On-chain Analysis: Axie Origin Season 4

60+ charts encompassing 5 areas of insights. We could not do better than this GameFi dashboard for the legendary Axie Infinity: Origin Season 4!

Having completed four seasons, Axie is now positioned for a new phase as it embarks on Season 5, which commenced on July 26, 2023.

The Epic Era gate has been shut down and the final leg Mystic Era door opened just yesterday. With players continuously and proudly displaying their Leaderboard standings, we're delighted to launch our Axie Origins Season 4 dashboard, designed to equip players with the on-chain analytics they need for a strong season finish.

Key Insights from Axie Origin Season 4 Analysis

This report focuses on 5 sectors:

User, Transaction & Market status

Top 20,000 players on the leaderboard

Wallets that made > $1,000 in profit from selling on the Marketplace

Top 500 players’ NFT shopping list

03 wallets with best performance in profits

Data commenced in May and ended in June 2023

Data is sourced from Ronin Blockchain

More details at M3TA Report: Axie Origin Season 4: More Balanced For Newbie?

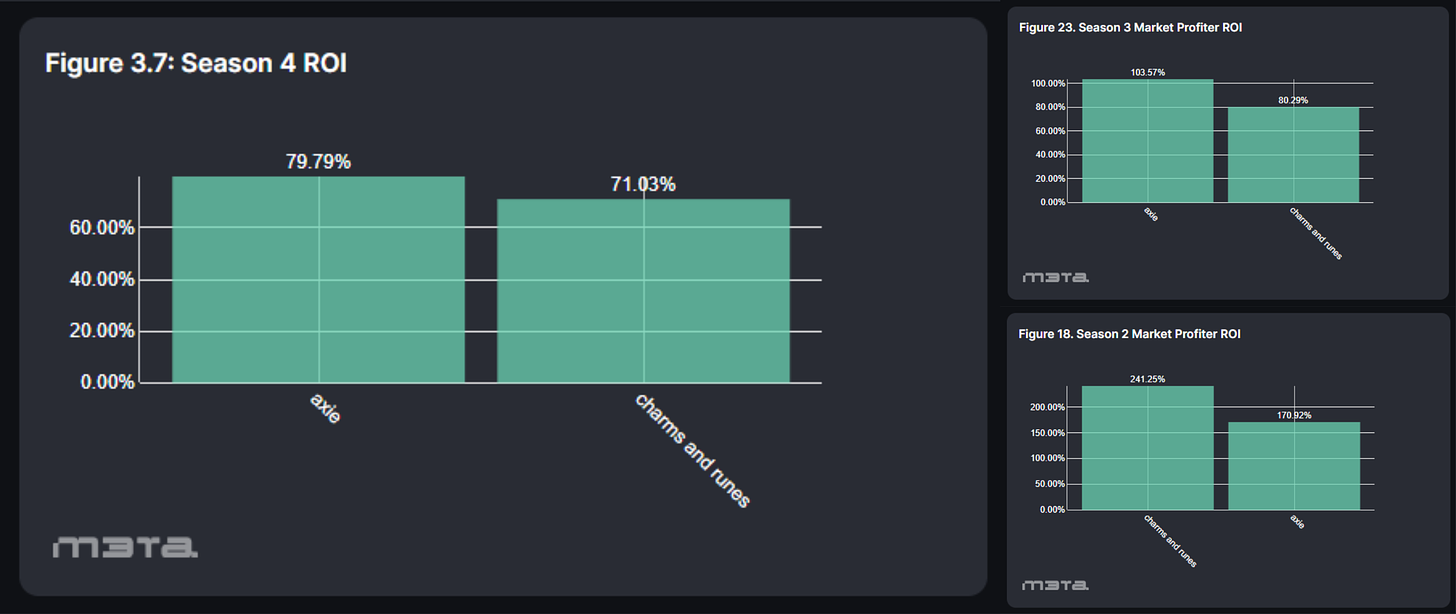

Comparing with Seasons 2 and 3, the current Axie trends reveal some positives like increased rewards for lower ranks and higher Axie sales revenue. However, wallet and transaction counts, NFT prices and vendors making > $1,000 profit decreased. ROI (Return on Investment) from Axie, Charm, and Rune investments also dropped.

