Cross-chain / Bridge War: A Stress Test for Innovation

Twice affected by Multichain's vulnerabilities since the dawn of 2023, innovators in first launched bridge solutions, and their native tokens, seized their moment to shine. Read on for more!

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

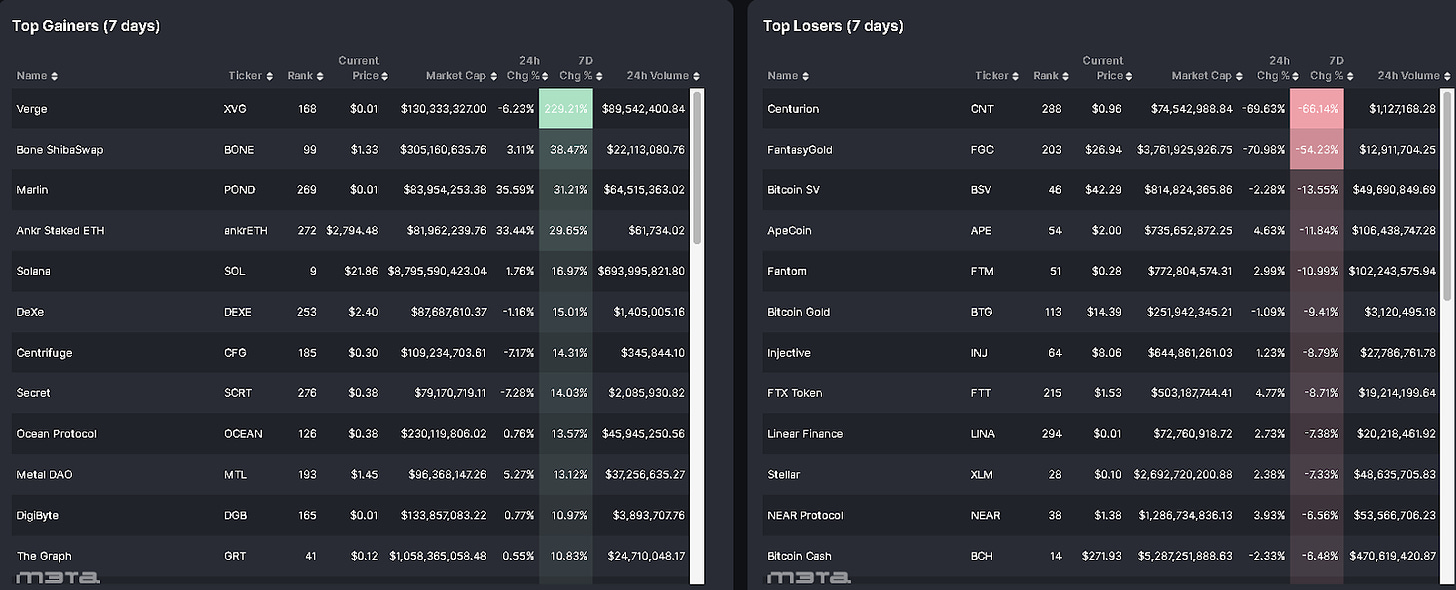

Top performers (7D)

Verge - $XVG: +229.21%

Price as of time of writing: XVG/USD - $0.007865

Verge offers user-friendly software that allows everyday people to make secure payments using blockchain technology. They have created a payment app called Vergepay, which includes the Tor network to protect the privacy and enhance the speed of Bitcoin transactions.

The value of $XVG started to rise when certain privacy tokens from the European Union were removed from the Binance exchange. Interestingly, XVG was not affected by this change. Additionally, the Gate.io exchange recently added support for the XVG/USDT trading pair.

Bone ShibaSwap - $BONE: +38.47%

Price as of time of writing: BONE/USD - $1.33

ShibaSwap is a decentralized exchange (DEX) project within the Shiba ecosystem that helps Shiba holders earn profits by providing Liquidity Pool and Staking on ShibaSwap. Currently, the project is still in the testnet phase.

