M3TA Recap: January 02 – January 08, 2023

First week of the year was waving with so many good news that resurrected the crypto market. Read on with M3TA Recap!

Market Wrap

Great Start for New Year as FED Implies The Economy is Decelerating

Cryptos

BTC and ETH broke the price level of $17,000 and $1,250 as the U.S. services industry and manufacturing activities were slowing down.

SOL skyrocketed by 40% following the release of $BONK, a Solana-based meme coin.

MATIC also gained traction following the partnership with Mastercard, recording a 4% uptick.

Insights

Trading Activity for Crypto Derivatives Declines in December

According to CryptoCompare, derivatives trading volumes dropped by 52.7% in December 2022 to a total of $1.16 trillion.

The derivatives volume on Binance has decreased by 50% to $726B.

Trading volume for cryptocurrencies on the CME (Chicago Mercantile Exchange) dove by 49.2% in December, totaling $14.2B.

Plausible cause: FTX's explosion has caused cryptocurrency investors to hunker down from grave risk. This consequently resulted in plummeting trading volume.

Equities

Nasdaq, the S&P 500, and Dow Jones Industrial welcomed their first week of the New Year with green candles showing gains of 2.58%, 2.28%, and 2.13% respectively.

Takeaways

The employment rate was 3.5%, lower than the expected rate of 3.7%.

The US added 223,000 jobs in December higher than the forecast numbers of 200,000 jobs.

Although December job numbers exceeded expectations, the figure was practically much lower than those of the first half of 2022 which was routinely above 300,000. This indicates that economic growth is slowing down.

Many investors hope that FED will ease the predetermined interest rate of 0.5% to 0.25%.

DCG - Genesis - Gemini

CoinDesk - January 03, 2023 at 6:04 PM UTC

Accusation: Genesis and its parent company DCG owe Gemini’s clients $900M; DCG owes Genesis $1.675B.

Response from Barry Silbert - CEO of DCG: the firm “did not borrow $1.675B from Genesis”, has never failed to make any interest payment, and has full control of all unpaid loans.

Bloomberg - January 07, 2023, at 9:59 AM GMT+7

Federal prosecutors and SEC are investigating Digital Currency Group (DCG) for internal transactions associated with its cryptocurrency lending service.

In a November letter to shareholders, Silbert disclosed that DCG had received about $575M in loans from Genesis Global Capital that are due in May 2023.

He also mentioned a $1.1B promissory note due in June 2032, resulting from DCG’s assuming liabilities Genesis had from exposure to Three Arrows Capital.

M3TA Insights

A few risks present here: (1) Creditors' investment from Earn (Gemini) has yet to come to fruition; (2) Genesis is working out to avoid bankruptcy; (3) DCG CEO Barry Silbert remains under the radar; (4) Cameron's letter mentioned co-mingled transactions between DCG and Genesis.

With their massive intertwined portfolio in digital asset investment (https://dcg.co/portfolio/), if DCG defaults, the explosion would send thundering damage to the market, even worse than the last one by FTX.

To uncover the DCG-Gemini-Genesis ticking bomb on Twitter, follow us and the thread here: @M3TA_Analytics.

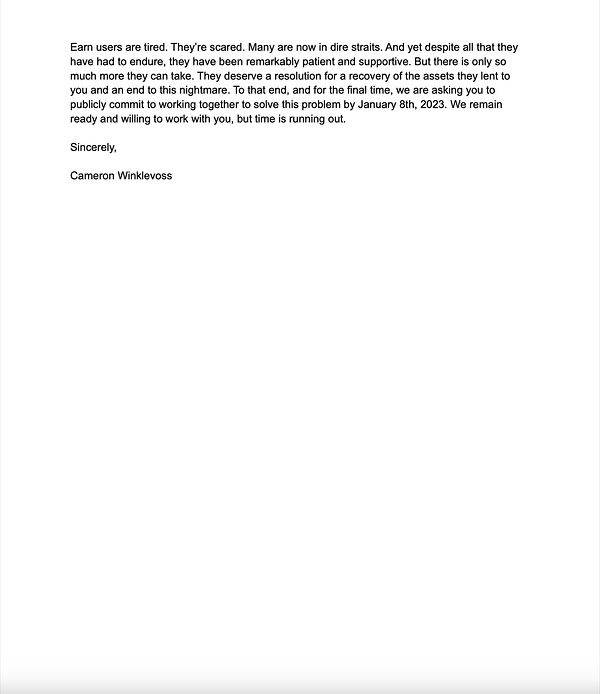

CoinDesk - January 06, 2023 at 9:56 PM UTC

What: Tron founder Justin Sun fired 20% of employees, banned the staff group chats, and demanded that workers receive their paychecks in stablecoins on Huobi.

