M3TA 101 - Episode 5: What is NFT Wash Trading?

This fifth episode of M3TA DeFi 101 gives a careful explanation of NFT wash trading, how to spot them, a M3TA-made case study along with a brief understanding of the recent Blur's incident.

Abstract

The trading of non-fungible tokens (NFTs) has long served a vital role in DeFi marketplaces. Yet the booming NFT market has also triggered unethical practices like NFT wash trading.

This fraudulent activity can, first and foremost manipulate marketplaces, especially ones that deploy incentives in the form of token rewards to traders with high trading volume. Secondly and more importantly, this practice deceives other traders and investors, leading to distorted market prices and decreased confidence as well as integrity in the concept of digital arts.

As you can see, the issue of NFT wash trading is quite damaging and there are multiple factors contribute to its prevalence. By breaking down the concept of non-fungible tokens (NFTs) and NFT wash trading with an illustrative example from our readily available dashboard collection, this M3TA 101 attempts to give you the simplest explanation on the deceitful scheme that is often right in front of your eyes.

As a data aggregation and analytics firm of Web 3.0, we also feel compelled to present some data-driven ways you can detect NFT wash trading on your own so that you may not fall for their manipulative schemes.

This article was done with a lot of help from hildobby on Dune, CoinGecko x Footprint Analytics, Chainalysis, CryptoSlate, DeCrypt, Forkast and M3TA Crypto Girlfriend Wash Trading dashboard.

Introduction

From artwork to music, collectibles to virtual real estate, NFTs have found their way into every corner of the internet.

As stated in The Chainalysis 2022 Geography of Cryptocurrency Report, NFTs have increasingly become a vital component of the DeFi ecosystem and the broader cryptocurrency industry, with Central and Southern Asia and Oceania (CSAO) countries serving as a prime example. (Figure 1)

Together with the staggering demand, their complex and overwhelming market daunts new traders in their decision-making process. As if this is not complicated enough, more and more new NFT platforms have entered the game, tipping the scale of competition among collections from “high” to “very high”.

This surely makes it so much harder for an average trader to prioritize which NFT collection or marketplace he or she should pay attention to. Naturally, they would have to rely on some visible metrics.

Beside platforms’ trading fees and creators’ royalties, one of the metrics which got instinctively picked is trading volume. This is logically understandable because an NFT’s price is either determined by how rare it is or how many people want to own it. In the NFT wash trading case, screwing the transaction volume falls into the territory of the latter.

This is where on-chain data analysis becomes necessary. Let us tell you why.

Imagine you are a security of a building, if only 20 people come in and out through the door per day, it is easy to spot who has shown up more than once and whether a person knows another, because your brain is capable of saving that little short-term memory for review. This is what an NFT seller and buyer can do without the need of using any tool.

But if we tell you, you got a promotion; you are now the head security of a shopping mall with an average traffic of more than 1,000 people per day. How would you detect if a person has come here 10 times within the past 24 hours and they have changed their clothes whenever they come back in?

This is what bare eyes cannot pick up and only by watching a few particular patterns from on-chain data can someone point out which transaction is organic and which one is washed.

But first, let us explain what NFT and NFT wash trading are all about.

What is NFT?

A non-fungible token (NFT) is a unique digital asset that represents the ownership or proof of authenticity of a piece of content or creative work.

Non-fungible

Cryptocurrencies such as Bitcoin or Ethereum, or any other currencies, are fungible (read our M3TA 101 Episode 1: The History of Money for more detail). One unit of Bitcoin is equivalent to another unit of the same currency. By contrast, NFTs are one-of-a-kind digital assets that cannot be exchanged on a 1:1 basis.

NFTs are minted (created) on a blockchain, which is essentially a decentralized, permanent, and transparent ledger that keeps track of ownership and transactions. Once NFT is minted, it is assigned a unique “ID" card” or “smart contract” that signifies the proprietorship of the asset and can be traced back to its original owner. This renders forging and destroying the NFT impossible.

The value of an NFT is determined by the market demand for that particular asset. For example, “Everydays: The First 5000 Days” (Figure 2) by the gifted artist known as Beeple was sold for $69M at Christie's auction house in March 2021. This closing marks the most expensive NFT to have ever been sold.

Following “Everydays”, a few of other NFTs have already been sold for millions of dollars, thus indicating the potential for explosive growth thanks to the increasing number of new market traders and how much they are willing to invest in trading this new type of digital assets.

