M3TA Recap: March 20 – March 26, 2023

Wow, the past week was quite exciting with the much-anticipated Arbitrum and Space ID airdrops. However, the world of crypto never sleeps. Let's dive in and explore the latest news with us!

Top performers (7D)

Block Commerce Protocol - $BCP: +800%

Price as of time of writing: BCP/USD - $0.096

Block Commerce Protocol (BCP) integrates social media, live commerce, and blockchain to create a global network where users can participate in social media activities and live commerce events while using blockchain technology to securely and transparently track transactions and payments.

There were no updates or news that could have caused the price of the project to rise. It's possible that the increase in price was due to a pump-and-dump scheme by whale(s).

tomiNet - $TOMI: +125%

Price as of time of writing: TOMI/USD - $2.86

tomi is a web3 company that leverages decentralized DNS, high-performance computing technology, a multi-chain wallet, and a unique browser to enhance the decentralization of digital assets and cloud services. Their ultimate goal is to establish a web3 internet infrastructure that enables further decentralization.

Tomi announced on March 21, 2023 that it has secured $40 million in a funding round led by DWF Labs - a top digital asset market maker and web3 investment firm. This could potentially lead to a rise in price.

inSure DeFi - $SURE: +110%

Price as of time of writing: SURE/USD - $0.0078

inSure DeFi offers insurance solutions that stabilize and secure crypto and DeFi portfolios in the cryptocurrency space.

inSure posted a tweet suggesting an uptrend for their $SURE, and since then, the token has continued to rise in value.

FUBT Token - $FUC: +84%

Price as of time of writing: FUC/USD - $1.55

FUBT is a centralized exchange registered in Hong Kong.

$FUC token has been rising consistently since last week, possibly because crypto firms in China are moving into Hong Kong after the city opened its doors to the struggling industry.

https://www.bloomberg.com/news/articles/2023-03-27/chinese-banks-court-crypto-firms-in-hong-kong-after-mainland-ban#xj4y7vzkg

TraderJOE - $JOE: +54,6%

Price as of time of writing: JOE/USD - $0.51

Trader Joe is a decentralized trading platform on the Avalanche network that offers leveraged trading by combining DEX services with DeFi lending. It includes an AMM exchange, yield farming, staking, and borrowing.

The price surge may be attributed to the teasing of a new liquidity management tool called "Auto-Pools" and the fact that $JOE will be used as collateral for borrowing $MONEY on the Moremoney Platform.

Top losers (7D)

Arbitrum related projects

Last week, the event of listing $ARB tokens caused many people to sell off their airdropped tokens to maximize their profit, leading to a dip in the price of $ARB. Some projects associated with the Arbitrum project were also affected, causing their price to decrease.

Camelot - $GRAIL: -31%

Price as of time of writing: GRAIL/USD - $2974

Camelot is a native DEX on Arbitrum.

We built a customized dashboard for Camelot DEX with several meaningful metrics for your trading strategy.

Comparative analysis among Camelot, UniSwap, and SushiSwap is also available: https://m3talab.io/reports/camelot-arbitrum

Arbitrove Protocol - $TROVE: -26,3%

Price as of time of writing: TROVE/USD - $0.035

Arbitrove Protocol introduces $TROVE, the governance token for a decentralized cross-chain asset management platform designed to optimize yield farming strategies and facilitate the seamless transfer of assets across multiple blockchains.

Roll-up technology

Two weeks ago, there was a surge in ZK (zero-knowledge) technology adoption that led to a significant increase in the prices of related tokens. The subsequent price decrease observed last week can be attributed to a price correction.

VelodromeFinance - $VELO: -28%

Price as of time of writing: VELO/USD - $0.13

Velodrome Finance is a high-performance, multi-chain (BSC & Ethereum) yield optimization platform with Velo as the native utility token, mainly used for rewarding liquidity providers through emissions.

Immutable X - $IMX: -26,2%

Price as of time of writing: IMX/USD - $1.08

Immutable X is a next-generation Layer-2 scaling solution for Ethereum, providing fast and secure trading with zero gas fees for NFTs and gaming assets, powered by zk-rollup technology. $IMX is the native utility (staking, fee payment, incentives) and governance token of Immutable X.

