An Eye for a (Worldcoin) Prize

Last week, no particular narrative stood out, but the 'Blade Runner 2049'-like iris scanning of $WLD sparked excitement on the listing day and a hint of apprehension against looking in the Orb.

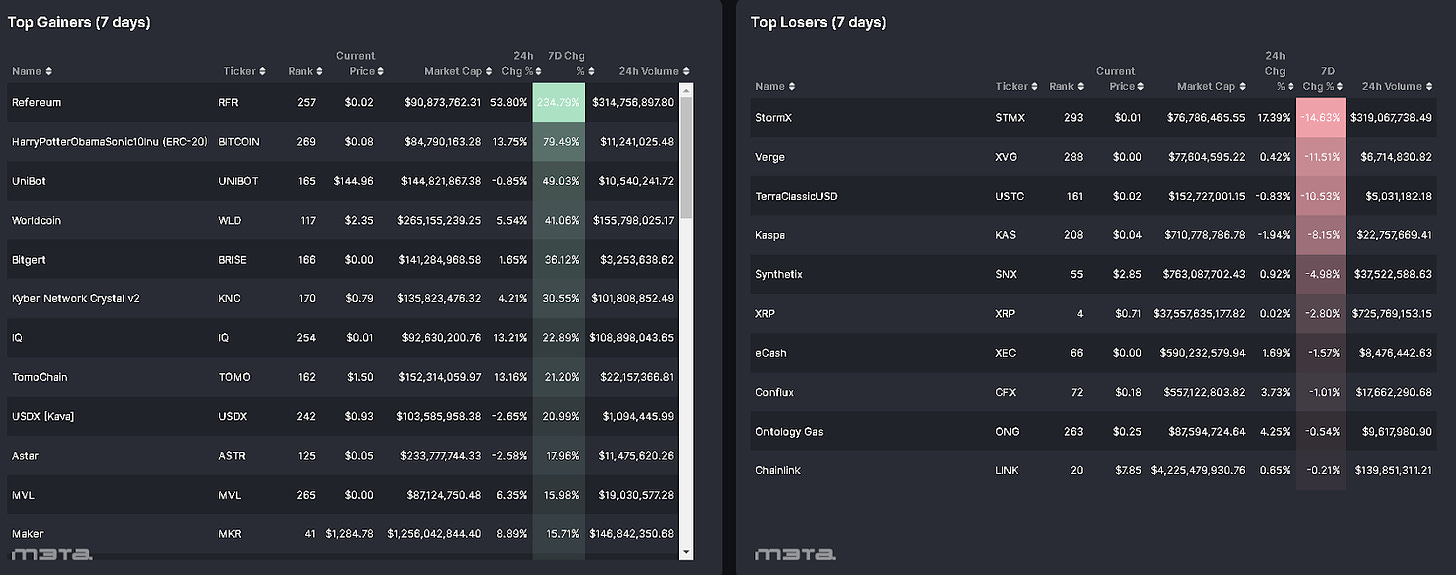

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

Top performers (7D)

Unibot - $UNIBOT: +49.03%

Price as of time of writing: UNIBOT/USD - $144.96

Unibot is a Telegram bot specializing in automated trading on the Uniswap decentralized exchange (DEX). It offers convenient features like sniping for instant token purchases upon listing and revenue sharing, making trading processes more streamlined and efficient.

The token surge follows the listing of a new category of Telegram bot by Coingecko.

Worldcoin - $WLD: +41.06%

Price as of time of writing: WLD/USD - $2.35

Worldcoin, backed by OpenAI's CEO Sam Altman, envisions a global identity and financial network accessible to everyone. They utilize Orb, a scanning device for iris recognition, to establish unique identities and distinguish real individuals from bots. Incentives in the form of $WLD are given to those who undergo this process, ensuring authenticity in an AI-driven era.

The token has seen a significant increase since the launch of WLD token on Jul 24, 2023.

Learn more about Worldcoin at this tweet!

