M3TA Recap: May 29 – Jun 4, 2023

Amid the rapid traction some Metaverse & AI-integrated projects were in, there is the debt ceiling crisis which prompted Circle to make a move and hindered BTC from dovetailing. What’s more?

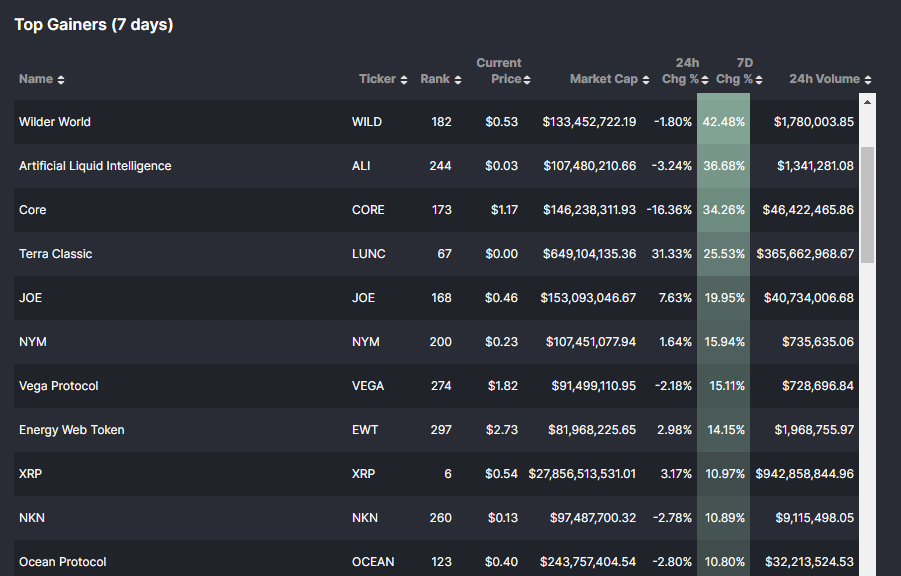

Top performers (7D)

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Wilder World - $WILD: +53.5%

Price as of time of writing: WILD/USD - $0.576

Wilder World is an immersive 5D metaverse built on Ethereum, Unreal Engine 5, and ZERO (a web3 wallet). It utilizes the WILD token for trading NFTs with in-world utility on the Wilder World Metaverse Market.

The upcoming launch of Apple's mixed reality headset on June 5th could potentially be behind the growth of WILD and other metaverse-native tokens.

Artificial Liquid Intelligence - $ALI: +34.8%

Price as of time of writing: ALI/USD - $0.0298

$ALI is the crypto token of Alethea AI network, a company dedicated to blending generative AI and blockchain technology. Their product lineup encompasses text-to-character, AI protocol, AI system, and AI SDK, positioning them as a research and development studio.

The AI trend does not seem to have been contained as AI tokens continued surging when it became a topic mentioned by CZ - the CEO of Binance and Elon Musk.

Nym Network - $NYM: +15%

Price as of time of writing: NYM/USD - $0.2267

Nym is an open-source, decentralized, and incentivized system that empowers developers to create privacy-focused applications with robust protection against metadata surveillance in network traffic, authentication, and payments.

The price surge could be attributed to the event offering users the opportunity to stake $NYM for a chance to double their NYM token balance. This growth came after the price of NYM hit its lowest point in December at $0.16.

Vega Protocol - $VEGA: +15%

Price as of time of writing: VEGA/USD -$1.85

Vega is a trading-optimized protocol that enables the creation and trading of marginal financial products and derivatives on decentralized markets within Web3 applications.

The recent release of Vega's alpha mainnet has probably incentivized users to purchase $VEGA, potentially leading to an increase in its price.

Trader Joe - $JOE: +13.7%

Price as of time of writing: JOE/USD - $0.454

Trader Joe is a decentralized trading platform on the Avalanche network that offers leveraged trading by combining DEX services with DeFi lending. It includes an AMM exchange, yield farming, staking, and borrowing.

