On-chain Analysis: Coin98

Our analysis has a different take from what is readily available on Coin98 Analytics. We're more interested in how users are viewing the ecosystem as well as what story the money flow can tell us.

Introduction

Decentralized finance has become increasingly popular in recent years, as more investors seek out blockchain-based financial services.

C98 - a Vietnamese-based project, with its set of a comprehensive suite of tools and services designed specifically for DeFi traders and investors, holds a prominent position among the top DeFi projects.

With the growing popularity of C98, it has become increasingly important to understand the platform's on-chain data and gain insights into the behavior of its users. In this article, M3TA will delve into the on-chain data of C98 and analyze its user activity, staking pools, and in/out net flow on several CEXes and DEXes to provide a comprehensive overview of the platform's performance.

TL;DR at M3TA Coin98 Token Analysis.

What is Coin98?

Coin98 is a liquidity protocol that prioritizes decentralized finance, offering an ecosystem of DeFi products that is more accessible to users.

With a focus on pulling liquidity from various decentralized exchanges, traders can utilize benefits like lending, borrowing, yield farming, and more in a cross-chain manner.

Coin98 also provides staking capabilities, multi-coin wallet storage, and access to the Coin98 Labs incubator for the latest in DeFi. Supporting nearly 20 blockchain networks and their tokens, including Binance Smart Chain, Ethereum, Solana, etc. Their vision is to provide users with an all-in-one trading platform for all DeFi needs, making it easier and more convenient for them to manage their investments.

Coin98 Main Components

Just as other decentralized financial services that aim to improve user experience, Coin98 also had their ecosystem covered in three frontiers: website, extension, and especially phone app.

The phone app is coined Coin98 Super App - a one-stop shop that provides non-custodial, multi-chain NFT & crypto wallets, built-in DEXs, a cross-chain bridge, and a dApp browser, a powerful terminal, attractive Earn, Gift & Campaigns, native swaps, and other globally needed services.

Here are some notable products on Coin98 Super App that we gather from their whitepaper:

Coin98 SpaceGate: a ‘teletransport' bridge that aims to support as many chains and tokens as possible, starting with Ethereum to Arbitrum and Optimism, etc.

Coin98 Exchange: a multichain liquidity aggregator supporting multiple assets issued on different blockchains for DeFi users to swap, stake, lend, borrow, and earn crypto.

Coin98 Portfolio: a ‘cabinet' that helps manage portfolio assets on different blockchains without requiring an Import Key.

Coin98 Markets: A real-time data platform providing market movement.

Coin98 Terminal: DeFi tools & utilities that allow users to send different outputs under 1 transaction or even launch their own ERC20 or BEP20.

Coin98 Staking: a DeFi mechanism that supports users in staking multiple crypto assets.

Coin98 Earn: a Learn-to-Earn model that allows users to claim rewards while learning about cryptocurrency projects, Web3, or blockchain topics. In order to obtain rewards, users must strive to achieve the highest possible score on the quiz and, if necessary, fulfill additional tasks that are relevant.

Coin98 Analysis

In order to gain a better understanding of the Coin98 ecosystem and its native utility token - C98, we have conducted an analysis using on-chain data from the Binance Smart Chain (BSC) blockchain.

The purpose of this analysis is to provide a high-level overview of the C98 token and ecosystem, with a focus on the activities that have taken place on the BSC blockchain during the timeframe of 01-01-2022 until 10-01-2023.

USER ANALYSIS

Monthly Active Users: Sudden Surges in Activity

According to the on-chain data, Coin98 had a total of 68.5K unique wallets in its ecosystem throughout the entirety of 2022 (Figure 1). On average, there were around 7K monthly active users in 2022. Interestingly, the month of July 2022 recorded the highest number of monthly active users at 20.8K unique addresses.

Out of these 20.8K active addresses, a staggering 18.8K were newly added wallets that were entering the C98 ecosystem for the first time. This surge in new wallets during July 2022 was also reflected in the number of unique transaction counts for that month, as shown in Figure 3. Coin98 was announced by Binance that they will be listed on Binance Launchpad around the same time, which could have contributed to the surge in new wallet creation.

However, although there were 18.8K newly added wallets during that month, the transaction volume did not increase significantly. In fact, it slightly decreased compared to the previous month, indicating that whoever newly entered during this period was trading at minimal volume.