Runes & Charms displayed a preference for buying before "Big Spending Weeks," with Charms being cheaper and more sought-after. Bug, Mech, Beast, and Dawn classes were favored for Axie NFTs. We also found 3 top wallets earned a consistent income throughout Season 3 and 4, consecutively raking in $1.4K, $3.2K, and $3.6K.

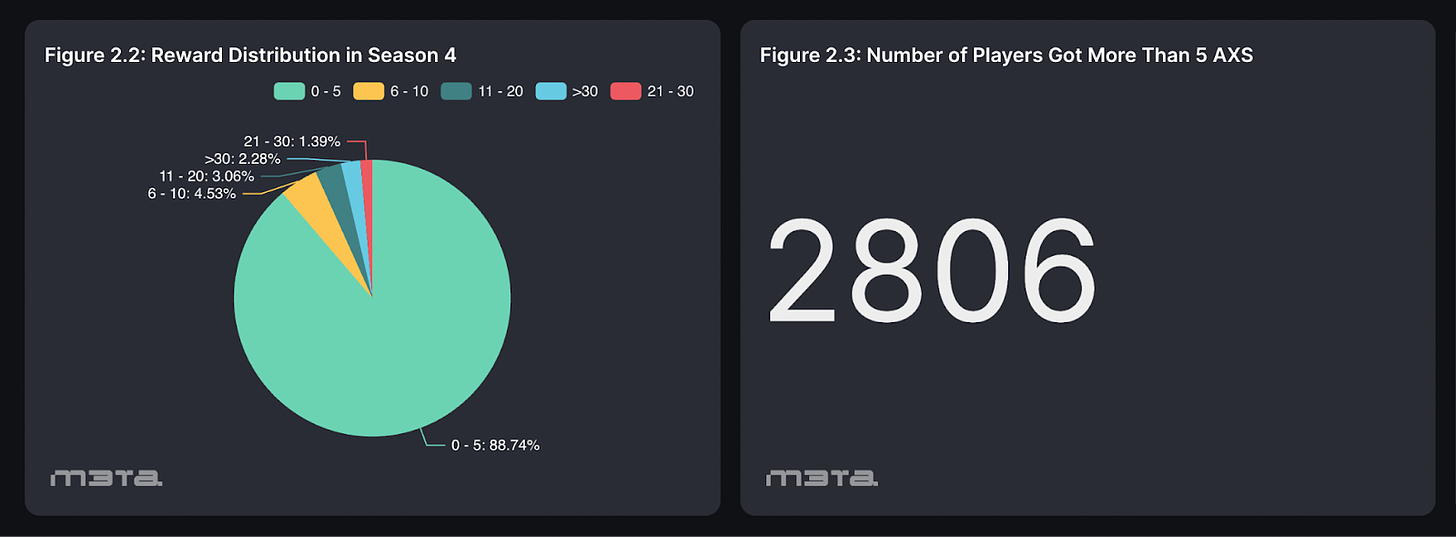

More Wallets Received More Than 5 $AXS in Season 4

During Season 4, a rise in wallets holding over 5 $AXS was evident with 2806 accountable wallets (11.26%), compared to Season 3's 2477 (<10%) and Season 2's 1931 ones (<10%).

This observation shows that Sky Mavis' strategy appeared to be geared towards sustaining the player base. Top players were usually more inclined to remain in the game, leading to a higher turnover (churn rate) among the lower ranks. By deliberately offering rewards to the lower tiers, Sky Mavis must have intended to encourage casual players to return, thereby bolstering the overall player retention.