Where Can you Trade NFTs?

NFTs can be bought and sold on various online marketplaces, such as OpenSea, Rarible, SuperRare, Magic Eden, Nifty Gateway, and Foundation. These platforms allow creators to mint and sell their own NFTs, while buyers can browse and purchase NFTs from different categories, such as art, music, videos, and more.

To buy an NFT, you need to have a cryptocurrency wallet that supports the blockchain on which the NFT is formed. The most popular wallets are MetaMask and MyEtherWallet. You can also use fiat currency to purchase NFTs on some platforms.

Once you have created your NFT or just simply want to sell your NFT, you can list it for auction on an NFT marketplace by setting a starting price (floor price) and a time limit. Then you wait for buyers’ bids.

Usually, as a seller, you would choose to sell their NFT to whoever bids the highest. However, sometimes, even the highest bid does not meet your price expectation. In this case, you would terminate the auction without completing any order.

But when someone purchases your NFT, meaning the price is reasonable enough, the transaction is recorded on the blockchain. You will receive the payment in cryptocurrency. The platform usually takes a percentage of the sale as a gas fee or a platform operation fee; some don’t, giving a freeway for wash trading; some charge royalties on behalf of creators; some even offer options for users to cross out royalties completely or reduce the required royalty tremendously, causing a big feud between the NFT creator community and NFT marketplaces.

But that is a story for another day.

What we need to focus here is the fact that this process clearly proves one thing: since it is significantly harder to sell an NFT and redeem fiat (which is money you can use in reality: USD, EUR, KRW, etc.), the NFT market is correspondingly less liquid and easier to be manipulated.

What is NFT Wash Trading?

NFT wash trading is a deceptive trading strategy where an individual or a group of individuals buy and sell the same NFTs to and from each other to artificially inflate the prices of the NFTs.

This appeals to a false sense of demand and causes the prices of the NFTs to rise rapidly. Once the prices reach a certain level, the group will sell their NFTs to unsuspicious buyers.

What these buyers do not know is that what they own is a balloon. It is destined to burst along with the plunge in the price of NFTs and the lack of liquidity, thereby incurring massive losses for investors. This destroys the investors’ faith in NFT through a wave of FUD (fear, uncertainty, and doubt), leading to a decline in the overall value of the crypto market.

Simple Breakdown

The most common method involves a group of traders colluding to create artificial volume and price increases. Here's how it works:

Step 1: Buy an NFT at a low price, say $100.

Step 2: Create clone wallets. Begin buying and selling NFT amongst themselves, creating a false sense of demand and activity around the NFT.

Step 3: As a result of fictitious trading by raising the price after each bid, the price of the NFT rises. The group then sells the NFT at a much higher price, e.g. $10,000, to unsuspecting buyers.

Step 4: Split the profits, with each member making a significant return on their initial investment of $100.

