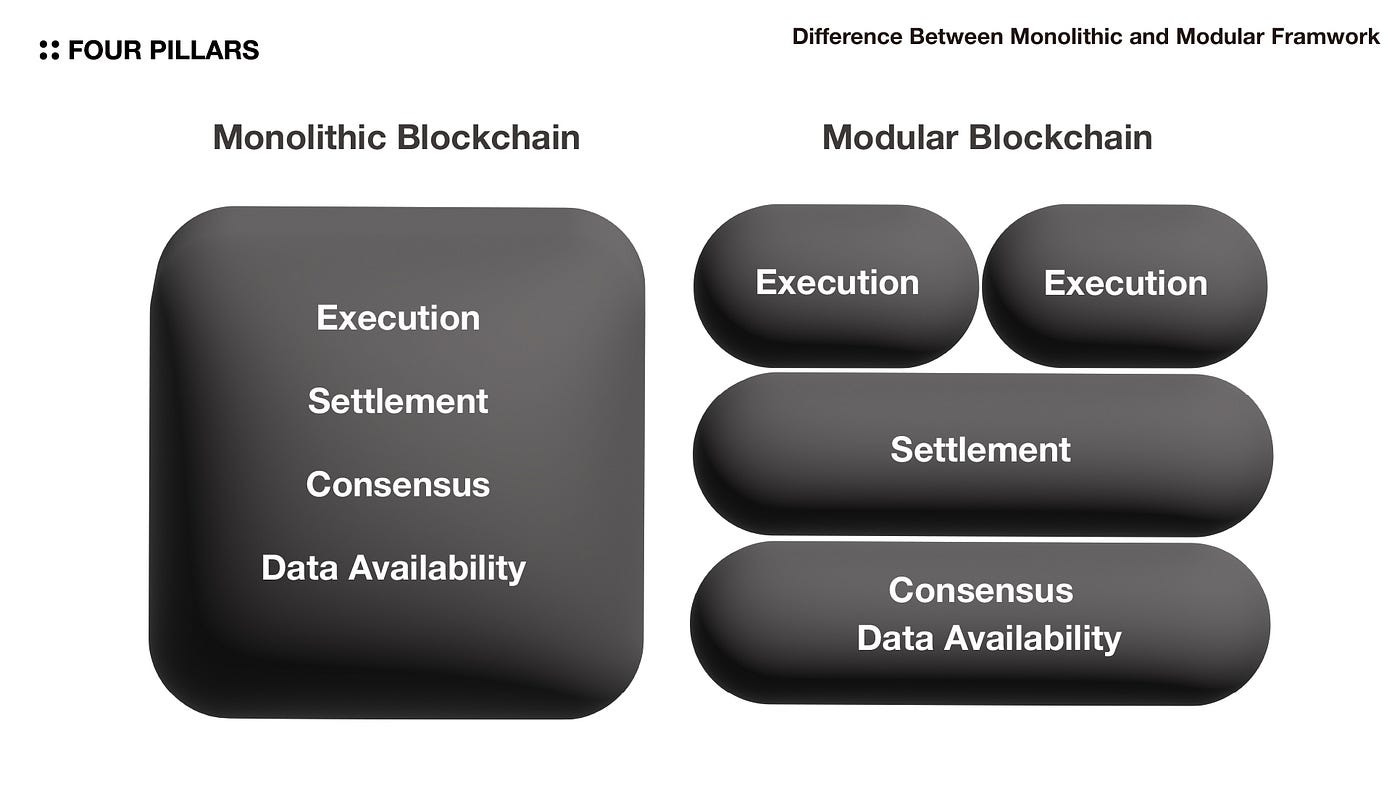

Most popular blockchains that you may have known like Ethereum or Solana are probably NOT ‘modular blockchains’. They fall under a category researchers term as ‘monolithic blockchains’. What is the difference between the two then?

Monolithic blockchains prefer things to be coherent. That’s why they are responsible for all 4 tasks: execution, settlement, consensus and data availability. We’ll get to the definition of each later. Meanwhile, modular chains see the world as joint pieces. You don’t have to do everything on your own, not always. Therefore, each blockchain following this model only takes care of either one or two tasks mentioned above and strategically share the rest to other chains.

