M3TA 101 - Episode 6: How to Find Smart Money?

Smart moneys are ‘investment gurus’ who operate under the radar and usually do better than the rest of us. Learn how to seek them out through on-chain data and tools with this M3TA 101.

Introduction

Since more people become interested in cryptocurrency as an option for investment, it's increasingly important to proactively monitor the market using on-chain data and figure out the opportunities. Unlike off-chain data, the data on the chain is (1) immutable - no one can alter or remove the written data, (2) public - anyone can easily access the data, and (3) decentralized - the data is not in any third party’s control.

However, these seemingly favorable properties of on-chain data along with the sheer quantity of blockchain activities taking place every day may have made more noise than sense.

Because of that, a quite popular and effective trading strategy emerges - following ‘smart money’ movement. By doing this, at least investors can exercise ‘copy-trade’ and know where to look out for rather than stumbling upon chaos.

Although paying attention to the transactions of a few selective ‘whale’ wallets, or ‘smart money’ can be particularly helpful, tracking these wallets within an ecosystem can pose a challenging endeavor, especially for those new to the digital investment arena.

The objective of this article is to explain the concept of "smart money" and examine some metrics that can pinpoint such notable wallets within an ecosystem. By leveraging these metrics and tools, investors can gradually understand smart money’s activities and make well-informed choices when participating in the cryptocurrency market.

What is Smart Money?

As explained by Investopedia, smart money can be loosely defined as the investments made by institutional investors, venture capitalists, hedge funds, central banks, and other financial professionals with a proven track record of financial success.

Smart money investors have access to better information and resources than regular investors, which helps them make well-informed decisions on where to invest their money. Therefore, company executives or board members can also be considered smart money due to the ‘in-the-know' information they possess.

This money, more than often in large volume, is believed to be invested in the most suitable investment option at the opportune moment, with the expectation of yielding consistent returns in the long run. This means that when smart money investors invest in a cryptocurrency project, it's a good sign that the project has the potential for success, which can lead to increased demand and higher prices for the cryptocurrency.

There is limited proof to substantiate the belief that smart money investments yield superior returns compared to non-smart-money investments. In fact, history has shown that the contrary can sometimes become true. Nonetheless, such capital inflows do affect the general speculation regarding the market or a project itself.

Additionally, investors who are considered smart money tend to rely on thorough analysis, research techniques and a set of tools and resources, like M3TA Reports, for instance. Their objective is to uncover insights that may be inaccessible to the average person at a given time.

As a result, their approach to investing can involve an intricate and well-defined process as well as a variety of investment criteria just to evaluate one project.

Don’t get mistaken though that it would be easy to understand the trading patterns of smart money as the process can be akin to completing a 2,000-piece jigsaw puzzle, given the sheer volume of data that can be extracted from the blockchain. Imagine having all the puzzle pieces in the palm of your hand, which ones would you select to begin with; which ones truly assist you in recognizing the pattern before other pieces fall into place?

How to Find Smart Money?

As mentioned earlier, identifying the metrics to detect smart money in crypto is quite challenging as there are various factors that can influence the movement of funds in the cryptocurrency market.

However, here are a few metrics that we propose:

