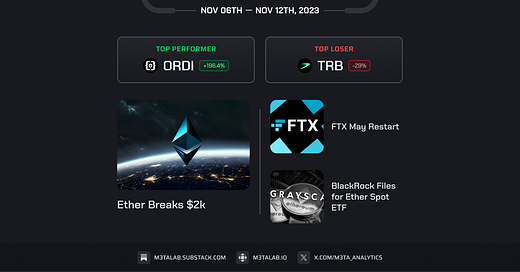

M3TA Recap: Nov 6 – Nov 12, 2023

Did you think Ethereum would let Bitcoin fly solo? Not at all! Ethereum surpassed $2k last week just to prove that the show isn't over.

AI BETA UPDATE!

EP 2: Train our AI YOUR way

You want our AI to work faster, smarter? Clarity is the key!

What indicators and data you need (in our example: 2 wallet addresses for sending and receiving transactions).

What is the best calculation for the request.

The time frame you want to narrow down.

The type of chart you prefer.

Prompt in the video:

Token inflow is the amount send to 0x57891966931Eb4Bb6FB81430E6cE0A03AAbDe063. Token outflow is the amount from this address 0x57891966931Eb4Bb6FB81430E6cE0A03AAbDe063. Net flow equals to inflow minus outflow. Calculate daily inflow, outflow and net flow of USDC from that address in the last 7 days. The outflow should take negative signs.

Make sure to secure an exclusive spot on our whitelist for immediate access and Stay tuned for more updates on our Beta!

Top performers (7D)

ORDI - $ORDI: +196.4%

Price as of time of writing: ORDI/USD - $21.79

Ordinals token on the Bitcoin network used to make waves during the May peak. It allows users to represent texts and images as NFTs and tokens. It is the first cryptocurrency developed in the BRC-20 format specifically designed for the Bitcoin network.

Reason: On Nov 17, Binance added $ORDI to spot trading and introduced $ORDI Cross Margin & Isolated Margin on Nov 09.

BONK- $BONK: +192%

Price as of time of writing: BONK/USD - $0.00000235

BONK is a meme token featuring a dog image on Solana, designed to reward the Solana community for enduring the challenging year of 2022. $BONK has multiple products developed to serve the community such as BonkSwap, Bonk Trading Bot, and Bonk NFTs.

Reason: With layer 1 protocols like Solana $SOL leading the current upward trend, $BONK is receiving positive attention from the market.

Bancor Network - $BNT: +132.1%

Price as of time of writing: BNT/USD - $1.3

Bancor serves as an on-chain liquidity protocol, facilitating decentralized and automated exchanges on Ethereum and various other blockchains.

One of its products, Carbon, a decentralized exchange, was introduced in early May 2023, featuring notable elements like Strategies trading and limit orders.

Reason: Binance cold wallet, holding 16% of the total supply, is the leading BNT token holder. Despite BNT's positive performance in the Upbit narrative, the major surge in volume and price is attributed to Binance. However, a deposit of ~21M $BNT by Binance cold wallet into its exchange has led to a slight drop in $BNT.

Celestia - $TIA: +128.1%

Price as of time of writing: TIA/USD - $5.32

Celestia, a Cosmos SDK chain, offers a modular data availability network that provides verifiability, collaboration, and ample blockspace for developers.

Reason: Celestia has garnered a positive response from the community after its listing on major exchanges in a favorable market.

Kujira - $KUJI: +106.2%

Price as of time of writing: KUJI/USD - $3.65

Kujira Network is an L1 blockchain focused on Web3 & Fintech projects, built on Cosmos, enabling access to the entire Cosmos ecosystem via IBC.

Reason: Within the past month, Kujira protocol's TVL has increased from $26M to an ATH of $93M.

On Oct 20, Kujira launched Pond, allowing developers to easily build dapps and interact with other dapps on Kujira to build a strong DeFi ecosystem.

On Sep 13, Circle integrated native USDC on Kujira, and Kujira added incentives for pairs such as $ATOM - $USK, $ATOM - axlUSDC, $ATOM - $KUJI, $USDC - $USK, with a fairly high APR, resulting in a positive growth in price and TVL.