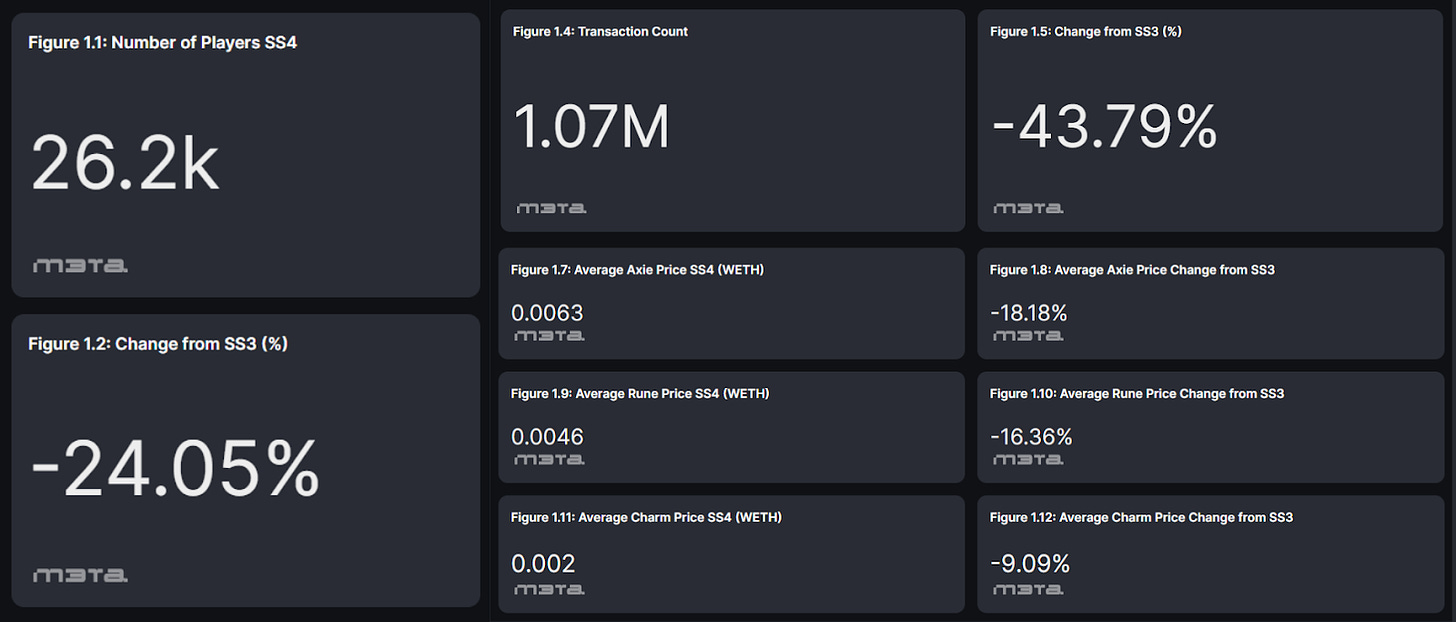

A Consistent Decline in Wallet Count, Transaction Count and NFT Price

Despite reward adjustments, significant declines in other metrics were observed: a 24% decrease in Wallet Count and a 44% drop in Transaction Count. Along with this, Charm's value also decreased by 9%, Rune's by 16% and Axie's by 18%, all compared to Season 3.