The price of BONE is increasing because the developer of SHIB, Shytoshi Kusama, revealed a possible release date in August for the much-awaited mainnet of the Shibarium Layer 2 blockchain.

Marlin - $POND: +31.21%

Price as of time of writing: POND/USD -$0.009

Marlin is a protocol that serves as the foundation for a privacy-focused network infrastructure. It enables highly efficient programmable performance for decentralized finance (DeFi) and Web3 applications.

There hasn't been any news about the rise in the value of $POND. It's possible that the increase is due to whales making significant purchases.

ankrETH - $ankrETH: +29.65%

Price as of time of writing: ankrETH/USD - $2,794

Ankr Staked ETH is an LST token that represents staked Ethereum on the Ankr platform. Every day, users receive a reward-earning bond that represents their daily rewards. 1 ankrETH is equivalent to 1,073 ETH.

The price surge could be due to ankrETH having an 18% premium on the Fantom network. AnkrETH is bridged by Ankr Bridge and is not dependent on Multichain, which has been hacked twice in recent weeks.

Moreover, the founder & CEO of Tagus Labs also recommends that projects on Fantom with Liquidity Pools involving ETH should consider ankrETH as an alternative.

Solana - $SOL: +16.97%

Price as of time of writing: SOL/USD - $21.86

Solana is a protocol that operates on a single chain and uses a delegated proof of stake (PoS) mechanism. The Solana blockchain has a high processing capacity and is designed using a combination of proof of history (PoH) and proof of stake (PoS) technologies.

The reason for the $SOL price increase could be attributed to the introduction of Solana's new bridge called deBridge. This bridge enables smooth transactions and transfers of funds between Solana and EVM blockchains. Given the recent security breach on Multichain, this feature of Solana might attract users to switch and start using Solana instead.

Top losers (7D)

Bitcoin SV - $BSV: -13.55%

Price as of time of writing: BSV/USD - $42.29

Bitcoin SV is a fork from Bitcoin Cash (BCH) blockchain in 2018, with a larger block size (128MB), which allows for faster processing speeds of over 50,000 transactions per second (TPS).

ApeCoin - $APE: -11.84%

Price as of time of writing: APE/USD - $2

ApeCoin is the utility and governance token used within the Bored Ape Yacht Club (BAYC), a widely loved collection of 10,000 distinct cartoon ape images sold as NFTs. It was designed to support and strengthen the community that revolves around the APE ecosystem.

Fantom - $FTM: -10.99%

Price as of time of writing: FTM/USD - $1.28

Fantom is a highly scalable, decentralized, permissionless and open-source platform used to build crypto DApps.

The Fantom Bridge is related to the Multichain exploitation.

Bitcoin Gold - $BTG: -9.41%

Price as of time of writing: BTG/USD - $14.39

Bitcoin Gold is a hard fork of Bitcoin created in November 2017. Unlike Bitcoin, which requires specialized machines called ASICs (Application-Specific Integration Circuits) to mine new coins, Bitcoin Gold can be mined using regular GPUs

Injective - $INJ: -8.79%

Price as of time of writing: INJ/USD - $8.06

Injective Protocol is a type of decentralized exchange (DEX) protocol that provides advanced functionalities such as cross-chain margin trading, derivatives, Forex (FX), synthetics, and futures trading.

The decline in the value of these tokens mirrors the downward trend of BTC's price.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Initial Jobless Claims - measures the number of individuals who filed for unemployment insurance for the first time during the past week.

Weekly jobless claims increased by 12,000 to 248,000.

Continuing Jobless Claims - measures the count of eligible unemployed individuals receiving benefits through unemployment insurance.

Continuing claims dropped by 13,000 to 1.720 million.

ADP Employment change - a monthly report of economic data that tracks nonfarm private employment in the U.S.

Private payrolls jumped to 497,000 in June.

Job Openings and Labor Turnover Survey (JOLTS) - a monthly report by the BLS counting job vacancies and separations, including voluntary quits.