NFT Wash Trading Throughout the Years

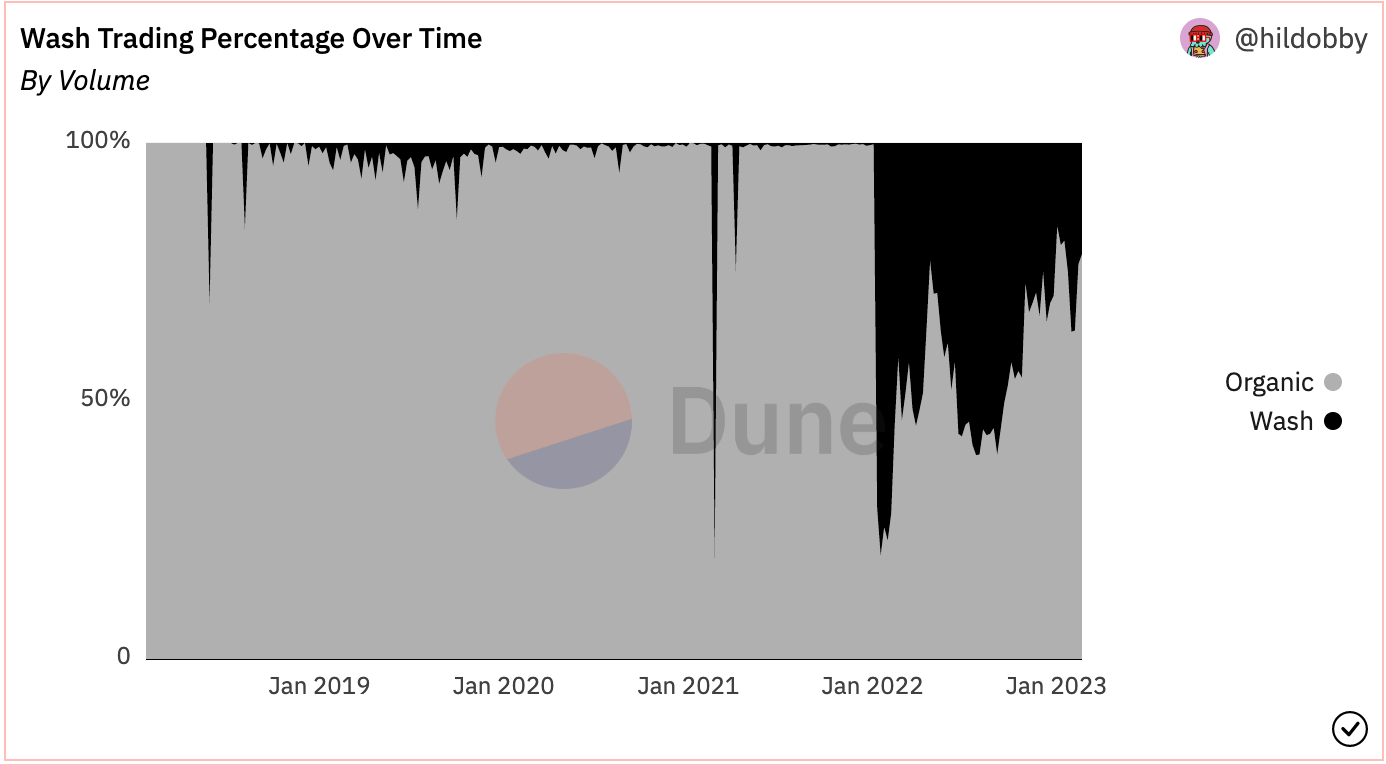

According to the data analyst

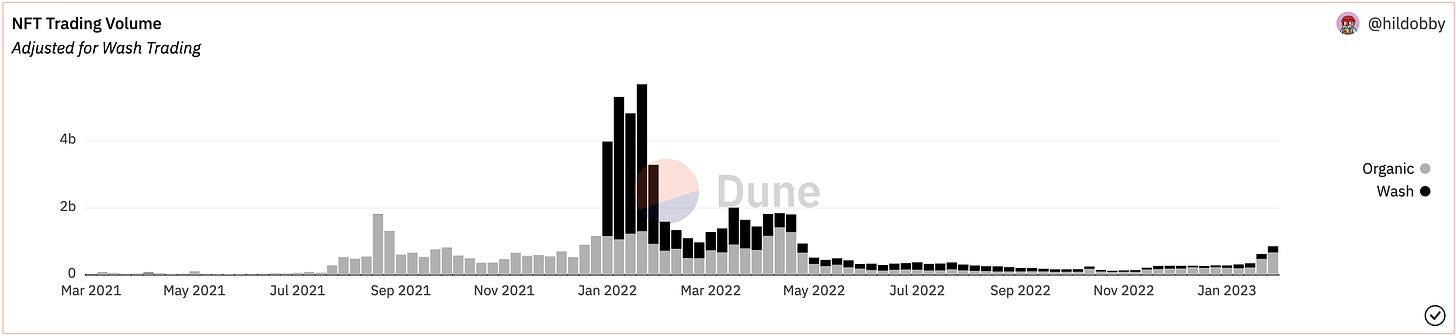

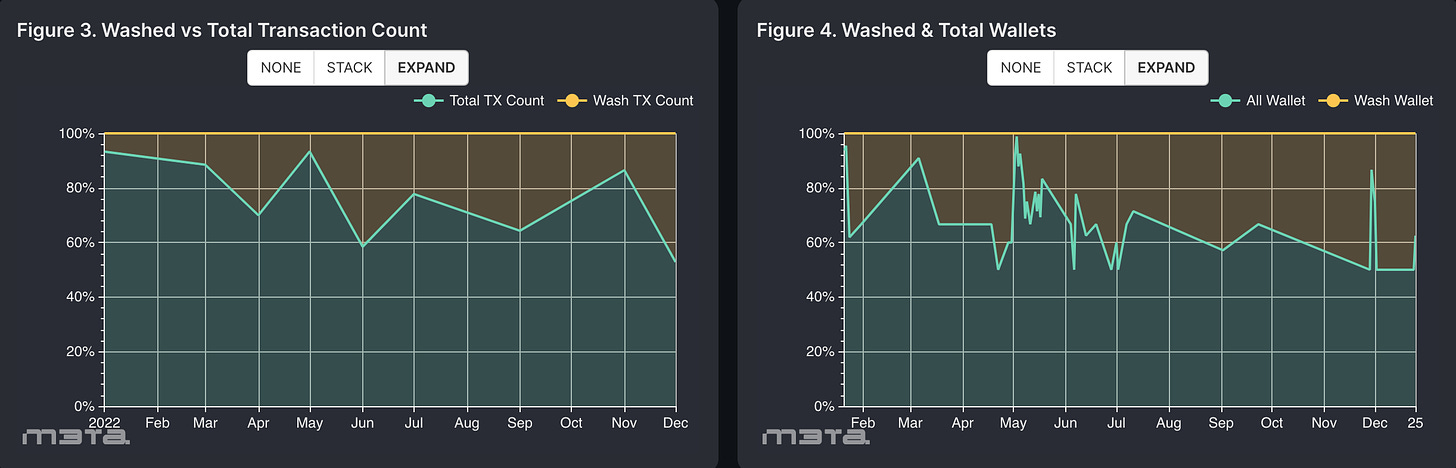

(Figure 3), during the 5-year period starting from January 2018, the proportion of wash trading volume was quite manageable with very rare incidents of spikes that account for more than a quarter (mid-2018) and up to 80% (February 2021) before 2022.As Figure 4 has pointed out, before the UST stablecoin exploded in May 2022, the NFT’s organic trading scene was still largely burgeoning. Taking advantage of this bustling market movement, wash traders were so busy flipping hands more than ever with January recording their most absurd ‘market manipulation’ march (80%).

At this stage, very few people were able to grasp the idea of wash trading and how this scam actually worked. Really, what kind of trader was brave enough to fathom that his/her millions of investment had been built on a foundation of lies?! Everyone was still intoxicated by the bull market of the year before. This year would be good, too, they said.

Since January 2022, it is clear that NFT wash trading has remained rampant and widespread, accounting for a sizable portion of the total volume (30-50%). Nevertheless, it has showed signs of fading in recent months as more and more people are becoming aware of the issue as well as more careful in how much they invest.

