On-chain Analysis: KLEVA Protocol

Whether you're familiar with leveraged yield farming or just getting started, KLEVA offers an enticing opportunity to amplify your returns or generate steady passive income through staking. Or both!

Introduction

1. What is Leveraged Yield Farming?

Leveraged yield farming involves Farmers utilizing borrowed capital from Lenders to enhance the returns obtained from yield farming activities on decentralized finance (DeFi) platforms. By securing loans at lower interest rates and allocating them to high-yielding liquidity mining pools, users can boost their overall gains.

This is yet another innovative feature that can attract users looking for new opportunities in DeFi.

An example of 3X Leveraged Yield Farming motion by Francium DeFi protocol.

2. What is KLEVA?

KLEVA is the first DeFi protocol on the Klaytn blockchain to specialize in leveraged yield farming and was said to have been the fastest TVL growth among all Klaytn-based DeFi protocols since its launch in mid-January 2022.

By taking advantage of the liquidity layers in decentralized exchanges (DEXs) and acting as an amplifier, KLEVA creates a route for liquidity to efficiently flow between DEXs and the protocol itself.

This inevitably facilitates a positive feedback loop that benefits the entire ecosystem:

more liquidity equals a more stable trading condition and less slippage;

less slippage attracts more users;

more users increase the Total Value Locked (TVL);

the higher TVL, the healthier the ecosystem;

Eventually, confidence is boosted and the chance of earning profits is more realistic.

KLEVA sets itself apart from its competitors with a dynamic capability that includes full transparency and disclosure of operations, as well as a strong team comprising WEMIX - a subsidiary of the KOSDAQ-listed video game developer giant Wemade, SOOHO - an audit firm specializing in the reinforcement of blockchain security, and Birk O'Sully - a company proficient in Web3 protocol development.

*KOSDAQ: Korean Securities Dealers Automated Quotations, an official technology-centric stock market in Korea which can be compared to NASDAQ of the US.

TL;DR at M3TA KLEVA Protocol Report.

Protocol Components

It is evident from Figure A that there are 3 key components that make up external participation from users, which would also be featured in our analysis.

Lending and Staking Activity

Farming Activity

$KLEVA token

Note:

‘KLEVA' addressed here refers to KLEVA as an ecosystem, as a DEX. ‘$KLEVA', on the other hand, mentions the reward and native token of the KLEVA platform.

Yield Farming: The APR of governance tokens Farmers get from participating in DEX’s liquidity pool mining. (as per KLEVA's definition)

Borrowing Interest: The interest Farmers pay to Lenders (as per KLEVA's definition)

Lenders

1. What can Lenders do?

Provide single assets into the Lending Pool, from which Farmers can borrow these assets and conduct Leveraged Yield Farming.

Receive ‘ibToken’s at the starting 1:1 ratio (1 deposited assets = 1 ibTokens).

‘ibToken’ generally stands for ‘interest-bearing tokens’ that KLEVA Lenders receive for the amount of assets deposited in the Lending Pool. For example, when you deposit KLAY, you receive ibKLAY (not ‘ibToken').

The ratio of each ‘ibToken’ to the original Token can vary. For example, if you deposit 400 KLAY in the Lending Pool while 1 ibKLAY is worth 1.6 KLAY, you will receive 250 ibKLAY (400/1.6 = 250).

Stake their ‘ibTokens’ in the Staking Pool and receive $KLEVA rewards.

Stake their $KLEVA in the Staking Pool and receive ibKLEVA.

2. Why do users choose to become Lenders?

No impermanent loss: single asset deposits are not affected by price volatility between a trading pair; therefore, the action eliminates impermanent loss).

No liquidation: as Lenders do not participate in Leveraged Trading, they are not limited in the amount of funds they can deposit in the pool.

3. What are the ways of earning profits as Lenders?

Make 81% of the Borrowing Interest by lending assets to Farmers.

Earn $KLEVA.

Make 10% of the Farming Performance Fee if they hold ibKLEVA, usually in DEX Governance Token Rewards.