Token Holding

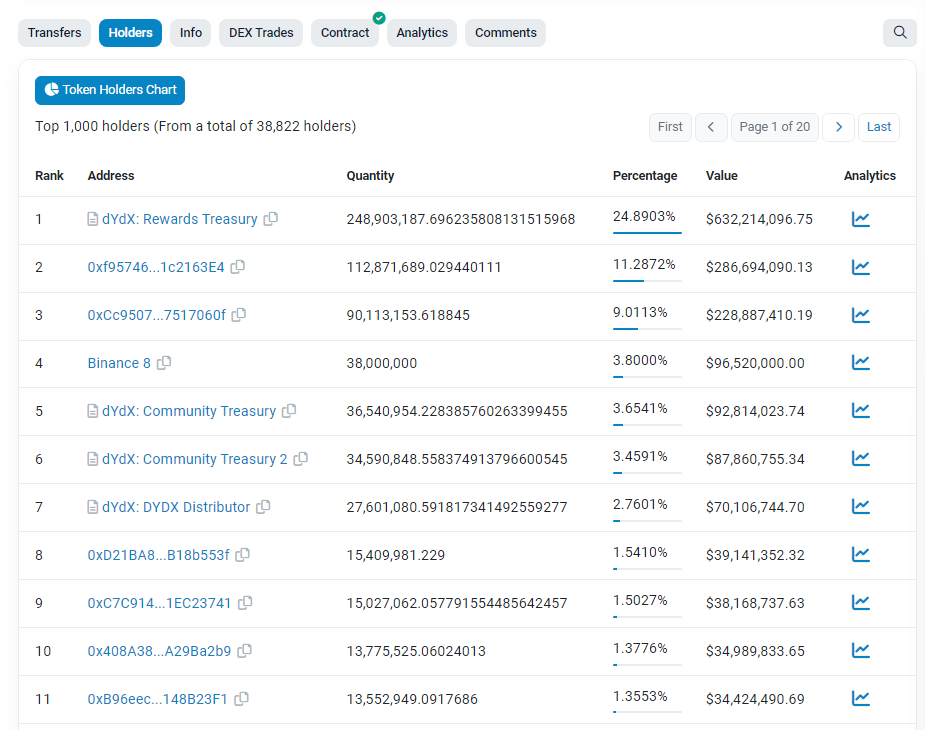

Investors can use blockchain-native explorers like Etherscan (for Ethereum blockchain) or BSCscan (for BNB Smart chain) to inspect a project's token distribution and identify any major token holders, excluding wallets linked to the project's Smart Contract.

For instance, to look into token holders on Etherscan, simply search for the token's Smart Contract, which you can easily take hold of from the project’s whitepaper or official social channels, and navigate to the "Holders" tab.

However, to determine which wallets qualify as "smart money", you will need to establish a balance threshold, which may differ depending on each specific project. Holding 1 percent of tokens may be insignificant for a new project, but it could be a considerable amount for an older, more decentralized protocol.

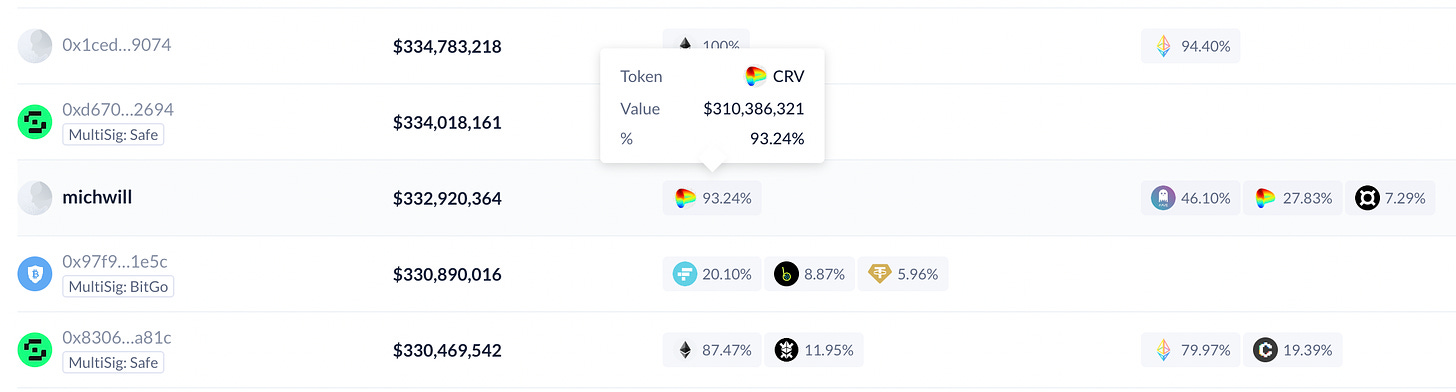

That's where DeBank comes in, making things simpler for users. By just focusing on the Top tokens column in their database, you can quickly discern which wallets are marked as whales of a particular token. However, the types of tracked tokens are still quite limited.

Trading Volume

A useful method for detecting smart money in the market is to track changes in trading volume without corresponding price movements.

Smart money investors often make large trades that significantly increase the trading volume of a particular asset, without causing any significant changes in the asset's price. This strategy helps them to conceal their investments from retail investors.

To monitor the trading volume of these investors, traders can use specialized tools like Watchers. The platform is suitable for a quick on-demand investigation. Watchers typically provides a preset guideline of market evaluation, specializing in BNB (BNB chain) and ETH (Ethereum chain). Other useful tools for smart money watching include Discovery Mode, Alpha Hunter and Investigation Mode (money flow).

M3TA is also building a Dashboard section for crypto investors where you can comfortably watch smart money movement from a bird-eye view by simply dragging and dropping their wallets to your dashboard. Stay tuned!