Execution: Runs transactions and calculates network state.

Settlement: Validates transactions and shares liquidity between related compute layers.

Consensus: Decides the order of transactions in new blocks.

Data Availability: Makes sure transaction data is stored, accessible, and can be downloaded.

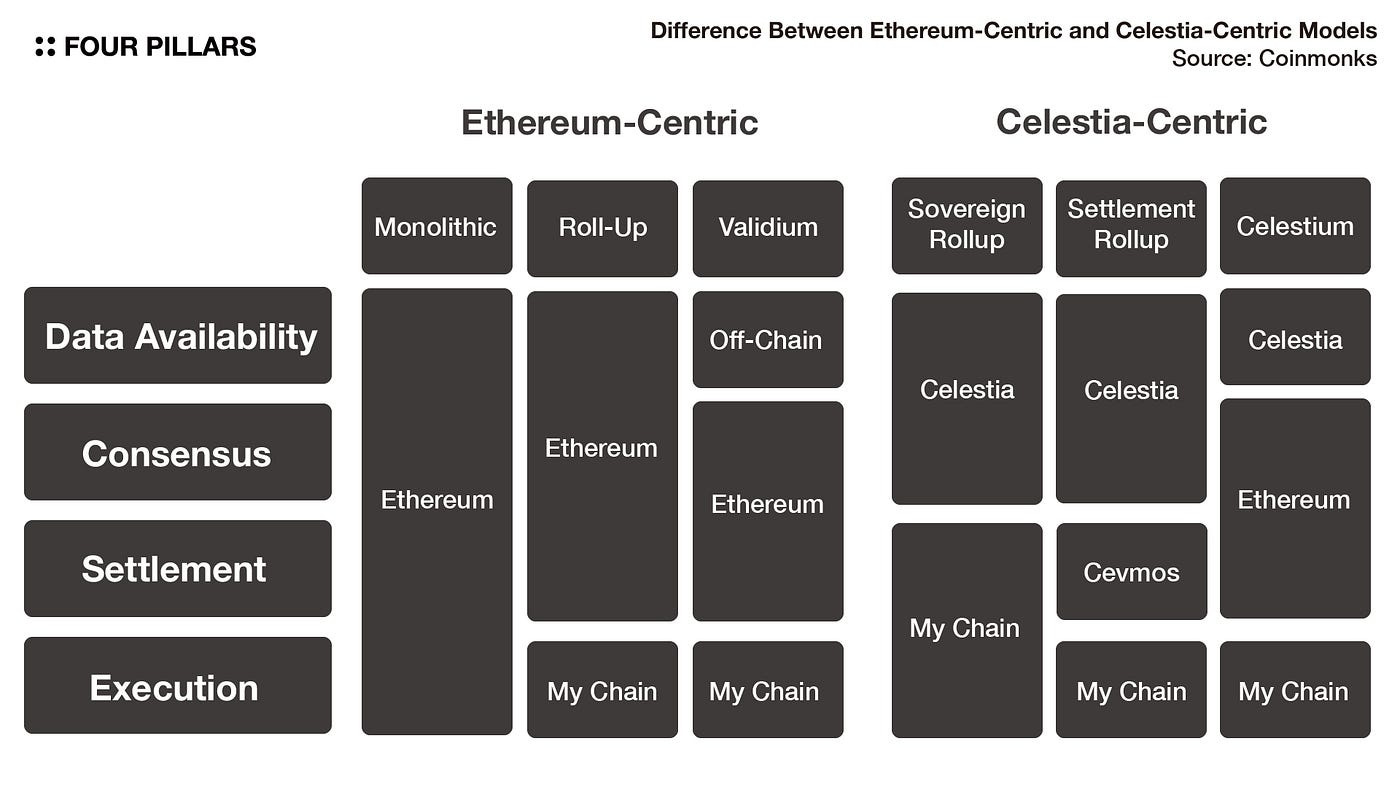

Just as in the case of Celestia, the chain only handles consensus and data availability. So Celestia can be referred to as the DA layer. With this approach, there's flexibility in configuring and executing layers.