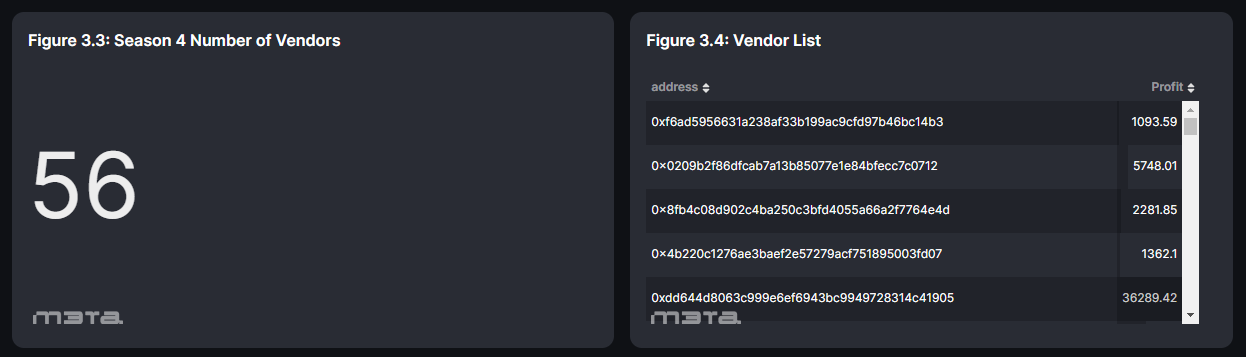

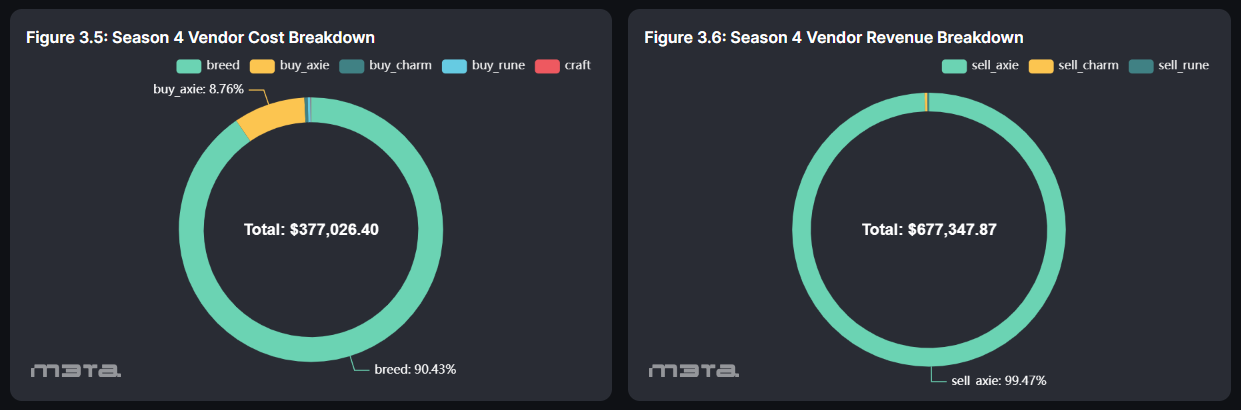

Vendor Analysis - Business was Hard

Vendors also felt the impact, with fewer wallets making > $1,000 from the market:

Season 4: 56 vendors

Season 3: 82 vendors

Season 2: 120 vendors

ROI trends for both Axie and Charm & Rune businesses were showing a declining trajectory across seasons as well.

Most revenue in the Axie ecosystem came from trading Axie NFT, with vendors spending 90% on breeding. That showed a tiny shift from Season 2 and Season 3.

