M3TA Epic Recap: 2022 A Year in Review

We get it - 2022 was eventfully brutal, but in all fairness, that is not all it was. Let's take a stroll down the memory lane and close the 2022 chapter together, shall we?

Introduction

The moment COVID came to pass, it was impossible to imagine anything worse than COVID itself could have happened to the economy. However, there’s a high chance crypto holders and investors in 2022 would state the opposite.

As the year headed on, swelling inflation rate across the world settled in, pulling people back to a bearish reality from the bullish hype that 2021 had instilled in their mind.

Inflation was just the start. As a majority of investors could recall, most catastrophes incurred last year were largely a result of ‘centralized greed’ - an unofficial term M3TA coined first for 2022, and for 2022 only.

Centralized greed describes how a small group of individuals in financial power were able to take advantage of public trust in order to accumulate personal benefits behind doors. They did this by introducing attractive, yet unsustainable, schemes that take custody of clients’ funds. While things were on good terms, clients were not instructed carefully to understand the stake at hands. But when things took a turn for the worse, clients’ interests were nowhere near the top priorities of these scheme architects.

In a bullish market, the centralized greed of certain entities managed to remain hidden. However, when the market shifted to a bearish trend in 2022, it exposed all the flaws and vulnerabilities in the industry.

This includes:

poor design and implementation of the allegedly safest digital asset ($UST stablecoin)

risky and overleveraged trading from hedge funds, crypto brokers and lenders without strict insurance requirements (Three Arrows Capital/ 3AC, Voyager Digital and Celsius)

assets with no sound store of value ($UST-$LUNA, $CEL, $FTT)

a $32B house of card with flimsy assets in reserve (FTX)

complicated relationships between brother-sister companies, allowing for ill-supervised balance sheets and tangled fund management (FTX and Alameda Research)

and most importantly

the failed delivery of credible figures at the time (Zhu Su and Kyle Davies of 3AC, Alex Mashinsky of Celsius and Sam Bankman-Fried of FTX)

While the public media had made extensive efforts to cover those events quite well within the year, M3TA would prefer to take a closer look on last year’s market movement instead. This could help investors understand how the market reacted during the chaotic recession, from macroeconomic impact to factors of microeconomy: equity, cryptocurrency, DeFi, stablecoin and CBDC. (*Hint: inflation was behind almost all of these movements!)

We also picked out ‘winners’ for each nominated category that represents last year’s most significant events at the bottom of this article FYR.

Enjoy your read!

A 2022 Financial Retrospect

Macroeconomy

Macroeconomy explores how the market behaves as a whole. Its analysis, therefore, focuses on general factors such as economy-wide events, inflation, unemployment, pricing, productivity and decision made by (inter-)national agencies, etc.

Inflation got the best of the market while fractured geopolitics is poised to stand in the way of economic growth

Towards late 2021, inflation rates skyrocketed. The last month of the year suffered inflation pressure at 6.8% - the highest point since 1982. At the next year’s onset, the market started to show weakening signs as Fed and central banks around the world tightened their monetary policy. This has usually been an attempt to hedge against the current consumer price spike.

However, the inflation-controlling attempt did not lessen throughout the year, as June 2022 witnessed the 9.1% climax of inflation rate over the past four decades. If you can recall, it was around this time that food and gasoline prices also soared. Despite the cool-down 6.5% in December, the latest report from Fed stated that the agency will keep influencing the rate hike further into 2023.

Not only in the US does inflation pose a threat, but it will also become the second-most-cited risk to the global economy next year, according to 1,192 respondents of a survey conducted by McKinsey & Company (top 3 global management consulting company). However, inflation remains the most threatening factor when it comes to the case of each country.

The top-potential threat to economic growth in 2023 was reported to be geopolitical unrest. Indeed, we have witnessed all too well the scar that Russia-Ukraine war left on both humanity and economy last year. In addition to this outbreak, there is an on-going undertow of political conflicts in other areas as well, namely:

The Collapse of the Arctic Council: undermining post-Cold-War stability

North Korean conventional weapons tests: increasing imminent clashes between Northeast Asia nations (South Korea, Japan, China and North Korea) in the coming 01 or 02 years

US-China microchip war: making it harder for China to access to advanced technologies, from AI, supercomputing to guiding weapons

Microeconomy

Microeconomy deals with how each economic player makes decisions. These players can be enterprises, consumers, equities, and cryptocurrencies, etc.