The token price of JOE has skyrocketed due to several key factors, among which is that:

The project has experienced a significant fourfold increase in user growth recently, while maintaining a stable trading volume.

This could be a direct result from some notable milestones the project managed to attain, including:

A successful launch on Arbitrum and strategic partnerships with cross-chain Stargate Finance and LayerZero for the integration of Omnichain token JOE.

A series of expansion by launching on the Binance Smart Chain and introducing Liquidity Book v2.

Top losers (7D)

TomoChain- $TOMO: -15.8%

Price as of time of writing: TOMO/USD - $1.38

TomoChain is a Layer 1 based in Vietnam that supports all smart contracts, protocols, and seamless token transfers across different chains that are compatible with the Ethereum Virtual Machine (EVM).

Kava- $KAVA: -13.43%

Price as of time of writing: KAVA/USD - $1.00

The Kava Network (residing on the Cosmos chain) is a Layer-1 blockchain that merges the scalability and speed of Cosmos EVM to connect any Kava-native dApps with others on Ethereum.

Kava is also a platform for cross-chain DeFi lending, allowing users to borrow the stablecoin USDX and deposit various types of cryptocurrencies to start earning profits.

Sui - $SUI: -11.3%

Price as of time of writing: SUI/USD - $0.96

The Sui network is a unique layer 1 solution that addresses the blockchain trilemma by prioritizing speed, scalability, and security.

FTX Token - $FTT: -5.6%

Price as of time of writing: FTT/USD - $0.97

FTX was a centralized crypto exchange focused on derivatives and leveraged products, filed for bankruptcy protection in the U.S. in November 2022.

Vulcan Forged PYR - $PYR: -4.27%

Price as of time of writing: PYR/USD - $3.52

Vulcan Forged is a blockchain gaming hub on Ethereum and Polygon. It creates games, supports developers, incubates DApps, and facilitates NFT trading.

These tokens had a lackluster performance last week due to Bitcoin's stagnant movement.

Macro

ADP Employment - a monthly report of economic data that tracks nonfarm private employment in the U.S

Private payrolls rose by 278,000 jobs in the last month.

Nonfarm Payroll - measures the change in the number of people employed during the previous month, excluding the farming industry, non-profit organizations and active military.

Payrolls in the public and private sector increased by 339,000 in May.

This exceeded the average forecast of 190,000 by economists polled by Reuters.

Philadelphia Fed President Patrick Harker called for a pause in interest rate hikes, suggesting it's time to "hit the stop button" for one meeting and evaluate the situation.

Meanwhile, on June 1st, the President of the U.S. Joe Biden signed a legal bill to suspend the debt ceiling limit through Jan 1, 2025, to prevent the United States from defaulting.

Micro

The Block - May 31, 2023

Core team of Trust Reserve, issuer of CNY-backed stablecoin and HKD-backed stablecoin, detained by police in China on May 29.

Trust Reserve's team dropped out of contact, and a notice of "judicial seizure" was found at their office in Shanghai.

