M3TA Recap: February 13 – February 19, 2023

BTC remains resilient despite regulatory scrutiny on Binance and negative economic news from the Fed.

Top performers (7D)

Conflux Network - CFX: +318%

Price as of time of writing: CFX/USDT - 0.22

Conflux Network is the only government-endorsed permissionless blockchain network in China. Its Conflux native token (CFX)’s surge was in line with its partnership with China Telecom to create new SIM cards called BSIM. The BSIM will be used to manage and store the user’s public and private keys in the card and carry out digital signatures so that the private key does not exit the card.

Despite the innovative relationship between a Web2 and a Web3 company, it is yet clear how a hybrid PoW/PoS blockchain can facilitate the adoption and effectiveness of SIM cards in reality.

Stacks - STX: +135.8%

Price as of time of writing: STX/USDT - 0.7

Stacks is a smart contract layer built on top of Bitcoin. It enables decentralized applications, such as decentralized finance, non-fungible tokens (NFTs), and more.

The price increase of the STX token was partly influenced by the Turkey fundraising initiative of the NeoSwap CEO. The idea was announced last weekend.

Another plausible reason could be the recent announcement of the “Building on Bitcoin Hackathon”.

This virtual hackathon is a free opportunity to experiment with Clarity, an easy-to-learn programming language for writing smart contracts on the Stacks 2.0 blockchain. The hack will let you experiment and familiarize yourself with Clarity’s developer environment. Clarity provides native functions that make it easy for developers to create complex smart contracts while protecting users at every step.

Cocos BCX - COCOS: +204.9%

Price as of time of writing: COCOS/USDT - 2.1

Cocos Blockchain Expedition is a full-stack DAO for games development that aims to enable fair and smooth operations for a high-quality game environment. Cocos-BCX provides connectivity to the game maker community through GameFi incubation, investment, distribution, IGO, and community.

Cocos’s recent partnerships with the likes of Ethereum and EOS have helped to increase its appeal to investors. The company has also partnered with major exchanges such as Binance and Huobi, helping to increase its liquidity and trading volume. They have also just released a decentralized exchange (DEX) and a smart contract platform.

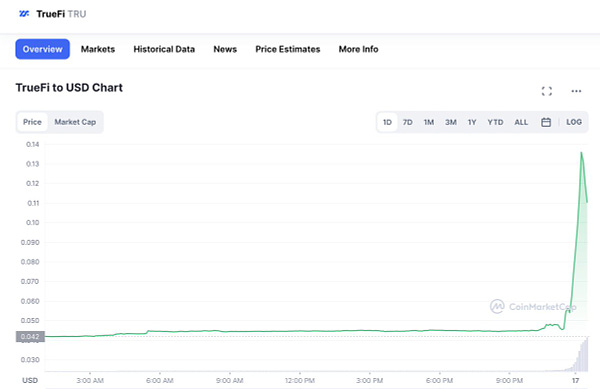

Truefi - TRU: +86%

Price as of time of writing: TRU/USDT - 0.078

TrueFi connects lenders, borrowers, and portfolio managers via smart contract protocol governed by the TRU token. The platform allows lending facilitation between participants in the digital asset credit markets.

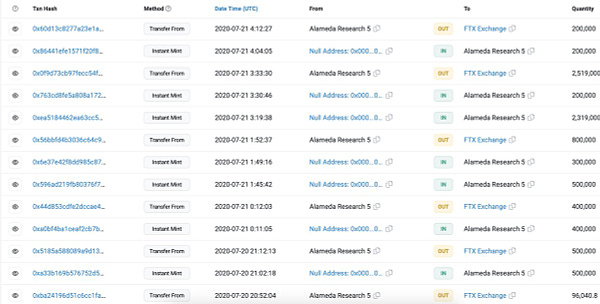

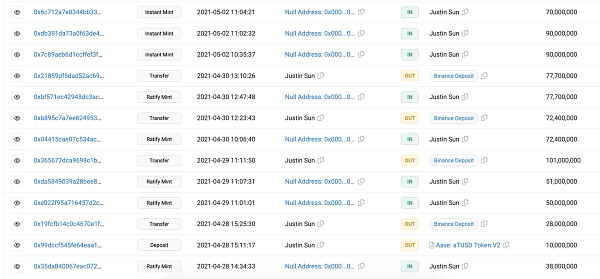

The recent price jump could be a “blessing in disguise", caused by the recent news that Binance has begun minting 50 million True USD (TUSD/USD) stablecoins. It seems that in the past, Truefi did release TUSD, but no longer does.

