What's New in Crypto: Put Bitcoin Network Congestion Under Investigation

On May 7th, the Bitcoin network experienced congestion. What was the cause of this? Was it due to a new wave of BRC-20? Read on!

Introduction

On May 7th, there was congestion on the Bitcoin network assumably caused by exceptionally high gas fees; and because of that, Binance stopped the withdrawal function of $BTC since they do not have Lightning technology at the moment to accelerate transaction times and reduce Bitcoin network congestion.

Let Us Investigate the Reason

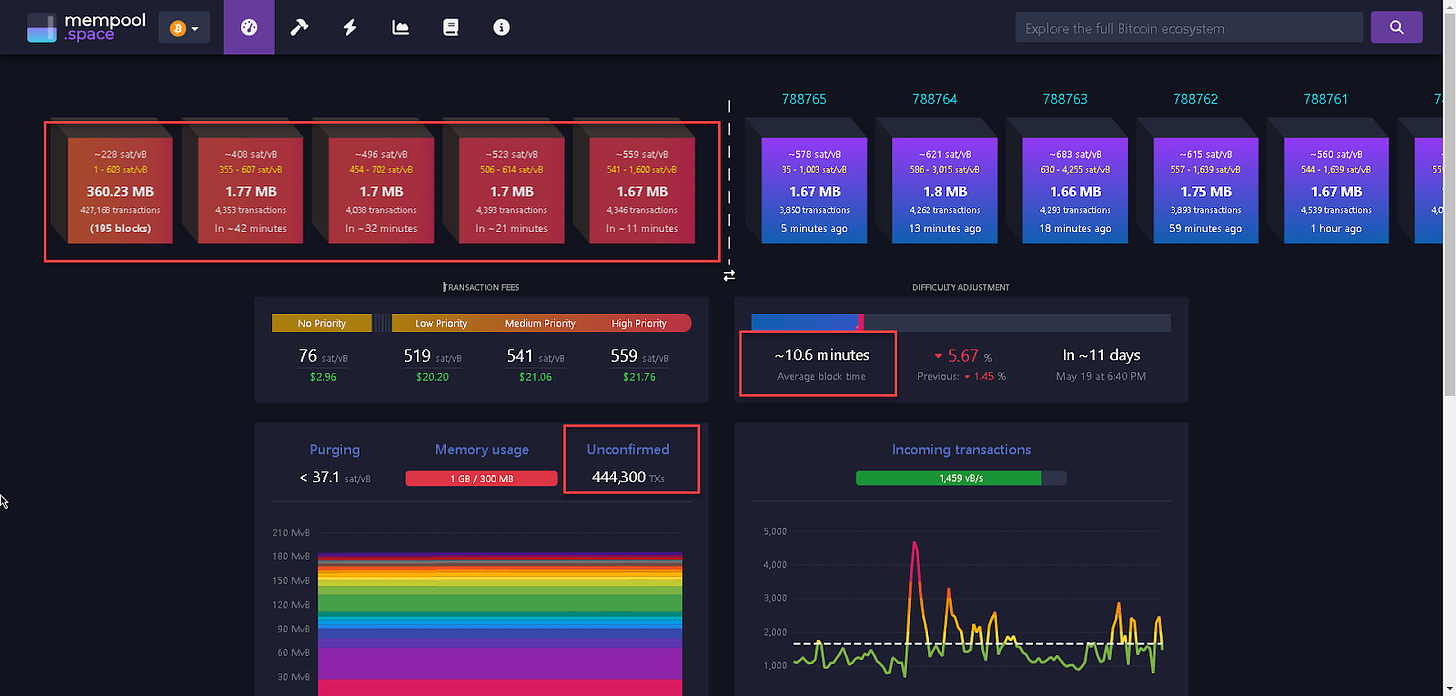

Through our research, it is evident that the BTC network is indeed congested. According to mempool, a block explorer, there were approximately ~444,300 unconfirmed transactions, which indicated that there was a huge amount of transactions waiting to be processed.

This boosted the fee of each Bitcoin transaction to reach as high as $20.

Mempool statistics also showed that it took around 10 minutes for a block, and there were still about 200 blocks waiting. That means it would take approximately 33 hours to process all these transactions.

Where Did These Transactions Come From?

According to domo (the first-and-only creator of the BRC-20)’s Dune analysis, the volume and transactions on Unisat, a marketplace where users can mint BRC-20 tokens, had reached an all-time high, surpassing other marketplaces.

Though intended for fungible token trading, Unisat operates similarly to current NFT marketplaces. That means it lacks a liquidity pool, resulting in a lack of liquidity. This means that when there is FOMO (Fear Of Missing Out) in the market, it is easier for market makers to manipulate the market with wash trading and net their profits.

Unlike other marketplaces that add liquidity pools to facilitate trading at low prices, this marketplace only lists tokens for users to buy. Therefore, if users start influencing the market through FOMO effects, market makers will sell their tokens for BTC.