Top losers (7D)

Tellor Tributes - $TRB: -29%

Price as of time of writing: TRB/USD - $84.76

Tellor Tributes is a decentralized price oracle network created with the aim of offering dependable and decentralized data streams to applications running on blockchain.

Gas - $GAS: -26%

Price as of time of writing: GAS/USD - $9.14

GAS is used to pay gas fees on the Neo blockchain.

Neo, a community-led, open-source blockchain platform originating from China, enables developers to automate and digitize asset administration via intelligent contracts. Key built-in functionalities of Neo include decentralized storage, oracle services, and domain name services, laying the groundwork for the future of the internet.

Polymath - $POLY: -25%

Price as of time of writing: POLY/USD - $0.253

Polymesh is a proof-of-stake blockchain built on Substrate, designed to effectively address rule enforcement, identity verification, compliance, data privacy, and transaction finality. $POLYX is the network's main token used for staking and securing the network, paying transaction fees, and participating in governance.

Blox - $CDT: -21%

Price as of time of writing: CDT/USD - $0.15

Blox is a solution designed for professionals, businesses, and enterprises to track, manage, and perform bookkeeping for their crypto assets. Blox is building the world’s first Non-Custodial Staking Platform for Ethereum and decentralized SSV-based staking pools.

Blox has rebranded to SSV Network $SSV.

Liquity - $LQTY: -15.7%

Price as of time of writing: LQTY/USD - $1.43

Liquity is a lending and borrowing protocol on the Ethereum blockchain. It allows users to create a dollar-pegged stablecoin called LUSD, which is used in the Liquity protocol and backed by Ethereum for loans with a 110% collateral ratio.

A few weeks ago, these tokens saw a significant rise in value, and the subsequent drop is a correction from the previous surge, resulting in a decline in their worth.

Macro

ETF-related

Crypto Fundraising

Japan's SBI Holdings Announces a $663M Fund Investment in Web3, AI, and Metaverse Startups

Lightspeed Faction, a Venture Capital Firm, Launches $285M Fund for Blockchain Startups.

Micro

M3TA Telegram - Nov 06, 2023

The NFT market surged in October, with a $99M increase in trading volume. Ethereum led with a 50% rise in volume, and Immutable X secured second place at $22M.

The $450M volume still falls short of the $2B peak.

The surge in NFT trading volume in October can be attributed to Bitcoin surpassing $35k.

M3TA Telegram - Nov 06, 2023

The scammer got 16.8 BTC ($588k) in 38 transactions. ZachXBT found the scam on Nov 5, and after the discovery, Microsoft removed it.

This isn't the first time a fake Ledger Live app has appeared on Microsoft's store; Ledger issued warnings in Dec and Mar. For secure downloads, use ledger.com.

Scammer's address: bc1qg05gw43elzqxqnll8vs8x47ukkhudwyncxy64q

M3TA Telegram - Nov 08, 2023

The Seed Round was led by 1kx and Variant.

The zero-knowledge machine learning tech, 'Remainder,' ensures tamper-proof AI outcomes on public blockchains.

The applications include cost reduction for dApps, on-chain trading bots, etc.

M3TA Telegram - Nov 08, 2023

The sharp drop in valuation was triggered by Coatue Management, a tech-focused investment manager, reducing its stake in OpenSea by almost 90%, reducing its value from $120M to $13M in Q2 2023.

Blur has surpassed OpenSea in the NFT marketplace, with higher Trade Market Share and Total Market Share.

M3TA Telegram - Nov 09, 2023

There are signs that the SEC may approve 2 or all 12 Bitcoin ETF applications by Nov 17, with positive discussions on spot Bitcoin ETFs with Grayscale. Additionally, BlackRock has officially filed for an Ether spot ETF.

$ETH breaking $2k marks the beginning of the ETH season, marking the second stage of the market cycle.

M3TA Telegram - Nov 09, 2023

The SEC hints at FTX potentially restarting under new leadership with legal understanding. The FTX auction has three bidders: Bullish, Figure Technologies, and Proof Group. If successful, the buyer may supervise FTX's reactivation post-bankruptcy in 2024.

On Nov 9, $FTT surged 90%, with trading volume jumping from $63.5M to $371.4M.

Disclaimer

The views expressed herein are for informational purposes ony and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.