Tips to maximize Borrowing Interest as a Lender:

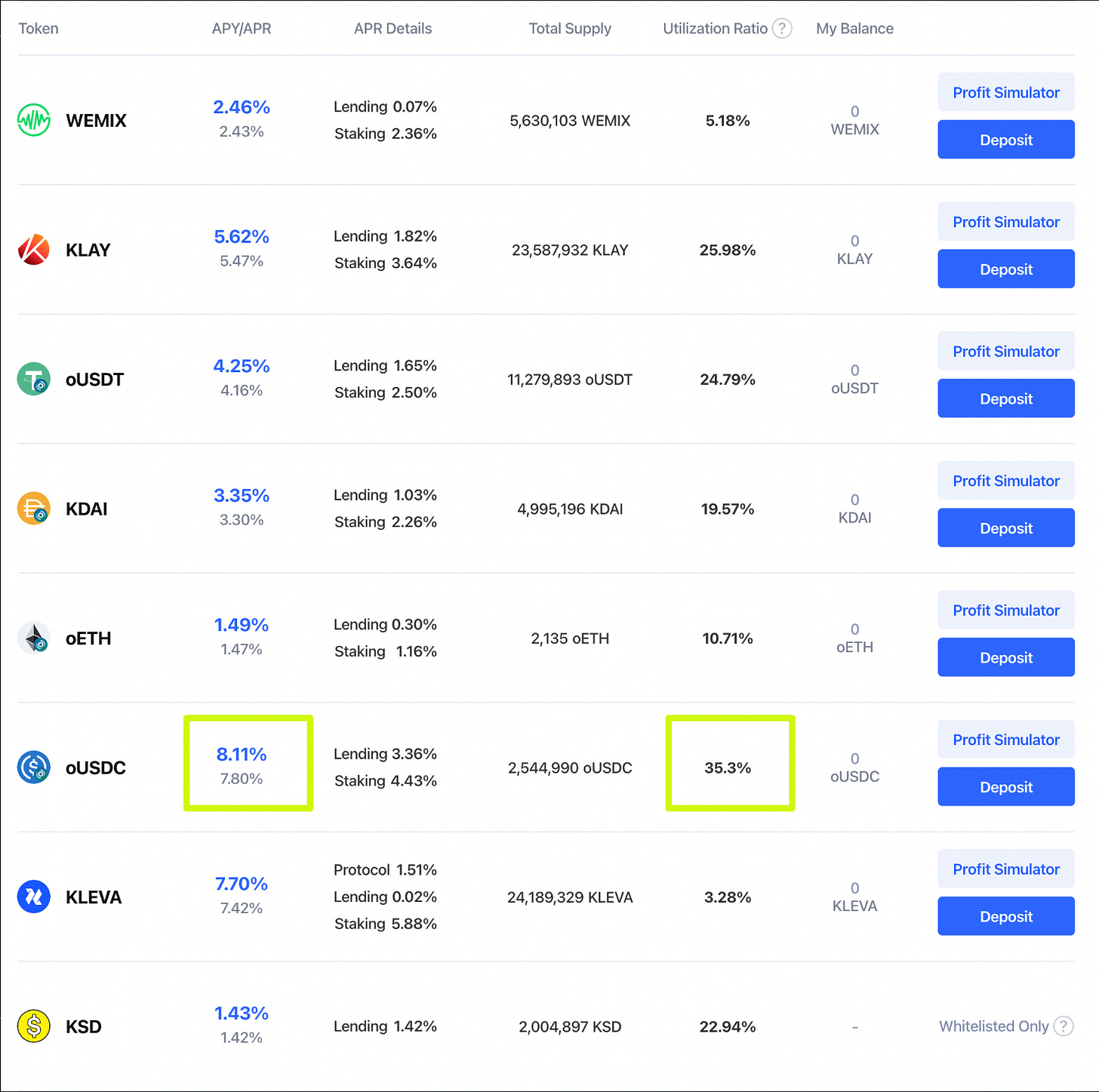

Lend assets that have the highest Utilization Ratio (UR), which defines how popularly an asset is being borrowed by Farmers. As more Farmers choose to borrow an asset, the UR will increase and the interest rate will follow (Figure B).