The minting move came after the US SEC began regulating Binance's native stablecoin, Binance USD (BUSD/USD).

Filecoin - FIL: +76.9%

Price as of time of writing: FIL/USDC - 8.6

Filecoin is a decentralized data storage blockchain that has played quite a big part on China’s token chart. The positive price action of its native token FIL was possibly caused by the recent buzz surrounding the imminent launch of the Ethereum-compatible Filecoin Virtual Machine (FEVM) on March 14.

The addition of FVM to Filecoin will introduce smart contracts and enable developers to design dApps, build games, implement liquid staking and create data-centric DAO. Being interoperable with the Ethereum Virtual Machine (EVM), the chain would form cross-chain bridges, enabling crypto funds to move from one blockchain network to another. These features are supposed to bring down user gas fees and increase transaction speed.

Top losers (7D)

LooksRare - LOOKS: -22.2%

Price as of time of writing: LOOKS/USDT - 0.23

Baby Doge Coin - BABYDOGE: -21.2%

Price as of time of writing: BABYDOGE/USDT - 0.000000003263

Tornado Cash - TORN: -17.3%

Price as of time of writing: TORN/USDT - 8.9

Onyxcoin - XCN: -12.4%

Price as of time of writing: XCN/USDT - 0.01230000

Evmos - EVMOS: -10%

Price as of time of writing: EVMOS/USDT - 0.3800

While some investors may be alarmed by the recent price decrease of certain tokens, it is important to note that this may simply be a natural adjustment after a prolonged period of growth and positive performance in the market.

News Highlight

CoinDesk - February 14, 2023 at 16:00 PM UTC

The launch has been set for March 27.

Polygon will release more details leading up to the March date in the coming weeks, with security as the highest priority.

ZkEVMs are a type of Zero-Knowledge rollup that increases transaction speed and reduces cost on layer 2, sending transaction data back to the Ethereum mainnet using "proofs" to ensure transaction security.

MATIC - the native token of Polygon - was not witnessed to make any sudden uptick or downturn in price action following the news.

CoinDesk - February 13, 2023 at 8:27 PM UTC

GMX generates over $5M in fees in 24 hours, briefly surpassing Ethereum as the largest DeFi revenue generator.

Total fees accrued since September 2021 have amounted to $120M, indicating fundamental strength for GMX's native tokens.

M3TA has also just released a comprehensive analysis for GMX margin trading on Arbitrum blockchain with insights into fees as well: https://m3talab.io/post/gmx-dex-analysis-insights-on-user-behavior-and-margin-trading

CNA - February 18, 2023 at 5:33 AM UTC

Binance considers pulling back from US partners after facing regulatory scrutiny.

The company may de-list tokens from firms based in the US, such as Circle's USD Coin stablecoin.

Binance had secret access to a bank account belonging to a US partner and transferred money to a trading firm managed by its CEO, Changpeng Zhao.

Macro

The Federal Open Market Committee (FOMC)

The FOMC - one of the most important governmental financial agencies of the US - holds meetings eight times each year. At these meetings, the Committee reviews economic and financial conditions, determines the appropriate stance of monetary policy, and assesses the risks to its long-run goals of price stability and sustainable economic growth. Open market operations (OMOs) - the purchase and sale of securities in the open market by a central bank - is managed by the FOMC.

January CPI (Consumer Price Index which measures the price of consumer goods and how they're trending)- at 6.4% fell short of market expectations at 6.2%, but marked the 7th consecutive month of decrease since peaking in July 2022.

Core CPI (CPI excluding food & energy) perched at 5.6%, higher than forecast (5.5%) but down from 5.7% last month.

US Retail Sales rose 3% in January, surpassing economists' expectations for a 1.8% increase and marking one of the biggest monthly increases in the past 20 years.