Equity downturn

The equity market took a hard beating last year, as reflected by the MSCI ACWI index. Maintained by Morgan Stanley Capital International (MSCI), the All-Country World Index of stocks (ACWI) consolidates stock performance of 23 developed and 25 rising markets every year. As such, the index lost roughly 20% of its global value last year, the worst performance since the 2008 recession.

As the global market shrunk tremendously, the US stock indexes were far from immune. Nasdaq - the tech-centric stock index - slid over -30%, S&P 500 sank nearly -20% and Dow Jones fared the least negative at a 2022 return of nearly -9%.

Cryptocurrency took a triple loss while BTC set disappointing records

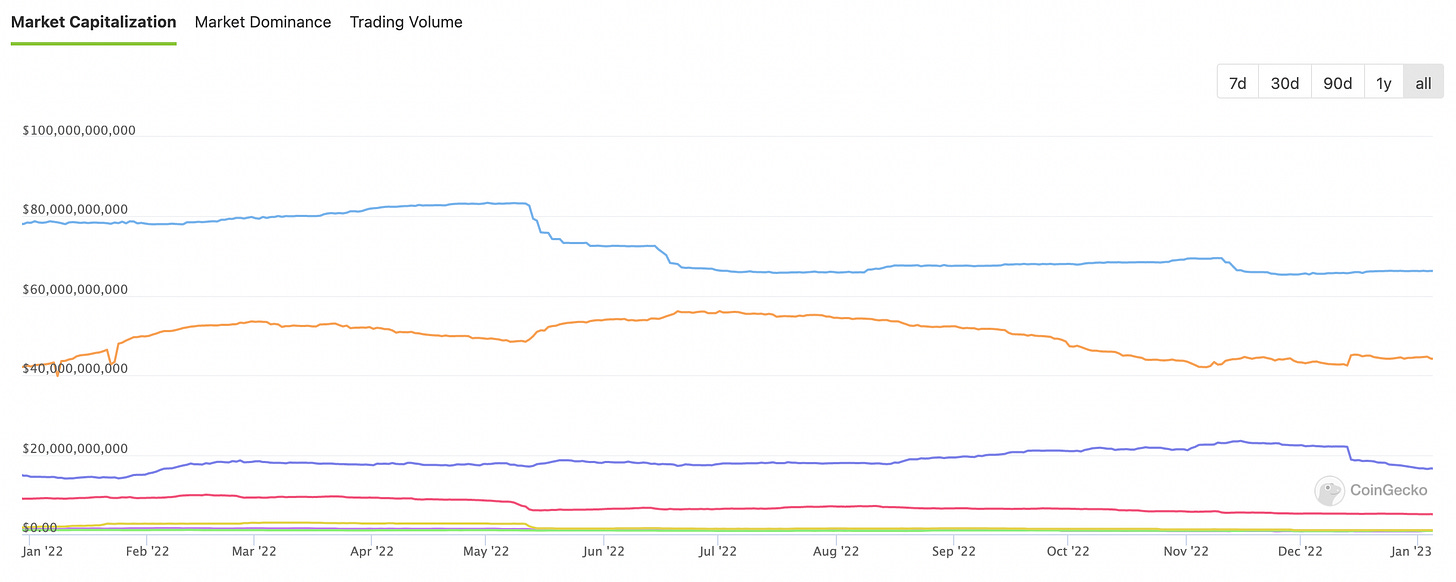

In cryptic words, let’s say the digital currency space was in turmoil. In solid numbers, the crypto market got pounded three times in total (Figure 3) as far as 2022 is concerned.

The pre-round occurred when the rising inflation near the end of 2021 pushed a majority of investors to be more risk-averse. They tended to migrate their investment to assets that were considered safer. This means cutting ties with volatile digital assets, including Bitcoin.

The largest digital coin by market cap was hugely affected by this act, seeing a 19% whipsaw in December 2021 and another 20% in January the following year.