China-related project

Conflux - $CFX: -26%

Price as of time of writing: CFX/USD - $0.34

Conflux Network is the only government-endorsed permissionless blockchain network in China.

The recent price drop of $CFX can also be attributed to a price correction.

Macro

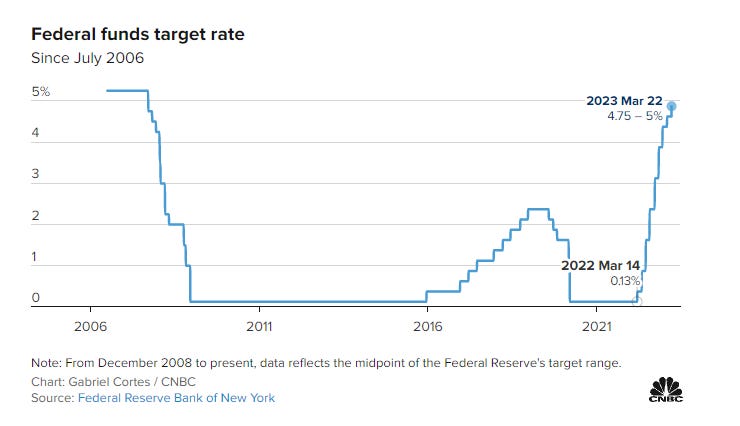

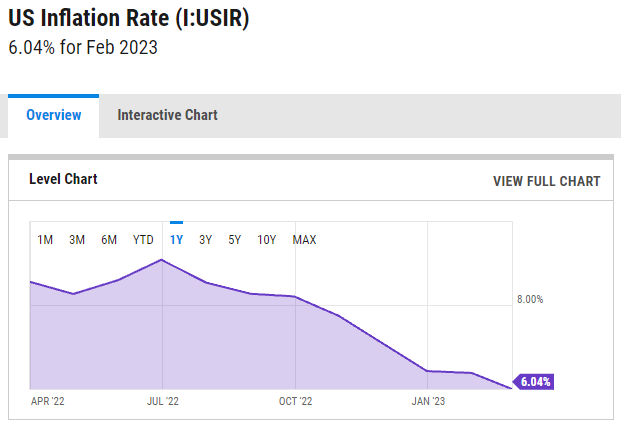

The Federal Reserve raised the target federal funds rate by 0.25% (4.75% to 5%).

This marks the ninth consecutive increase in one year since the central bank began the current rate-hiking cycle to combat rising prices.

Committee expects further policy tightening to achieve the inflation target of 2%.

Feb 2023 inflation rate was 6.04%.

Micro

Crypto Daily - March 22, 2023

Hong Kong aims to become the next global crypto and financial hub, with a regulatory framework set to take effect in June 2023. Also from June 1st, Hong Kong will permit retail investors to invest in large-cap cryptocurrencies.

Over 80 foreign and Mainland China crypto firms have expressed interest in establishing offices in Hong Kong and obtaining local licenses. These include virtual asset exchanges, blockchain infrastructure, network security, virtual currency wallets, payment companies, and Web3 ecosystem projects.

Legislation to regulate crypto space will be almost identical to traditional finance.

Hong Kong's government expects more quality virtual asset enterprises to set up businesses or seek development opportunities in the city.

The Block - March 25, 2023 at 13:25 PM UTC

Coinbase

Coinbase received a Wells notice from the SEC related to its asset listings, staking service, Coinbase Earn, and Coinbase Wallet.

The Wells notice is not a foregone conclusion or action, but it is issued to entities under investigation.

Coinbase share dropped ~20% after the news on that day.

Justin Sun

Justin Sun and his companies, including Tron Foundation, were charged by the SEC for the unregistered offer and sale of two "crypto asset securities."

Allegedly, the companies offered and sold Tronix and BitTorrent as investments through unregistered "bounty programs."

Sun was accused of violating federal securities laws by artificially inflating $TRX trading volume in the secondary market.

$TRX also dropped ~14% after the accusation.

CNN Business - March 23, 2023 at 3:17 AM UTC

South Korean cryptocurrency mogul Do Kwon was arrested in Montenegro on March 23, 2023.