As of time of writing, the most attractive assets to lend based on Utilization Ratio is oUSDC at 35% (Figure C).

Farmers

1. What can Farmers do?

Deposit tokens on KLEVA and yield farms on different decentralized exchanges (DEXs) without borrowing assets.

Deposit tokens on KLEVA and borrow more assets from Lending Pools to maximize profits from other decentralized exchanges (DEXs) and Receive $KLEVA when borrowing assets.

Open several Farming positions simultaneously as a hedging scheme.

Hold Long-Short positions: when applying Leverage over 2, Farmers hold Short positions with Borrowed assets; when applying Leverage below 2, Farmers hold Long positions with both Collateral and Borrowed assets.

Stake their $KLEVA in the Staking Pool and receive ibKLEVA. This only applies to positions that have Borrowed Assets included.

2. As Leveraged Farming involves more risks than Lending, Farmers should be aware of:

Borrowing Interest: Farmers will need to pay for this type of fee to borrow any asset from the Lending Pool. The rate of the borrowed assets should not be higher than their compounded yield so that Farming profit is still intact. Pay attention to the Utilization Ratio, too.

Impermanent Loss: Volatility can be mitigated by farming with stablecoin-stablecoin pools or token-stablecoin pools.

Liquidation Threshold: More volatile assets are associated with lower thresholds. Typically, the thresholds range around 80-90% for 2.0x - 3.0x leverage, which is quite higher than other Leveraged Yield Farming platforms like Alpaca Finance (50-70%) and Apricot Finance (60-80%).

Leverage Multiple (2.0x, 3.0x, 4.0x, etc.): as Farmers double (2.0x) or triple (3.0x), etc. their Farming positions, their yields also multiply along with the higher risks of liquidation and borrowing interest of the assets.

When Farmers get liquidated, their Collateral assets (what they deposit onto KLEVA) will be directed back to Farmers after the Liquidation Fee is applied. That means 5% the sum of Collateral asset and Borrowed asset value will be deducted.

3. What are the ways of earning profits as Farmers?

Earn 70% of the yield farming reward from DEXs. This could be doubled or tripled as Farmers apply Leverage.

Earn $KLEVA, only applied to Farming positions with Borrowed Assets.