Bitcoin was sometimes crowned the “digital gold” in the past, as a sound store of value without being affected by external factors such as geopolitical unrest and inflation rates, like gold. Yet, 2022 demonstrated clearly this was not the case, because the price of Bitcoin did plunge when inflation rate swelled in January, and when Russia invaded Ukraine in February - aka the first hit of 2022 on the crypto industry.

Another reason why Bitcoin was said to have lost its highly regarded title was that the coin had started to mimic the movement of digital stocks on the market since late 2021. As equities climb, BTC rises. As equities fall, BTC follows.

Although Fed was able to temper with inflation according to their monthly plan, they still have not achieved their 2% goal within 2022. Therefore, combined with the observation of the surging macroeconomic inflation, we can safely say that a new cycle has not yet been dawned on the crypto market. We’re still on the later end of recession and it will be hard to see any major change in market conditions in 2023.

Beside BTC price, there is another trusted metric that helps investors decide when to buy or sell: the Crypto Fear & Greed Index (CFGI). It measures how people are feeling about the market. The index puts emotions into 5 zones, with a score of 0-100. A higher score means people are feeling optimistic and a lower score means people are feeling more pessimistic:

Extreme Fear (0-20): investors feeling anxious and pessimistic (buy signal)

Fear (21-40): investors feeling more hesitant and less confident

Neutral (41-60): investors feeling neither particularly bullish nor bearish

Greed (61-80): investors feeling more confident and optimistic

Extreme Greed (81-100): investors feeling complacent (downturn signal)

2022’s sentiment was definitely not for the faint of heart. The overall sentiment refused to break the shell of Neutral at 60. There are some points as of mid-May to late June where the index could go as low as 10 to 6 points, possibly stemming from consecutive collapses of Terra-Luna, 3AC, Voyager and Celsius taking place at this time. These events have evidently pushed most investors to the brink of crypto-insanity.

Going back to BTC’s last year performance, the token garnered quite a few records as it strolled along 2022. Observation made by CryptoCompare from Nov 2021 (when BTC’s price reached its historic peak) to the same month of 2022 (when FTX exploded) showed how many BTCs had left centralized exchanges to be secured offline.

Data showed that around January, October and November last year, a large load of BTC was removed from exchange platforms. The historic record was established by November 2022 figure, after the centralized and manipulative FTX’s debacle had shattered investors’ trust in handing asset custody over to central entities. This insight also realized a “bullish” prospective for the future: the less deposits were on an exchange, the longer investors were “HODLing” their BTC.

To put it lightly, the price performance of major digital currencies, beside BTC, in 2022 was not the best to have made the history book. Examine the following list of tokens in order of their market capitalization (biggest to smallest):

BTC: -64%

ETH: -68%

BNB: -52%

XRP: -52%

ADA: -73%

DOGE: -60%

MATIC: -70%

SOL: -94%

On-chain data also provided us another BTC record set by 2021-2022: BTC’s price experienced a four-quarter streak decline, smashing previous three-quarter streaks held by 2014-2015 and 2019-2020 periods. To break it down further, 8 months of 2022 was submerged in the red zone while only the remaining 4 months within the same year saw slight upticks in green.

By the end of 2022, BTC price had dropped -74% since November 2021 peak value of roughly $70K while the token’s market cap had shrunk to $326B.

BTC’s trading volume also faced a bleak outlook with averaged 24H trading volume revolving under $10B daily, which was three to four times less than that of previous years.

Despite having to weather mostly rough days in 2022, BTC managed to score a historically low volatility index at the 11.46 benchmark during the last few days leading to New Year, nailing its third record in 2022 as well as giving people a new hope for the token’s price next year.

Low volatility is usually a good sign for a token’s price as the situation inherently forces out arbitrage traders and derivatives ones - without volatility, there is essentially no market for these two. At the same time, it attracts more long-term holders who consider BTC more as a sound store of value rather than a type of financial leverage. The more people choose to hold BTC, the more resilient the token will be against market volatility.

The incidence could have also overlapped with the fact that a majority of BTC miners halted their operation during this period of holiday. No mining might have led to no BTC selling activity, either - which stabilized the price tremendously.