However, in November 2022, the cryptocurrency market was faced with a major crisis that had ripple effects throughout the industry. FTX, a popular cryptocurrency derivatives exchange, had collapsed due to financial mismanagement and other issues.

This caused widespread panic among investors and traders, who rushed to cash out their holdings and move their funds to safer platforms. As a result, there was a sharp increase in transaction volumes on both decentralized exchanges (DEXs) and centralized exchanges (CEXs) of Coin98 which makes November the month with the highest trading volumes in 2022.

C98 ANALYSIS

What is C98?

Coin98 Token (C98) is the native utility token of the Coin98 DeFi platform built on Ethereum, Binance Smart Chain (BSC), and Solana. Beside C98, Coin98 Labs, the entity behind the Coin98 project, also issued a stablecoin called Coin98 Dollar (CUSD).

As of time of writing in March 2023:

Total Supply: 1,000,000,000

Circulating Supply: 216,944,444 (21.7%)

Market Cap: $41,985,214

C98 Token Use-Cases

As the native utility token of the Coin98 platform, the C98 token serves several purposes. These include:

Transaction fees: Coin98 Exchange charges a transaction fee on every transaction made on the platform, which is paid in C98 tokens.

Product development: The C98 revenue generated from transaction fees is used to fund future product development and ecosystem growth.

Staking incentives: C98 token holders are eligible to receive a portion of the transaction fees as staking incentives through the C98 Liquidity Provider program.

Governance: C98 token holders can stake their tokens to gain voting power and participate in the governance process, which allows them to propose changes to the platform's product parameters.

Unique membership rights: C98 token holders enjoy various benefits on the platform, such as tiered rewards, retroactive incentives from Coin98, and privileges when joining Coin98 products and services like Coin98 Launchpad and Coin98 Exchange, or participating in events from strategic partners.