According to Chainalysis 2022 Crypto Crime Report, 262 users sold an NFT to a self-financed wallet over 25 times, 110 of which generated a total of $8.9M in profit in 2021 (Figure 5).

However, most of the above-mentioned NFT wash traders were not profitable since their profit did not compensate for the gas fees for each Ethereum blockchain transaction. (Figure 6).

How to Spot Wash Trading

After scouting different data analytics methods, we were able to identify some overlapping patterns that are core to wash trading:

Transaction history

An NFT that is bought more than a normal amount of times in a day (eg. more than 3 times) while other NFTs in the collection remain untouched

An NFT that is bought by the same wallet address within a limited range of time (typically within 2 hours)

The same address is trading the same NFT repeatedly, whether it was in a short high frequency or not, as in the case of CryptoPunk 9998.

All the active trading addresses have some intermediary connection with 1 to 2 addresses.

Price history

A series of trades that occur at identical prices without ‘rare’ outliers

The NFT’s completed transactions on marketplace A show an average price that is X times higher than that on marketplace B.

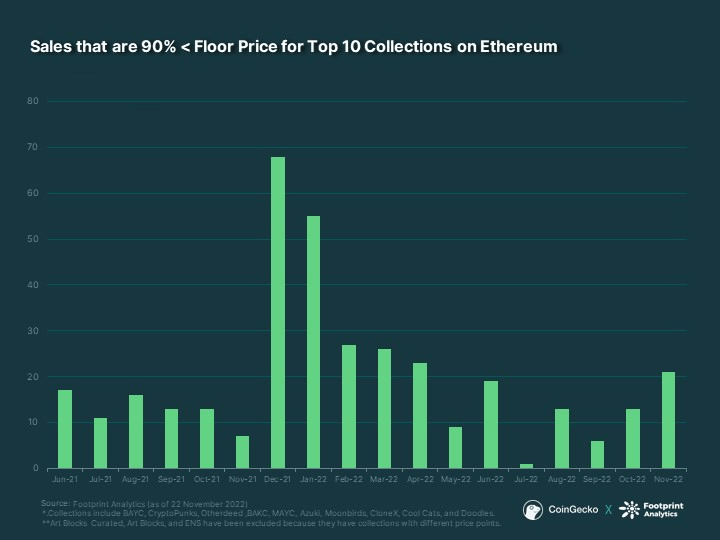

An NFT that is listed at an unreasonably higher price point, compared to the collection’s floor price (the lowest price bid for an NFT in the collection on the market). Questions should especially be raised if the NFT includes no rare attributes that would explain the exceptionally high price.