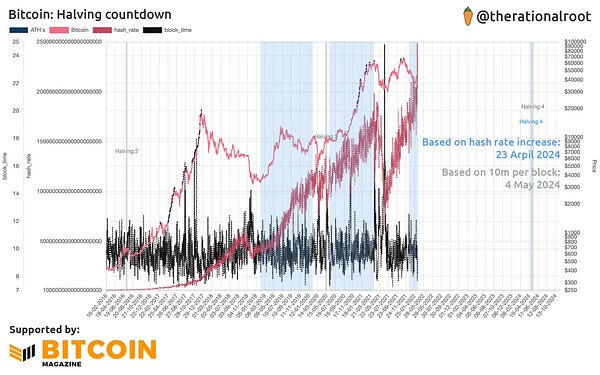

Speaking of price, halving mechanism also had its share in affecting BTC’s value. BTC halving process involves dividing miners’ rewards into two on Bitcoin. It aims to curb the token’s supply, control inflation and, consequently, amplify BTC price. In other words, the mechanism was introduced to make it harder to obtain Bitcoin, hence the price appreciation. The process takes place every 4 years. The resemblance in time frame and magnitude could make it the Olympic of cryptocurrency.

Before the first BTC Olympic, mining rigs were able to mine 50 BTC per 10 mins. After 2012 halving, the rewards shrunk in half to 25 BTC per 10 mins and consecutively to 12.5 BTC per 10 mins in 2016. The latest halving occurred in May 2020, and since then, the chain has been paying miners 6.25 BTC per 10 minutes.

As of the next halving, some experienced traders and analysts have attempted to put forward their estimation, resulting in inconclusive dates. But generally, most analysts listed April and May among their closest predictions.

The next halving will further cut down the mining rewards to as low as 3.125 BTC per 10 mins. Logically, as supply shrinks, demand sustains or even rises, BTC’s value will ultimately appreciate. This has been proven by previous halving durations with 2013-2014 frame witnessing a staggering price jump of 9.5 thousand %. But before the price acceleration happened, Bitcoin would move sideways first, also proven by the last 2 halving events.

DeFi: stable-bluechip staking and derivatives were the ways to go

DeFi stands for decentralized finance - an umbrella term for all peer-to-peer financial services and products conducted by anyone who has access to ETH (to pay gas fees). DeFi stands as a separate section because it makes up a large portion of digital asset tradings and their diverse range of innovations matter significantly to the well-being of the crypto industry.

In 2022 DeFi got pounded by the macro-market the most. Liquid staking became more relevant for investors in turbulent times when they were exposed to small or almost no risk of impermanent loss. Lending’s APY is not attractive enough for providers. Derivatives trading generated more growth for DeFi and even multiplied popularity for new protocols of the same sort. ETH experienced downturn on the whole, but were held off exchange more often and made a significant impact in liquid staking.

DeFi’s number:

1. Lido

Type: Liquid staking

Performance: roughly 3x ETH staked by December

2. MakerDAO

Type: Lending & borrowing, stablecoin minting

Performance: 86% plunge in revenue in Q3 2022, only $200M behind Lido’s TVL

3. Aave

Type: Lending

Performance: 75% decline in TVL, $2.8B behind MakerDAO’s TVL

4. Curve Finance

Type: Stablecoin-centric decentralized exchange

Performance: released whitepaper for crvUSD stablecoin in Q4 2022, only $100M behind Aave’s TVL

5. Uniswap

Type: Ethereum-based decentralized exchange

Performance: still dominated the decentralized swap scene, only 12% of active decentralized traders did not use Uniswap in 2022

When linked with the surging inflation rate of macroeconomy and the risk-averse sentiment of investors to take shelters in low-risk assets in 2022, the narrative undoubtedly had influence on DeFi. This was shown in the products investors chose to deposit the most funds in.

As proven by Nansen’s data, liquidity pools of stable or ETH pairings on Uniswap prevailed with close to $250M locked in 2022. As stablecoin trading pairs present low slippage and ETH informs deep liquidity, these were considered sound investments in an arid bear market.

M3TA’s data aggregation of stablecoin pairings’ TVLs also displayed a consistent trend across different DEXs. Learn more here.