Wallet Labels

Wallet labels are titles assigned to crypto wallets. These labels can mostly be obtained free of charge from various platforms such as CEXs, DEXs, specialized crypto market makers and data aggregators, and can assist investors in identifying smart money wallets.

Identifying these wallets without their labels can be challenging as most wallets are identified by a complex string of letters and numbers, making it difficult to differentiate among them. Because of that, typically, only a limited number of wallets are labeled or marked by trusted third parties.

Fortunately, there are online tools available to help identify wallet owners. Some of these tools, like OXT and Arkham are free, while others, like Nansen or Chainalysis, require payment.

OXT: provides a Bitcoin "Rich List" on their website, including the top Bitcoin holders.

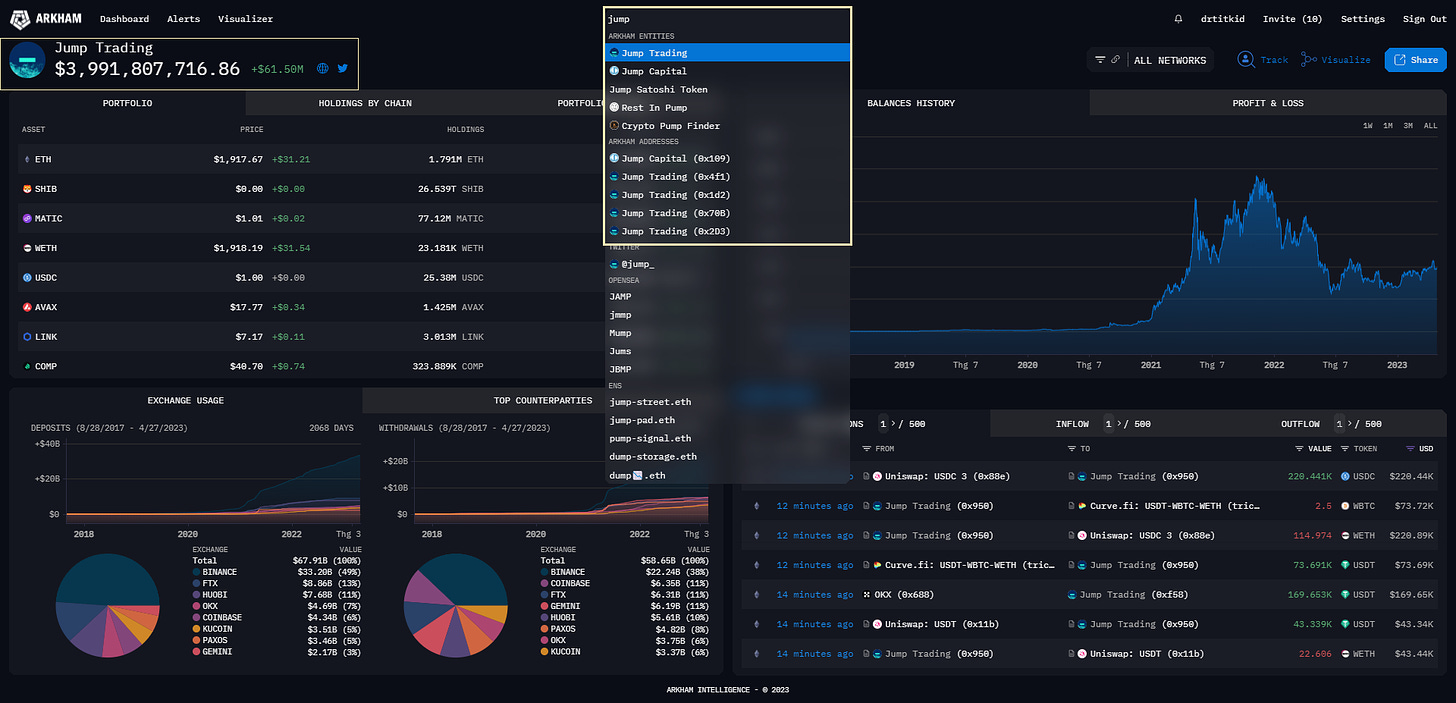

Arkham: has a convenient search bar that allows users to quickly search for the wallet of a well-known entity or fund.

Nansen: offers unique features called Smart Money, which is available to paid users, tracks the activities of large cryptocurrency holders and provides insights into their investment strategies.

Chainalysis: helps organizations find and track Smart Money. Chainalysis provides a range of tools to identify wallet owners, monitor transactions, and ensure regulatory compliance. However, Chainalysis is designed for use by businesses and government agencies, rather than individual users.