Job openings declined by 496,000 to 9.824 million in May.

Nonfarm Payroll - measures the change in the number of people employed during the previous month, excluding the farming industry, non-profit organizations and active military.

Nonfarm payrolls increased to 209,000 in June, below the consensus estimate for 240,000.

The reports indicated that laid-off workers were experiencing shorter unemployment periods, increasing the likelihood of the Federal Reserve resuming interest rate hikes this month, following a pause in June.

Micro

CoinDesk - Jul 06, 2023

dYdX, a decentralized exchange (DEX), has launched its public v4 testnet on Cosmos.

The launch marks the transition of dYdX away from its current version built on Ethereum as users can now place market orders, generate private keys, and place limit orders with advanced options on the dYdX testnet.

Initially, the public testnet includes Bitcoin and Ethereum markets, but dYdX plans to expand to over 30 markets in the future.

dYdX announced last year that its "v4" version would be developed as a standalone blockchain using the Cosmos SDK and Tendermint consensus protocol. The original DEX was built on Ethereum.

Blockworks - Jul 08, 2023

The Aave community has approved a governance proposal to convert most $ETH in the DAO treasury to $wstETH and $rETH to increase yields.

The Aave DAO currently holds 1,786.51 awETH (v2) and 104.548 units of ETH in the Collector Contract. The awETH deposit in Aave v2 generates an APR (annual percentage rate) of 1.69%, while wstETH offers an APR of 3.8% and rETH provides an APR of 3.13%.

The proposal converts unproductive ETH balance and aWETH (v2 and v3) into equal amounts of wstETH and rETH.

News Highlight

UniSat Wallet - Jul 09, 2023

The Bitcoin wallet for Ordinals and BRC 20 UniSat announced that its NFT marketplace is launching this week, supporting all existing 1500+ collections by utilizing information stored in the ‘Ordinals Collections Standards’ GitHub repository.

The service fee will also be reduced from 1.6% to 0.x%; and even without the celebratory discount, UniSat claims to keep the rate lower than that of other marketplaces (2-3%).