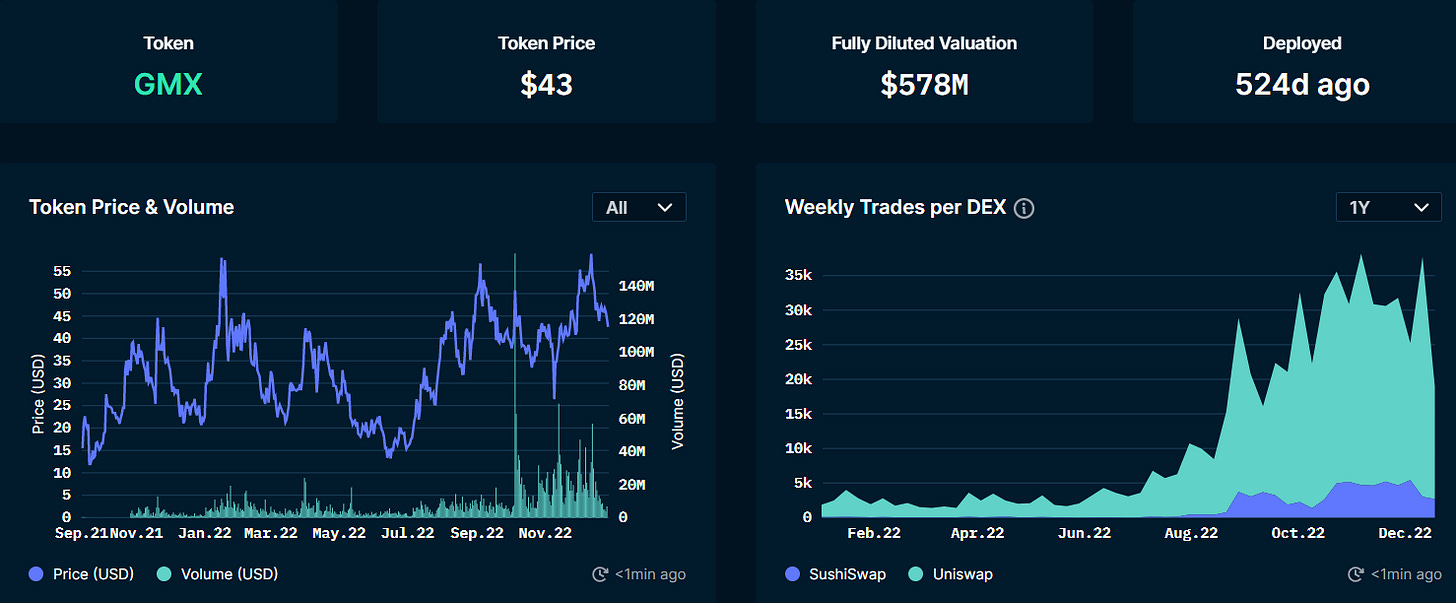

Despite the ups and downs of 2022 in leverage trading, perpetual futures trading still caused a bang in the DeFi market, managing to take a larger market share at 7.9%. Tradings using perpetual derivatives are different from spot ones. Instead of buying or selling tokens, you deposit collateral and take long-short positions. The leverage could be as high as 50x, in the case of GMX - one of the leading perpetual dApp. Beside GMX, there were other noticeable players, too: Rage Trade, dYdX, ApolloX, and Perpetual Protocol with each dedicated to serving users on different Layer 1 networks and mostly handling under $100M in transaction volume per day.

On the other hand, there were a few aspects that did not fare so well, among which was liquidity mining, lending protocols and yield farming.

Impermanent loss was too heavy to bear in high-volatile pairs for liquidity providers so they had to tremendously pull out of mining pools. In contrast to liquid staking (which fared the best in 2022 and led by Lido), yield farming had the worst performance of the year with 85% market cap fallout and 4.1% share contraction, according to CoinGecko. In terms of market share, lending protocols (led by Aave in top 5) had seen better years than the last one with as high as 12.5% plunge.

ETH reserve on exchanges led its downward trajectory (Figure 8). Exchange reserve shows the total number of coins held in wallets of all exchanges, in this case, the total ETH held in exchange wallets.

In most cases, as the value in reserve goes down, it indicates an opposite trend in price and a low selling pressure. For derivative exchange, this indicates low volatility on the horizon.