Social media presence

The collection is trending with high volume, but beside the intensifying volume, nothing else gets brewed around the collection.

The main channel does not look legit with a considerable number of followers.

No marketing or promotion is used to back the sales but the NFT can still automatically sell itself.

Fraudsters may exploit news coverage and social networks to create all the marketing hype and interest, as these platforms are the most susceptible to sudden on-chain changes.

To mask the parade, a group of wallets would trade the same NFT continuously, magnifying random polished trade performance of a specific crypto collection or project. Without much DYOR (Do Your Own Research) and with much FOMO (Fear Of Missing Out), some unsuspecting investors may fall prey to the tactic.

Monitoring the investor behaviours

It can be assumed as a sign of wash trading activity when a particular trader is entering into a large portion of transactions, especially in irrelevant contexts. (e.g. no apparent news or market event).

Although this acts are not considered abnormal in crypto nor does it always merit 100% accuracy (the term is ‘Degen’, who invests substantial sums in risky and suspicious crypto projects), we think it’s worth a mention considering how badly it can affect others’ decisions.

It is also essential to beware of traders who suddenly become more vigorous or who start to accumulate assets or securities that are outside of their typical investment strategy.

Case Study: Crypto Girlfriend Wash Trading

According to the project’s website, Crypto Girlfriend is a collection of 1269 uniquely designed NFTs minted on the Binance Smart Chain. The project claimed to launch stake-to-earn games soon where you can stake your Crypto Girlfriends to earn other collectibles. In addition, the project will offer an NFT rarity service and serve as a marketing resource for other NFT projects through AMAs on Telegram, YouTube, and Twitter Spaces.

To detect wash trading in this NFT project, our analysis utilizes proprietary data aggregated by M3TA to identify some suspicious trading patterns.

These include (1) the repetitive transfer of NFTs to a single wallet, (2) frequent trading of the same NFT among a group of wallets, and (3) high-volume trading of a single NFT within a short period of time.