Analysis

User Preferences on KLEVA Platform: Lenders vs Farmers

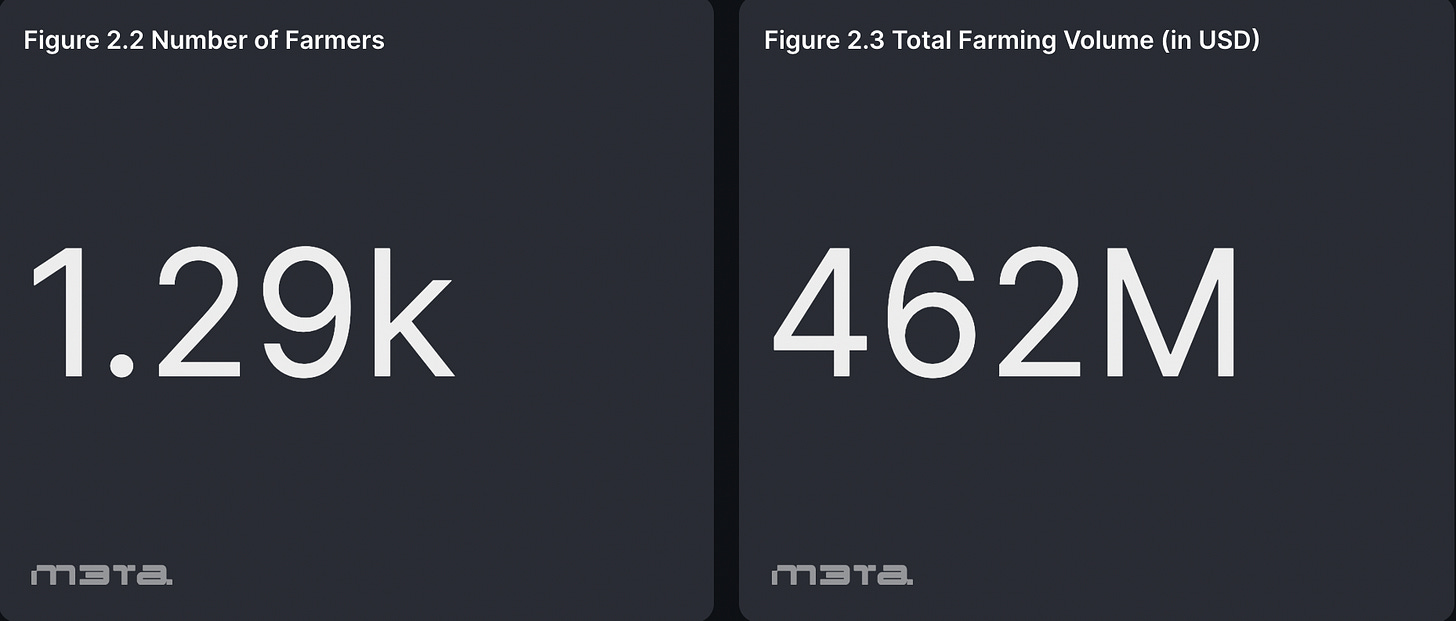

Figure 1.1 and Figure 2.2 provides a glimpse into the user base of KLEVA's lending platform. The data suggests that KLEVA's lending service has been more popular than the farming one.

Per time of writing, the number of Farmers using the platform stood at 1.29K, which was significantly lower than the number of Lenders at 12K. This indicates that Lenders had a more significant presence on KLEVA's platform.

The lending volume on the platform, as indicated in Figure 1.3, was a staggering $9B, which was significantly higher than the Farming volume of $462M (Figure 2.3). This is likely due to the tokenomic structure that KLEVA has in place, which seems to offer more ways to earn profits for Lenders than Farmers.

The platform's tokenomic structure also provides a compelling incentive for Lenders to stake their ibTokens into KLEVA's staking pool, which attracts more than 95% of Lenders (11.6K Lenders out of 12.1K Lenders have chosen to stake).

By staking their tokens, Lenders can earn additional yield, making their investment even more profitable. This provides Lenders to have access to three sources of rewards, including interest rewards, KLEVA rewards from staking ibTokens, and a bonus reward if they hold ibKLEVA.

KLEVA made waves in January 2022 with the announcement of its KLEVA Protocol. As expected, the launch attracted a significant number of users, as seen in Figure 1.4. However, at launch, users were limited to using only the "Lend" and "Stake" functions, which explains the absence of data on Farmers (Figure 1.6).

On January 27, 2022, KLEVA announced the launch of its flagship product, Leveraged Yield Farming, which was set to go live the next day. This was a highly anticipated step for KLEVA, and many were eager to try out the new feature.

Unfortunately, the team encountered an unexpected error during the update and testing process of the ibKUSDT Vault, which led them to close all deposits and withdrawals to prevent further damage.

During this period, an excessive amount of 52M KUSDT was withdrawn from the vault. However, the KLEVA team quickly sprang into action and compensated any affected users.

Despite the incident being resolved, many users lost their trust in the project, which can be seen in the gradual decrease in Total Lenders in Figure 1.4. While the setback was unfortunate, it highlights the importance of thorough testing and quality control in the development of blockchain technology.

Despite the challenges, KLEVA remains committed to providing a safe and reliable platform for its users and continues to work towards improving its services and rebuilding trust with its community.

KLEVA made a significant update to its Leveraged Yield Farming Service on April 1, 2022, by adding 12 new KLAYswap liquidity pools. This was a highly anticipated move that drew the attention of many Farmers within the KLEVA community. As expected, there was a surge in Farmer counts following this update, as shown in Figure 2.6.

As we approached the second half of 2022, it is interesting to note that the monthly Lender and Farmer count on KLEVA's platform seemed to have stabilized. This could be indicative of the platform's growing base of loyal users who continued to utilize its services.

The stability in the monthly Lender and Farmer counts may also suggest that KLEVA's user acquisition efforts were paying off, as more people became aware of the platform and the benefits it offered.

