On-chain Analysis: Friend.tech, Post.tech & Stars Arena

As the hype for the world of SocialFi calls for it, we have done our analyses on three most mentioned protocols over the past 2 weeks with the company of our latest dashboard: Friend.tech. Read on now

SocialFi Introduction

SocialFi protocols are where users indulge in decentralized social interactions, addressing their social requirements and income generation simultaneously.

Counter to the recent upsurge in hype, the concept of SocialFinance (SocialFi) is not new at all. In fact, you might have encountered these platforms while participating in airdrop farming and retroactive hunting, possibly without realizing that they belong to the SocialFi category, namely:

Galxe ($GAL)

Lens Protocol

Mask Network ($MASK)

Hooked Protocol ($HOOK)

CyberConnect ($CYBER)

This development has undoubtedly stirred up some curiosity regarding our latest rising stars. In light of the numerous protocols already in existence, one may wonder how Friend.tech and its counterparts like Friendzy on Solana, Friend3 on opBNB, Post.tech on Arbitrum, and the current frontrunner Stars Arena on Avalanche have managed to garner such attention in the crypto community lately.

Why Friend.tech (and alike)?

Friend.tech is a decentralized social app built on Base, a layer-2 blockchain from Coinbase. Friend.tech platform enables users to acquire and trade unique "keys," which grant them special privileges to participate in chatrooms moderated by the key's X (formerly Twitter) creator.

Creators receive royalties when their keys are traded, and traders can potentially profit by trading or investing in these keys.

The usual one-way content consumption where users are fed with (seemingly) free content, and creators gain followers, reap interactions to generate revenue elsewhere, either from platforms ads or affiliate sponsors, does not necessarily strengthen the connection between creators and users. Sometimes, creators are forced to monetize their content through irrelevant ads, securing their income stream but adding virtually no value to their users.

Friend.tech seems to offer an ideal solution to this problem. As an advancement beyond the traditional 'subscription' paradigm, Friend.tech's revenue structure benefits creators on the business front by unifying the definitions of 'content consumers' and 'sponsors' into one. It simultaneously enhances the consumer experience as well. Why not when:

Users are willing to pay to nominate creators and content they are in favor of.

Users will have private access to the like-minded community and exclusive knowledge with ‘backstage’ 1:1 interaction.

Users can make profits re-selling the ‘keys’ they hold.

The referral scale of this kind is only for ‘the richer’ as the keys’ value only goes up as long as there are users demanding for the content you’re producing. This means that creators have basically nothing to lose, but to focus on delivering their best to the quality-conscious consumers.

It's time to examine any unique characteristics that each protocol might bring to light (if they exist):

1. Post.tech (on Arbitrum)

Builds an exact replica interface of X.

Rewards active users with an airdrop scheme associated with point accumulation. The first reward pool goes up to $100,000.

Whose team will “reinvest 30% of protocol fees from Sept 9 to Nov 20 to enhance liquidity.”

Allows users to tokenize their profiles and posts for trading.

Has an anonymous founder Racer.

2. Stars Arena (on Avalanche)

Directly connects to your ‘X’ account.

Connects your Avalanche C-chain wallet to use $AVAX to buy/sell ‘tickets’ (tickets in Stars Arena are similar to keys in Friend.tech) or drop tips for your favorite creators. You don’t need to deposit $AVAX to start posting and interacting on the platform. $AVAX is only needed when you initiate ticket transactions.

Has a public list of creators that you can follow without having to pay for the tickets; No referral codes needed.

Allows creators to set duration for subscription and the associated price; they can also decide the revenue-sharing percentage for ticket holders.

Rewards active users with an airdrop scheme associated with point accumulation. Airdrop rewards are distributed weekly, and the program started on September 26, 2023, with no set end date.

Has anonymous founders called ‘theBuilder’.

New user shares on Stars Arena start at 0.0066 AVAX, while on friend.tech, the initial price of new user shares is based on the user's Twitter data.

Analysis

Post.tech and Stars Arena: Data as of Oct 5, 2023

Friend.tech: Data as of Oct 7, 2023

Our primary focus is on 3 noteworthy SocialFi protocols for a direct comparison, and we highly recommend refraining from drawing broad conclusions about the entire SocialFi sector based solely on this evaluation.