If there are no buyers, the tokens remain listed, similar to NFTs.

Why did So Many Transactions Come at Almost the Same Time? What Kind of Game Pulled on Unisat that was Causing Users to Immediately Pour Their Money in?

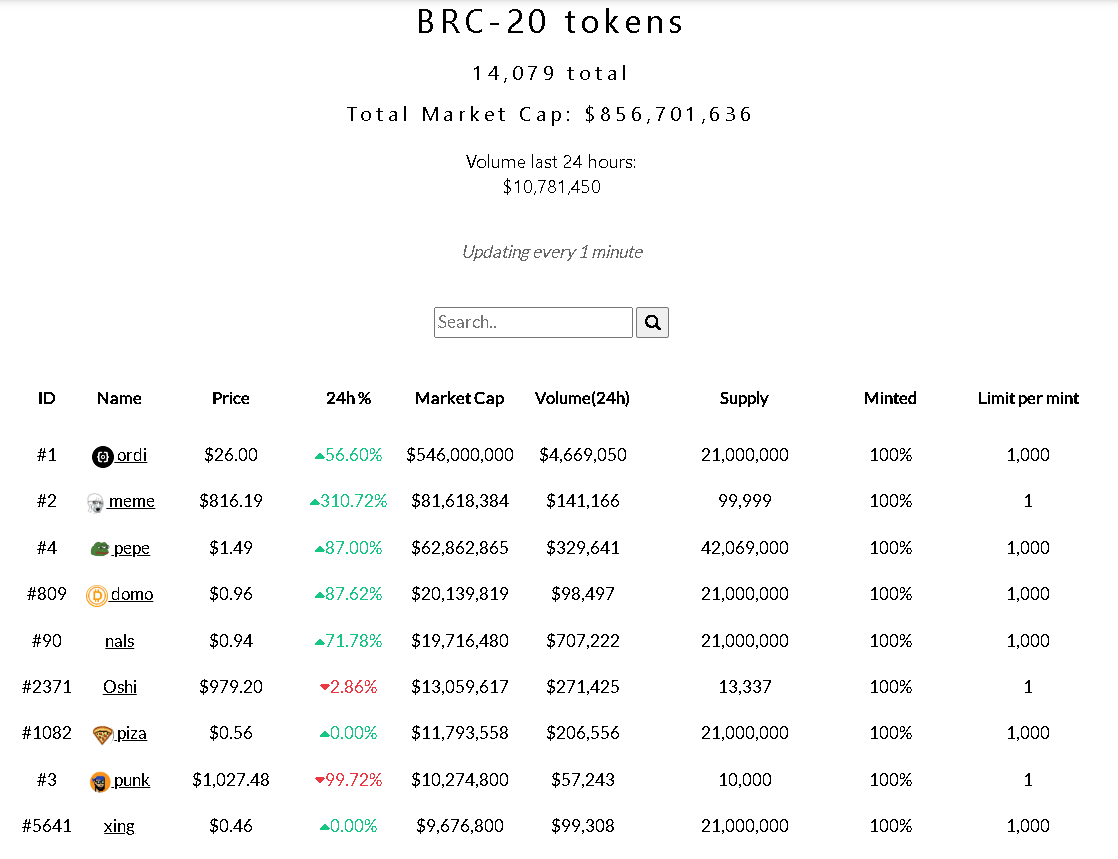

The recently listed token on Gate.io, $ORDI - a BRC-20 cryptocurrency that utilizes inscriptions recorded on the Bitcoin blockchain, has garnered massive attention from investors. Despite having a market cap of over $500 million, its volume was only $4 million in the last 24 hours, which is relatively low for a token with such a high cap.

The volume recorded here did not match what was shown in domo's Dune analysis, either.

Therefore, we suspected that Bitcoin was not optimized for scaling, so when a large number of users tried to mint this token, the network got congested and could not record the volume quickly enough.