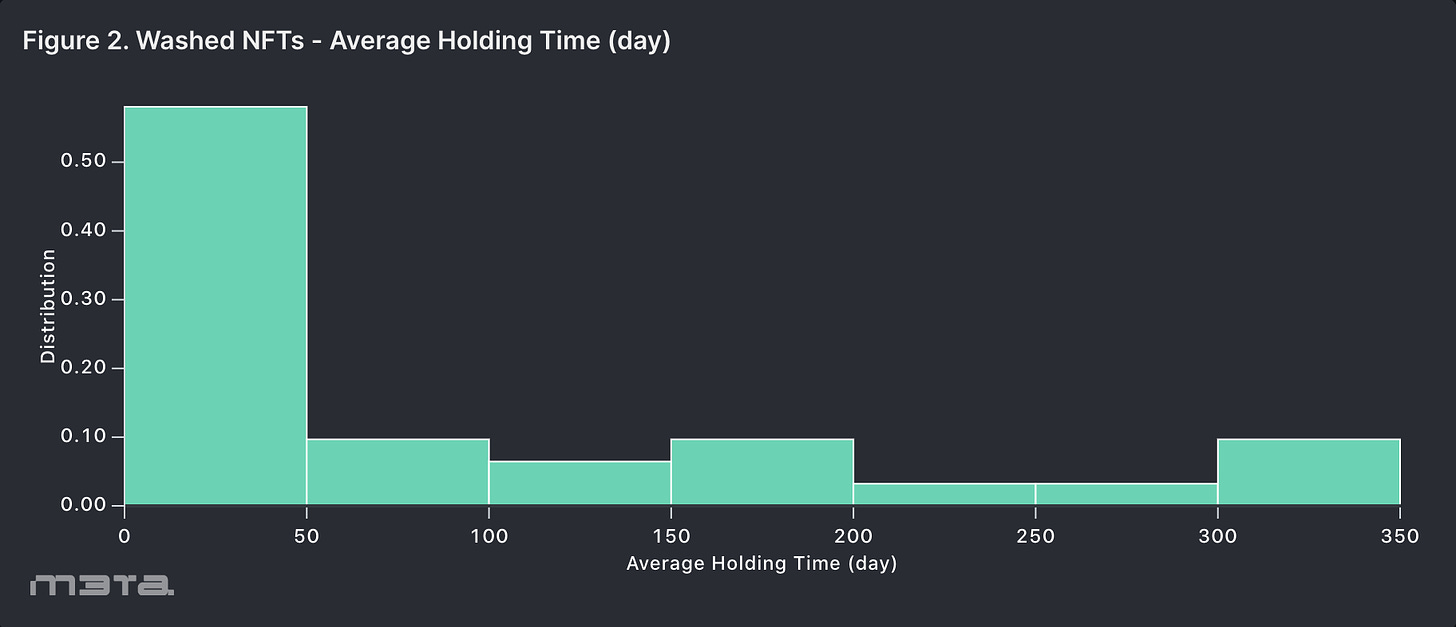

Based on Figure 8, it can be observed that NFTs involved in wash trading have significantly shorter average holding periods.

Although genuine transactions remain the majority, there is an increasing trend in the proportion of wash trading transactions observed for this NFT project in 2022 (Figure 9). Additionally, the number of wallets engaged in this deceptive practice is growing over time.

Are you an NFT supporter? Do you have an NFT collection that you want us to check if there is a ton of wash trading activities behind it?

Send us an email to hello@m3talab.io or leave a comment below!

