On-chain Analysis: GMX (Arbitrum)

Curious on how the top dApp by TVL and the leading DeFi derivative exchange perform since the launch? Unlock margin trading insights into GMX with this second episode of our on-chain analysis.

Introduction

GMX is a decentralized derivative exchange (DEX) for top cryptocurrencies such as BTC, ETH, AVAX, LINK and UNI. The exchange was launched in September 2021 and currently supports Arbitrum (Layer 2) and Avalanche (Layer 1) chains. We should point out that our following comprehensive analysis focuses on the Arbitrum-native trading data only.

When it comes to derivative trading, it offers leverages of up to 50x, and you trade perpetually without actually buying or selling any token. The platform is also open to spot swap but this kind of trading is not prioritized in our analysis.

With zero price impact trades, limit orders, low swap fees and a friendly UX design, GMX quickly attracted DeFi enthusiasts, especially those trying to qualify for the potential Arbitrum airdrop.

It was said that trading assets on GMX, among other tasks, can help you receive ARB - the Arbitrum-native token - when it is launched.

TL;DR at M3TA GMX (Arbitrum) Dashboard.

Why GMX?

GMX is a decentralized spot swap and perpetual contract trading platform that offers a unique and innovative approach to DeFi leveraged trading. Let's break it down a bit.

Spot swap is the usual practice of swapping tokens 1:1 on the spot (hence the name)

Perpetual exchange or Derivatives is the practice of betting on a long position (when the asset price rises, you win) or on a short position (when the asset price rises, you lose).

Derivative traders are also called margin traders in this analysis.

Decentralized Derivative Exchange

Before the wave of GMX and alike, traders usually went to CEX like Binance or Coinbase to conduct perpetual trading. Not a lot of DEX chose to offer derivatives. It is simply because the gas fees could be outrageous, liquidity could be in shortage and price slippage was too pervasive.

However, GMX happened to offer solutions to these DeFi problems.

Unlike a centralized exchange, the decentralized anon-built GMX hardly runs into issues of security, data privacy protection or regulatory issues.

GMX uses Chainlink's oracles to provide accurate price data for the assets being traded on the exchange.

Oracles are essentially data feeds that provide real-world information to the blockchain. Chainlink is a decentralized network of oracles that provide accurate and reliable data to blockchain applications. In GMX's case, the data here refers to the price feed from other leading exchanges.

By obtaining accurate price data, GMX is able to optimize its trading algorithms to reduce the amount of fees that users have to pay. This is because the more accurate the price data, the more efficient the trading algorithms can be, which can help to reduce the cost of trading on the exchange.

GMX offers zero-price impact trades through a custom algorithm that ensures large trades are broken up into smaller pieces and executed gradually over time.

In traditional exchanges, large buy or sell orders can have a significant impact on the price of the asset being traded. This is because such orders can quickly exhaust the available liquidity, leading to slippage and a higher price for the remaining orders.

In contrast, GMX's zero price impact trade allows the market to adjust to each chunk before the next one is executed, reducing the overall impact on the price and making GMX a more attractive option for institutional investors and high-volume traders.

Protocol Fees

There are two types of protocol fees that margin traders are required to pay:

Trading Fee: 0.1% on the position size to open or close a trade

Borrow Fee, or as we'd like to call it, Lending Interest Rate:

= (assets borrowed) / (total assets in the pool * 0.01%) per hour

which depends on the popularity of the asset and could go up to 52.56%/year (as of time of writing)

Essentially, when you trade derivatives, you are not using your own coins to trade; you are borrowing others' coins, the liquidity providers’. Therefore, these people would receive rewards for lending their money to you (which is partly from this fee). The more margin traders borrow an asset, the higher the fee, and vice versa.

Another type is swap fee, which is not fixed, but varies depending on the type of asset being traded. When users swap one asset for another, they pay a fee based on a percentage of the total value of the transaction. This fee does not apply to margin traders, only swap-pers.

It is worth noting that the protocol fees are split between GMX and GLP token holders in the following ratio:

30% to GMX stakers

70% to GLP holders, i.e. liquidity providers

Tokens and their Utilities

GLP

GLP is a liquidity provider (LP) token that is used to provide liquidity for margin traders on GMX. Traders can buy GLP tokens with any of the assets that are in the liquidity pool, including USDC, DAI, LINK, ETH, etc. The moment they receive the GLP token, it is defaulted as a staked GLP because it cannot be transferred elsewhere.

