M3TA Recap: March 13 – March 19, 2023

Arbitrum overwhelmingly won the public plaudit last week, but beside that, what else? We've got you. Our weekly sweep does not let any major update (potentially alpha) out of sight. Read on!

Top performers (7D)

FUBT Token - $FUC: +2300%

Price as of time of writing: FUC/USD - $0.847725

FUBT is a centralized exchange registered in Hong Kong.

Recently, Hong Kong announced that from June 1st, all retail investors will have official permission to trade large-cap cryptocurrencies which led to an increase in the price of $FUC.

Conflux - $CFX: +183.5%

Price as of time of writing: CFX/USD - $0.45

Conflux Network is the only government-endorsed permissionless blockchain network in China.

On March 15, CNHC (Chinese yuan-backed stablecoin project, not CBDC), a partner of Conflux, was invested $10M by Kucoin and Circle. This could be the reason that led to the increase in price.

Note: If you want to catch the next pump, it's important to keep an eye on major macro market changes, especially in countries with stricter crypto regulations like China and Korea, etc. These 2 particular types of pump prove that point.

The next 3 coins can be associated with the latest airdrop sensation of ARB (Arbitrum).

Hamachi Finance - $HAMI: +389%

Price as of time of writing: HAMI/USD - $0.00095

Hamachi Finance is a Meme-Fi launched on the Arbitrum Network that allows holders to diversify their crypto currency portfolio by buying and holding $HAMI.

Meme-fi = meme token + DeFi rewards

The surge in $HAMI price could be owing to their partnership with LOTTO and the game establishment in Ponzu Protocol. In Ponzu protocol, the users will stake $HAMI, which accrues rewards for 3 days. After every 3 days, a lucky jackpot winner will be selected.

You can refer to their official tweets as they have explained the scheme quite clearly:

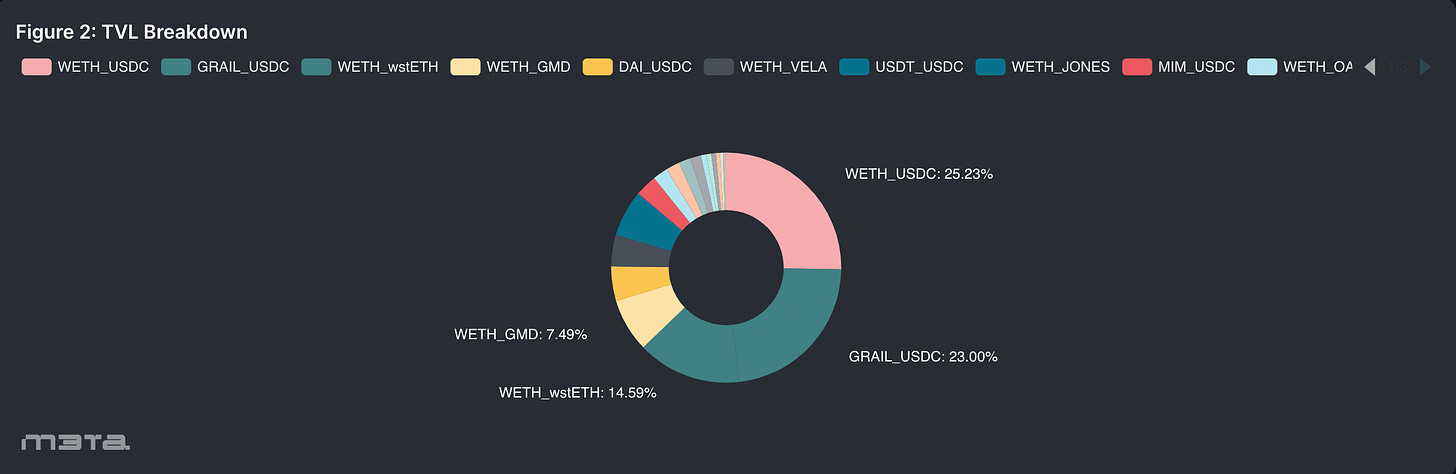

Camelot - $GRAIL: +155%

Price as of time of writing: GRAIL/USD - $4,241

Camelot is a native DEX on Arbitrum.

The recent price movements of $GRAIL can be attributed to the partnership between Camelot and Vendor Finance (a native lending platform on Arbitrum) which uses $GRAIL as loan collateral assets.

We built a customized dashboard for Camelot DEX with several meaningful metrics for your trading strategy.

A bonus tip: When looking at a native token of DEX trading, you should look for ways the project is using to keep the token from being over-inflated (e.g: staking scheme, burning, rewards, etc.). With that said, staking pools are the first indicators.

$GRAIL is also receiving a healthy BUY & SELL volume on the DEX.

Comparative analysis among Camelot, UniSwap, and SushiSwap is also available.

