M3TA Recap: June 05 – June 11, 2023

Seems like SEC is very serious about the crypto policy as they charge Binance and Coinbase for operating as Securities Exchange, blanketing the crypto market in red. Are you pro-crypto or pro-SEC?

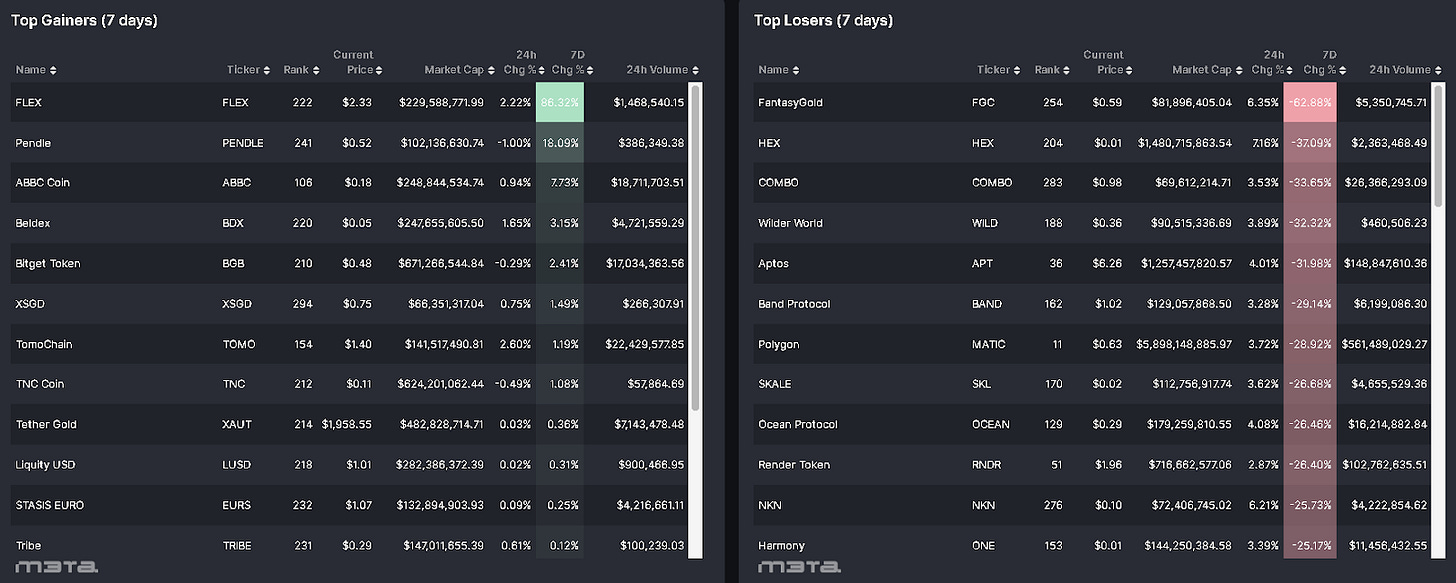

The ranking in our Market Mover Report and the project list below may not match.

This is because M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

to minimize the chance of including ‘rug-pull’ projects in the list, protecting our readers.

You can explore more high-cap projects from our Market Mover Report on m3talab.io now!

Top performers (7D)

CoinFlex - $FLEX: 86.32%

Price as of time of writing: FLEX/USD - $2.33

CoinFLEX, standing for “Coin Futures and Lending Exchange”, is a cryptocurrency exchange that focuses on futures and perpetual contracts, as implied in the name. Unlike other exchanges that offer spot trading, CoinFLEX also offers an Automated Market Maker (AMM+) feature that allows users to earn yield without dedicating much time or effort to actively trade.

In April, the project announced its rebranding and transition to Open Exchange (OPNX Exchange).

The recent price surge could be attributed to the tokenomics of $OX, the native token of OPNX exchange, that enables users to exchange 1 $FLEX for either 100 unstaked $OX or 125 $OX when staked.

Recently, rebranding projects have gained attention, leading to short-term growth in tokens like Combo, Alpha, and Dusk.

Pendle Finance - $PENDLE: +18.9%

Price as of time of writing: PENDLE/USD - $0.52

Pendle Finance is a yield trading protocol focused on LSD-fi. Users who provide liquidity in the bear market may incur Impermanent loss, which could be avoided with Pendle’s mechanism.

On June 12th, the $PENDLE price surged due to the Penpie project's Innitial Dex Offering (IDO) sale on Camelot. To participate, users need to hold staked tokens: xGRAIL, mPENDLE, vlMGP and provide liquidity on Penpie.