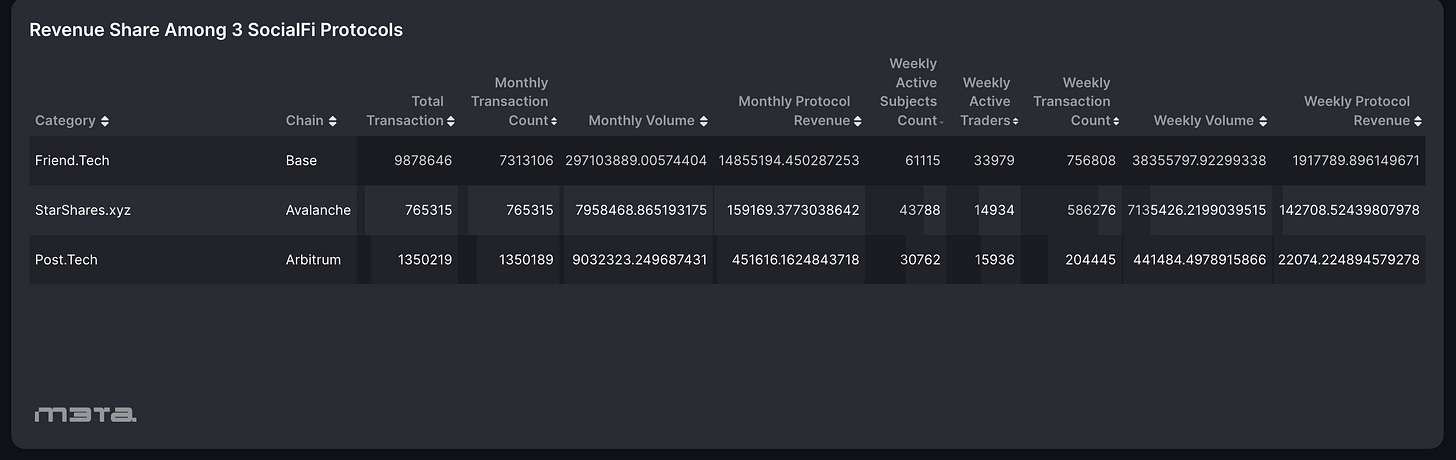

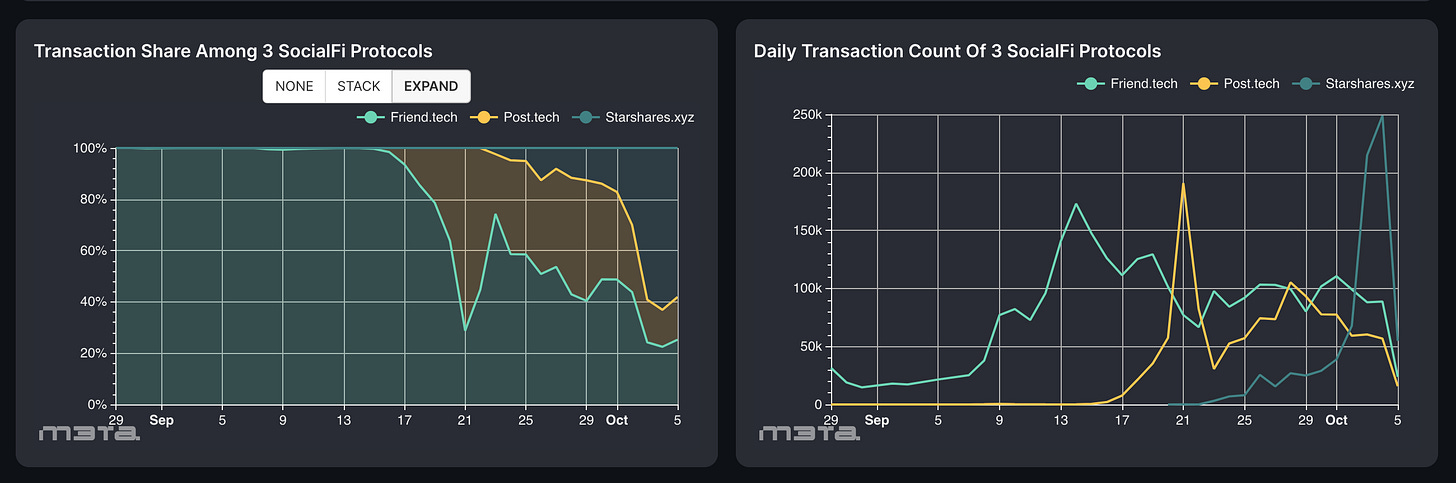

Stars Arena, which has been on the market for more than two weeks, has seemingly outperformed Post.tech in four out of five weekly metrics: revenue, trading volume, transaction count, and active subjects. Active traders, however, are gradually catching up.

Monthly numbers are still reigned by Friend.tech although the protocol has had its transaction share cut down by more than half since the hype for Stars Arena started on Oct 3.