Top 500 Shopping List

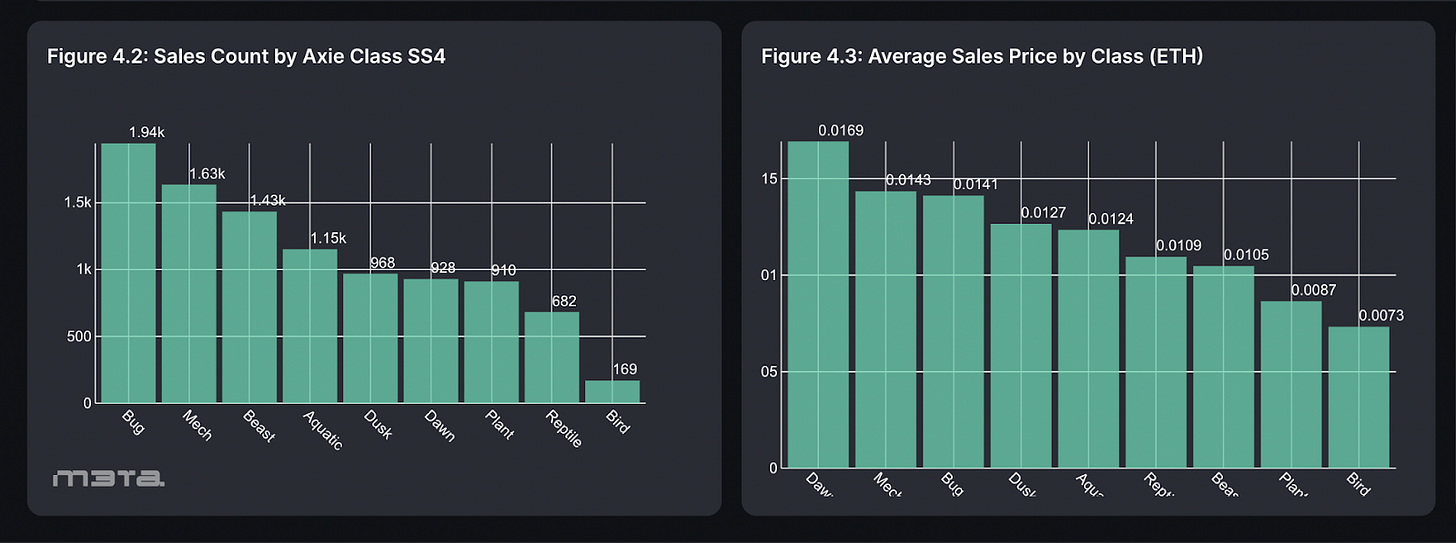

Within the selection of Top 500 players' preferred Axie NFTs, Bug stood as the foremost choice in terms of Sales Count, while Dawn took the lead in Sales Price.

Dawn-classed Axies exhibited a lower transaction count yet commanded a higher average price. This pattern suggests that the Dawn class was relatively rarer compared to other Axie classes. Such rarity, in turn, could be driving its premium pricing in the marketplace.

Runes & Charms Analysis

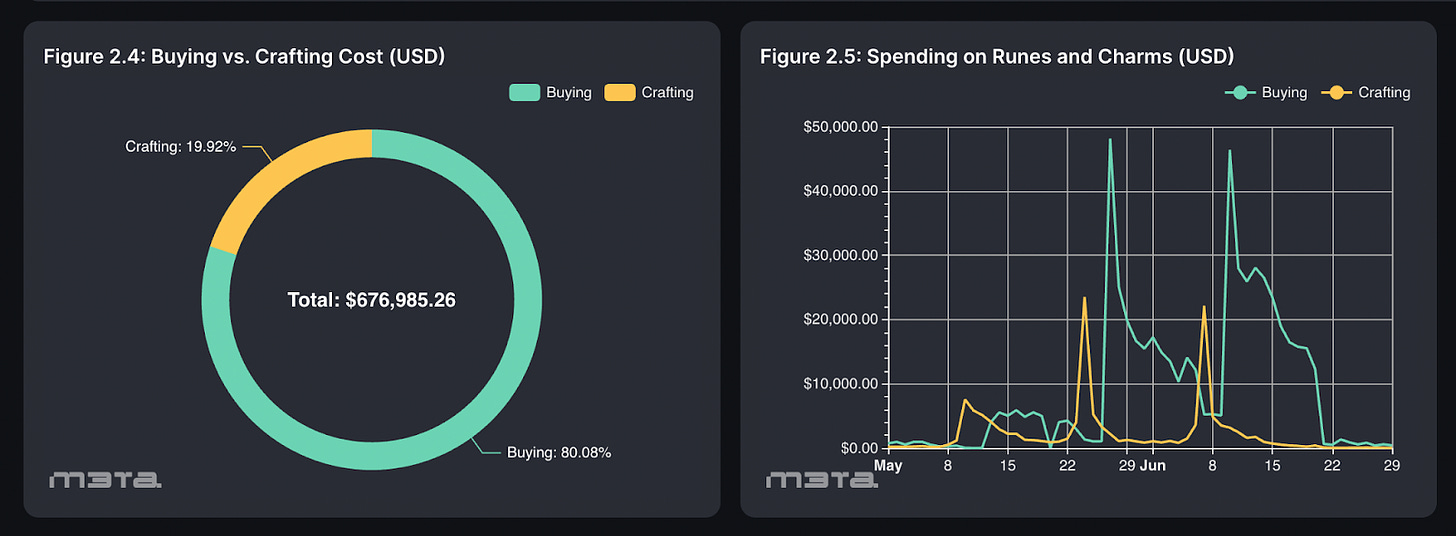

Regarding Runes & Charms acquiring, approximately 80% of NFT values originated from purchases, particularly in late May and mid-June, commonly referred to as the "big spending weeks." It's worth noting that crafting values experience a surge before purchases, suggesting users usually used up their raw materials to craft prior to buying.