Zyberswap - $ZYB: +134%

Price as of time of writing: ZYB/USD - $7.19

Zyberswap is also a native DEX on Arbitrum.

On March 16, Arbitrum announced the airdrop for early users to experience and build projects on Arbitrum.

The next day, March 17, Zyberswap announced that the entire airdrop will be put into the ZYB 90d staking pool. As a result, everyone that stakes in this pool will get double rewarded, leading to a surge in the token's value.

Top losers (7D)

Euler - $EUL: -60%

Price as of time of writing: EUL/USD - $2.56

Euler Finance is a protocol that allows users to lend and borrow a variety of crypto assets without needing any trusted third party, meaning anyone with a crypto wallet can use it without restrictions based on location or minimum funds required.

The $EUL price dropped because of the recent exploitation of ~$200M last week.

Helium - $HNT: -31%

Price as of time of writing: HNT/USD - $1.55

Helium is a network for IoT devices based on blockchain technology, where wireless devices are connected to the network through nodes called Hotspots.

On March 17, Binance made the announcement that the trading pair HNT/BUSD would be delisted on March 24th, which resulted in a drop in its price. HNT/USDT leverage ratio has also been adjusted.

Truefi - $TRU: -21%

Price as of time of writing: TRU/USD - $0.083

TrueFi is a blockchain-based lending platform that offers collateral-free loans and uses $TUSD stablecoin.

After much ambiguity, CZ finally tweeted that Truefi had completely no relation to TUSD. Consequently, the price of Truefi sharply dropped.

Bone ShibaSwap - $BONE: -20%

Price as of time of writing: BTM/USD - $1.19

As the governance token for ShibaSwap, BONE permits users to vote on significant proposals concerning the protocol.

Earlier last week, Shibarium launched its testnet, allowing users to experience and add the chain to Metamask. However, it was discovered that the chain ID 917 was identical to the Rinia chain on Fire Network.

As a result, early adopters of the Shibarium network condemned the project for allegedly copying code on the Shibarium Discord channel which led to a decrease in price.

Macro

Consumer Price Index (CPI) - which measures the price of consumer goods and how they're trending

CPI rose 0.4% in February, after increasing 0.5% in January

Year-on-year increase in CPI was 6.0% in February, down from 6.4% in January

Core CPI (without food and energy prices) rose 0.5% in February, compared to 0.4% in January

Year over year (YoY) core CPI increased 5.5%, versus 5.6% in January

Producer Price Index (PPI) - which measures price change from the perspective of the seller

US producer prices fell unexpectedly in Feb, offering some relief in the fight against inflation.

PPI for final demand slipped 0.1% last month, with Jan data revised down to 0.3% from 0.7%.

PPI increased 4.6% YoY in Feb after rising 5.7% in Jan.

Retail Sales - which tracks consumer demand for finished goods over time by measuring purchases of durable and non-durable goods

Retail sales dropped 0.4% last month.

Inflation in the US may be beginning to ease slightly, as seen in the decrease in YoY CPI from January to February, as well as the unexpected fall in PPI for final demand. However, the overall CPI and core CPI still show a significant increase YoY, indicating that inflation is still a concern. Overall, while there are some signs of a slight easing in inflation, it still remains a significant concern in the US.

The drop in retail sales could also be a result of consumers feeling the impact of higher prices due to inflation.

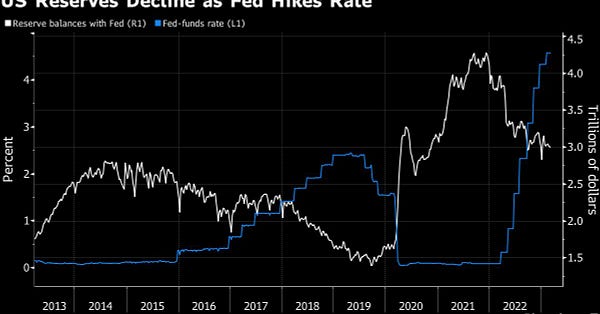

New Fed Bank Backstop: Potential to Inject “Up to” $2 Trillion

Bloomberg - March 16, 2023 at 10:45 AM UTC

Federal Reserve's new bank backstop program called “Bank Term Funding Program” (PTFP) which supports American businesses and households by providing additional funding to eligible depository institutions, ensuring that banks can meet the needs of their depositors, could inject up to $2 trillion in liquidity to the economy.

If we're not careful with the wording, it looks as if AN UNIMAGINE NUMBER ($2 Trillion) will SURELY make way into depositors' hands. As our in-house analyst gave her 2 cents in the tweet below, this ambiguity of “up to $2 trillion" can be misleading.

Based on uninsured deposits at 6 US banks, different analysts predict that the amount could be closer to $460B.