Do Kwon is accused of orchestrating a multi-billion dollar fraud that shook global crypto markets last year. It was the collapse of $UST (Terraform-Lab-made stablecoin) and the native token of the Terra blockchain $LUNA.

You can read about the incident from our article “The Downfall of Terra Luna” published in May.

He was arrested at the airport in the capital city, Podgorica, after being found carrying falsified documents.

News Highlight

Airdrop Took the Spotlight

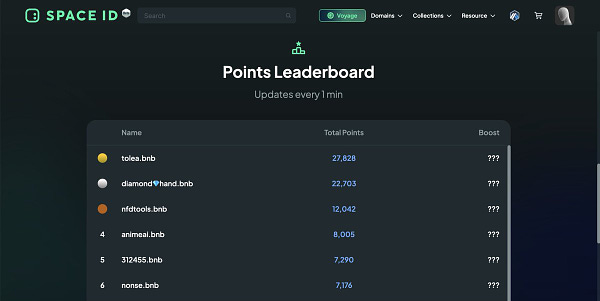

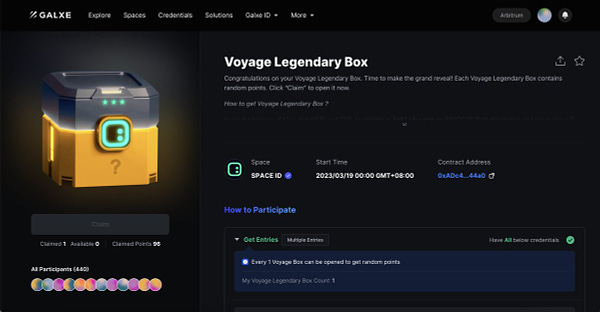

Space ID

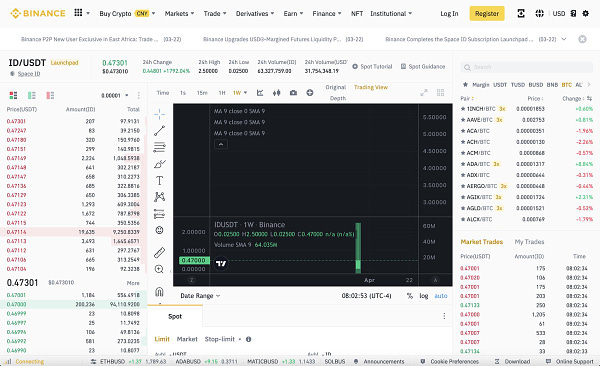

On March 23, 2023, the Space ID token (ID) was listed on Binance at a price of $2.5.

Space ID was also running an airdrop for users as part of Voyage Season II.

42M ID tokens were allocated for the airdrop, 2.1% of 2 billion total initial supply.

Users must hold a valid .bnb or .arb domain name, which was confirmed through a snapshot at 2:00 PM UTC on March 14, 2023 to be eligible for tokens.

Users can check eligibility and token amount on SPACE ID.

Token claiming opened on March 22. Unclaimed tokens will be put into a pool for future airdrops.

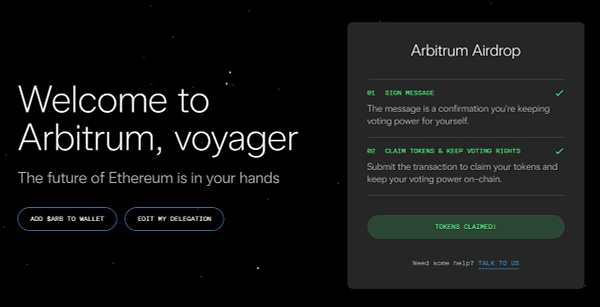

Arbitrum $ARB Airdrop

Many users were unable to claim and sell $ARB tokens at a high price due to the Arbitrum site crashing prior to the listing time.