CoinTelegraph - Jul 08, 2023

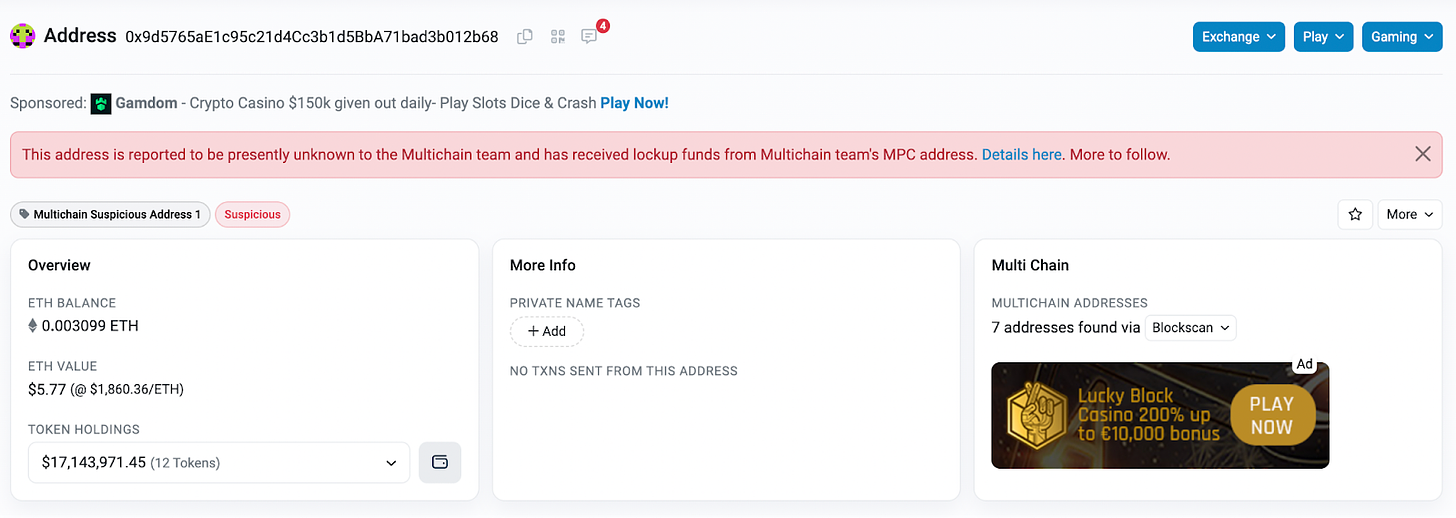

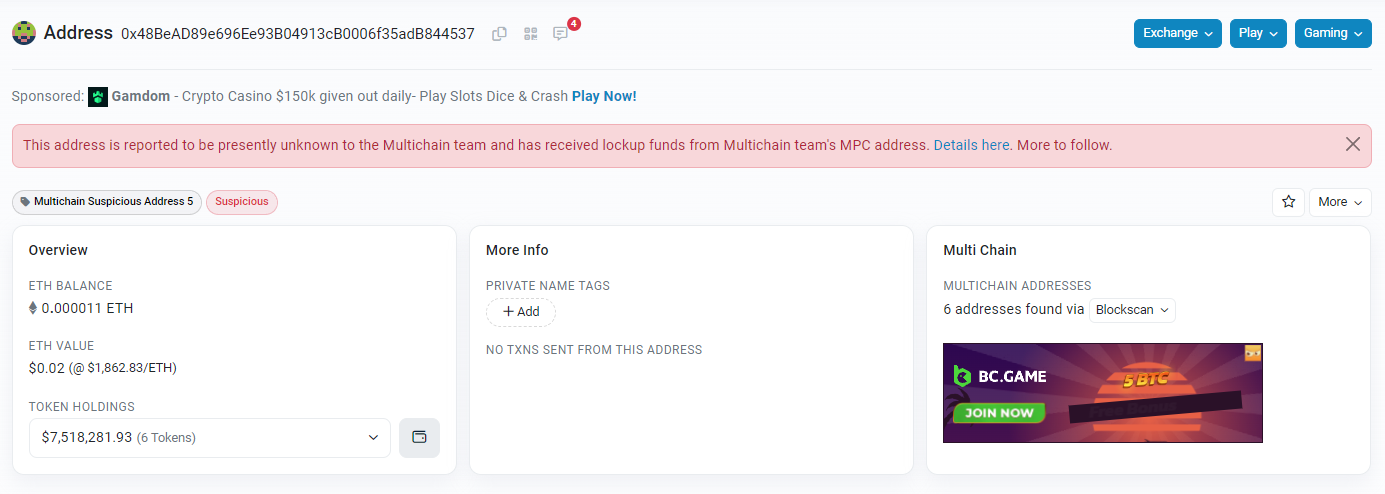

Stablecoin issuers Circle and Tether have frozen over $65 million in assets tied to the suspected exploit of cross-chain router protocol Multichain.

~$126 million worth in cryptocurrencies was withdrawn from multiple wallets of Multichain on July 6, affecting Multichain’s Fantom bridge, as well Dogechain, Moonriver, Kava and Conflux's ecosystems.

03 addresses receiving $63.2 million in USDC from Multichain are now frozen.

02 addresses receiving $2.5 million in USDT are also frozen and listed as "Multichain Suspicious Addresses".

Cause of abnormal asset transfer remains unclear.

Multichain suspends services and urges users not to use their bridging service.

Shardium - Jul 08, 2023

Layer-1 blockchain Shardeum raised $5.4 million in strategic funding at a valuation of $248 million.

Shardeum utilizes dynamic state sharding to ensure low gas fees and high transactions per second as participation increases.

Participants in the funding round include Amber Group, Galxe, J17 Capital among other.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.