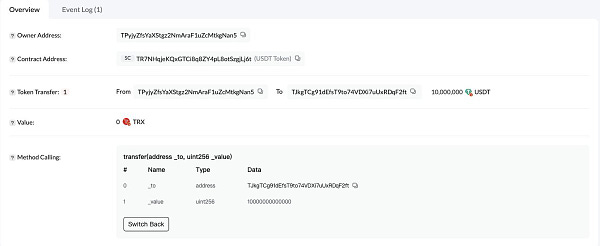

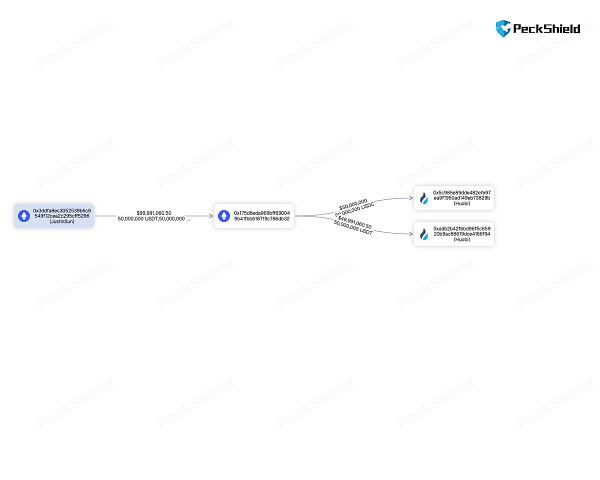

Security firm PeckShield noted that Justin Sun moved ~10M USDT from Tron to Binance and ~100M stablecoins (USDT & SUDC) to the Huobi platform.

Price: TRX and HT tokens fell 8% and 11% in 24H, respectively; Tron-based stablecoin USDD lost its peg by 3 cents.

M3TA Insights

The total Proof of Reserve of Huobi is $1.9B (at the time of press) which mostly includes volatile assets (HT and USDT). If these assets, especially non-stablecoin tokens in this pool plunge, the proof of reserve will definitely lose its credibility.

CoinDesk - January 04, 2023 at 11:08 PM UTC

SOL also gained more than 35% in 2 days since the release of the $BONK token. This also increased more than $20M in $SOL trading volume.

M3TA Insights

Basically, $BONK has two mechanisms for interested users from Solana. $SOL holders receive an airdrop $BONK token and high APR (999%) when locking the token in liquidity pools. It seems very risky when $BONK has both a high APR from DeFi and FDV/MC > 1. Nevertheless, this will benefit $SOL for a short while.

CoinDesk - January 05, 2023 at 8:51 AM UTC

SEC's suspicions:

Binance.US needs to provide the capacity details for buying Voyager

Will Binance.US ensure customer assets and their cryptocurrency portfolio balance?

Texas State Securities Board and the Texas Department of Banking objection:

Voyager and Binance.US are not authorized to conduct business in Texas

M3TA Insights

The acquisition of Voyager did not create any particular security concerns that CFIUS could detect. However, it emphasized that due to bankruptcy court restrictions, the organizations have occasionally been unable to transfer assets due to national security concerns.

Voyager’s business license is in the US, not sure about Texas, but the acquisition process could be put a stop to if Binance.US cannot prove their financial capacity.

Cryptonews - January 03, 2023 5:30 PM UTC

Binance bought a majority stake in Gopax and was in the final legal steps.

No official announcement has been made and Gopax has so far denied the rumor for fear of arbitrariness.

According to Chosun on Jan. 6, Gopax is facing a shortfall of 600 billion won (approximately $471 million) from its deposits in Genesis Trading.

M3TA Insights

During the bear season of 2022, Binance penetrated 2 markets - Japan & Indonesia (All in Asia!). Ergo, it is not surprising that Binance continues its yearly expansion plan to another booming Asian market: South Korea.

However, Binance is being delayed in the acquisition. This could be because after the incident of Luna Terra, Korea got more strict with the laws related to cryptocurrency.

Note: If the negotiations for Binance’s acquisition of Gopax shares fail, there is a high possibility that the damage to Gopax investors will become a reality since Gopax has its assets trapped in the Genesis platform.

EXPLOITATION

CoinDesk - January 06, 2023 at 8:24 AM UTC

The Mutant Ape Planet NFT devs promised to reward those who bought the NFTs, but then took nearly $3 million to their own wallets.

The devs were arrested on the account of false marketing.

M3TA Insights

This was a scam project which promised a lot of benefits for investors, yet refused to fulfill any. These kinds of projects are usually allured to high-value investors who hardly do any homework before making investment decisions. Please Do Your Own Research (DYOR).