A few insights into the $ARB airdrop using on-chain data:

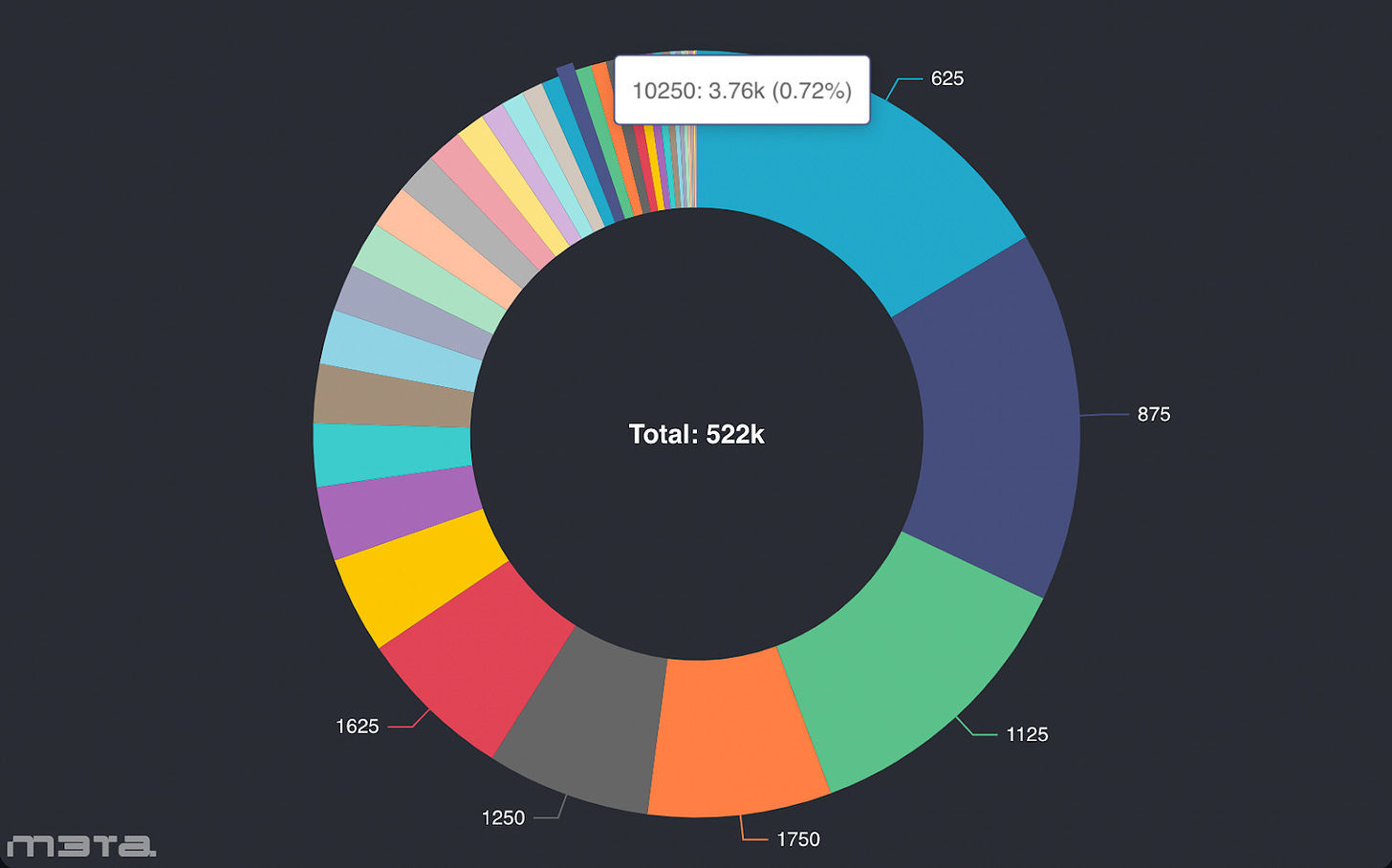

During the first 3 hours, a total of 29.5K wallets have claimed their $ARB. The number has so far climbed to 522K.

- Of all the airdrop wallet groups, 85.7K wallets receiving 625 $ARB account for the highest claimed proportion (16.41%).

- Only 3.76K wallets that receive the highest tier of 10,250 $ARB tokens (0.72%) have claimed their $ARB.

The chart below categorizes wallets based on the specific points which they received for completing certain tasks and are then converted into the amount of $ARB they should receive such as 625, 875, 1125, and 1750 $ARB, etc..