From Figure 2, if we use Ethereum and Celestia as benchmarks for rollup models and ‘My Chain’ as the rollup you’d like to build, you can see there are 6 model types in total: monolithic, roll-up, validium, sovereign rollup, settlement rollup, and celestium.

For example, if the rollup you’re referring to only handles the execution task and is based on Ethereum, it’s probably the ‘Roll-up’ type, or most often ‘Layer 2’.

And this is exactly what Optimism, Polygon zkEVM and zkSync Era follow.

Economics: Cost, Revenue and Profit

In the same vein as businesses handling their financial management, modular blockchains’ economic structure can be examined from 03 essential financial pillars: cost, revenue and profit.

Although different blockchains might have varying structures, the following framework would predominantly align with most chains in the current scenario.

All Types of Cost

We do not differentiate the cost of users, aggregators or sequencers.

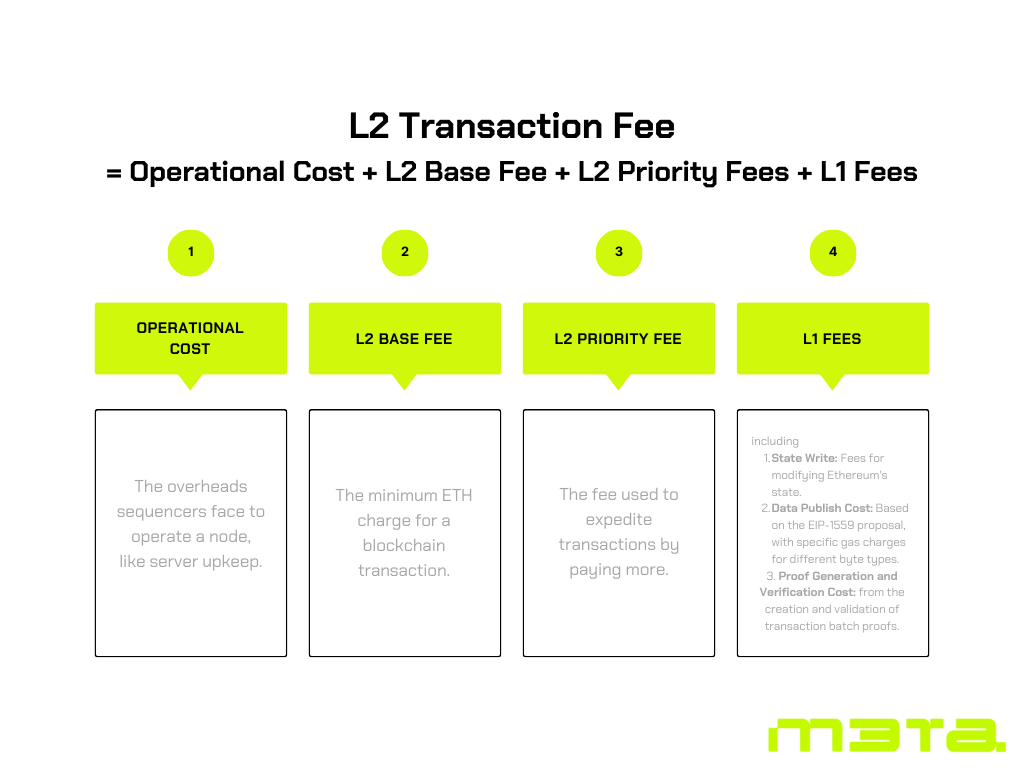

When we mention ‘cost’ or ‘fee’ under the context of Layer 2 (L2), most of the time, the term refers to L2 Gas Fees - a fee incurred whenever users transact on a layer 2 blockchain.

The L2 Gas Fees can be calculated by:

Revenue

We choose to specify the revenue to sequencers only, not to the rollups.

Sequencer Revenue is essentially the accumulation of all L2 Transaction Fees directed to a specific L2 Sequencer.