Token Movement Analysis

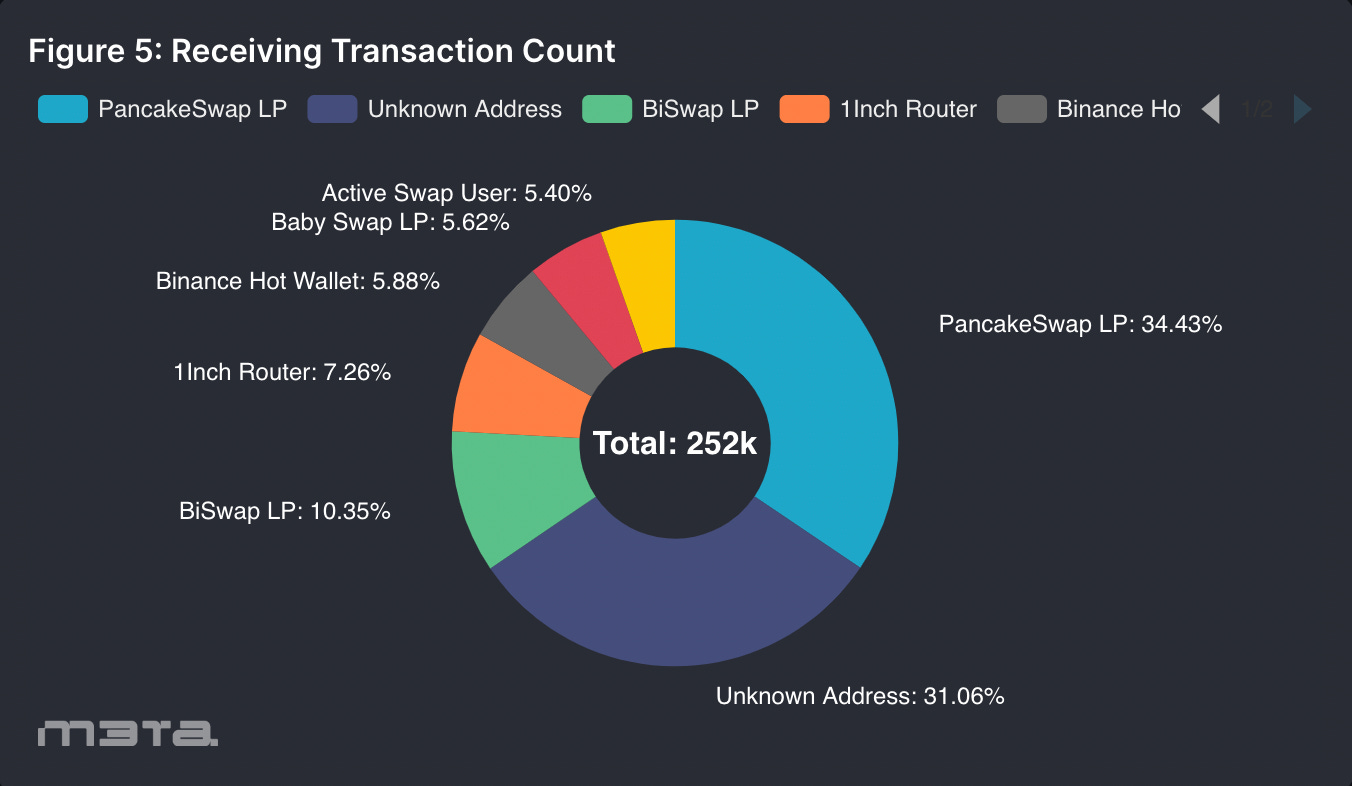

In analyzing the transaction count of various liquidity pools within the Coin98 ecosystem, we found that the WBNB-C98 on PancakeSwap, a decentralized exchange (DEX), was the most active liquidity pool. The data shows that PancakeSwap was responsible for approximately 30% of the total transaction count within the ecosystem, also indicating that it was the most popular platform for trading this pair.

The dominance of PancakeSwap, in this case, can be attributed to the fact that PancakeSwap's integration with the Binance Smart Chain (BSC) provides users with fast and low-cost transactions, making it a popular choice among traders.

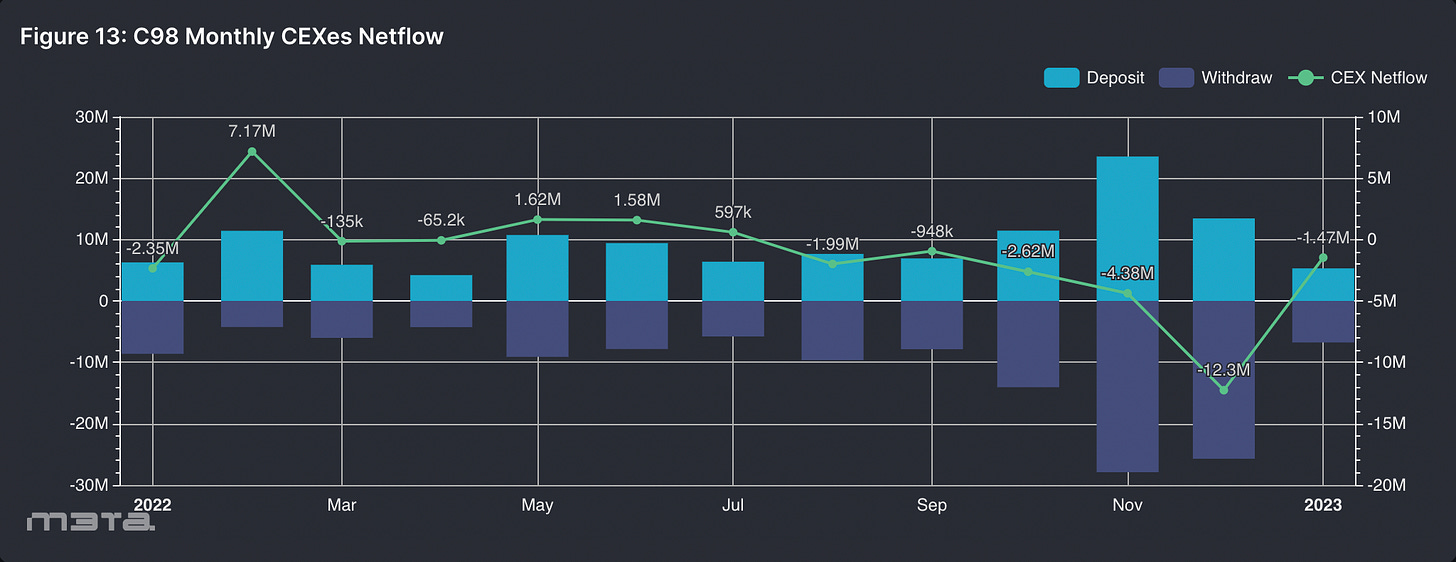

According to Figures 11 and 13, it appears that Binance was the most favored centralized exchange (CEX) for traders of the $C98 token, accounting for more than 90% of CEX transactions on Binance Smart Chain at certain times. This suggests that Binance played a vital role in the $C98 ecosystem, as a large portion of the token's trading volume occurs on its platform.