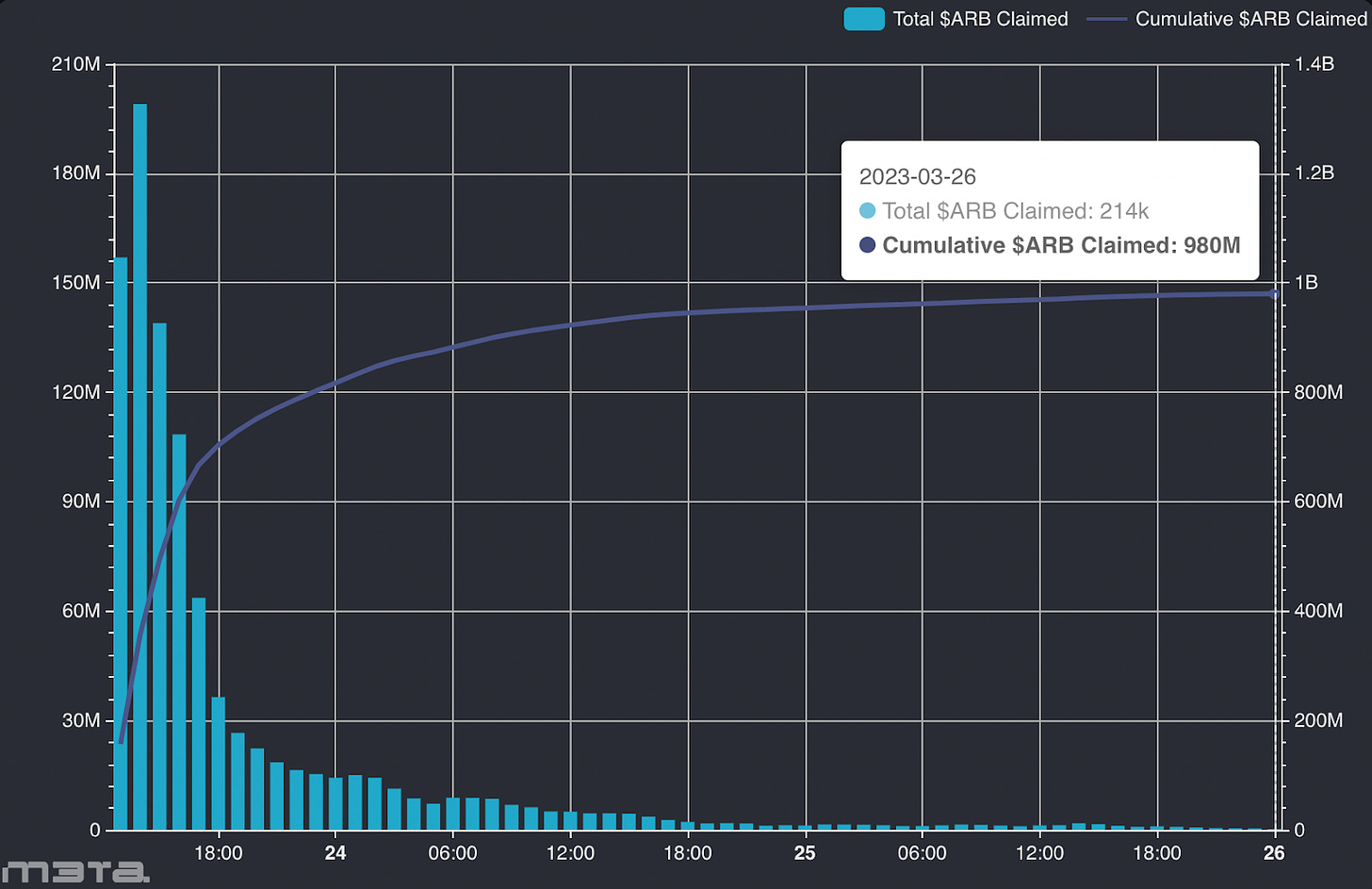

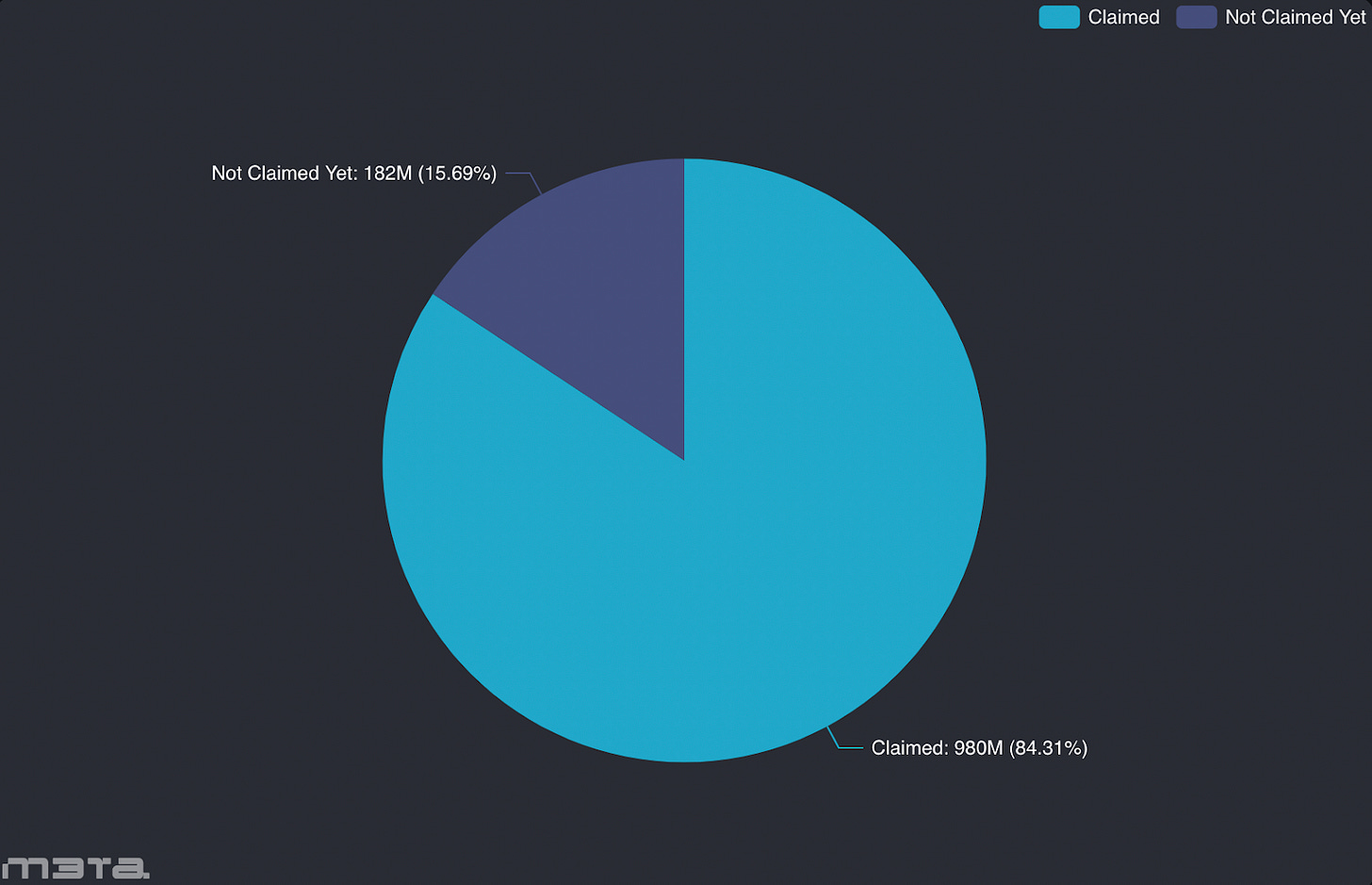

After 2 hours of the airdrop, a staggering 356M $ARB tokens were claimed. However, the $ARB claimed per hour is witnessing a consistent decrease over time with the total amount of $ARB claimed plateauing at 980M.

980M $ARB tokens have been claimed, making up 84.31% of the total airdrop supply for Users. 15.69% remained unclaimed.

