M3TA Recap: January 30 – February 05, 2023

Several upgrades and launches took place last week, even the most unbelievable one by Huobi. All eyes were on DAO, stablecoins, AI tokens and an uncracked Twitter trend going on. Read on with M3TA!

Top performers (7D)

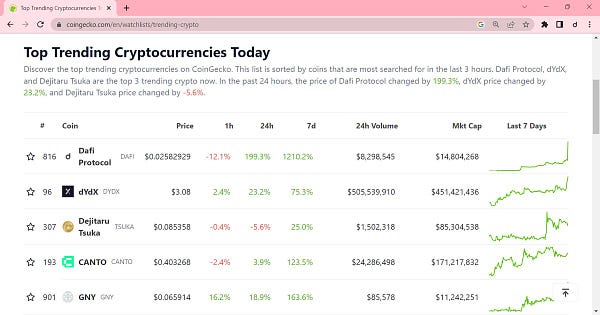

Dafi Protocol - DAFI: 275.1%

Price as of time of writing: DAFI/USDT - 0.03493

Dafi - a DeFi protocol that offers staking, liquidity and bounty based on growing network demand - recently saw an uptick in its native token DAFI price.

This could be due to its latest unveiling of the "Web3's First Hybrid Crypto Exchange" on Feb 01.

The hybrid model is claimed to solve the pains of CEX and DEX with better added functions. The most important added function must be SuperStaking: you stake DAFI, earn DAFI and more tokens from exchange fees (ETH, USDT, BNB, etc.)

The company has also teased the upcoming release of major news for the DAFI this week.

FLEX Coin - FLEX: 148.8%

Price as of time of writing: FLEX/USDC - 1.4279

CoinFLEX, the futures exchange and yield platform, recently announced on Feb 02 that a rebranding of FLEX is next to no time with new tokenomic changes. This might explain the sharp increase in the value of the FLEX native token last week.

MarsDAO - MDAO: 113.4%

Price as of time of writing: MDAO/BUSD - 0.5275

MarsDAO, a decentralized investment platform, announces a staking partnership on WePad IDO launchpad for rewards in MDAO tokens, driving MDAO price higher.

MarsDAO products range from DEX index contract, wallet bot, re-staking farming to tokenization of real assets (real estate, watches, aircraft, land, etc.)

WePad is a decentralized launchpad hosting and listing potential projects for IDO.

Measurable Data - MDT: 112.7%

Price as of time of writing: MDT/BUSD - 0.06107

SingularityNET - AGIX: 111.6%

Price as of time of writing: AGIX/BUSD - 0.41905

Last week, AI-related tokens saw a notable increase in price due to the rise of an underground trend in the AI space. Tokens such as MDT and AGIX experienced a surge in their respective prices.

Users will get rewards in MDT (Measurable Data Token) as they share anonymous data points through a dApp called MyMDT. Its parent company Measurable AI provides consumer insights to various businesses through data collected from transactions.

On the other hand, AGIX was created to become the exchange currency on the AI marketplace SingularityNET, on which anyone can sell and buy AI solutions that match their needs.

Top losers (7D)

Constellation - DAG: -18.6%

Price as of time of writing: DAG/USDT - 0.049795

Aptos - APT: -18.4%

Price as of time of writing: APT/USDT - 14.7102

BTSE Token - BTSE: -16.9%

Price as of time of writing: BTSE/USD - 2.7334

Ronin - RON: -14.8%

Price as of time of writing: RON/USDT - 0.829

These tokens experienced a significant increase in value two weeks ago, mirroring the trend of Bitcoin. Last week also saw a 3.41% drop in the price of Bitcoin, which led to a similar decline in the tokens' value. The cause of the drop could be attributed to some investors taking profits after a month-long bullish trend.

STEPN - GMT: -15.6%

Price as of time of writing: GMT/USDT - 0.5112

STEPN to unlock 1.46% of total supply on Feb 09 might have caused existing investors to sell off for fear of extreme volatility.

News Highlight

AMBCRYPTO - January 30, 2023

No date fixed and fUSD V1 will be liquidated first.

The upgrade focuses on improving stability and cost effectiveness of the platform, paving the way for more B2B products.

The new version enables users and developers to allocate fees in either FTM or fUSD and predict costs in advance.

fUSD is an over-collateralized stablecoin (similar to DAI) backed by staked FTM.

