On-chain Analysis: Aerodrome Finance

The primary focus of this investigation is to utilize Aerodrome as a case study for a comprehensive examination of the mechanics of a ve(3,3) protocol, offering valuable guidance for future evaluation

Note: This analysis is supported by our Aerodrome - The Future of Base dashboard.

The Big Brother Velodrome

Understanding Aerodrome begins with Velodrome. If Velodrome functions as a vital liquidity hub on the Optimism platform, Aerodrome assumes a similar role on Base, leveraging technology inherited from its predecessor.

Since the launch of V2 on Optimism, Velodrome's TVL has experienced a significant increase. The trading volume on Velodrome, though, has not reached the levels seen during its peak in March and April. This is due to the announcement that 40% of the veAERO tokens from Aerodrome will be airdropped to veVELO Lockers, resulting in some investors choosing to invest in VELO, lock their assets and mint veVELO to receive veAERO.

The Newer, Shinier Sibling Aerodrome

Since Aerodrome is forked directly from Velodrome, the protocol shares similar technology advances of ve(3,3), including Curve Finance's vote-escrow (ve) model and OlympusDAO's (3,3) game theory.

Voting Escrow represents the process of staking Curve’s governance token, CRV, to obtain VeCRV, which allows for more rewards as an LP (liquidity provider). This mechanism was initially introduced by Curve to strengthen incentives for long-term token holders.

The (3,3) game theory model provides insights into user actions and their impact on their profits. 3 stands for 3 actions: Staking, Bonding, and Selling, which would play out into different profit advantages between 2 participants of the protocol, hence 2 number 3s.

Combining these two parts aims to benefit both token holders and traders, increasing earnings for projects using the Ve(3,3) protocol, especially new ones. It also makes rewards for providing liquidity work better. But the spiral also has its limit. Here are 2 scenarios according to Wu Blockchain research:

The Pros of Ve(3,3)

Profitable Liquidity: When $AERO token value rises, liquidity providers earn more, deepening liquidity, increasing trading, and attracting more participants to lock $AERO for protocol income.

Rising Popularity: The protocol's appeal grows, drawing in more external protocols. This positive feedback loop pushes up the $AERO token's value.

→ On its launch day, Aerodrome attracted $200 million in Total Value Locked (TVL), showcasing the strength of the ve(3,3) mechanism in the Base chain.

The Cons of Ve(3,3)

With the continuous issuance of $AERO tokens in exchange for liquidity, the overall supply of $AERO gradually grows, and this is the point where progress may cease.

Liquidity Mining Profit Drop: When the $AERO supply grows, savvy traders realize that rewards from liquidity mining decline, prompting some to sell their $AERO holdings.

Price Decrease: This selling pressure leads to a drop in the $AERO price.

Balance Disruption: As selling and buying forces reach equilibrium, the upward momentum ends, and the $AERO price stabilizes.

→ If selling continues to outpace buying over time, the $AERO price can decline, initiating a downward spiral.

Unfortunately, with the current fundamentals of Aerodrome protocol, we suspect this is now the case. Details in the Analysis section below.

What does Aerodrome do?

Aerodrome facilitates token exchanges and generates fees from traders, attracting liquidity. After each Epoch, liquidity providers (LPs) earn $AERO tokens through the Emission mechanism, distributed based on their shares in the Liquidity Pools.

Participants can lock $AERO to vote in the next epoch and become veAERO voters, who are rewarded for their votes with 100% of the protocol's transaction fees from the previous period or any other incentive activities, proportional to the tokens they've locked. In short, users lock their $AERO tokens to get veAERO, engage in voting pools, and earn rewards as outlined in the emission schedule.

Analysis

Decline in Total Value Locked (TVL)