January's producer price index (PPI) which measures price change from the perspective of the seller rose by 0.7%, exceeding the estimated 0.4% increase.

The core PPI, which excludes food and energy, rose by 0.5%, beating the predicted 0.3% increase.

Jobless claims slightly decreased to 194,000, below the estimated 200,000.

Recent economic indicators suggest that the US is still struggling to control its inflation rate. Higher-than-expected CPI (Consumer Price Index), Retail sales, and PPI (Producer Price Index) all point to this trend, which could lead to the Federal Reserve increasing interest rates to try and slow down inflation. Comerica's Adams predicts that the Fed will raise its fed funds rate by a quarter percentage point at each of the next three meetings (in March, May, and June), leaving it in a range of 5.25% to 5.50% before pausing.

The announcement of such rate increases is often met with negative reactions from the stock market, which typically experiences a downturn as a result. However, the cryptocurrency market seems to be immune to such effects, with Bitcoin reaching new all-time highs every week. Recently, Bitcoin reached a new high of $25,260, a remarkable feat for the digital currency. As always, the world of finance can be unpredictable, but keeping an eye on economic indicators like CPI, Retail sales, and PPI can help investors make informed decisions about where to put their money.

China boasts the world's second largest economy and has recently expanded at a pace ~2.2% faster than the US.

The People's Bank of China (PBoC) is the world's third largest central bank with ~$6T in assets and plays a key role in global liquidity.

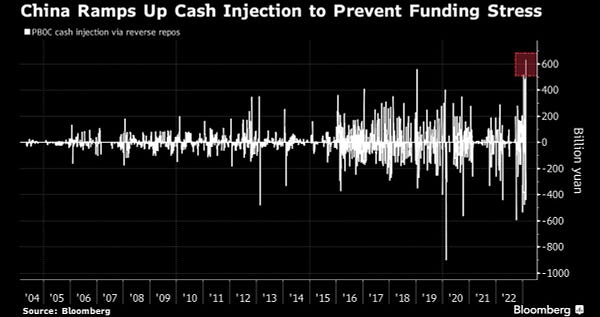

The People's Bank of China (PBOC) has injected a record-high amount of short-term cash into the financial system to address liquidity concerns and support economic growth.

The funds will be used to support small and medium-sized enterprises (SMEs) that have been struggling due to the impact of COVID-19 and to maintain stability in the financial system.

The overall impact on the economy is expected to be positive, as the injection of funds is likely to boost economic growth and improve liquidity in the financial system. It could also increase speculation in the cryptocurrency market as investors look for alternative investments to park their excess liquidity.

The PBOC's move to inject liquidity is different from the US Federal Reserve's recent moves to tighten monetary policy to address inflation concerns. The PBOC's focus is on maintaining liquidity in the financial system and supporting economic growth, while the Fed is taking steps to rein in inflation by raising interest rates and reducing asset purchases.

A worthwhile Twitter thread to dig deeper behind this phenomenon with macro data-backed:

By keeping interest rates low, the Chinese government aims to encourage people to buy homes or goods, which in turn helps to support the broader economy. However, despite the government's intentions, many Chinese consumers are not using the low-interest rates to buy goods. Rather, they are using the money to prepay their mortgages or invest in the stock market. This trend is likely due to the Chinese people's wariness of the COVID pandemic and the uncertain economic future. They are stocking up on goods and limiting their spending on non-essential items to invest their money, hoping to build a more secure financial future.

Micro

CoinDesk - February 14, 2023 at 6:14 PM UTC

CRV token gained 11% in 24 hours due to current hype for decentralized stablecoins.

Curve's upcoming crvUSD token is highly anticipated in the crypto community.

The proposal required for crvUSD to function autonomously was teased by Curve, potentially causing demand for CRV.

Traders took notice, leading to over $770 million in CRV trading volume on crypto exchanges.

NEWSBTC - February 18, 2023

Filecoin is launching the Filecoin Virtual Machine (FVM) on March 23

FVM brings smart contracts and user programmability to Filecoin Mainnet

FVM is compatible with Ethereum Virtual Machine (EVM)

Filecoin network can support multiple VMs, providing benefits to an open data economy

FVM will enable Filecoin to serve many users.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.