Top losers (7D)

HEX - $HEX: -37.09%

Price as of time of writing: HEX/USD - $0.01

HEX is an ERC20 token on Ethereum that introduces itself as the initial blockchain certificate of deposit (CD). Similar to traditional CDs that provide higher interest rates to customers who keep a lump-sum deposit locked for a specific duration, Hex holders can stake HEX tokens for designated time periods.

The longer the staking period, the greater the benefits for HEX holders.

Aptos - $APT: -31.98%

Price as of time of writing: APT/USD - $6.26

Aptos is a PoS Layer 1 developed by former Facebook employees. It leverages Move, a Rust-based programming language developed independently by Meta (formerly Facebook).

It offers several key benefits: 1) Enhanced security; 2) Flexible key management and trustworthy transaction transparency; 3) High throughput and low latency; 4) Support for complex transactions without compromising data integrity; 5) Easy upgrades and future scalability initiatives.

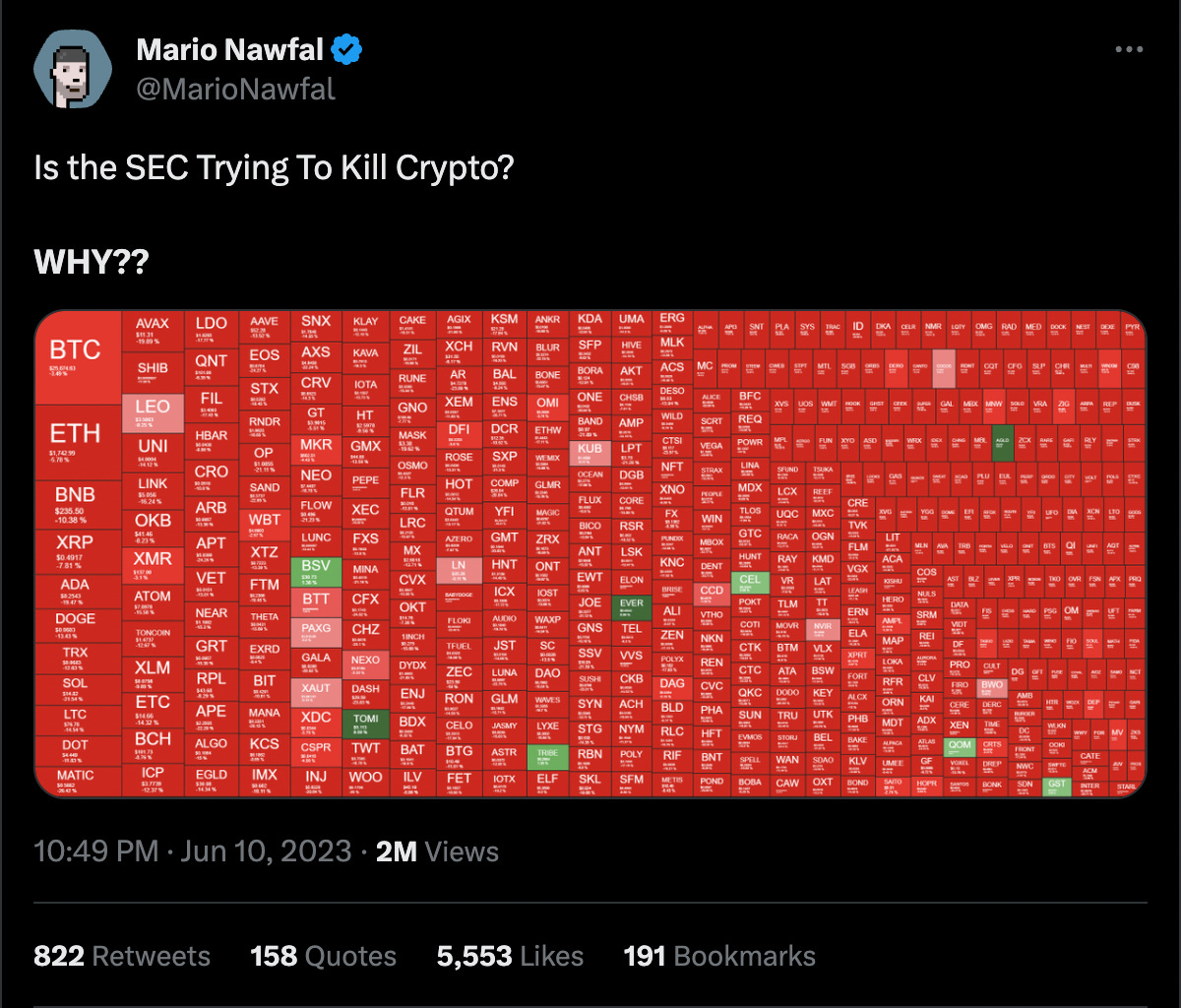

This week, crypto projects experienced heavy price declines as there have been negative developments in the market, such as the SEC's issues with Binance US and Coinbase, as well as fake news and speculations about other major entities.