Wallet Balance over Time

If the balance of a smart money investor's wallet suddenly decreases significantly, it may indicate that they are selling their holdings, which could lead to a downward price movement in the market and vice versa.

This strategy of tracking wallet balances can be executed using blockchain analytics platforms such as Glassnode.

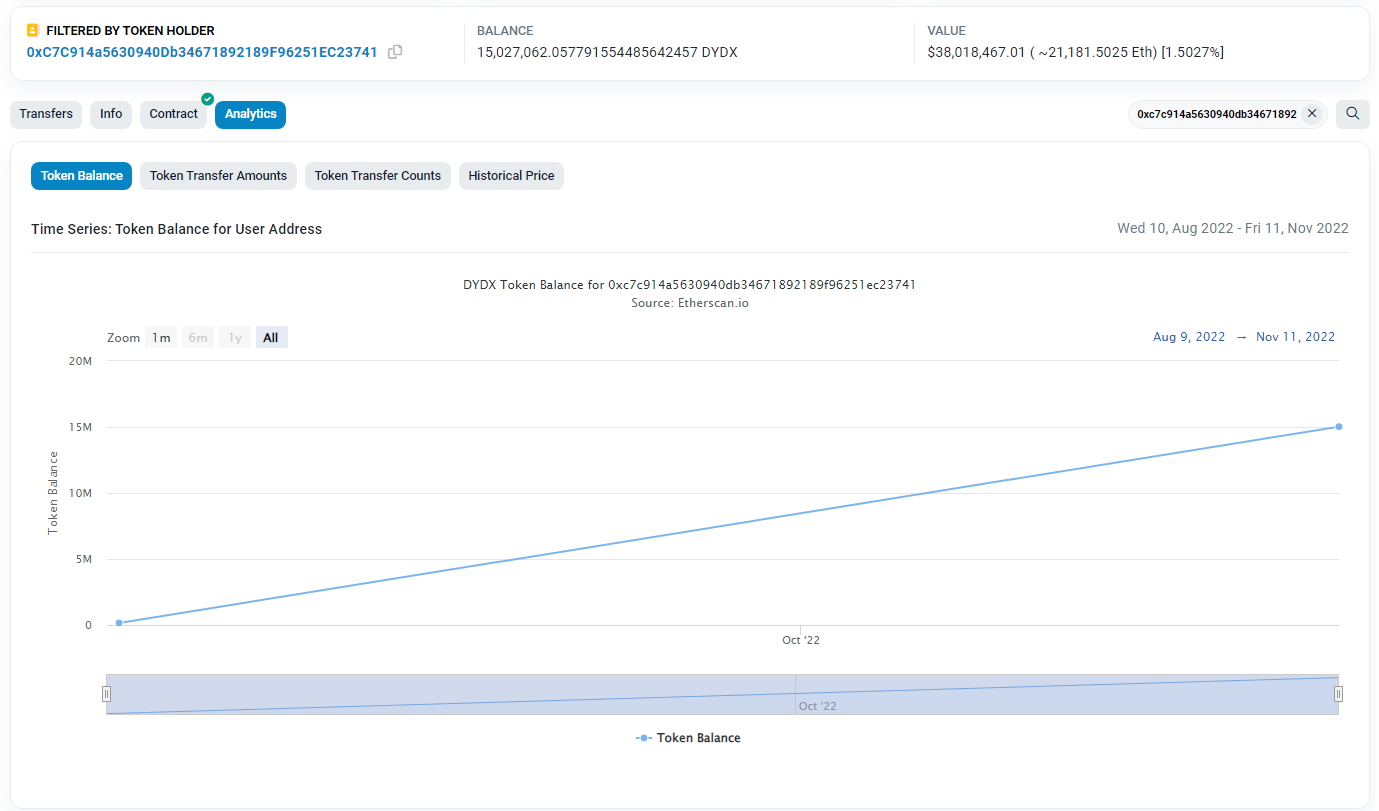

Investors can also use the "Analytics" tab on Etherscan to investigate a wallet's balance for a specific ERC20 token.

For example, this wallet that we deem as smart money bought some $DYDX tokens on August 10, 2022, at a price of $2.44 per token. Then, on November 11, 2022, the same wallet bought more $DYDX tokens at a lower price of around $1.95 per token. The wallet has been holding onto these tokens since then, and currently, as of time of writing, the price of $DYDX is $2.5 per token. Based on this information, the wallet has made a profit of approximately 25% on its $DYDX investment.