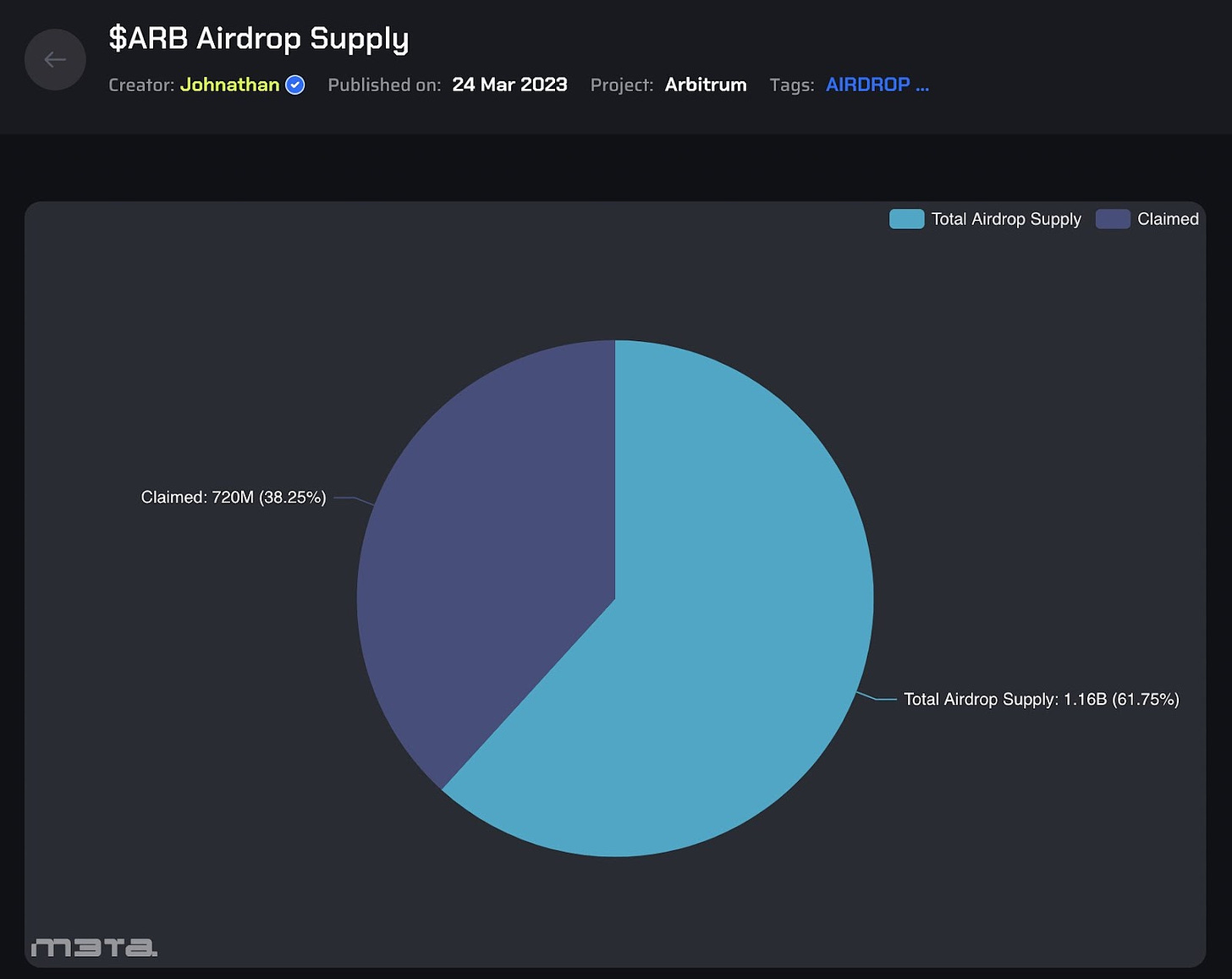

Within the last 3 days, nearly 50% of the total airdrop supply was seen to be claimed by users, according to the comparison of the 2 charts below.

$ARB Airdrop Claimed Ratio on March 24, 2023.

$ARB Airdrop Claimed Ratio on March 27, 2023

Note:

These charts only entail the total airdrop supply for Users, 1.162B (100%). We do not count the DAO airdrop in the total supply.