These rumors include Binance's under-collaterized Proof of Reserves (PORs), the liquidation of $200M from an exploiter's wallet (case BNB bridge) that was being lent on Venus will liquidate at $220 BNB, and the depegging of TUSD following True USD's suspension of minting via Prime Trust.

Macro

Innitial Jobless Claims - measures the number of individuals who filed for unemployment insurance for the first time during the past week.

US unemployment claims reach highest level in over 1-1/2 years

Memorial Day holiday may have caused volatility in the data

Initial claims rise by 28,000 to 261,000, surpassing economists' expectations of 235,000

Micro

CoinDesk - June 10, 2023

Ooki DAO was charged with operating an illegal trading platform and acted as an unregistered futures commission merchant.

Penalty: $643,542, cease operations, and shut down its website

The lawsuit accused Ooki DAO of offering leveraged and margined Crypto transactions without KYC.

Ooki DAO never formally responded to the lawsuit, it did geofence the U.S. (stop providing services to the US-inbound users) after the suit was filed.

CoinDesk - June 10, 2023

Minting and redemption services through other banking partners are unaffected.

The pause in minting is connected to rumors of insolvency surrounding Prime Trust.

Laying off a significant portion of its workforce in Jan 2023.

Acting as a middleman for Binance.US.

Prime Trust is now in the process of being acquired by crypto custodian BitGo.

This does not come at a right time when the US Securities and Exchange Commission (SEC) has proposed rule changes that aim to restrict crypto companies from acting as custodians for their customers.

News Highlight

U.S. Securities and Exchange Commission Sues Binance and Coinbase

Multiple Sources - since June 05, 2023

Lawsuits accuse Binance and Coinbase of operating as unregistered securities exchanges, brokers, and clearing agencies.

Binance lawsuit lists 12 assets as securities: BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI.

Coinbase lawsuit lists 13 assets as securities: SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO.

