M3TA Recap: Nov 20 – Nov 26, 2023

Relinquishing command of the CEO post, CZ is now just a name to remember. No matter what or who goes up or down, the market moves forward.

Top performers (7D)

TerraClassicUSD - $USTC: +294.6%

Price as of time of writing: USTC/USD - $0.052623

TerraClassicUSD was a decentralized algorithmic stablecoin on the Terra Classic blockchain. Following USTC's depeg in May 2022, the Terra community opted to establish a new blockchain, Terra 2.0, without algorithmic stablecoins.

SuperVerse - $SUPER: +203.6%

Price as of time of writing: SUPER/USD - $0.385218

SuperVerse is developing and providing Web3 products that empower crypto enthusiasts with advanced NFT features while also introducing Web2 users to immersive blockchain gaming experiences.

Sidus - $SIDUS: +142.5%

Price as of time of writing: SIDUS/USD - $0.00871364

SIDUS HEROES is a Web3 gaming metaverse set in space, offering interstellar exploration and conquests. Fueled by AI, it integrates multiple game studios, shared lore books, and a unified economy.

EthereumPoW - $ETHW: +61.7%

Price as of time of writing: ETHW/USD - $2.63

EthereumPoW is an Ethereum blockchain hard fork post the Ethereum Merge. After the Merge shifted Ethereum to proof-of-stake, ETHW remains being driven by the proof-of-work mechanism.

Blur - $BLUR: +56.4%

Price as of time of writing: BLUR/USD - $0.524

Blur operates as an NFT marketplace with no transaction fees and suggests a standard royalty rate of 0.5% for buyers, but users have the flexibility to adjust or set it to 0.

Reason:

The previous week witnessed a money influx into NFTs and the GameFi/Metaverse narrative, causing a surge in related tokens. The rise in other tokens may be attributed to potential market manipulation by whales.

Top losers (7D)

Ultima - $ULTIMA: -26.8%

Price as of time of writing: ULTIMA/USD - $8,547.92

ULTIMA is a robust cryptocurrency ecosystem focused on the ULTIMA token. It features innovative products like modern crypto wallets, a unique crypto debit card, a crowdfunding platform, and its marketplace.

Siacoin - $SC: -25.5%

Price as of time of writing: SC/USD - $0.00430684

Siacoin is the native utility token of Sia, a decentralized cloud storage platform. Users can lease unused storage space through smart contracts, with Siacoin serving as the medium of exchange. The project aims to be the "backbone storage layer of the internet."

aelf - $ELF: -24.3%

Price as of time of writing: ELF/USD - $0.448517

aelf is an open-source blockchain network designed for comprehensive business solutions, featuring a 'one main-chain + multiple side-chains' structure for independent DApp deployment. The technology employs Parallel Processing & AEDPoS Consensus Mechanism, ensuring secure communication and direct interoperability between the main-chain and all side-chains.

ARK - $ARK: -24.1%

Price as of time of writing: ARK/USD - $1.23

ARK is a blockchain-based platform that provides a scalable and interoperable infrastructure for the development and deployment of dApps. It uses a unique consensus algorithm called Delegated Proof of Stake (DPoS) to enable fast and secure transactions, and supports cross-chain interoperability.

CorgiAI - $CORGIAI: -21.4%

Price as of time of writing: CORGIAI/USD - $0.00088745

CorgiAI is a merchant software leveraging AI for payment fraud prevention.

Bitcoin's recent underwhelming performance indicates a potential downturn for these tokens.

Macro

Crypto Fundraising

Former NYSE President's Company Acquires Crypto News Platform CoinDesk. Digital Currency Group (DCG), the erstwhile parent company of CoinDesk, took over the media company in 2016, sealing the deal at $500,000.