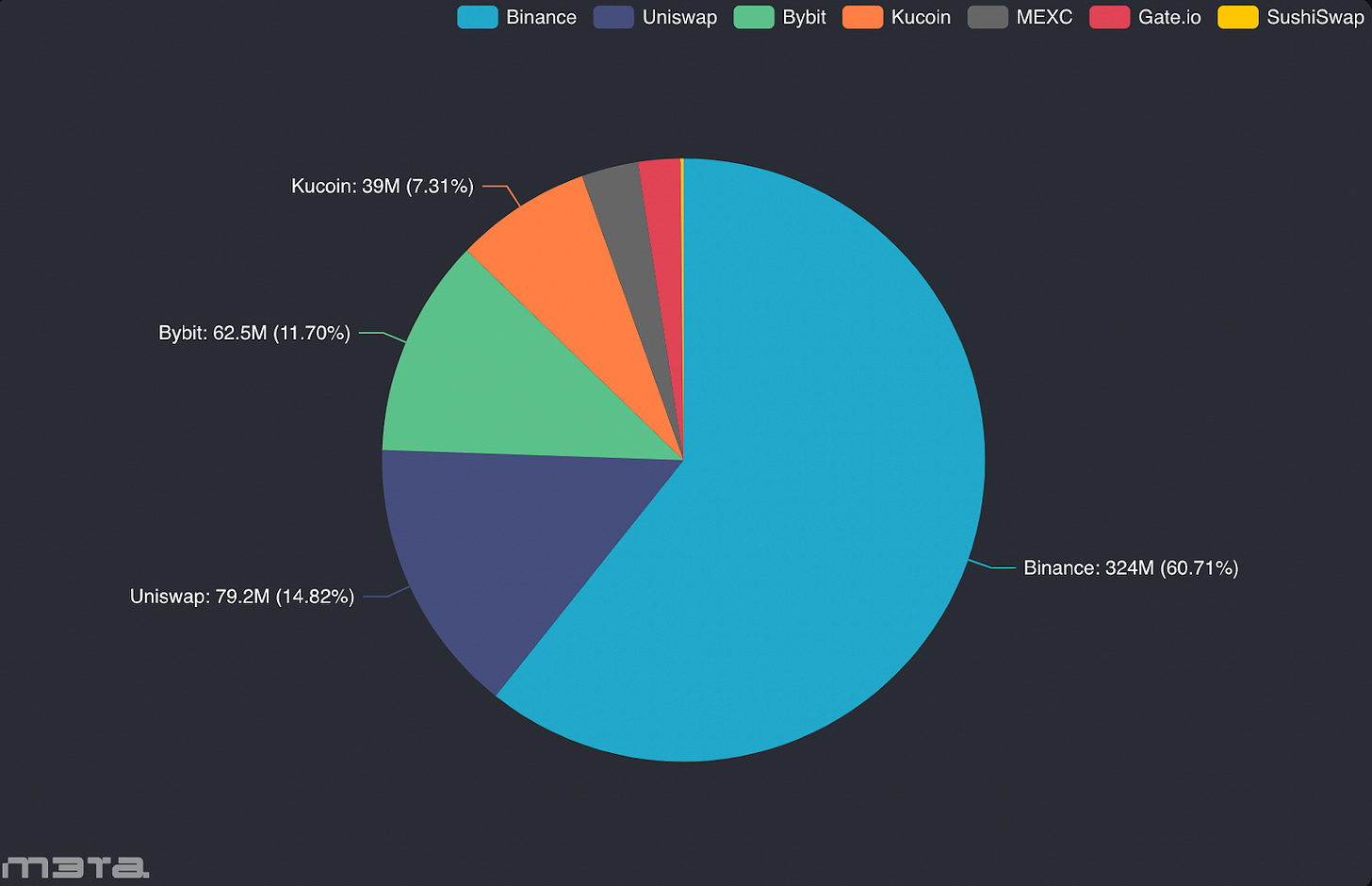

Binance is by far the most used CEX to make transactions by $ARB claimers, followed by Uniswap, Bybit, Kucoin, MEXC, Gate.io, and Sushiswap respectively.

All of these exchanges were said to experience technical trouble during the first hours of the airdrop (when $ARB price corrected around $10 to $4).

Binance only listed $ARB after 2 hours of the official #Arbitrum airdrop. (at 15:00 UTC on March 23, 2023).

Follow our Twitter to keep track of the most trending crypto projects through Snapshot real-time charts.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.