In 2022, sharp declines were witnessed in July and November, moving in tandem with the collapse of 3AC, Celsius, Voyager Digital and FTX. Towards the end of the year, investors seemed to be more reluctant in selling the deep liquidity ETH, but more assured by securing the top altcoin off exchanges, possibly to self-custody.

Stablecoin: the ultimate settlement currency for crypto and a ticking bomb of massive destruction in 2022

Stablecoin is a cryptocurrency that pegs to a more stable asset, usually to a type of fiat currency (USD, EUR, KRW, etc.). In its nature, stablecoin is designed to hedge against volatility, and therefore, was highly sought after in such uncertain market conditions as 2022. Such success in public attraction mainly contributed to why the explosion of UST back in May was so scary and irreparable.

With UST’s holders hammered by Terraform Labs in May, we think stablecoins should be on our watchlist from now on.

Market cap: $28B vanished with USDT & Pax Dollar shredded by 15%, FRAX by 41%, TUSD by 42%, and DAI by 44%. 2 exceptions were USDC and BUSD, rising 5.4% and 16% respectively.

Stablecoin market cap comprises 18% of the total crypto market cap.Volume: +600% in 2 years

Total value settled with stablecoins: $7.4T (more than Mastercard, American Express, and Discover can handle individually)

There were still incidents when stablecoins were ‘not that stable’, or in crypto sleuth’s slang - they ‘depegged’.

UST: a (notorious) algorithmic stablecoin that employs the mint-burn mechanism by leveraging $LUNA token. With every $UST minted, you pay in $LUNA, which will be burnt to constrain $LUNA’s supply and consequently, uphold $LUNA price. The opposite is also true in the case of minted $LUNA. The centre point behind this model is arbitrageur - whose job is to sell $LUNA when $UST depegs below $1 and keeps the price in check. However, as worst came to worst, $UST crashed in an instance of 1 day, diving 99% off the cliff.

DEI: a cross-chain algorithmic stablecoin working on Deus ecosystem (a Fantom-based DeFi project), losing peg not long after the demise of $UST and other algorithmic stablecoins’ fallout. It is now trading at $0.23.

FlexUSD: an interest bearing stablecoin, redeemable for 1:1 with USDC that froze customers’ accounts and paused services after losing $1 peg in late June, currently trading at $0.3.

HUSD: a fiat-backed stablecoin that depegged in August once due to a liquidity problem caused by difference in banking hours, recovered and depegged again in October after Huobi decided to delist 20 HUSD pairings and switch to USDT instead. The coin is now trading at $0.1.

2022’s moral lesson is “nothing is truly safe”, including stablecoins. DYOR (Do your own research) , diversify your portfolio and always stay afloat of the latest market news. And with the rise of DeFi in recent years, investors should probably keep an eye out for DeFi-native stable tokens such as crvUSD (Curve) and GHO (Aave) with high utility in the space, rather than a store of value.

CBDC marathon: the race of payment innovation or of institutional power?

CBDC stands for Central Bank Digital Currency. As its name indicates, instead of cash (fiat money or paper money), this is a type of e-money issued by a country’s central bank. The concept is not new (the first CBDC project was incubated in 1993 by the Bank of Finland), but there are some reasons for why central banks have recently taken a keen interest in this type of currency:

Cash usage has declined while online payment risen, as stated in the Euro area study in 2022. This threatened the core role of central banks as the main cash issuer and handler in the increasingly digital world of money.

Monetary value is no longer preferably stored in cash or bounded within a country’s border. The acceleration of crypto ownership worldwide is an early sign that privately issued digital assets are being chosen as a means of saving or wealth multiplication rather than public cash programs on digital apps. Blockchain technology has also allowed digital assets to be lucid between borders, making it harder for banks to govern cash flows locally.

Illicit financing (terrorism, weapon purchasing, money laundering, etc.) is increasingly on the loose, partly due to obscure identification in decentralized space. Putting back the corporation of trusted parties like central banks in the digital world could be helpful for governments to impede these activities.

Soaring interest rates and ZLB of conventional cash (Zero Lower Bound: when interest rate is near zero, showing no stimulation for economic growth) can be controlled through another instrument - CBDC.