Panoptic, an Options Platform, Secures a $7M Seed Round Led by Greenfield Capital

Layer 2 Blast Raises $20M With Paradigm Leading, Launching Early Access Program

Colony Lab Sponsors 500K $AVAX For The Development of The Avalanche Ecosystem

Privy Infrastructure Platform Secures $18M in Series A Funding Led by Paradigm

Bitfarms Reveals $60 Million CAD in Private Placement with U.S. Institutional Investors

Micro

M3TA Telegram - Nov 21, 2023

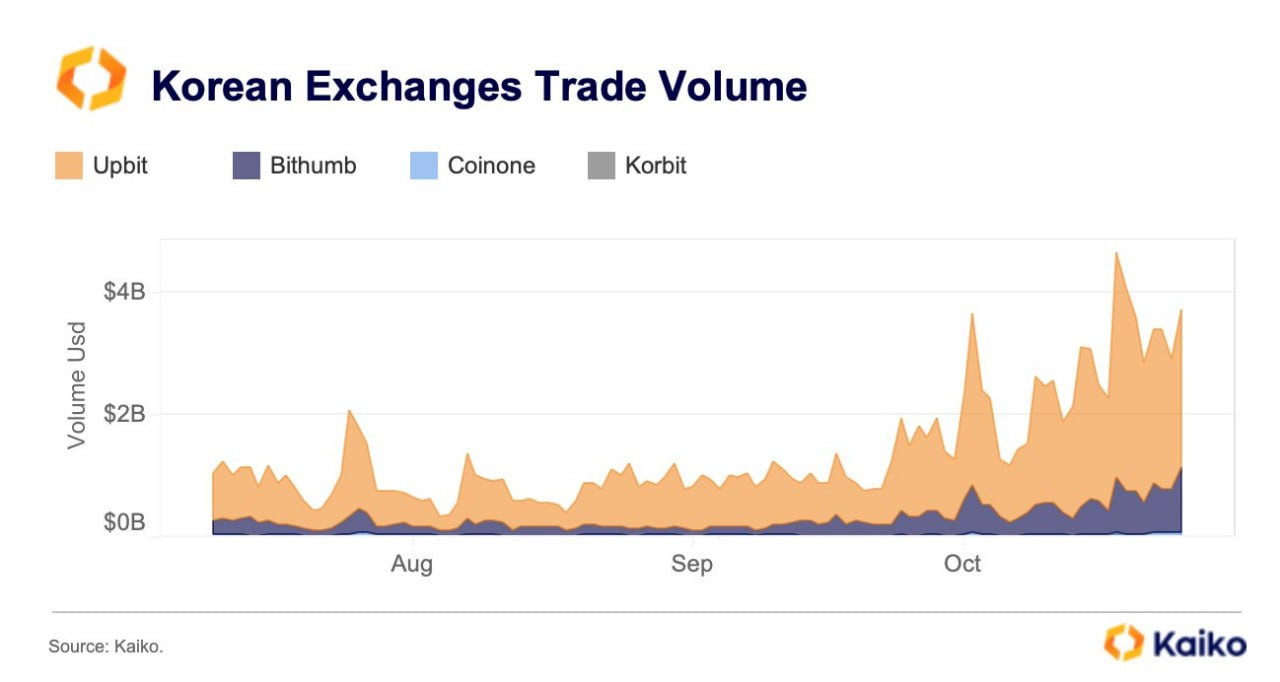

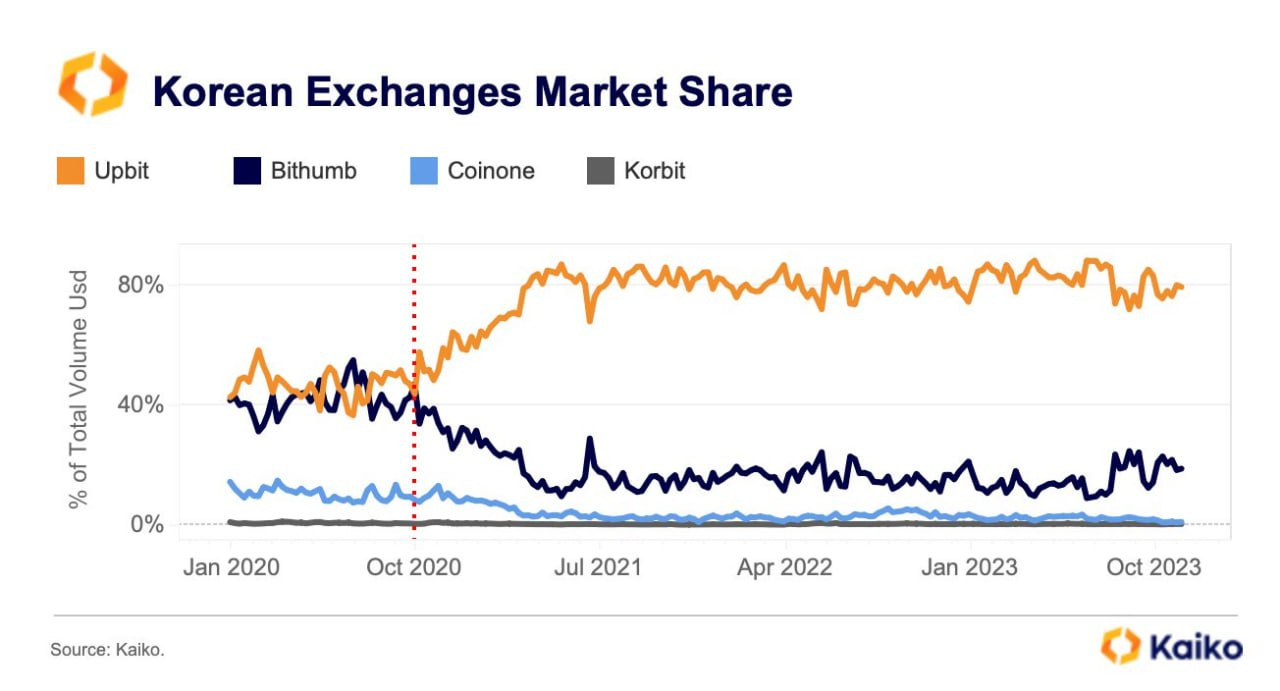

In October and November, South Korean exchanges surpassed U.S. volumes, holding a 12.9% market share. Upbit, with over 80% market share, led in altcoin trading.

Altcoins surged, tied to Upbit's influence, indicating ongoing impact on the market.

M3TA Telegram - Nov 21, 2023

Bitcoin transaction fees spiked to $10.65M from Nov 16 to 18, surpassing Ethereum's $6.9M.

Fees surged over 1,000%, peaking at $18.67 on Nov 16, attributed to Bitcoin's price rise and $ORDI listing on Binance.

IntoTheBlock shows a 67.62% adoption rate with a surge in wallet creation, reaching ATH for long-term holders with 1 BTC.

M3TA Telegram - Nov 21, 2023