Assuming that depositing into CEXes suggests selling behavior and vice versa, the month of February 2022 interestingly recorded the highest sell-off amount of $C98 among traders (as shown in Figure 13). This sell-off behavior may indicate a short-term bearish outlook on the token, with traders looking to capitalize on the token's declining value.

In contrast, December 2022 was a month where traders accumulated $C98 the most, with a net withdrawal of 12.3 million tokens. This suggests that traders may have had a more bullish outlook on the token, with much more increasing demand for it.

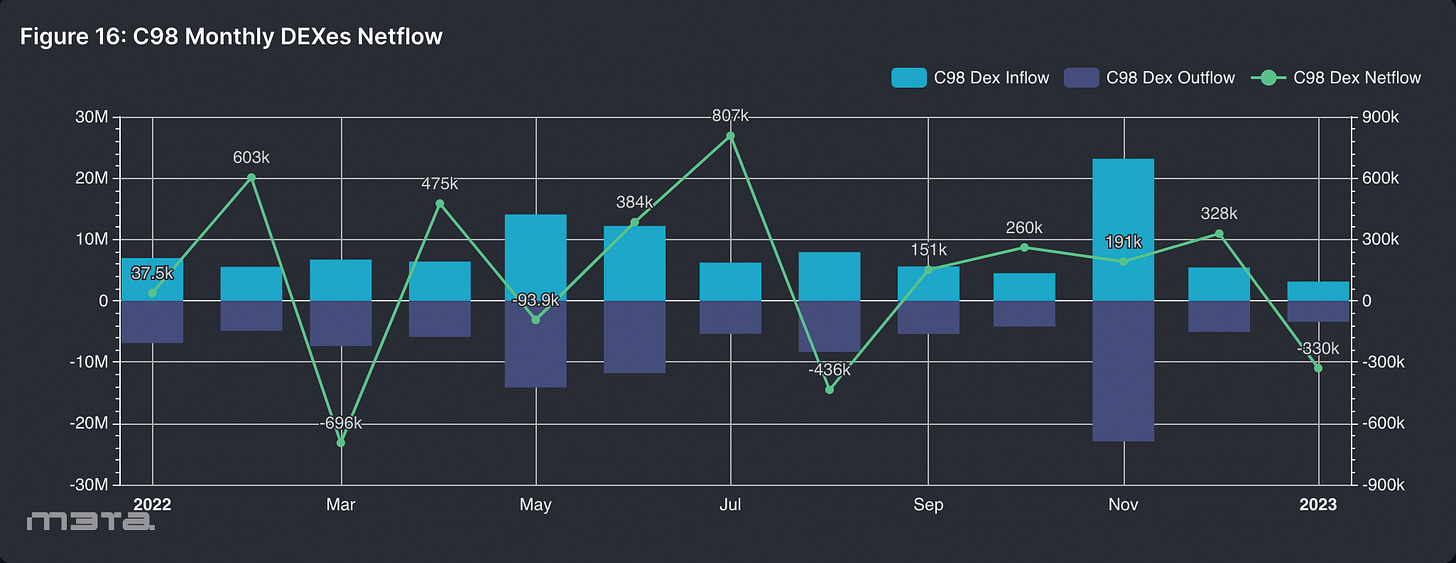

PancakeSwap continued to dominate as the DEX handling the highest volume traded by $C98 owners. However, when compared to centralized exchanges (CEXes), the trading volumes for Coin98 tokens on DEXes were significantly lower.

The data shows that the highest sell-off month for 2022 was July, with more than 800K $C98 deposited. March had a negative net flow of almost 700K $C98 withdrawn which could signal that DEX traders were accumulating these tokens.