GLP Pool

Unlike traditional centralized exchanges which process trades through order books, GMX operates through a community-driven liquidity pool, called the GLP pool, where users can provide liquidity and earn 70% of all protocol fees based on their contributions.

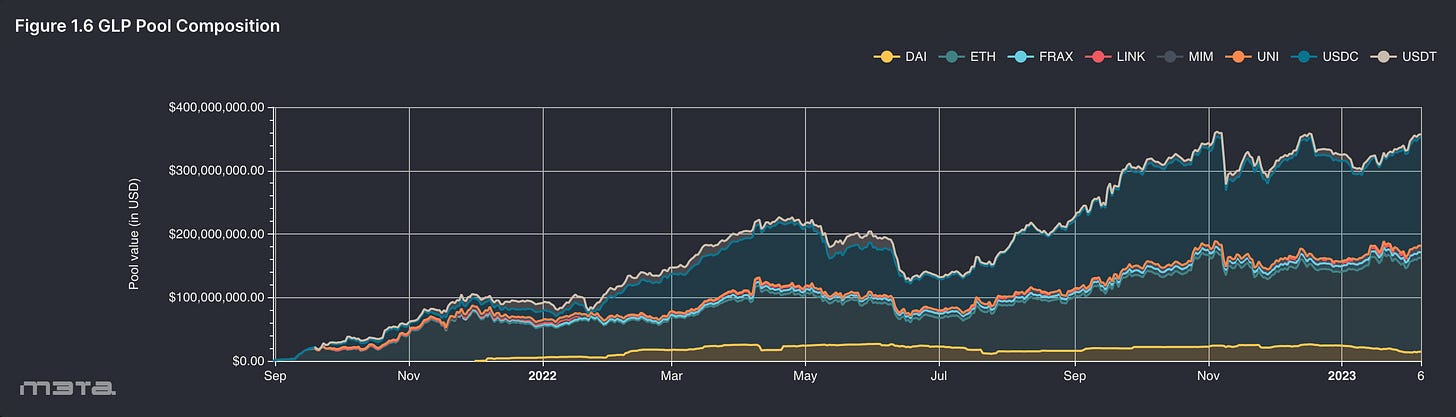

The GLP pool consists of a variety of assets, including stablecoins (USDC, USDT, FRAX, MIM, DAI), ETH, and other altcoins (LINK, UNI).

When a user deposits one of the assets above on the exchange, a corresponding amount of GLP is minted. On the other hand, GLP is burnt when they withdraw their deposits by swapping GLP to the desired assets.

GMX

GMX is a governance token that can be used for various purposes in the GMX ecosystem.

Staking

To receive Escrowed GMX tokens (esGMX), which will automatically convert to GMX after a 12-month period or can be re-staked for the same rewards of GMX staking.

To receive 30% of all protocol fees in the form of ETH and AVAX APR.

To receive Multiplier Points every second at a fixed rate of 100% APR. For example, if you had to stake 1000 GMX for one year, you would earn 1000 more Multiplier Points after 12 months. Multiplier Points owners are eligible for reduced fees, faster transaction times or other exclusive features that encourage them to keep staking more GMX.

Margin trading

GMX offers a user-friendly interface and easy access without requiring registration or an account. Rather than trading the token, users deposit collateral assets to open long or short positions. Long positions earn profit in the pair's other token (such as ETH or BTC) while short positions use USDC to pay for profits.

GMX Swap

GMX offers a swap service with several benefits for users. Zero price impact trades and low swap fees are among these advantages, as the prices of assets on GMX are based on Chainlink's oracles that aggregate price feeds from leading exchanges.

Analysis

An expanding user base with robust swap and margin actions and concentrated LP providers

As explained earlier, there would be 3 main actions users can take when interacting with GMX:

Providing liquidity for GLP pool

Trading derivatives

Swapping GMX on the spot

Throughout the later half of last year, GMX witnessed a significant rise in the number of unique users (Figure 1.4 & Figure 1.7) who actively engaged in the 3 main trading activities on the platform, mostly in swapping and margin trading.