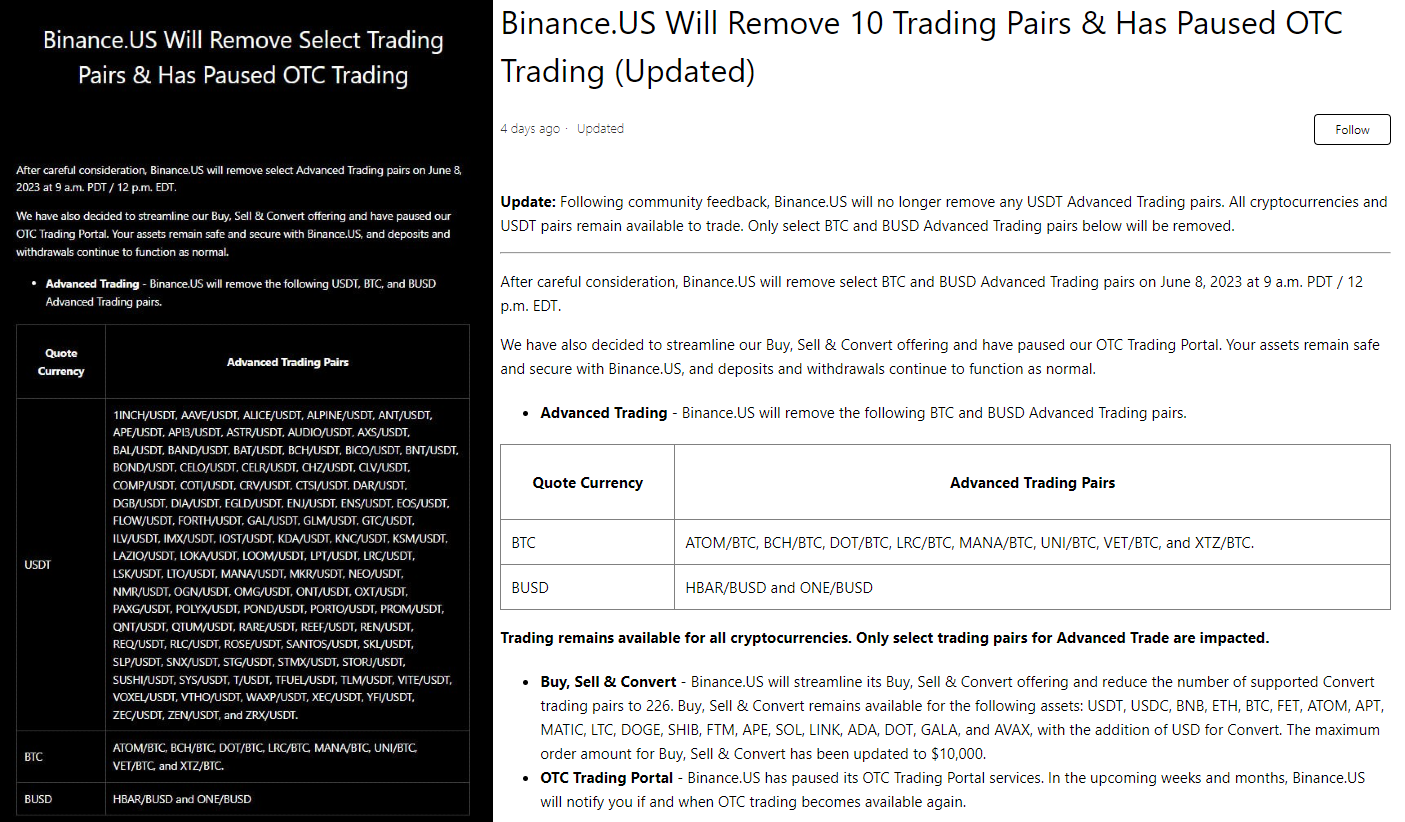

Binance

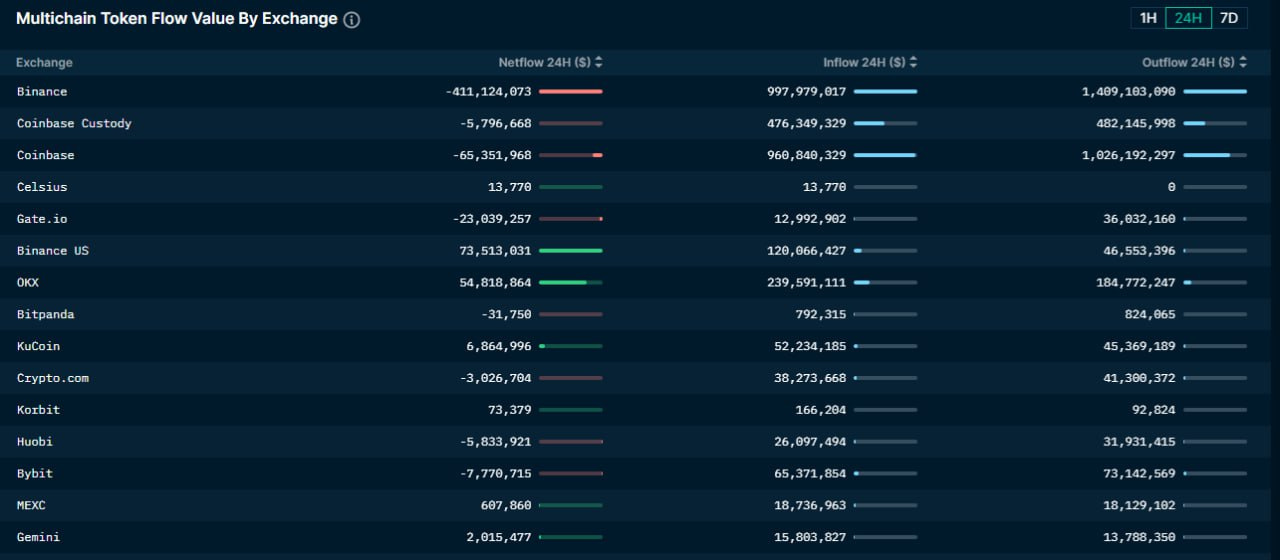

Binance faces $500M withdrawal on June 05 but is not a major concern compared to previous periods in March.

On June 8, Binance US initially plans to delist 100 trading pairs, including USDT, but later decides to delist only 10 trading pairs without USDT pairs.

On June 9, due to SEC aggressive tactics against crypto in the US, Binance US will temporarily halt USD deposits and withdrawals from June 13th, 2023.

Coinbase

Coinbase only faced ~$70M decline in 24H netflow after the allegation.

On June 8, Coinbase CEO said that Coinbase has NO intention of delisting tokens or shutting down its staking services, and is determined to compete with the SEC.

Coinbase also created an NFT collection called “Stand with Crypto” as a symbol to seek sensible crypto policy.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.