It's worth noting that the $C98 deposited and withdrawn from DEXes are also subject to Adding/Removing Liquidity actions, which are not strictly trading activities. These actions involve adding or removing liquidity to the liquidity pool of a DEX, which helps facilitate the trading of $C98 and other assets.

Therefore, the amount of $C98 deposited and withdrawn from DEXes is not solely indicative of trading activity, but also reflects liquidity provision activity.

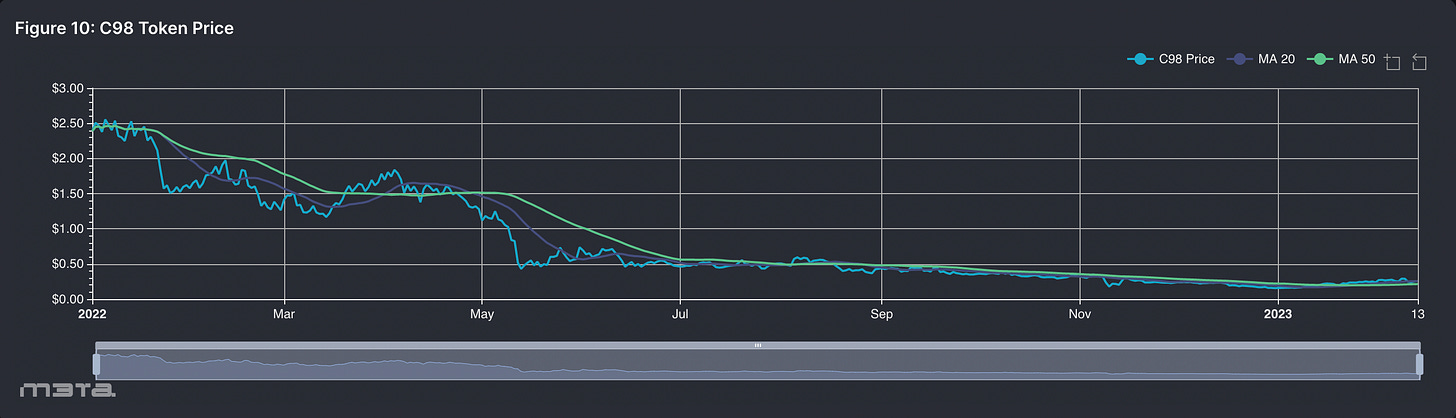

The decline in the price of $C98 during the first half of 2022 was a significant concern for the C98 ecosystem. This decline was mainly attributed to the overall bearish market trend in the crypto industry during that period.

As depicted in Figure 10, the value of the token had dropped from $2.5 to approximately $0.5, indicating a decline of 80% in its value. This sharp drop in price negatively impacted the staking pool, leading to a negative netflow from March to July, which further reflected a decrease in the overall confidence of the community in the asset.

While the market was still struggling to recover, however, the staking pool started to show signs of recovery after July, with increasing staking assets observed month over month until the end of 2022. This development was a positive signal for the C98 ecosystem as it indicated that the community was regaining trust in the asset's value and long-term potential, even during an unpredictable market condition.

The staking amount is considered an important metric that partly represents the long-term belief of the community towards that asset. The increased staking means that more assets are locked out of circulation, which has the potential to increase the token's price. Therefore, the staking figures from the second half of 2022 were a significant development for the C98 ecosystem, reflecting the community's growing confidence in the asset's future value.

Conclusion

As we delved deeper into the data, we found that despite the initial decline in price, the C98 token remained a popular choice for many investors. We observed a consistent increase in the number of wallets holding C98 tokens, with over 68.5K unique wallets recorded in the C98 ecosystem throughout the year.

This indicates that while some investors may have sold their tokens due to the price decline, many others were still interested in holding onto their tokens and potentially benefiting from any future price increases.

Another positive development for the C98 ecosystem was the growth in the staking pool during the second half of the year, as mentioned earlier. This growth in staking assets represents a long-term belief in the asset by the community, and it can potentially lead to a decrease in circulating supply, thus increasing the token's price.

As the C98 ecosystem is faring pretty well on its own as shown in our on-chain analysis, its future growth potential definitely depends on its ability to continue innovating and expanding its offerings to attract more users and remain one step ahead of other cutting-edge protocols rolling out on the market every year.

Until the next dashboard!

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.