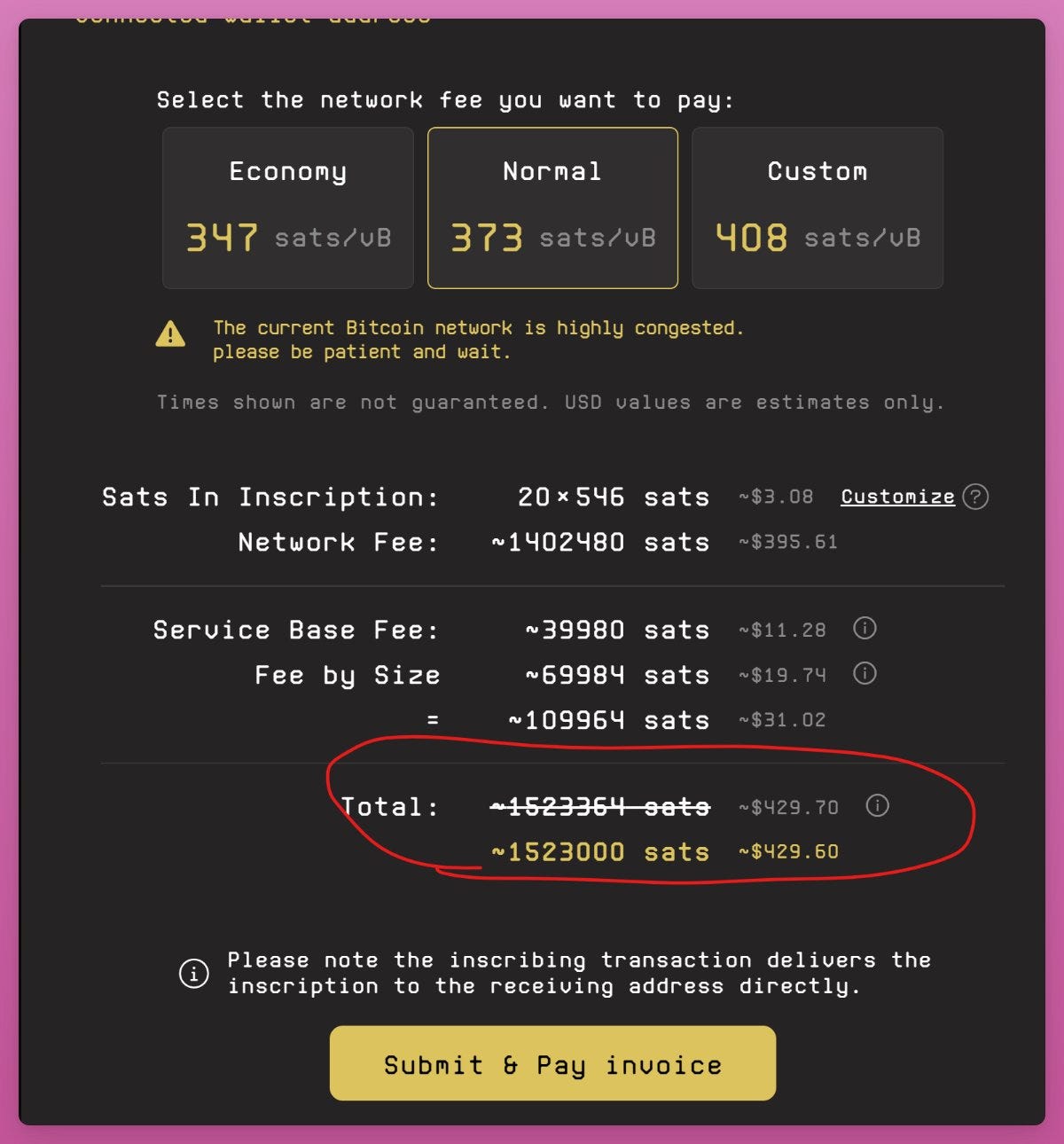

After much chasing this rabbit down the hole, we found that to trade on the Unisat marketplace, users must have an OG PASS (owned by 500 people) or 20 UniSat Inscribe belonging to BRC-20 standard on the Bitcoin blockchain.

However, due to the high transaction volume, the transaction fee to obtain 20 UniSat Inscribe on BRC-20 has increased significantly, up to $400, depending on the timing.

So Why were Users still FOMOing into BRC-20 Despite the High Transaction Fees?

The answer boils down to SOME being EARLY.

Some investors have racked in a massive profit by minting $ORDI tokens for only $1 in March while its current price has experienced an approximately 26-time sporadic spike (at the time of writing, $ORDI was trading at $26).

Moreover, BRC-20 is primarily filled with meme coins, and it is currently a meme coin season, so no surprise that people are jumping into tokens on BRC-20.

This sudden influx of demand did cause most meme coins’ prices to move north on May 7th, which resulted in transaction congestion, indicating that user buying power was high, resulting in rallies in meme coins’ price actions.

The main reason for this trend must largely stem from the ridiculous, yet auspicious, gain the $PEPE meme token (ERC-20) is bestowing on crypto users, which has enticed users to FOMO into meme tokens on Unisat Marketplace. However, in order to trade on this marketplace, users must first pay a network fee to acquire "20 UniSat Inscribe". That’s why the gas fees on BTC reached their all-time-high (ATH) level (7 folds) in May 2023, as per M3TA's statistics.

Conclusion

In summary, the recent congestion of the Bitcoin network can be attributed to the growing popularity of both $ORDI tokens and meme coins on the BRC-20 marketplace. However, this congestion also highlights the growing potential of the BRC-20 as more and more investors become aware of the opportunities offered by BRC-20.

It is likely that we will see an increase in the adoption and usage of BRC-20 in the coming months. Overall, the future of BRC-20 looks promising, and it will be interesting to see how it will change the Bitcoin network.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.