Kyber Network Crystal v2 - $KNC: +30.55%

Price as of time of writing: KNC/USD - $0.79

Kyber Network is a multi-chain hub of liquidity protocols that aggregates liquidity from various sources to provide secure and instant transactions on any decentralized application (DApp). The main goal of Kyber Network is to enable DeFi DApps, decentralized exchanges (DEXs) and other user-friendly access to deep liquidity pools that provide the best rates.

The price of KNC surged after the project revealed its integration with the Linea chain.

IQwiki - $IQ: +22.89%

Price as of time of writing: IQ/USD - $0.01

IQwiki is an education project that merges AI and Blockchain technologies to enhance cryptocurrency knowledge. It consolidates a vast array of crypto-related topics and branches of knowledge onto the Polygon blockchain. The platform leverages the power of GPT-4 to power its comprehensive wiki product. Notably, Sam Kazemian, the founder of Frax Finance, is one of the co-founders of IQwiki.

The token, which was launched in 2018, experienced a surge as it teased the new stablecoin standard on Frax v3 as ‘leadked alpha'.

TomoChain - $TOMO: +21.20%

Price as of time of writing: TOMO/USD - $1.5

TomoChain is a Layer 1 based in Vietnam that supports all smart contracts, protocols, and seamless token transfers across different chains that are compatible with the Ethereum Virtual Machine (EVM).

The token experienced a rapid surge as the project hinted at an important announcement on X.

Top losers (7D)

StormX - $STMX: -14.63%

Price as of time of writing: STMX/USD - $0.0064

StormX is an online shopping platform and a partner with Samsung, Nike and Lego that allows customers to make purchases using cryptocurrencies. Customers receive cashback in the form of STMX tokens after making online purchases.

STMX was among the Top Performers 2 weeks ago.

Verge - $XVG: -11.51%

Price as of time of writing: XVG/USD - $0.0049

Verge offers user-friendly software that allows people to make secure payments using blockchain technology. They have created a payment app called Vergepay, which includes the Tor network to protect the privacy and enhance the speed of Bitcoin transactions.

XVG is on a 3-week streak of losing value.

Kaspa - $KAS: -8.15%

Price as of time of writing: KAS/USD - $0.04

Kaspa is a PoW cryptocurrency that uses the GHOSTDAG protocol, whose way of working could be loosely compared to sharding. Thanks to GHOSTDAG protocol, transactions can take place concurrently across different chains, unlike traditional blockchains which usually facilitate one by one.

KAS was among the Top Performers 2 weeks ago.

Synthetix - $SNX: -4.98%

Price as of time of writing: SNX/USD - $2.85

Synthetix is a lending and borrowing protocol that allows users to collateralize and mint synthetic assets (tokens represent real-word assets) on the Ethereum and Optimism networks.

SNX was among the Top Performers 3 weeks ago.

Ripple - $XRP: -2.8%

Price as of time of writing: XRP/USD - $0.71

Ripple is an open-source, permissionless, and decentralized technology that serves as a payment settlement system and currency exchange network, capable of processing global transactions. Ripple also supports countries in launching Central Bank Digital Currencies (CBDCs).

XRP was among the Top Performers 3 weeks ago.

Excluding $XVG, these tokens are experiencing price declines as a corrective measure following a surge in prices over the past few weeks.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Interest rate - a key indicator of the economy as it affects the cost of borrowing and lending money. A higher interest rate indicates that borrowing money is more expensive, while a lower interest rate indicates that borrowing is more affordable.

FED raised rates by 25 bps in July after pausing in June, highest level in 22 years.

Gross Domestic Product (GDP) - a measure of the total monetary value of all final goods and services produced within a country during a specified time period.

The US GDP grew at an annualized rate of 2.4% in Q2, exceeding market expectations of 1.8%.

Personal Consumption Expenditures Price Index (PCE) - measure how much people in the US are paying for goods and services.

Core PCE rose 0.2% on the month and 4.1% YoY, slightly below the estimated 4.2%. It's the lowest rate since September 2021, down from May's 4.6%.