The Block - January 31, 2023 at 12:00 PM UTC

Djed is a stablecoin developed by blockchain firm Coti and Cardano's core developer Input Output.

Djed is aimed to be used in the Cardano ecosystem's DeFi protocols as a stable alternative to volatile cryptocurrencies, over-collateralized by 400-800% with ADA and using SHEN as a reserve coin.

Expected to be integrated into 40 apps, receiving support from MinSwap, Wingriders, and MuesliSwap and planning to launch DjedPay for accepting stablecoin payments.

AMBCRYPTO - February 03, 2023

dYdX delays token unlock until Dec 01, 2023.

dYdX accrued less revenue for token holders than GMX despite growing volume.

Whales remain optimistic about dYdX, but decreasing interest from new addresses and slowing network growth imply less transfer activity.

Twitter - February 04, 2023 at 02:00 PM EST

No one actually comes forward and confirms what this weekend phenomenon is, although there are some circulating theories. Regarding the en masse of these DeFi projects, whatever this requires significant resources and widespread marketing partnership. It could be the launch of:

either $crvUSD

or Arbitrum Airdrop

Twitter - February 05, 2023 at 11:55 AM UTC

Basically, they are securitizing subprime loans (a higher-interest loan for people who are usually late in payment and are not qualified for a standard-interest loan) and selling them out to naive investors.

If this concept can be any more familiar, it's exactly how Collateralized Debt Obligations (CDOs) - the bad ones - were made back in the financial crisis in 2008.

Macro

Interest rate

Fed increases interest rates by 0.25 points, with a target range of 4.5% - 4.75%.

FOMC aimed at bringing down inflation, which is still elevated despite recent signs of slowing.

Job growth

Job numbers exceed forecasts, rising from 260,000 to 517,000.

Despite the promising number, the number might have been skewed by the service industry which is happily operating after Covid.

But on the other hand, the employment landscape does not look that positive in the tech realm with FANG (Facebook, Amazon, Netflix and Google) as well as several others (Microsoft, IBM, Salesforce, Paypal, etc.) continuously slashing jobs every day. Techies have been known to earn the highest average salary and likely spend the most across sectors, so the fact that they cannot keep their jobs could mean that the economy will become stagnant for a while.

Or, as Tom Simons - money market economist at Jefferies suggests, the increase in job numbers could be attributed to fewer workers being let go, rather than an actual increase in jobs created.

Micro

ZyCrypto - January 30, 2023

Cardano (ADA) price has risen by over 50% since the beginning of the year.

Mysterious buyers purchased over 4 billion ADA, worth approximately $1.72B between $0.365 and $0.376.

The recent surge in ADA price triggers selling from whales, with 31 addresses holding 100,000 to 1,000,000 ADA selling or redistributing their tokens.

71% of ADA holders are currently holding at a loss, with 26% being profitable.

The low profitability count may indicate that this is a good point for entering new positions.

CryptoGlobe - January 31, 2023

Ethereum network's unique addresses increased by 130,000 per day, reaching 221.3 million. We do not eliminate the odds that a majority of these can be bot addresses.

Aggressive accumulation of ETH by "shark addresses" seen in data from on-chain analytics firm Santiment: Wallets with 100-10,000 ETH have been accumulating ETH since Nov. 2020, resulting in the creation of 3,000 new shark addresses.

Total number of shark addresses reached an all-time high of 48,556.

BNB Chain - February 01, 2023

BNB Greenfield is a blockchain-based decentralized storage network that will enable Web3 cloud computing. It can be applied to: (1) website hosting, (2) personal cloud storage, (3) blockchain data storage, (4) publishing, (5) social media, (6) token-curated registries.

If you're familiar with Google Drive, DropBox or AWS (Amazon Web Service), this solution is supposedly a competitor to that model.

Read more about BNB Greenfield here:

M3TA Insights:

The crypto market movement this week appears weaker compared to 2 weeks ago, possibly due to the anticipation for the Federal Reserve interest rate announcement. Post-Fed's announcement, the market showed a slight recovery but failed to see a strong surge, causing a 4-day decline in BTC. Despite the fluctuations, the market remains in a sideway range and investors appear to be healthily greedy. It's advisable to exercise caution when managing assets.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.