Profit

We choose to specify the profit to sequencers only, not to the rollups.

Given the ambiguity in pinpointing L2 Sequencers' Operational costs, we deduce their profit by contrasting the L2 Transaction Fees from users against the L1 data-related costs.

In formulaic terms, Sequencers' Profit = L2 Revenue - L1 Cost.

Analysis

Optimism

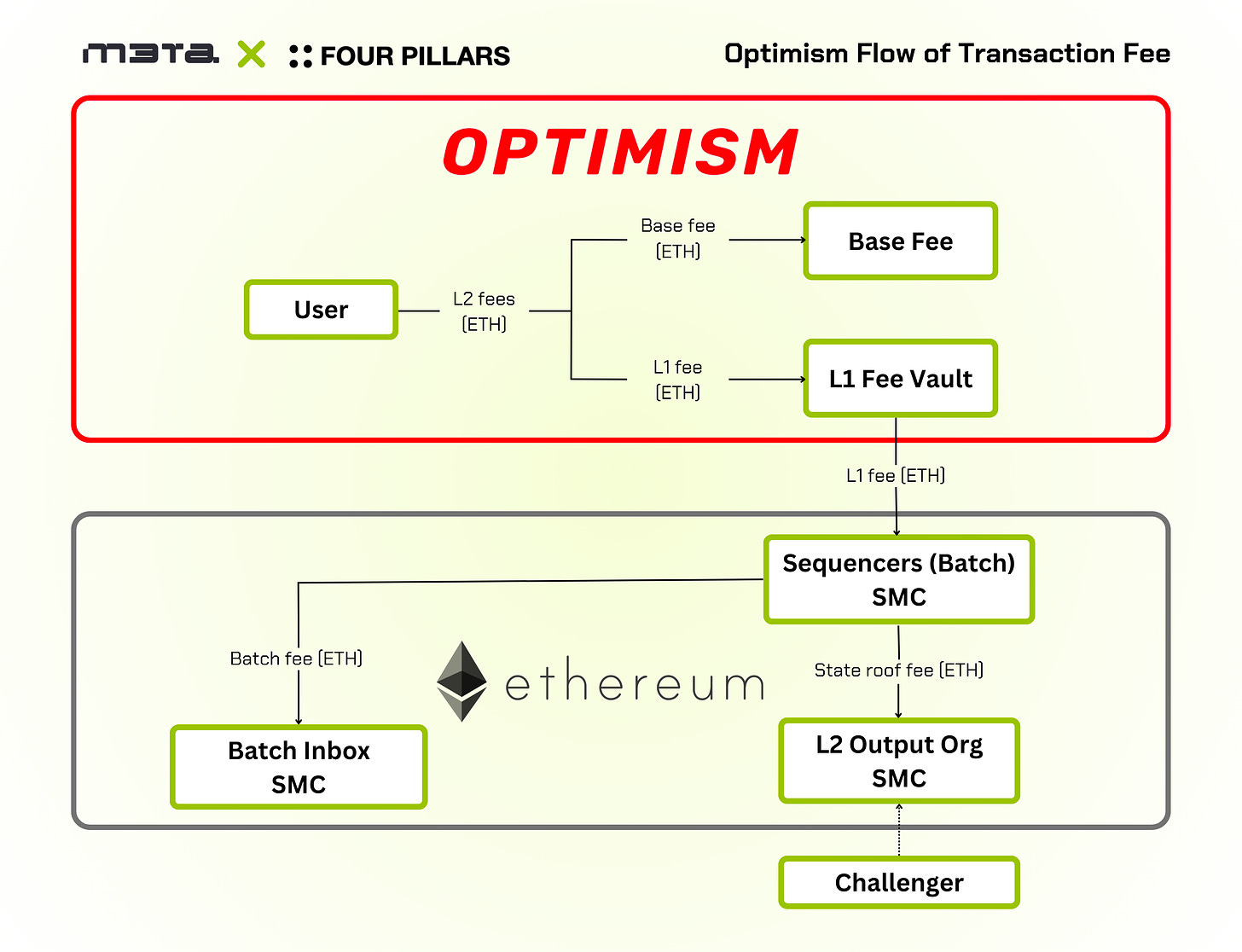

Optimism is a layer-2 scaling solution for Ethereum that uses fraud-proof optimistic rollups to increase transaction throughput and reduce gas fees. It is a trustless and permissionless system that is designed to be interoperable with Ethereum.