But when we consider the cash flow perspective, Friend.tech still retains the largest active user base, enabling it to command over 80% of the trading volume and achieving a 95% revenue ratio.

More on Friend.tech:

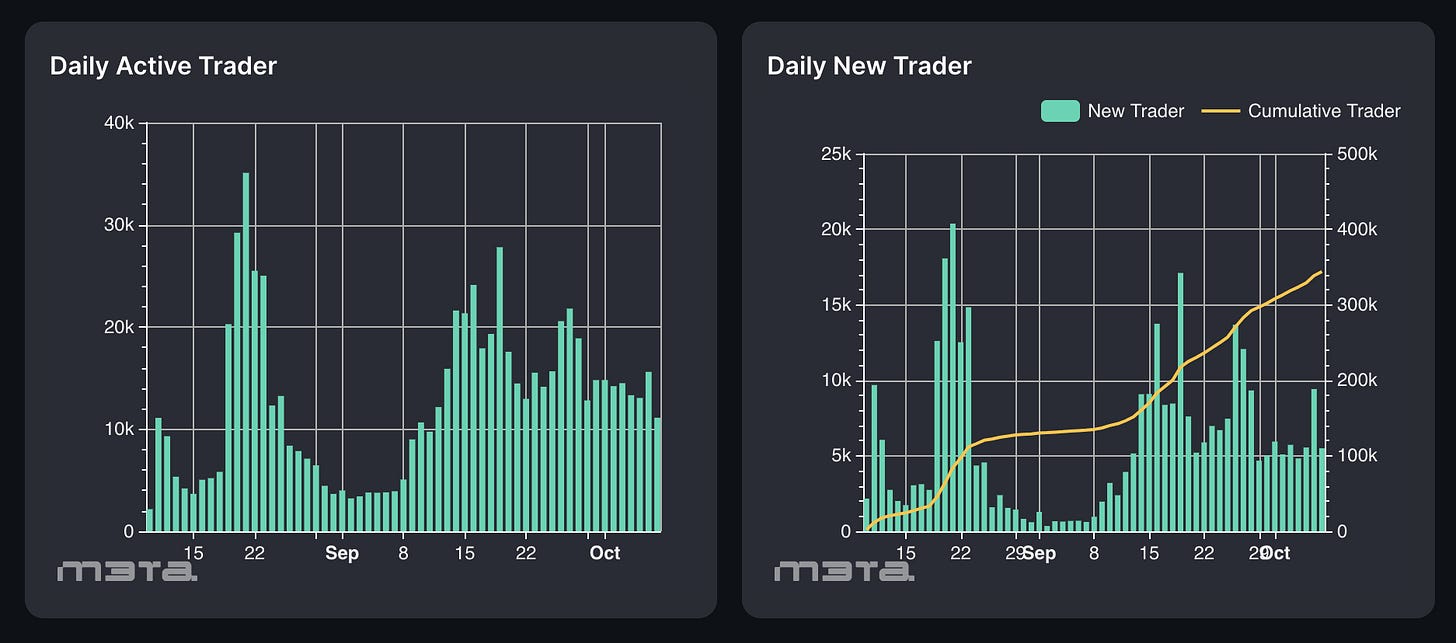

Despite a highly competitive market, Friend.tech consistently maintains over 10,000 active traders daily, with 50-75% of them usually being newcomers. This rate of growth in new traders is particularly striking when contrasted with other protocols.