The Motives Behind NFT Wash Trading

Driving attention to a collection

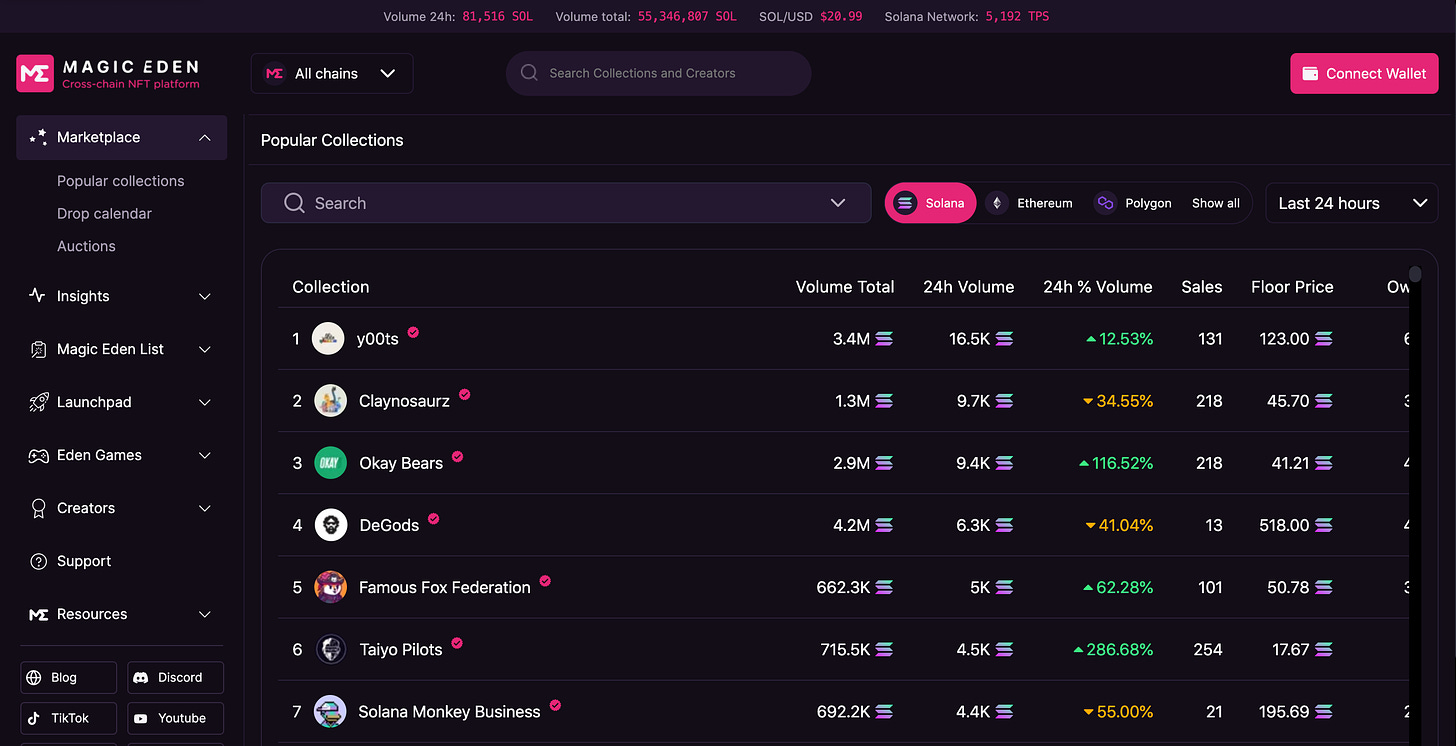

To get noticed in the fast-paced digital art market, NFT founders and sellers resort to various tactics to attract attention and generate narratives. One of the most effective ways to achieve this is to land on the front page of popular NFT marketplaces like OpenSea, LooksRare, and Magic Eden, all of which have a landing page highlighting trending collections (Figure 10).

As per CryptoSlate, while the exact algorithms used to determine trending collections are unclear, it is believed that trading volumes play a significant role in the selection process. This encourages NFT founders to engage in wash trading to boost their trading volumes and increase their chances of appearing on the Trending Collections list.

However, this unethical practice can also lead to market manipulation and give a false impression of liquidity, potentially leading unexperienced buyers to purchase NFTs at inflated prices.

Fortunately, blockchain technology allows us to view every factor so clearly. We hereby borrow the master table @hildobby has compiled to observe wash trading situations on various marketplaces currently running on the Ethereum network (Figure 11).

Interestingly, there is a considerable variety in the wash trade ratio among platforms. For instance, OpenSea, CryptoPunks, and Foundation observe minimal wash trades regarding both of their trading volumes and transaction counts.

This is in contrast to LooksRare and X2Y2, whose trading volume rely on a large proportion of wash trading, although only a small percentage of their total trades involve washes. Specifically, LooksRare has a wash trade rate of 11%, while X2Y2's rate is 21%. These figures may seem high, but they are quite expected considering that both platforms offer token incentives for usage volume, which leads us to the next motivation.

Token rewards

To explain this, we will lead with 2 most prominent examples of marketplaces that offer daily token rewards to users: X2Y2 and LooksRare.

X2Y2 and LooksRare allocate tokens daily to sellers and buyers based on their trading volume as a percentage of the total volume on the marketplace platform.

The tokens are fixed on a daily basis, allowing wash traders to repeatedly earn reward tokens by wash trading when the daily distribution resets.