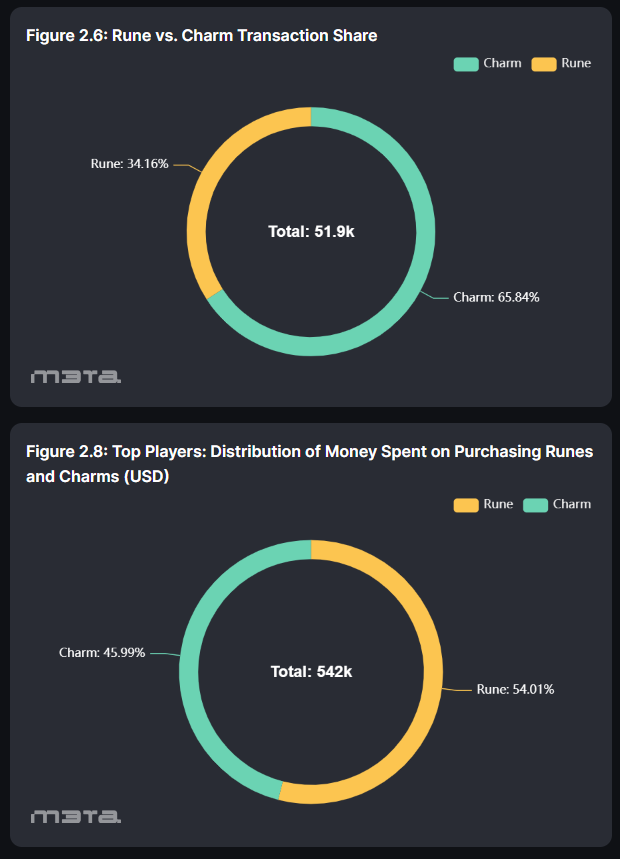

Additionally, Charms surpassed Runes in transaction volume. Despite their higher frequency of transactions, Charms' expenditure constitutes only 46% of the total spent on both Charms and Runes, underscoring the fact that Charms are cheaper than Runes in prices.

Top 3 Performers in Profit Since Season 3

Each wallet's strategy and outcomes provide valuable insights into the diverse ways players navigate and profit within the Axie Infinity ecosystem.

1. Wallet 0xdee51119838146b1be75bee55e4f2745cb0c67ae

This player exhibited a unique strategy. They refrained from any Axie breeding activities, resulting in a breeding fee of $0. Their investment strategy leaned heavily towards the Beast Axie class. This approach yielded them a commendable net profit of approximately $3.6K, the highest among the three.

2. Wallet 0x0051463893d80bd2de2dd31f6a74edac96441de5

This wallet showcased a different approach. The player demonstrated a strong inclination towards the Bug type Axie and actively participated in Axie breeding. Their endeavors in the Axie ecosystem culminated in a net profit of around $1.4K, the lowest among the three.

3. Wallet 0xf61c5f77194cfa3399ab49c86c1cf722b275077f

The strategy adopted by this player was balanced. They abstained from Axie breeding, incurring no breeding fees. Their spending was evenly distributed between the Bug and Mech Type Axies. This well-rounded approach led to a net profit of approximately $3.2K.

Conclusion

With four seasons behind us, Axie Infinity stands at a pivotal juncture. Season 4 has provided a wealth of insights, from player preferences in Axie classes to the economic dynamics of the marketplace. While there have been challenges, such as declining wallet counts and transaction volumes, Sky Mavis' strategies reflect a commitment to sustaining and enriching the player experience. As we transition into the final Era of Season 5, these insights serve as a foundation for understanding the game's evolving ecosystem and the potential opportunities and challenges ahead.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.