Multichain for an Interconnected Blockchain

Exploring how an evolving Multichain ecosystem eliminates security risks, exorbitant fees, and interoperability issues, creating a streamlined and interconnected blockchain universe.

In the dynamic tapestry of blockchain, obstacles such as security, exorbitant transaction fees, and interoperability frequently rise as towering mountains. Take Ethereum as an example - the pioneer of smart contracts and decentralized applications (dApps), but a victim of its own success as skyrocketing fees during the meme coin frenzy have illustrated.

These seemingly Herculean challenges, however, are not intractable. The solution? An evolving Multichain ecosystem, where dApps can proliferate across diverse blockchains, paving the way for a more streamlined, decentralized, and interconnected blockchain universe.

What is Multichain?

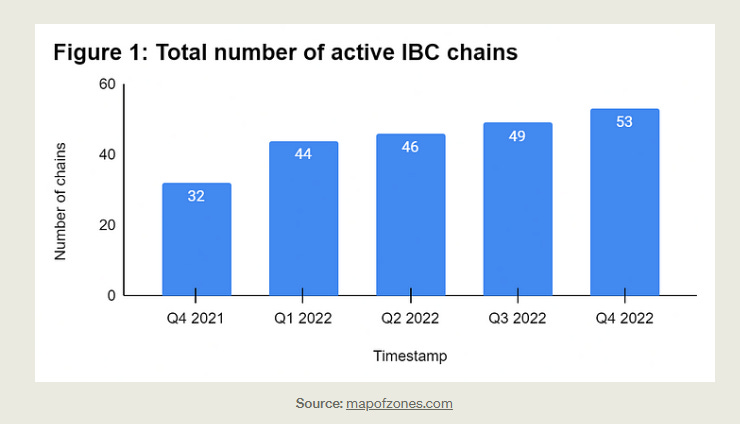

Multichain refers to the capability of creating and connecting multiple independent blockchains within an ecosystem such as Cosmos. This is achieved via the Inter-Blockchain Communication (IBC) protocol, which allows heterogeneous blockchains to transfer tokens and data to one another. Heterogeneous chains refer to blockchains that have different layers and different validator sets. With IBC, blockchains with different applications and validator sets can seamlessly interact and exchange value. It enables interoperability between public and private blockchains, making it unique among blockchain frameworks.

The Ideas of Multichain - The Internet of Blockchains

As depicted in Figure 1, Cosmos ‘zones’ are interconnected through ‘hubs’, with the Cosmos Hub being the primary hub among them, although other hubs are also available.

Each zone is designed to operate independently, taking responsibility for authenticating accounts and transactions, generating and distributing new tokens, and implementing changes to the blockchain.

While it is not mandatory for every zone or hub to interact with one another, every new zone is connected to the Cosmos Hub as it maintains a record of the state of each zone.

Address the Drawbacks of Cross-chain Solutions

According to Vitalik Buterin, cross-chain technology has its drawbacks as it increases the security risks involved in transferring assets. When assets are moved across different chains using cross-chain bridges, their security becomes dependent on the verification of both the source and destination chains, as well as any other cross-chain solutions used in the process.

Buterin provides an example to illustrate the risks: If someone moves 100 ETH onto a bridge on Solana to obtain 100 Solana-WETH, and then Ethereum experiences a 51% attack, the attacker can deposit their own ETH into Solana-WETH and revert the transaction on the Ethereum side. This results in the Solana-WETH contract no longer being fully backed, potentially causing a decrease in the value of the acquired 100 Solana-WETH, like 60 perhaps. Even with a secure bridge using technologies like ZK-SNARK, it can still be vulnerable to theft through 51% attacks (1).

Moreover, spreading assets across different blockchain networks increases interdependence and contagion risks. If one chain suffers an attack, it can have a ripple effect on other chains, creating a systemic threat to the entire ecosystem when there are many interdependencies between chains.

Additionally, most cross-chain bridges currently use centralized federations and external validators instead of the decentralized validation process of blockchain networks. This approach speeds up transactions and reduces costs, but it also means we have to rely more on the bridge operator, which undermines the trustless nature of the original blockchain network.

In summary, when it comes to cross-chain solutions, there are two main risks to consider. First, there is a higher chance for assets to be targeted by attackers because there are more ways for them to access the assets across different chains. Second, these solutions rely on external validator networks, which may not be fully decentralized and trustworthy (2).

Projects Adapting the Multichain Technology

Future multichain networks such as Polkadot and Cosmos, along with cross-chain solutions like AtomicDEX, will be crucial in linking isolated blockchains and ensuring their security through shared mechanisms.

Notable projects like Terra, THORChain, Crypto.com's Cronos chain and Sommelier have selected Cosmos as their platform's foundation. A co-founder of Sommelier, will discuss the promising prospects of Multichain systems at KBW 2023..

Sommelier is a PoS blockchain that is built on the Cosmos SDK (4). Its reliance on the Cosmos ecosystem also means that the network inherits Cosmos' security features and has its own security layer, which makes it safer than cross-chain solutions.

Unlike traditional bridging methods that lock up assets and mint equivalent tokens on different blockchains, Sommelier's architecture relies on a validator set to achieve consensus on ‘rebalance messages’ sent by their strategists. These rebalance calculations occur off-chain, ensuring the privacy of the vault strategies and enabling the use of various data modeling techniques.

Once consensus is reached, the rebalance message is passed through a bridge (either Sommelier's proprietary bridge to Ethereum or the Axelar bridge to alt-EVMs) to interact with smart contracts on the native blockchain. This process does not require asset bridging (5).

By avoiding asset bridging, Sommelier reduces gas fees and offers a cost-effective alternative to Ethereum's high transaction costs.

Conclusion

In conclusion, Multichain presents an innovative and advantageous concept that enables users to transfer funds seamlessly across various independent chains. By creating these chains within a mainnet, Multichain ensures enhanced security during the fund transfer process. Since hacking an entire blockchain mainnet is a significantly challenging task, users can have peace of mind knowing that their funds remain protected. Even in the unlikely event of a blockchain being compromised, the decentralized nature of Multichain allows users to retain ownership and control over their funds, minimizing the risk of financial loss.

Reference

Vitalik Buterin, [AMA] We are the EF's Research Team (Pt. 7: 07 January, 2022), January 07, 2022

CryptoSlate, Vitalik Buterin on why cross-chain bridges will not be a part of the multi-chain future, January 14, 2022

IBC Protocol Medium, A Review of the Major Developments of 2022

Sommelier Whitepaper, Tokenomics

Sommelier, Vault Strategies

The Block, Axelar enables Sommelier DeFi vaults to connect to Arbitrum, May 02, 2023

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.