Optimism achieves its scalability by batching transactions off-chain and then submitting them to the Ethereum mainchain for finalization. This allows Optimism to process a much higher volume of transactions than Ethereum can on its own.

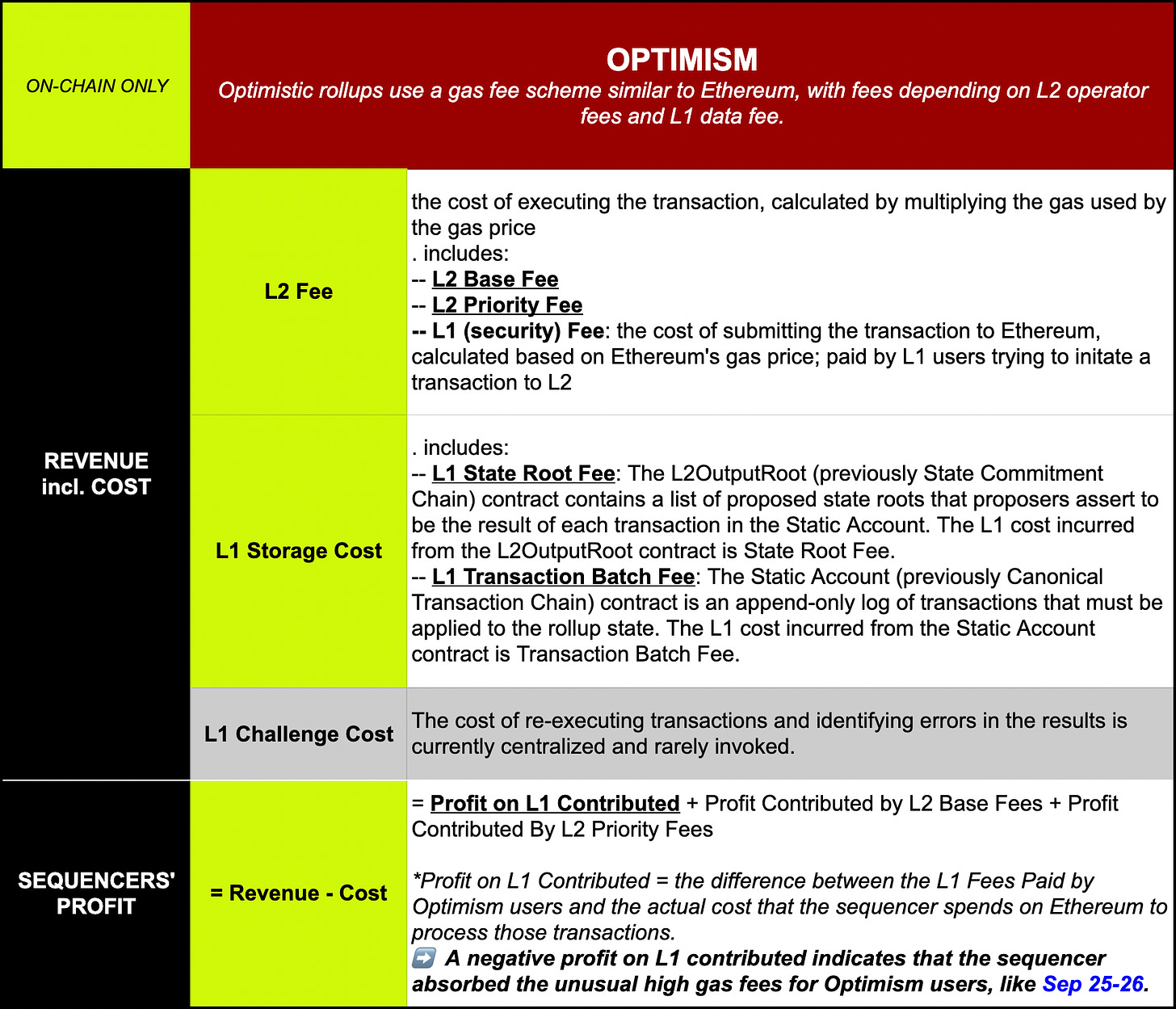

For an overview of fees and costs in the Optimism ecosystem, see the table provided. It’ll help you tremendously to compare with the other 2 protocols.