TVL Surge: TVL rises from $35B to $45B in a month, promising recovery, though below the year's ~$50B peak.

Marketcap Milestone: Market cap hits ATH at $1.5T in 2023, an 80% surge from $830B at the year's start.

DEX Trading: Layer 1 fees surge (Ethereum 180%, Bitcoin 362%) in the last 30 days. DEX trading fees notably increase in Nov, driven by rising volumes in Synthetix, dydx, and GMX.

M3TA Telegram - Nov 22, 2023

Binance CEO CZ resigned on Nov 22, settling with U.S. agencies for $4.3B over SEC accusations. Penalties include $3.4B to FinCEN, $968M to OFAC, a $50M fine, and a $175M bond for CZ. Richard Teng takes over as CEO. Binance faces 5 years of compliance requirements and monitoring, while CZ is prohibited from Binance involvement for 3 years.

M3TA Telegram - Nov 23, 2023

Crypto remains resilient post-Binance news. JPMorgan views Binance's settlement as positive, reducing systemic risk. Despite over $1B withdrawn, no crash occurred, indicating trust. Bitcoin hits new hashrate ATH at 497 TH/s on Nov 23, unaffected by Binance FUD. SEC Commissioner supports Spot Bitcoin ETF, signaling regulatory openness.

Disclaimer

The views expressed herein are for informational purposes ony and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.