Joe Brusuelas, the U.S. chief economist at RSM, stated that it is time for the Federal Reserve to give the economy sufficient time to absorb the impact of past rate hikes.

Micro

CoinTelegraph - Jul 26, 2023

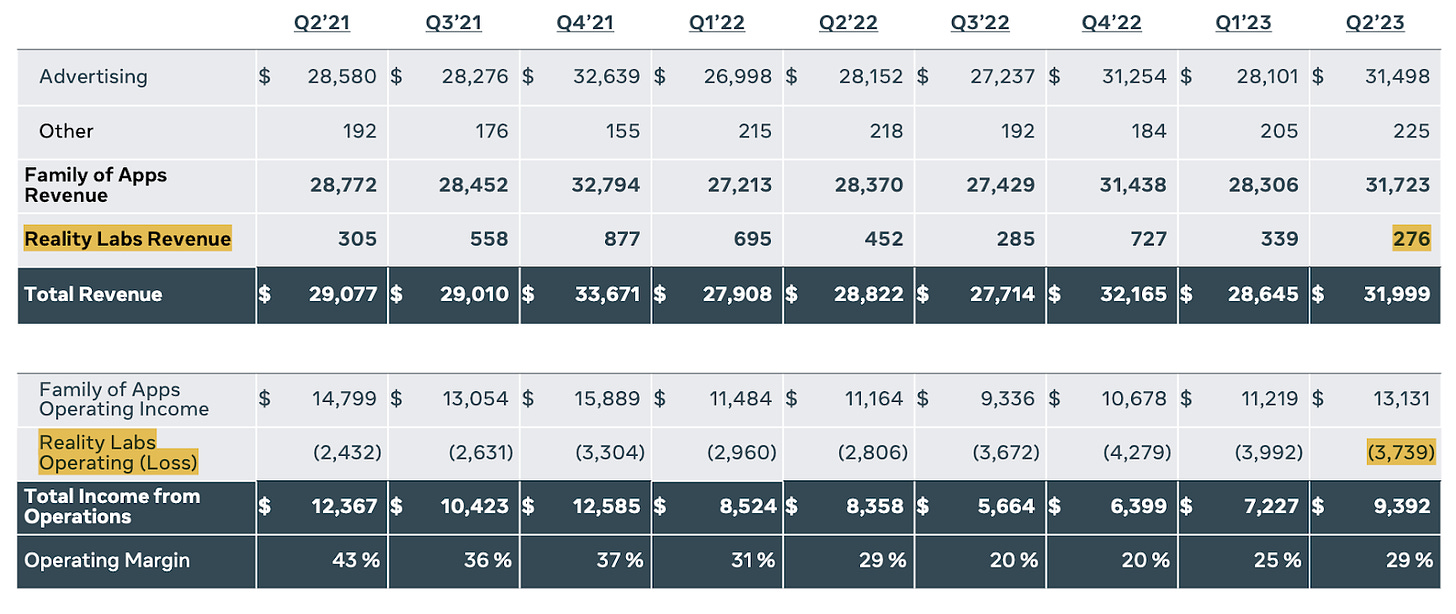

Meta's Reality Labs unit, encompassing augmented reality, virtual reality, and the metaverse software platform, reported a net loss of approximately $3.7 billion in Q2 2023.

Meta's Facebook Reality Labs (FRL) division, responsible for the metaverse, faced a loss of $13.7 billion in 2022 with $2.2 billion in revenue, compared to a loss of $10.2 billion and $2.3 billion in revenue in 2021.

Mark Zuckerberg reaffirmed Meta's strong commitment to both AI and the Metaverse, despite the financial challenges.