This is also shown in an according spike in the density of these two’s activities in Figure 1.5, even though it is worth noting that towards the end of the year, the market was moving sideways. This means fewer opportunities for margin traders to make leveraged profits, indicated by a contraction of margin trading and liquidity providing actions during the last 3 weeks of 2022.

However, a similar trend was not seen in the number of GLP liquidity pool providers. Their operations remarkably intensified during Q4 of 2022 although there was not an upsurge in the count of distinctive liquidity providers at the time, indicating that merely a limited set of users were taking part in this LP "game.".

Tip: Click on the 4 labels of “Margin Trading User"/“Margin Trading Action” & “Swap User"/“Swap Action" in Figure 1.4 & 1.5 to turn off the 2 actions while highlighting the data available for “GLP Pool Provider”/”GLP Liquidity Providing Action”.

The surge in the number of unique users in the second half of 2022 can be attributed to the listing of the GMX native token on centralized exchanges such as CoinEx, Bybit, Binance, and many more, which had drawn the interest of many users to explore the platform's offerings.

Within the same period, over the week of June 27, there was a notable upswing in all three types of users, marking the highest number ever recorded of users so far on GMX. The evidence was also backed by a concurrent soaring of new users added to the system on June 28 and 29, with approximately 12-15K new users each day (Figure 1.7).

A plausible explanation should be the effects of Arbitrum Odyssey Week 2, when Arbitrum partnered with Yield and GMX. On the GMX's part, users were incentivized to complete either of those 3 tasks: leveraged trading, providing liquidity to mint GLP, and spot swapping, in exchange for receiving NFTs from Arbitrum.

Bridging to Arbitrum rewards users with an exclusive NFT. And rumor has it that the Arbitrum Odyssey NFT is a requirement for receiving the Arbitrum token. This led to a significant influx of both GMX users and their track records of on-chain activities.

Additionally, GMX was also conducting a series of informative AMA events, known as GMX AMAzon, which could also have contributed to the surge. These activities illustrate the effectiveness of GMX's marketing initiatives in attracting new users and creating a vibrant trading ecosystem.

One key indicator of the platform's growth is the data presented in Figure 1.6, which shows a surge in minting transactions (when people provided liquidity onto the GLP pool) from September to early November. During this period, a significant amount of USDC and ETH was deposited into the GLP pool, indicating the popularity of these assets among the platform's user base.

However, the remaining period of November saw withdrawals of these assets and subsequently a periodic action of assets supplied in the pool. This could be an indirect result from the fact that the market was bearing the explosion of FTX (Nov 6-Nov 11) and risk-averse traders were trying to secure their assets from an uncertain economic condition.

Despite this, the continuous growth of the platform's user base and its activities demonstrate GMX's potential for providing efficient and lucrative trading opportunities to its users.

To exemplify this point, we can observe that after the Arbitrum Odyssey Week 2, between September 2022 and January 2023, there was a consistent rise in the number of new users with an average of 1K to 3K fresh sign-ups per day (Figure 7). Another data point can be made use here is the fact that the quantity of committed GMX users has been leveling off at around 80% of total platform users, and is often surpassing the number of new users per day.

Margin: the Double-Edged Sword

Figure 1.7 reveals an interesting trend where Swap Trading appears to have been more popular among users compared to Margin Trading.

However, despite Swap Trading having a higher user base, Margin Trading has yielded greater trading volume and fees as shown in the four Figures 2.1 to 2.4. This trend could be attributed to the ease of use and lower risk associated with Swap Trading, making it a more accessible option for beginners. On the other hand, Margin Trading requires users to have a good understanding of trading strategies and the market's volatility, which explains its popularity among more experienced and institutional traders.

Margin Trading enables high leverage, which allows traders to open larger positions with less capital, potentially leading to higher profits. However, it is important to note that the higher leverage also poses a higher risk of losses.

Figure 2.5 shows that margin traders on GMX have mostly experienced losses throughout the majority of 2022, causing a negative PnL for the year. The period between December 2021 and October 2022 was particularly challenging for these traders, as they suffered a total loss of over $50M.