With those prevailing challenges above, you can imagine CBDC has various use cases, depending on the national citizens’ digitized demand for payment systems, as well as that nation’s monetary policy. For payment purposes, that could simply mean to become a one-stop shop for storing and paying for things online (Challenge 1).

Nevertheless, a majority of CBDC projects to date has emphasized more on the latter (from Challenge 2 to Challenge 4). That is how governments and banks can gain back their influence on the financial systems again through CBDC.

The bull run of 2021 caused an influx of digital asset interest and an explosion of capital, leading to several central bankers deciding to integrate CBDC and meet market demand.

However, as of inflation-driven 2022, the operability rate significantly slowed down. In the same year, there were 70 CBDC projects across the world releasing their update, making up more than half of the total 129 active CBDC projects, according to CBDC Tracker. Among those projects announced last year, only 2 was launched, 46 are still in the early Research stage, 13 are now in the Proof-of-Concept stage (advanced research), and 7 are going under Pilot, meaning their functions and features are being tested in a small selected group of users for a period of time before public use.

Leading the talk of Pilot games in 2022 was China’s retail e-CNY. Launched in April 2020, the currency’s pilot is considered to be the longest CBDC trial to date with roughly $2B in circulation by the end of 2022. The uptake was still considered slow (15% growth in December 2022) and did not even represent up to a fraction of the circulating 10.47 trillion yuan at the time. These results came despite several use cases had emerged for e-CNY such as: currency for paying things via WeChat Pay and AliPay, payments for government-related fees, tax refunds, funds for helping people in need and insurance payments, etc.

China is also notoriously known for banning crypto trading back in 2021 as well as exercising overwhelming control over its citizens. That’s why, up to now, user privacy of e-CNY still turns a heated debate when mentioned, even though the People’s Bank of China had claimed that they are ‘pro-privacy’ this time. Should the government find unusual activities in any of one’s transactions or even in one’s daily life activities (opposition to national policy, inappropriate speech, etc.), such centralization also poses a threat to their funds.

2022 also made some countries rethink on their CBDC’s operability.

The DBS Bank of Singapore halted their retail project in March, citing mass use cases ‘not compelling’. This was reasonable with a country with a fast, cheap and efficient digital financial network, they said. Though later in November, they announced a wholesale project, highlighting the application of AMM (Automated Market Maker) to their wCBDC token.

If financial inclusion (the percentage of people owning a digital device to access to CBDC) became the strong indicator for Singapore to drop a CBDC project, it stood as a drawback for Philippines’s defunct retail project. Philippines dropped out of their retail CBDC plan just after more than 3 months of researching. Beside large gap in digital access, the 2nd-ranked country on the crypto adoption index also reasoned that they did not want to squash the competitiveness of ‘private players’ by issuing a retail CBDC.

CBDC projects in 2022 were yet to show no signs of considerable added value for users, compared to other virtual currencies. So far, however, it has offered the closest lenses to observing how banks would overcome their ‘identity crisis’ against digital assets. Obviously, their ultimate goal is to assume the centralized role for virtual assets. But to achieve that, there are some hoops they would have to jump through first: large-scale investments, suitable technology application, adoption incentives, unclear use cases, disproportionate debit-lending models with fiat money, etc.

2022 M3TA Staff’s Choice

Biggest Crypto Exploit: Ronin Hack | March 2022

In 2022, one of the largest cryptocurrency hacks in history took place on the Ronin chain. The hack was a result of a compromise in the smart contract code, which allowed the hackers to steal a total of 173,600 ETH, valued at approximately $590 million at the time of the hack, and 25.5 million USDC. The root cause of the vulnerability was traced back to 2021, when Axie Infinity made the decision to sacrifice security measures for network throughput due to excessive demand from users.

The Ronin Hack was just one of the 192 exploits that took place in 2022, which resulted in a total loss of $3.57B in value.

Most Dramatic Collapse: Terraform Labs, $UST, $LUNA | May 2022

Luna went from the 8th largest cryptocurrency by market capitalization to…essentially, the bottom.