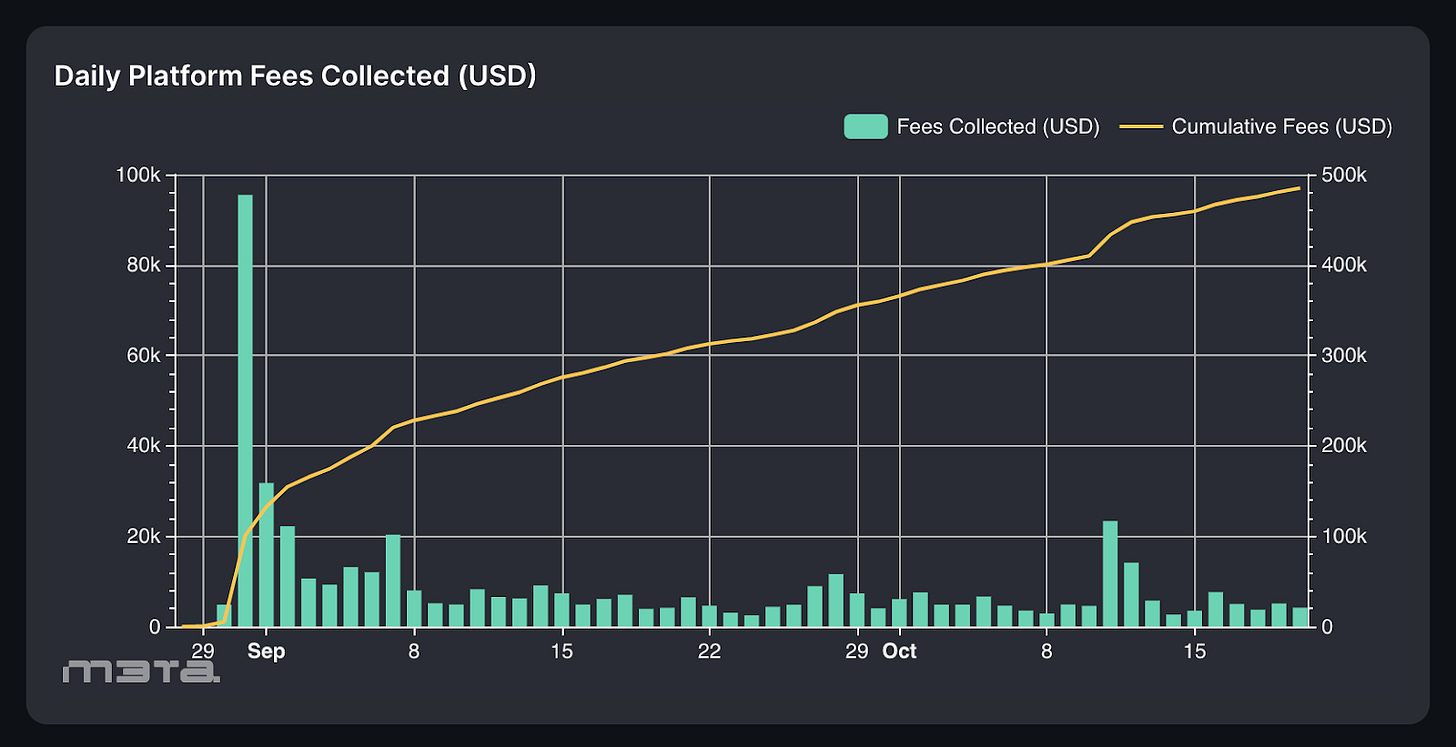

On Tuesday, August 29, 2023, Aerodrome was successfully launched on the BASE network with the $AERO token, and the airdrop was conducted. This provides an explanation for the high volume of transactions during the very first hour on Wednesday.

Aerodrome TVL hit its peak on September 2, but after the launch, it seems to have struggled to maintain its momentum. While the staking of $AERO tokens has shown gradual growth over time, the $AERO token price has not followed the same trajectory.

It has experienced a significant drop, plummeting from its peak at 0.2 to 0.02 (as of the time of writing), marking a 90% decline. This drop in token value explains the substantial decline in Aerodrome's TVL.

Resilient Community

The Daily Wallet and New Wallet Count, however, remain steadfast and unwavering, much to the delight of investors. What's the secret behind this remarkable stability? It lies in their continuous efforts to integrate and adopt numerous projects, all aimed at attracting a broader user base.

Moreover, they introduced an initiative known as the "Flight School" program on Sep 25. This program is designed to empower their partners and lockers by providing them with the opportunity to earn $veAERO tokens on a monthly basis. These rewards are distributed in proportion to their active participation within the protocol. This approach not only fuels Aerodrome's growth but also ensures that both partners and lockers are actively engaged and incentivized to contribute to the network.

The "Flight School" program operates on a fundamental principle: rewarding those who actively contribute to the platform and its associated protocols. It encompasses both the individuals who drive substantial volume to the platform and those who choose to lock their veAERO tokens.

We've observed that the AERO-USDbC and USDbC-WETH trading pairs consistently exhibit the highest trading volumes. This suggests that, **theoretically**, the swapping volume could reach remarkable heights with the "Flight School" program in place.

However, in practice, we've noticed a gradual decrease in the Daily Swapping Volume over time. The positive aspect of this trend is that, even with the decline in trading activity, the platform continues to generate revenue from swapping fees.

When will Aerodrome Make its Grand Finale?

It's a good idea to remain optimistic about Aerodrome. Although it might not be at its peak right now, there are clear reasons for this. Part of the reason is that Aerodrome plays a crucial role in handling money within the Base network, thanks to its advanced ve(3,3) system.

To see Aerodrome thrive, other DeFi projects in the Base ecosystem need to do well first. Most of Base's income now comes from Friend.Tech, which suggests that DeFi projects haven't attracted users as effectively as SocialFi projects. As a result, many users can't find a strong reason to use AERO right now.

But if these DeFi projects manage to attract more users, Aerodrome could become a major hub for handling money using the veToken system. If projects buy AERO and lock it up to gain more voting power, it could attract even more users. To sum it up, Aerodrome's success is closely tied to how well DeFi projects in the Base ecosystem do. If they do well, Aerodrome will do well too.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.