SiliconANGLE - January 02, 2023 at 4:00 PM UTC

Luke Dashjr - a respected BTC core developer was stolen 200+ BTC right at New Year.

Cause of loss: hacker(s) compromised his PGP key.

He has asked the FBI for help but since, no reply is in sight; however, Binance CEO Changpeng Zhao has offered support and warned of the risk of using self-custody wallets.

M3TA Insights

Even the best-trained veterans can still make unfortunate mistakes. This time, the same mistake as anyone who stores their funds on hot wallets or installs them on working devices.

CoinTelegraph - January 04, 2023

The community saw an unusual trade of GMX.

CertiK and PeckShield confirmed the exploitation.

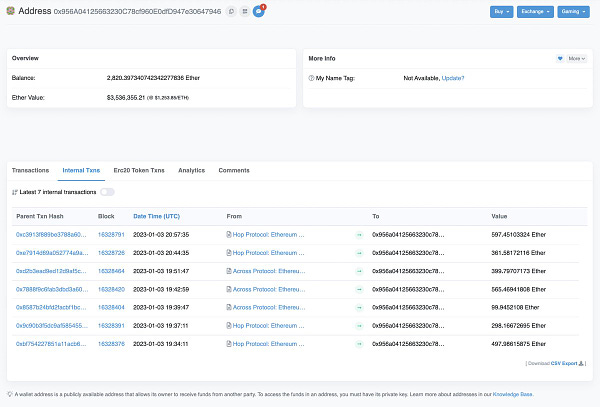

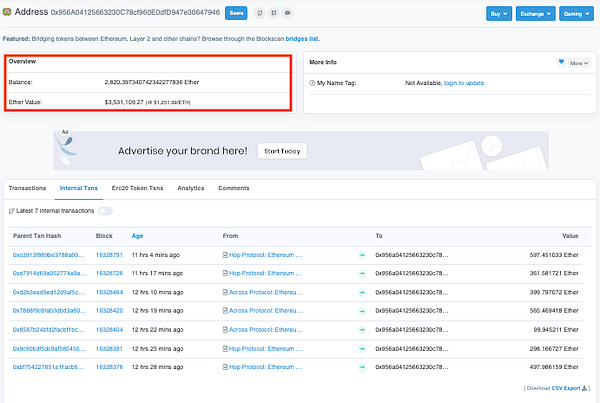

The hacker swapped the stolen 82,519 GMX from a GMX whale for 2,627 ETH.

GMX price dropped 3% when the exploitation occurred.

M3TA Insights

GMX accounts for the top revenue on layer 2 Arbitrum at the present. Therefore, the most recent exploitation of GMX’s whale wallet put forward a lot of hypotheses: Is this real Whale’s wallet or just from GMX’s team?

CoinTelegraph - January 06, 2023

M3TA Insights

As an integral part of crypto exchange, stablecoins account for 17.7% of the crypto market cap ($137.07B/$806B). If stablecoins are not strictly regulated, they can affect the whole market as in the case of UST by Luna. However, it might take long before the CBDC-stablecoin switch can take place because (1) the Hong Kong CBDC is not yet available, (2) switching from CBDC to stablecoin means swapping e-money with decentralized assets (the technology adaptation will take a few months to years).

CoinDesk - January 03, 2023 at 10:40 PM UTC

The Sushi Dex halted the development of Kashi (Sushi Lending) and MISO (Sushi Launchpad) projects.

Reason: low public interest and intense work effort for maintenance.

M3TA Insights

As a result of uncertain market conditions, layer 1 and layer 2 projects' dynamics have continuously shifted, followed by whitepaper updates and other less exciting actions (labor cuts, project cuts, budget cuts,...) to stay current on and ahead of financial headwinds. In this fight of the Sushi family, the ‘cash cow' Sushiswap wins.

CoinTelegraph - January 04, 2023 at 10:04 PM UTC

The DeFi auditor is reported to have flagged and recommended solutions to a re-entrancy vulnerability of ‘medium severity’ (high impact & low likelihood) in the new smart contract Universal Router. The smart contract was launched by Uniswap on Nov 22, 2022.

The issue could have allowed bad-faith actors to drain customer assets mid-transactions by intercepting the code with a malicious third-party destination.

M3TA Insights

A win-win-win situation: 1st win - Debaub, 2nd win - Uniswap, 3rd win - users. Since securing assets should be the top priority of any financial institution, the practice of bug bounty should be encouraged with sustainability.

CoinDesk - January 05, 2023 at 2:00 AM UTC

Coinbase's share price went up more than 9% after the news.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.