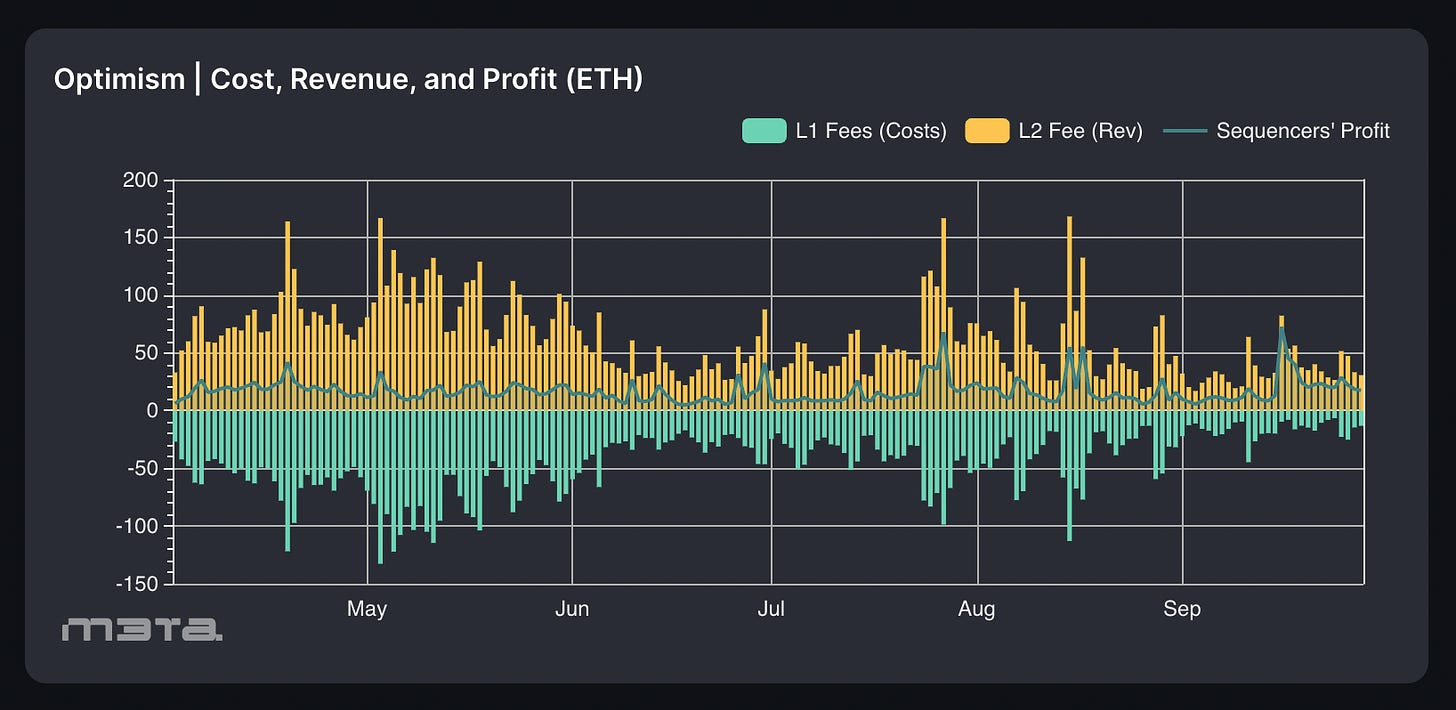

As per our on-chain statistics, Optimism is showing strong profitability. Sequencers have the potential to earn 25 ETH on most days and even surpass 50 ETH on exceptional days.