JPMorgan believes the program should inject enough reserves to reduce reserve scarcity and reverse the tightening that has taken place over the past year.

Every week, the Fed will regularly announce the usage of BTFP when publishing data on the Fed's balance sheet.

The Bank Term Funding Program (BTFP) provides banks loans for up to one year by offering assets as collateral to “safeguard deposits and ensure the ongoing provision of money and credit to the economy.” Janet Yellen, the United States Secretary of the Treasury, approved the use of up to $25 billion as a backstop for the fund.

Micro

Decrypt - March 14, 2023

Just as recently as November last year, Meta was super-charged with the ‘NFT-marketplace on social media” concept and launched their creator-selected beta version.

Our coverage of the news remains here: https://m3talab.io/post/m3ta-recap-october-31-november-6-2022

Nevertheless, Meta is shifting its focus away from its NFTs initiative.

CoinDesk - March 15, 2023 at 4:00 AM UTC

In February, 0x Plasma Labs' governance proposal to deploy Uniswap v3 on BNB Chain passed with over 55 million UNI token holders voting in favor.

The multi-chain bridge Wormhole was chosen as Uniswap's designated bridge to BNB Chain in a preliminary vote.

Uniswap Protocol users can now trade and swap tokens across the network using BNB Chain's high-speed and low transaction fees.

Uniswap's integration with BNB Chain unlocks a new pool of liquidity with its large DeFi developer community.

CoinDesk - March 17, 2023 at 1:00 AM UST

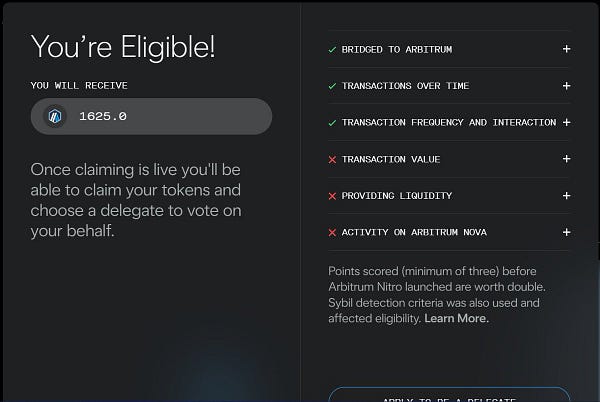

Arbitrum collaborated with Nansen to assess user activity for ARB token eligibility in February. Factors considered included transaction count, number of applications used, and length of use, among others.

Eligible users were able to claim the tokens by visiting gov.arbitrum.foundation.

ARB's total circulation is said to be 10B tokens, with 56% controlled by the Arbitrum community, 11.63% distributed to eligible users via airdrop, 1.1% to DAOs in the ecosystem, and the remaining going to a treasury controlled by the new Arbitrum DAO.

The remaining 44% will be allocated to investors and employees of Offchain Labs, the firm behind Arbitrum, with some tokens subject to lock-up periods and vesting schedules for the next 4 years.

The $ARB token will be published on March 23, 2023.

BSC News - March 18, 2023

Space ID is launching a payment and governance token called $ID on Binance Launchpad.

Space ID provides users with a human-readable domain name for their crypto wallets which are usable across Web3, social media, and email.

Binance will calculate exchange users' BNB holdings over five days to determine their $ID purchase amount.

$ID launchpad price is $0.025 per 1 $ID, with 5% of the total $ID supply allocated to the launchpad event.

The $ID launchpad event has a hard cap of $2.5 million, setting the project's market capitalization at $50 million.

The Block - March 14, 2023 at 1:00 AM UTC

Web3 data-warehousing platform Space and Time is partnering with South Korean gaming firm Wemade.

Wemade will use Space and Time's developer tools to power its gaming services.

Space and Time will assist Wemade by simplifying payouts for their games, performing secure analytics on game activity, and lowering on-chain storage expenses with their data warehouse.

News Highlight

Beincrypto - March 13, 2023 at 7:31 AM UST

Binance to convert remaining $1 billion Industry Recovery Initiative funds from BUSD to cryptocurrencies include Bitcoin, Binance Coin, and Ethereum.

The decision was made due to recent changes and turbulence in stablecoin market and banks

CEO Changpeng Zhao says the move is a way to keep funds in safe assets.

Financial Times - March 19, 2023

Credit Suisse, a Switzerland-based financial services firm and global investment bank, is among the 30 banks worldwide deemed "too big to fail" due to their significant importance to the banking system.

Credit Suisse has been going down due to risk control issues and slow changes after the 2008 financial crisis.

UBS acquired Credit Suisse for $3.25 billion on March 19. The acquisition marked the end of Credit Suisse's 167-year existence as an independent organization.

BS Chairman Colm Kelleher stated that taking over Credit Suisse was an emergency rescue mission as it was a severe blow to Switzerland.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.