Another helpful tool, though at a fee, is chainEDGE Alpha Stream, which excels at revealing smart money insights by integrating filters, such as address, buy token and sell token into transaction details. This enables you to effortlessly analyze average entry and exit points of savvy investors.

For instance, by filtering buy tokens for "Blur" and sorting by buy price, you can identify those who managed to secure outstanding entry points on the token (30-50 cents) compared to the highs of $1.37.

Token Balance Distribution

Smart money investors often hold multiple types of tokens, and by observing the distribution of these balances, we may be able to identify unusual patterns or movements that could indicate the presence of smart money.

If there is a sudden shift towards larger balances of a particular token, it could suggest that smart money is accumulating the token.

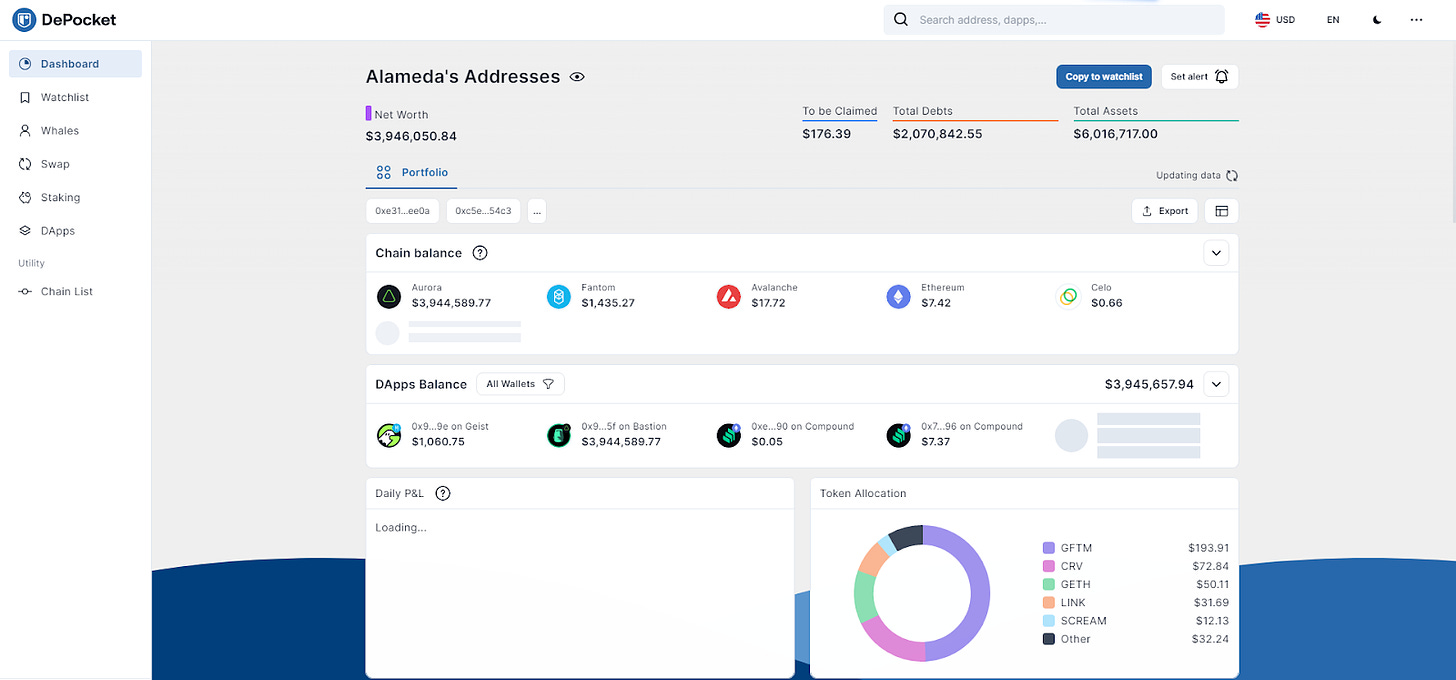

Several tools, including blockchain explorers like Etherscan and Blockchair, can be used to monitor token balance distributions. Depocket also displays a list of named wallets in the ecosystem identified by its research team. Users can check the wallet balance, profit & loss, and portfolio to gain further insights into the activity of smart money investors.

Whales Watching Alert

Once you have identified the whale wallets you want to track, there are various apps available that can help you monitor the activities of these large players.

For instance, you can use Nansen’s Smart Alerts function to personalize alerts for various crypto events. However, access to Nansen Smart Alerts is only available to users who have subscribed as Nansen Standard User or above.