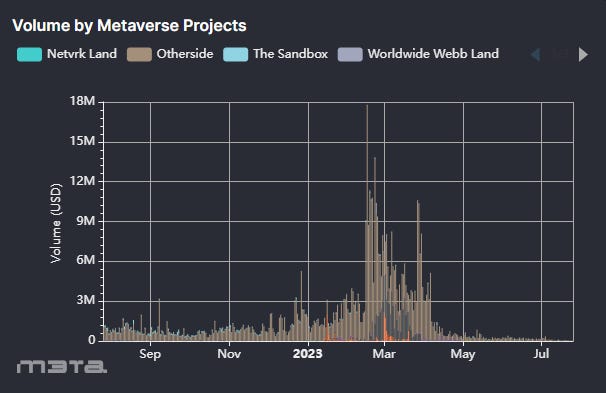

The Q2 2023 volume in the crypto's Metaverse has been lower than expected, raising doubts about the momentum of the Metaverse trend.

This corresponds to the decline in the number of NFT buyers, as NFTs and the Metaverse have a strong connection.

M3TA Telegram - Jul 25, 2023

On July 26, U.S. lawmakers convened for a "markup" session to review, discuss, amend, and vote on the three bills:

HR 4763 - The Financial Innovation and Technology for the 21st Century Act:

Establishes guidelines for defining security in the context of digital assets.

Sets regulations for exchanges and brokers dealing with digital assets.

Proposes the creation of a standard advisory commission.

HR 4766 - The Clarity for Payment Stablecoins Act of 2023:

Outlines regulatory recommendations for payment stablecoins and their issuers.

HR 1747 - The Blockchain Regulatory Certainty Act:

Aims to exempt blockchain developers and service providers from being considered financial brokers, except when they own digital assets.

The Financial Innovation and Technology for the 21st Century Act and the Blockchain Regulatory Certainty Act have both passed the congressional committee successfully.

News Highlight

M3TA Twitter - Jul 30, 2023

Blockworks - Jul 27, 2023

Worldcoin, a crypto project backed by Sam Altman, the CEO of OpenAI (ChatGPT) made a debut with the launching of $WLD on July 24 across several exchanges.

What makes the project difference is the Proof of Personhood (PoP). You can read more about Worldcoin at our X thread!

However, according to Vitalik, there are some related risks including privacy concerns with iris scanning, limited accessibility due to the hardware nature of Orbs, potential centralization issues, and security vulnerabilities from phone hacking and fake identity creation.

There is actually a black market for verified credentials, with World IDs available for as little as $30. This allows anyone with enough money to obtain multiple digital identities, posing a challenge in connecting real people to digital identities.

M3TA - Jul 31, 2023

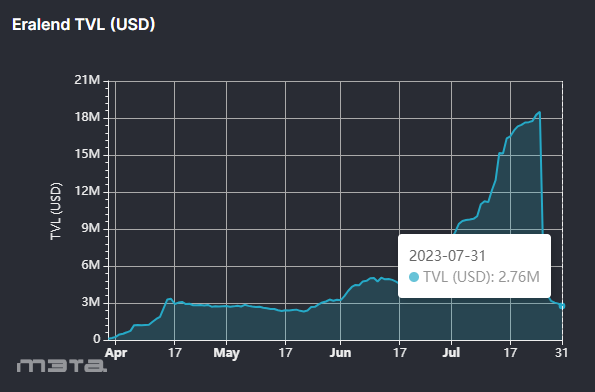

Eralend, a lending protocol on zkSync, experienced a $3.4M exploit due to a read-only reentrancy vulnerability in the USDC pool.

The exploit was caused by an issue in Eralend's LP oracle, which incorrectly used pool reserve amounts instead of balance amounts to determine LP price.

The attacker manipulated the oracle price by re-entering with the yet-to-be-updated reserves.

The reserve update behavior is part of SyncSwap pool's intended design, as mentioned in the source code. Eralend is a fork of the SyncSwap project.

The problem has been resolved, and temporary compensation measures have been implemented to address the negative market reaction.

However, the protocol's Total Value Locked (TVL) dropped significantly from $18.51M to $2.76M (as of time of writing) as a result of the incident.

Eralend allows users to lock lending assets in the project. However, after the exploit, users may have withdrawn both the original and lent assets, leading to this dip.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.