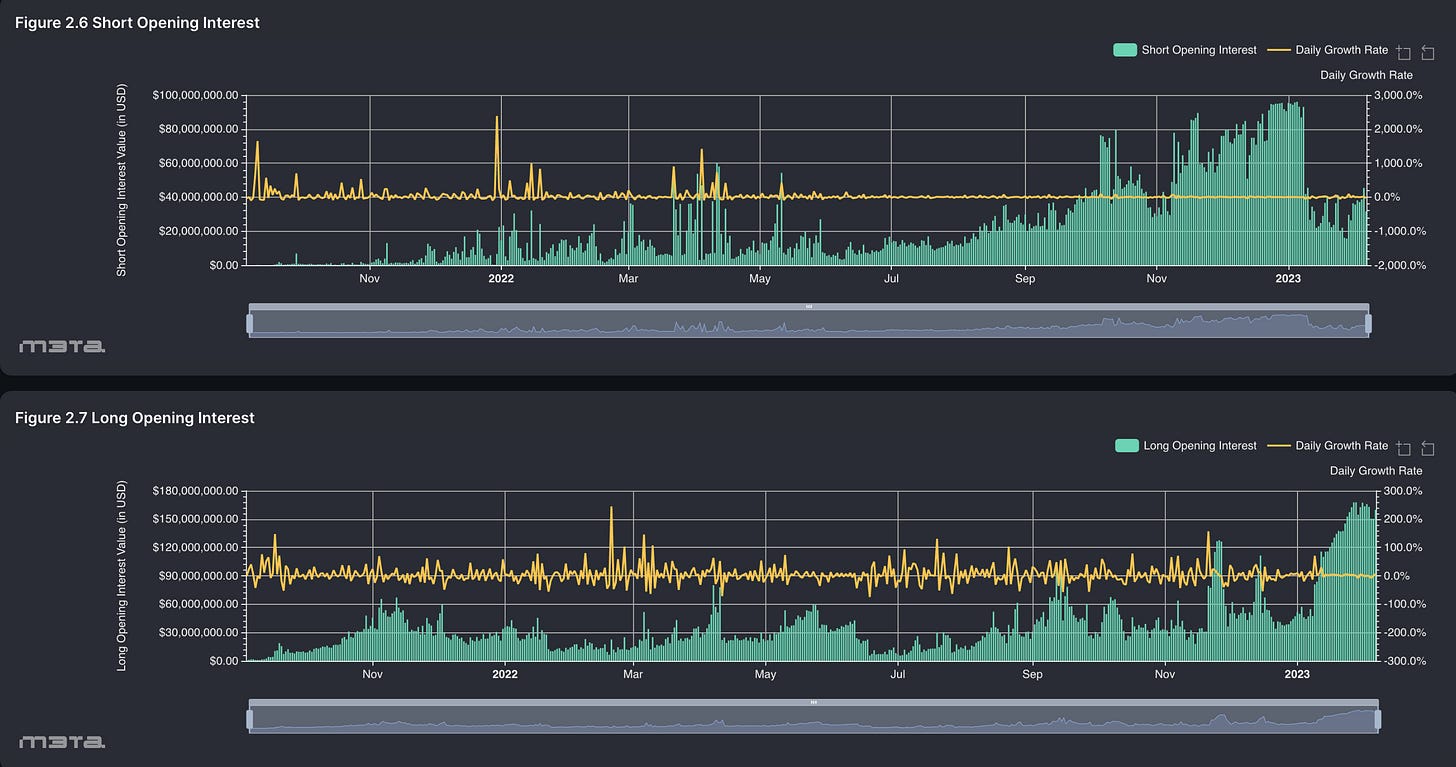

Figures 2.6 and 2.7 provide further insight, revealing that until the middle of last June, a higher proportion of users had opened and held long positions rather than short positions, which is unsurprising given the bullish market conditions that prevailed most of 2021.

What was surprising to those traders is that the tokens they were leveraging against continued to follow a downturn trajectory into 2022 (Figure 2.9 & 2.10), subsequently resulting in long position traders receiving margin calls. This is evidently seen in the June liquidation which amounted to $44M (Figure 2.8).