$LUNA value loss: 133% (from an all-time high $119 to $0.000158) at the time of press

Ecosystem market cap loss: $60B (compounded)

Impact: BTC plunged 50% from its all-time high in November 2021; ETH plunged 20% compared to 2 days prior to the fall; DeFi TVL across the board dumped 43% in the third week of May, compared to 2 weeks prior.

Learn more in detail about Luna’s crash in our deep-dive article published in May: The Downfall of Terra Luna.

Toughest Crypto Sanction: Tornado Cash | August 2022

OFAC added Tornado Cash and 44 other associated wallets to its Specially Designated Nationals (sanction) list.

Tornado Cash is an Ethereum-based mixing service that corrupts transaction history. In other words, Tornado Cash makes it impossible to identify a wallet’s journey. Due to its untraceable nature, Tornado Cash can be deployed as an assisting tool for criminal acts, such as money laundering for illicit gains through theft, hack, ransomeware, fraud and terrorism.

According to the cryptocurrency analyst firm Elliptic, by August 2022, Tornado Cash had laundered at least $1.54B worth of crypto, out of over $7B total deposits on the platform.

Many investors protested that the OFAC penalty was for the technology itself instead of the organization behind it, though it’s essentially impossible to shut down the technology.

Most Criticized Man & Woman: Sam Bankman-Fried & Caroline Ellison | November 2022

Beside fraudulent attempts, co-mingling fund behind doors, price manipulation and lying, Sam Bankman-Fried also managed to get away with imprisonment on an unusual bail (?!). His perpetual partner in crime, Caroline Ellison is also the subject of hate for a number of reasons, including her association with Alameda Research and FTX, which is known for market manipulation, and her perceived role in perpetuating the same.

A certain number of companies that have surfaced to assume substantial exposure to FTX include:

Genesis Trading (OTC Desk & Crypto Lender): $175M

Amber Group (Market Maker): <10% trading capital

Voyager Digital (Crypto Brokerage): FTX used to bid $1.4B to acquire the firm

Multicoin Capital (Investment Fund): 10% Master Fund’s assets, accounting for -55%

Galois Capital (Investment Fund): 50% fund

Most Hyped Event: Ethereum’s The Merge | September 2022

The Merge was an event proposed by core developers of Ethereum network to start a new version of their blockchain - Ethereum 2.0. The new chain made a mass exodus of miners in proof-of-work mechanism, and gave way to a set of new validators in proof-of-stake mechanism. These validators now assume the responsibility of running the network.

The Ethereum community has been waiting for The Merge to take place since May 2021. After much tease and delay, The Merge finally took place on Sep 15, 2022. The most anticipated upgrade was conducted without a glitch and even brought ETH to its deflation zone for the first time.

Learn more about Ether’s deflation status in another article we published in December 2022: Does Deflation Suit Ether?

Most Impactful External Worldwide Affair: The War of Russia and Ukraine | February 2022

The recent fall in cryptocurrency prices was partly due to actions taken by Russia and Ukraine against cryptocurrency mining and trading. According to experts cited in Time, some believe that this could be the start of a larger trend of government intervention in the cryptocurrency market, while others reckon that it is just a temporary setback.

Conclusion

It is true that the crypto market has always been resilient. It is also not wrong to say that events taking place last year have left behind irreparable damages and bitter lessons for not only retail investors, but professional and institutional investors as well.

The year caused an array of sudden, yet reasonable demises, mostly from organizations that employ leverage strategies to multiply their short-lasting financial gain. This type of approach could be said to work in a bull market condition, but it will surely bust under the pressure of a bear market, as proven by last year. Despite the unfortunate consequences, the mega-destruction also happened for the better.

Cryptocurrency, metaverse and web3 are still such nascent industries that neither shortcuts nor solid prediction would hold at this time. Only changes are constant. At M3TA, we believe changes are a thing of the present, and they stem from perspectives. Perspectives take time, yes; but it is rather that than another death spiral dragging down the whole community, while only ill-intentioned opportunists benefit.

Some BUIDL pioneers of the industry has clearly realized this sooner than others. As a result, a wave of realistic use cases for blockchain technology has recently emerged to back these ideals. Follow us to the upcoming article of “2023: The Year Forward” to see where the crypto sphere is heading to this year.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.