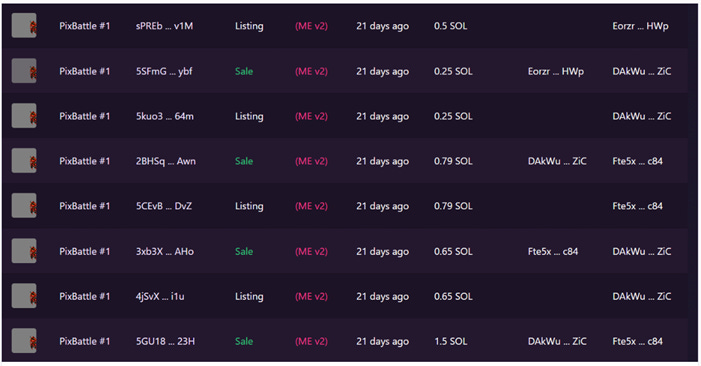

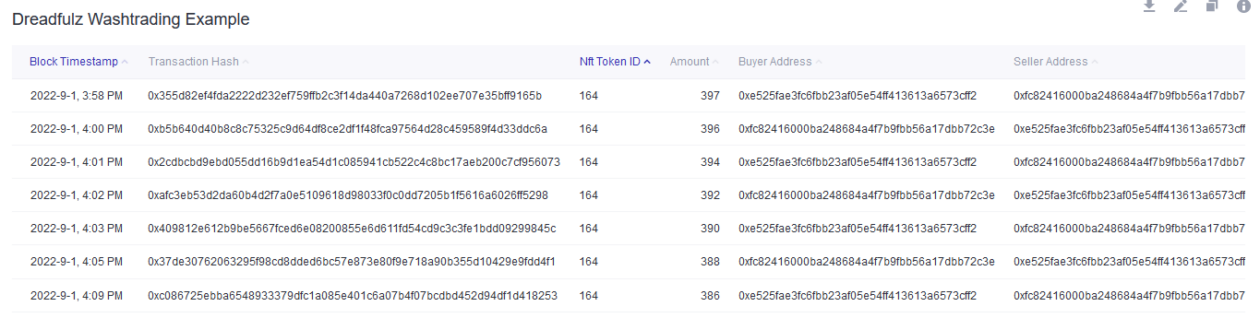

The example in Figure 12 demonstrates wash trading activities on the X2Y2 marketplace involving the Dreadfulz NFT collection.

As shown, NFT ID 164 was bought and sold between the same two wallets various times in a single day, with each transaction amounting to over 300 ETH. On September 1, 2022, these two wallets traded 19 times, generating a volume of 7228 ETH and paying 36.14 ETH in platform fees to X2Y2.

It is worth noting that Dreadfulz did not have a set royalty fee rate on X2Y2, meaning no creator fees were paid. Wash traders tend to choose collections with no creator fees to minimize their wash trading costs.

This still rings true till today with the latest emergence of Blur - which is also another NFT trading platform with virtually no creator fees and absolutely no platform fees.

Blur rewards exclusive use of its platform and trading via its bidding pools with free tokens.

According to DappRadar, following its first airdrop of BLUR tokens on February 14, Blur surpassed OpenSea in total trading volume ($429.15M in 7D). Despite this, OpenSea still has more daily wallets making trades (93.43K active wallets in 7D).

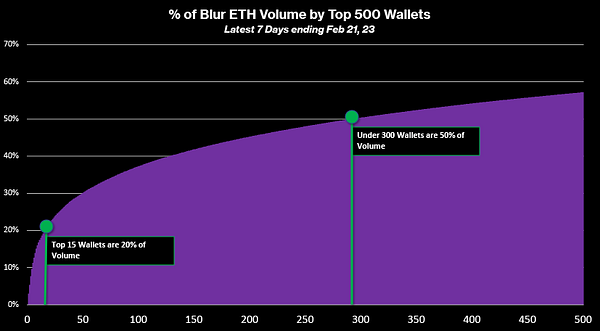

50% of Blur’s NFT trading volume is generated by only 300 wallets, while 1% of traders account for 74% of the total asset value, as detected by @poof_eth on Twitter and @denze on Dune.

The NFT community is divided over Blur's gamification tactics, which have caused market-wide shifts and prompted OpenSea to cut some creator royalty protections. While some see it as a natural evolution for NFTs, others criticize flippers who are trading NFTs repeatedly like fungible tokens.

According to a report article from DeCrypt, who references the points of view from @hildobby and CryptoSlam (a platform for tracking NFT sales), the term "wash trading" may not accurately describe what's happening at Blur, but the sudden trading spike has caused reliable metrics to be muddled and players in the space to reconsider their perceptions of NFTs.

Money laundering

NFT wash trading can be an ideal gateway for money laundering, given the lack of regulation and oversight in the NFT marketplace. Art has long been used for money laundering due to its easy portability and subjective pricing, but NFTs offer a unique opportunity for criminals to exploit through legitimate transactions and volatile price changes. By purchasing NFTs with illegally obtained funds and selling them later, they can conceal the connection to their criminal activity.

Minimizing tax liability

For a layman, NFT wash trading is also utilized for tax avoidance. Since NFTs are considered capital assets in some jurisdictions and are subjected to capital gains tax, traders can offset investment losses in their final tax calculation. Those who bought NFTs at high prices can sell them at a loss to offset gains they have made in other assets (Figure 13).

Wash trades are quite useful in avoiding high tax since it is easy to sell NFTs at a low price to another wallet you control, and there is a lack of regulatory oversight in NFT marketplaces.

Conclusion

In conclusion, NFTs are marvelous investment opportunities. However, it is essential to be highly cautious and avoid fraudulent practices such as wash trading.

By doing your own research, proving the ownership and authenticity of the platforms or the collections, you can defend yourself against wash trading and reach rational investment decisions. It is important for buyers and sellers to remain vigilant and report any suspicious activity to ensure a fair and transparent market.

Furthermore, NFT marketplaces must take steps to prevent wash trading and other forms of market manipulation to protect their users and the integrity of the NFT market.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.