As a consequence, the open interest of long positions started decreasing in the subsequent month, and eventually got replaced by short opens (Figure 2.6 & 2.7). But again, as observed in Figure 2.8, the negative impact of margin calls did not show signs of easing off as liquidation volume had risen dramatically in Q4 2022.

Tip: Click on the 2 labels of “Margin Trading Volume” & “Liquidate/Margin Volume Ratio" in Figure 2.8 to turn off the 2 indexes while highlighting the data available for “Liquidate Volume”, as shown in Figure 2.8 in this article.

Nonetheless, in early 2023, we observe that the long opening interest on the platform has begun to increase and has surpassed the short positions, indicating a shift in market sentiment and potential for increased profitability for traders.

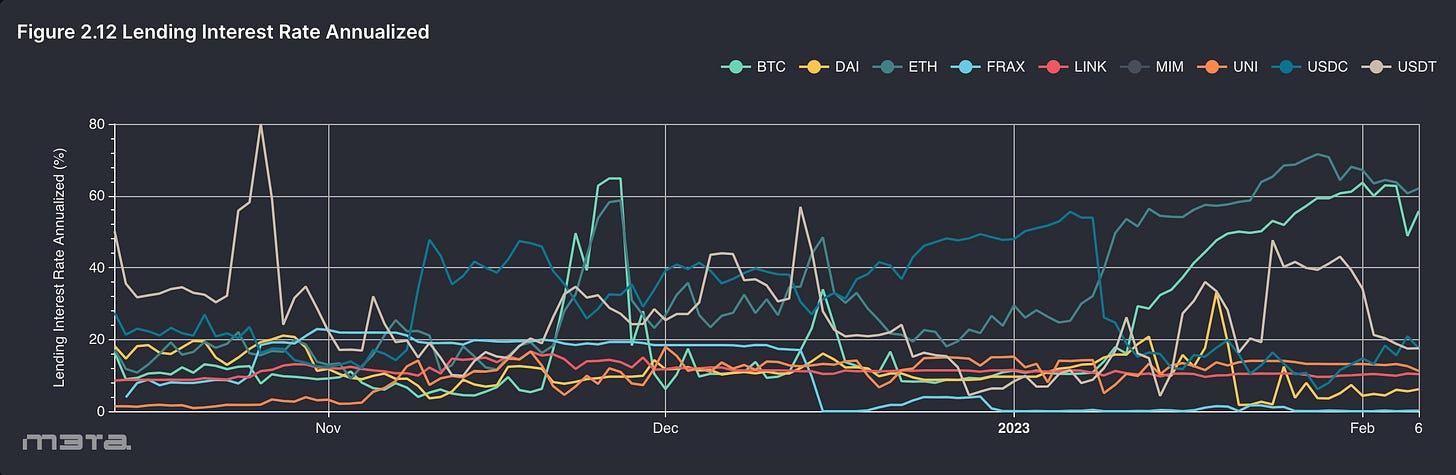

To maximize profits or minimize losses in leveraged trading, traders rely on the annualized lending interest rate as a crucial metric.

GMX calculates this rate by multiplying the Borrow Fee by 24 hours and 365 days and updates it every hour.

It is crucial for users to be aware of sudden rate spikes, as they can impact their trading activities. While the annualized lending interest rate for assets in the pool typically ranges from 1% to 40%, this rate can experience sudden increases due to high demand or withdrawal activity.

Currently, BTC and ETH have a higher annualized lending interest rate of around 60%, while other assets have rates below 20%. Thus, keeping track of these rates is essential for traders who want to make informed decisions on the GMX platform.

Conclusion

Our analysis uses a highly concentrated amount of margin trading data on GMX platform. Via thorough research, we found that the platform witnessed a growing user base with a focus on swap and margin trading and a smaller set of liquidity providers.

Although swap trading had a larger user base, margin trading seems to have generated higher trading volume and fees, but overall GMX margin traders mostly experienced losses in 2022.

To succeed in leveraged trading, traders should pay attention to another indispensable metrics, too: the annualized lending interest rate.

Overall, we deem that the GMX platform still has got a lot more to offer beside its readily existing robust trading options. We have high expectations that the platform’s user base and trading volume will continue to grow.

Until the next dashboard!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.