Additionally, it could be a sign of increased trust in KLEVA, as users continue to rely on the platform for their lending, borrowing, and farming needs.

Lending & Staking Activities

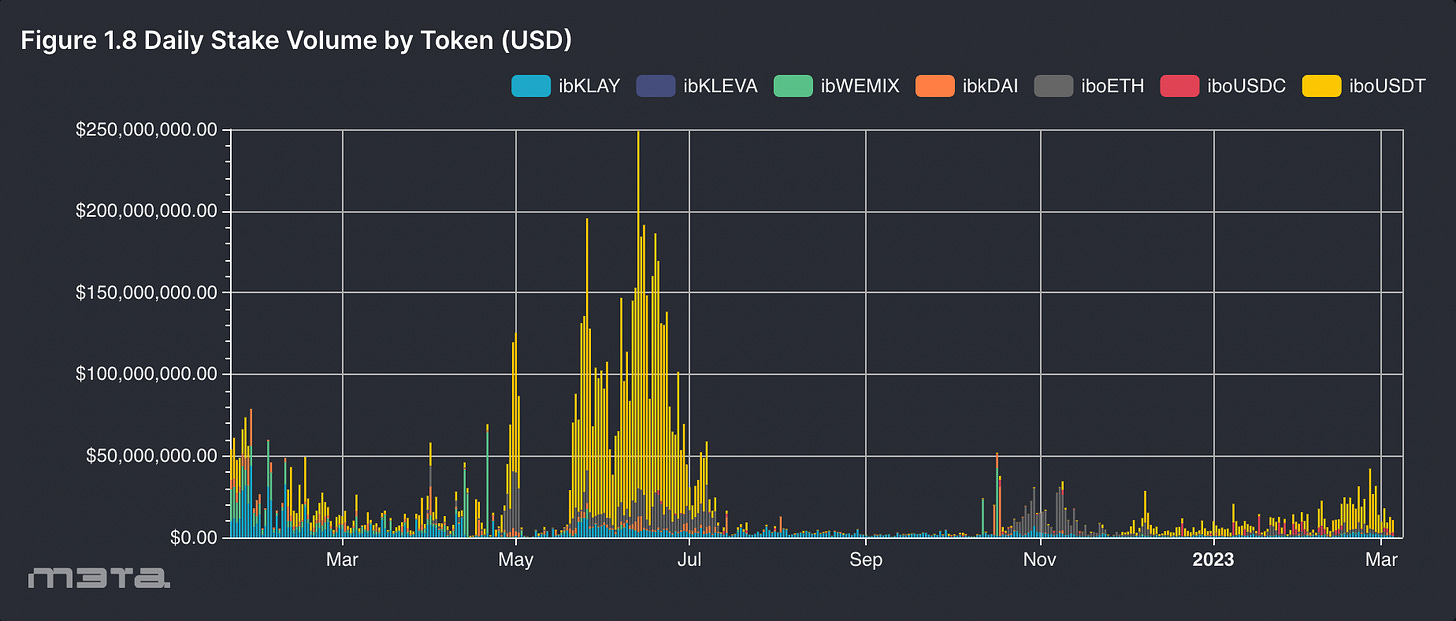

The months of May to July 2022 data show a remarkable surge in lending and staking activities during this time (Figure 1.6). The market was highly volatile during this period, with the Terra Luna downfall and plummeting BTC prices, which made investors anxious about the safety of their assets.

Further analysis of the on-chain data reveals that investors were primarily lending and staking $USDT stablecoin during this period, as evidenced by the data in Figures 1.7 and 1.8. This suggests that USDT was the preferred asset for investors seeking a safe haven during the market meltdown, and KLEVA was their preferred platform to entrust their assets.

As seen in Figure 1.9, KLEVA has consistently provided a high level of reward volume for Stakers throughout the year, indicating the platform's dedication to incentivizing participation in its staking program.

Additionally, the Average Monthly Staking Rewards Volume per Staker has been trending upward (Figure 1.10), indicating that Stakers were receiving increasingly higher rewards on average.