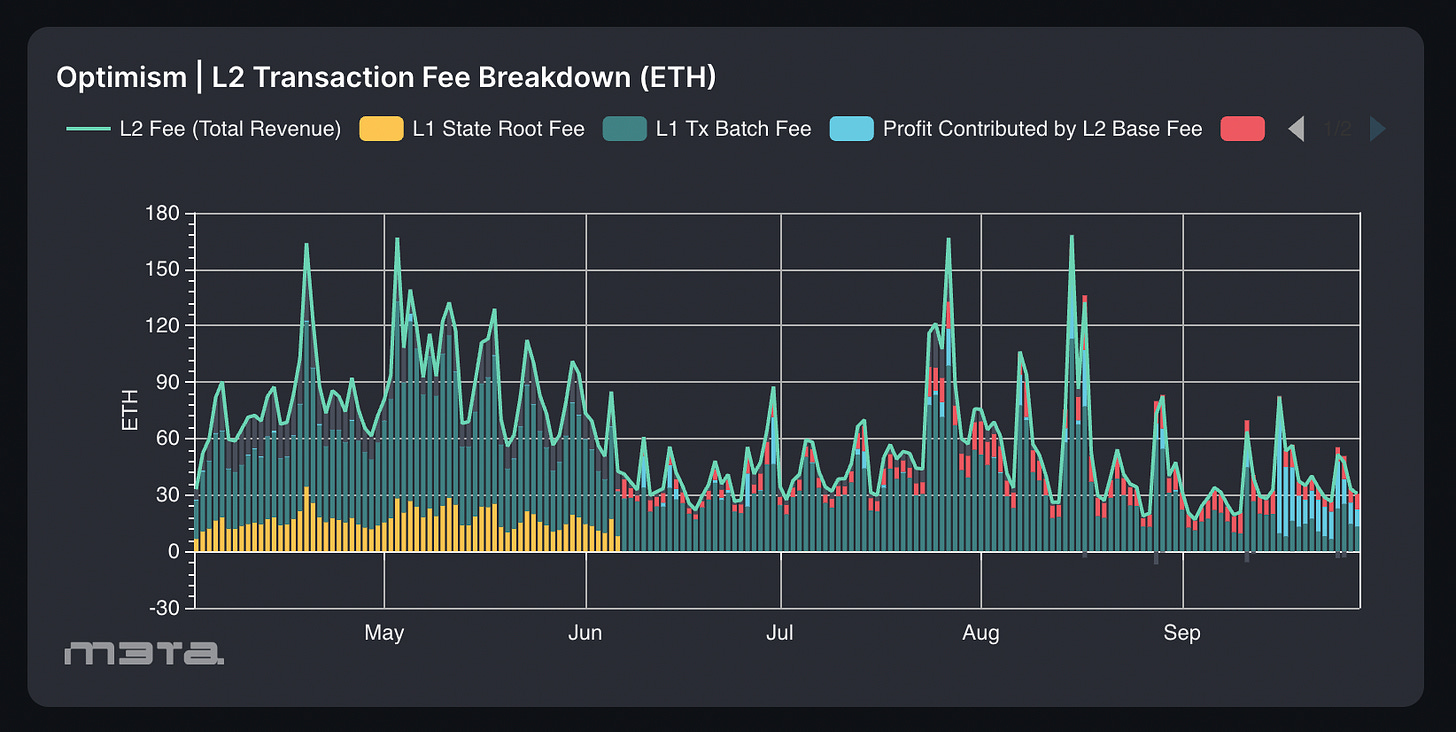

A closer inspection of the L2 Fees reveals that the bulk of the expense is attributed to the "L1 Tx Batch Fee."

This marks the end of Part 1. Join us tomorrow for Part 2, focusing on the economic structure of Polygon zkEVM and zkSync Era. We’ll also provide you some comparison insights between these 3 structures.

But if patience isn't your virtue, the dashboard is there for you.

Catch you in Part 2!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.