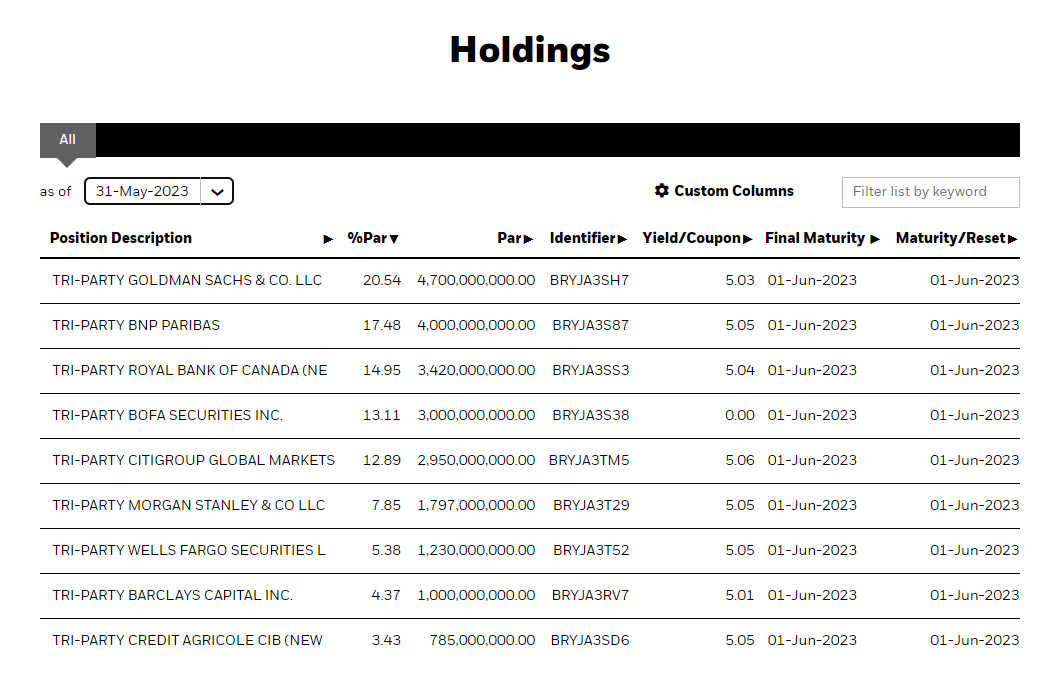

CoinDesk - June 1, 2023

Circle, the issuer of USDC, has removed all U.S. Treasury bonds from its reserves as a precautionary measure against potential risks related to the U.S. debt ceiling showdown.

The Circle Reserve Fund, managed by BlackRock, held $24 billion in assets under overnight repurchase agreements as of May 31st.

An overnight repurchase agreement (repo) is a transaction in which the Federal Reserve buys a security from an eligible counterparty under an agreement to resell that security in the future. (perplexity.ai)

The purpose of this change is to protect the $29 billion USDC stablecoin from potential bond market volatility during discussions to prevent a government default.

Circle's CEO, Jeremy Allaire, announced that the fund would no longer hold Treasury bonds maturing beyond the end of the month.

Instead, overnight repurchase agreements have been chosen as replacements for maturing bonds in Circle's reserve fund.

CoinTelegraph - May 30, 2023

Ordinals market and Bitcoin Miladys NFT collection have introduced the BRC-721E token standard for transferring ERC-721 NFTs to Ordinals.

Bitcoin Ordinals, a layer-2 solution for decentralized art storage on the Bitcoin blockchain, now supports migration of Ethereum ERC-721-based NFTs through the BRC-721E standard.

To migrate, users burn the ERC-721 NFT on Ethereum and inscribe valid BRC-721E data to claim the NFT on Bitcoin with complete metadata. Basically, they work like a fax machine but only one copy is kept.

Indexers verify the burned NFT data inscriptions, ensuring there is only 01 valid inscription and matching genesis address with the burn transaction call data.

News Highlight

CoinTelegraph - May 30, 2023

Tenet, a layer-1 blockchain, partners with LayerZero to connect its liquid staking derivatives (LSD) platform to a cross-chain DeFi ecosystem.

Tenet operates on its own diversified proof of stake (PoS) consensus framework, with its stablecoin, LSDC, backed by a basket of interest-bearing LSDs from various blockchains.

Tenet's initial network security stake includes ETH, ATOM, BNB, MATIC, ADA, and DOT.

CoinDesk - June 2, 2023

Taurus partners with Polygon to facilitate tokenization of real-world assets (RWA).

Taurus raised $65 million in funding in February, led by Credit Suisse and Deutsche Bank.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.