An alternative is Lookonchain, a free-of-charge social alert with details of whale movement on trending projects.

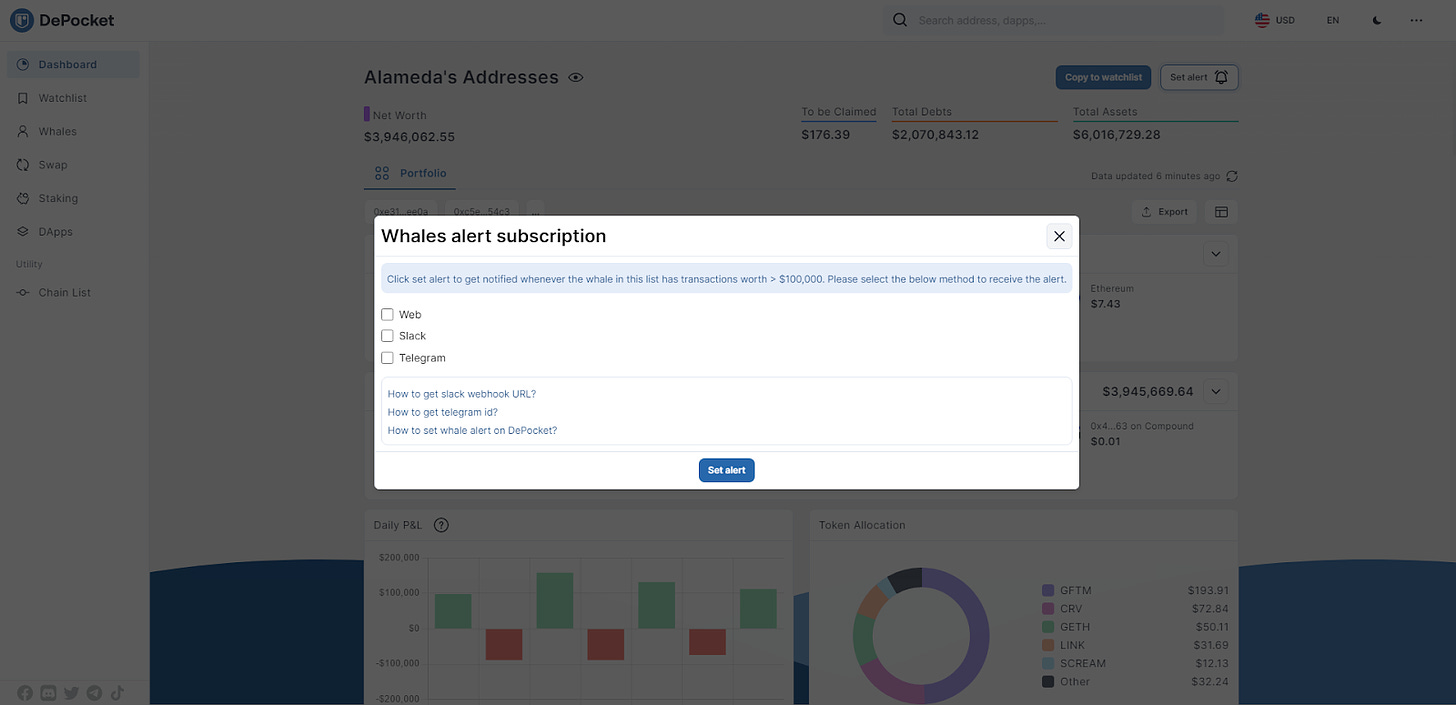

Depocket's "Whales" feature offers curated wallet addresses that are actively analyzed in selected ecosystems. Users can add these wallets to their watchlist to create their own Alpha dashboard and monitor them for any updates.

Conclusion

Identifying smart money is not an easy task, and there are several strategies that they use to remain anonymous and keep a low profile. For instance, they may employ intermediaries or pseudonymous wallets to avoid attracting attention to their investments.

Additionally, they may spread their trades across multiple accounts or make small trades over a long period to avoid drawing attention. Smart money investors may also use OTC markets to trade large volumes of cryptocurrency discreetly without affecting the market price.

Although the information above is just a few examples of how smart money operates, it is crucial to understand that identifying smart money goes beyond these basic metrics. It requires extensive research, staying updated with market trends and news, and using analytics and tracking tools to identify patterns in trading behavior.

While it may be challenging, identifying smart money can provide valuable insights into market trends and potentially lead to profitable investments.

Keep your on-chain data close with M3TA and stay ahead of the crowd.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.