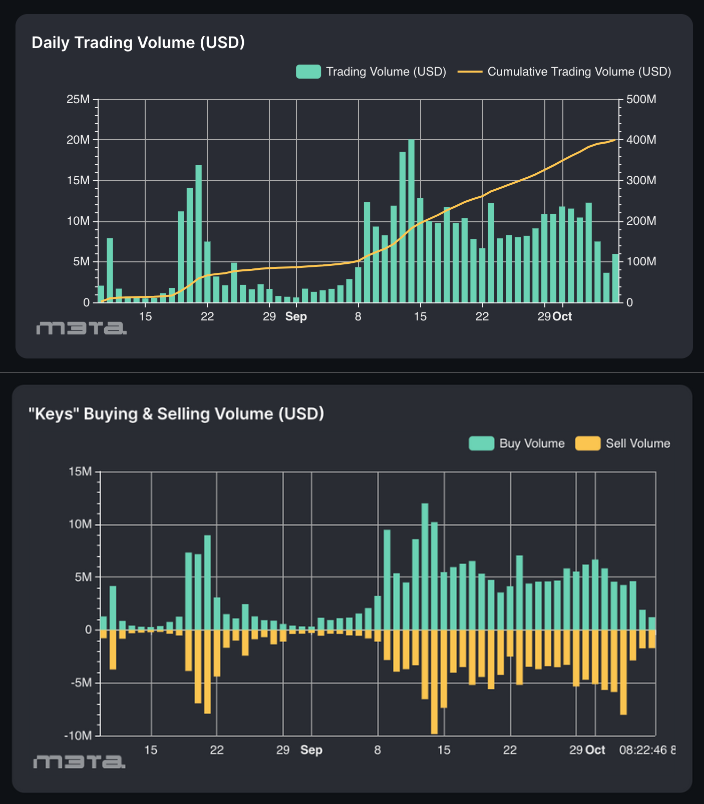

The cumulative transaction count on Friend.tech has now surpassed 10 million, and its total value locked (TVL) stands at nearly $45.9 million as of the current time. It's worth noting that its TVL briefly exceeded $50 million on two particular days: October 01 and October 02, immediately before the high-profile rug / SIM swap incidents on Friend.tech.

Just like other metrics, trading volume has also taken a toll since several users continued coming forward about how their account and their key holders got exploited through something as basic, and quite alarmingly common, as SIM swap.

SIM swap takes place when the attacker tries to deceive your mobile carrier that he/she is the owner of the number so as to gain control of all known accounts that are registered with that phone number.

Friend.tech transactions entail dual 5% fees (10% in total). One portion is directed to the protocol's treasury, and the remaining 5% is granted to the creator whose keys are being traded.

This has been pointed out by Post.tech to be a tiny bit less advantaged for key holders (users who have bought their favorite creators’ keys). And so they add 5% revenue share for the key holders in each transaction to gain an edge.

Stars Arena seems to take a different approach when the platform intentionally allocates more fee share for creators at 7%, 1% for referrals and just 2% for the protocol’s treasury. This might also skew the speed of protocol fee accumulation on Stars Arena compared to Friend.tech. Just in case you see any chart depicting the number for this protocol, take this into consideration.

Track more detailed insights such as Top Traders by Earnings, Top "Subjects" by all-time Royalties Earnings (ETH) and Top "Subjects" ranked by "Key" Supply Change vs 7d ago (in %) in our Friend.tech dashboard.

Conclusion

Recent SocialFi protocols no doubt gain an upper hand with its no-brainer on-ramp registration process, allowing users to sign up with just an email, X account, or phone number. However, as with any trend in the past, it will eventually face its own challenges.

To sustain its enduring popularity, it's critical to revisit how users can experience more lasting benefits, beginning with prioritizing security. Presently, it appears that neither Friend.tech nor Stars Arena has successfully achieved this goal, especially considering the latter's recent experience of two separate attacks over the weekend.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.