It is important to note that staking rewards are typically distributed proportionally among all those who participate in the staking process. However, there are cases where Stakers may receive more rewards than others.

For instance, if fewer people are staking in a particular crypto asset, the rewards may be more evenly distributed among those who do participate in staking, resulting in higher rewards for each individual Staker.

Therefore, the uptrend in Average Monthly Staking Rewards Volume per Staker could be attributed to a decrease in the number of Stakers (Figure 1.5), leading to a more significant distribution of rewards among those who were still staking.

Farming Activities

In Figure 2.5, WEMIX-KLAY, oUSDT-DAI, and oUSDT-WEMIX emerged as the top-performing pools in terms of Farming Volume trading. However, while the oUSDT-DAI pool ranked second in terms of farming volume, its trading volume percentage only dominated the other pools in March 2022, as illustrated in Figure 2.4.

In contrast, the Farming percentage for the WEMIX-KLAY and oUSDT-WEMIX pools remained stable throughout the year.

It is worth noting that pools containing $WEMIX appeared to be more preferable, possibly due to the loyalty of WEMIX's users; not to mention, WEMIX, a subsidiary of KOSDAQ-listed Wemade, is one of the development teams behind KLEVA.

The histogram 2.7 analyzes the farming volume distribution among KLEVA users, as it excludes those with a stake of more than $50,000, allowing for a more accurate assessment of a typical user’s behavior.

The figure shows that almost half of users had a farming position valued at less than $2,000, indicating a relatively low level of investment. Around 19% of users have a moderate level of involvement, farming in the range of $2,000 to $10,000. Finally, approximately 11% of users are farming in the higher range of $10,000 to $20,000, indicating a comparatively high level of engagement.

These findings suggest that the majority of KLEVA users have a low-to-moderate level of involvement in farming activities, with only a minority engaging in high-value farming.

Token Analysis

According to Figure 3.3, only 35% of the 44.7M $KLEVA tokens are currently in circulation, indicating a healthy supply restriction.

Furthermore, more than 50% of the total $KLEVA holdings are locked up through staking activity. This suggests a strong and committed community of investors who believe in the token's long-term potential.

The fact that a significant portion of the tokens are locked up through staking also means that there is less available supply in the market, which can create scarcity and potentially drive up the token's value.

In Figure 3.1, a significant increase in Burned $KLEVA was observed in November 2022. KLEVA attributed this to a Buyback & Burn event that took place during the month.

The event was initiated due to the accumulation of an exceptionally large fund, resulting in the buyback of a considerable amount of $KLEVA tokens. All of the tokens that were bought back were subsequently burnt on November 25th.

According to analysis conducted by CoinMarketCap, KlaySwap is the primary marketplace for buying and selling $KLEVA tokens, with more than 95% of $KLEVA transaction volume occurring in the KLAY-KLEVA Liquidity Pool on KlaySwap (Figure F).

Therefore, the netflow of $KLEVA tokens from this pool serves as a strong indicator of the current market demand for the token.

By monitoring the netflow, investors can gain valuable insights into the token's price movements. A positive netflow suggests that demand for the token is strong, while a negative netflow indicates a lower level of demand. These insights are particularly useful for investors who are looking to make informed decisions about buying or selling the token.

For instance, in February 2023, we observed a net inflow of 844,000 $KLEVA tokens, which correlated with a significant surge in the token's price from $0.07 to $0.23 during the same period (Figure 3.5).

This indicates that demand for $KLEVA was high during that time, which likely contributed to the price increase. Investors who were monitoring the netflow at the time could have potentially capitalized on this price movement.

Conclusion

KLEVA's success can be attributed to a combination of factors, including its innovative protocol, well-designed tokenomics, and a well established team behind the project.

Despite its relatively small user base, KLEVA has managed to achieve impressive growth and appreciation of its token.

This is a testament to the team's dedication to building a quality product and providing a user-friendly experience for their customers.

As the DeFi space continues to evolve and grow, KLEVA is well-positioned to continue its upward trajectory and attract even more loyal customers and investors.

Until the next Report!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.