A Quiet Crypto Week

Despite several positive updates from various projects last week, it appears that these developments were not sufficient to sustain investors' sentiment, resulting in a gradual decrease in BTC price.

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

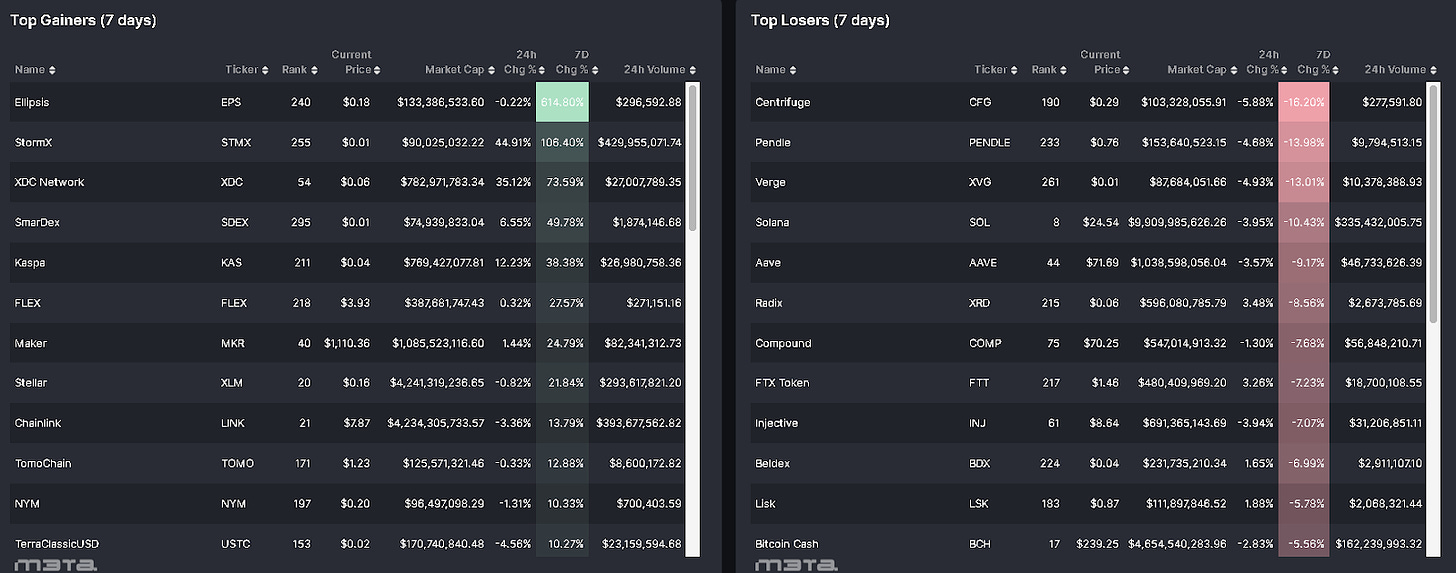

Top performers (7D)

StormX - $STMX: +106.4%

Price as of time of writing: STMX/USD - $0.01

StormX is an online shopping platform and a partner with Samsung, Nike and Lego that allows customers to make purchases using cryptocurrencies. Customers receive cashback in the form of STMX tokens after making online purchases.

After a smart contract issue related to STMX on Binance, the price of STMX experienced a sudden increase.

XDC Network - $XDC: +73.59%

Price as of time of writing: XDC/USD - $0.06

XDC Network is an open-source and EVM-compatible blockchain protocol. With its ability to tokenize real-world assets and financial instruments, it has the potential to revolutionize and decentralize the finance trading industry.

The mention of The International Trade and Forfaiting Association (ITFA), partner of XDC Network in significant news about the signing of The Electronic Trade Documents Bill could be a key factor behind the surge in XDC.

The bill aims to change the way of international trading from paper to electronic.

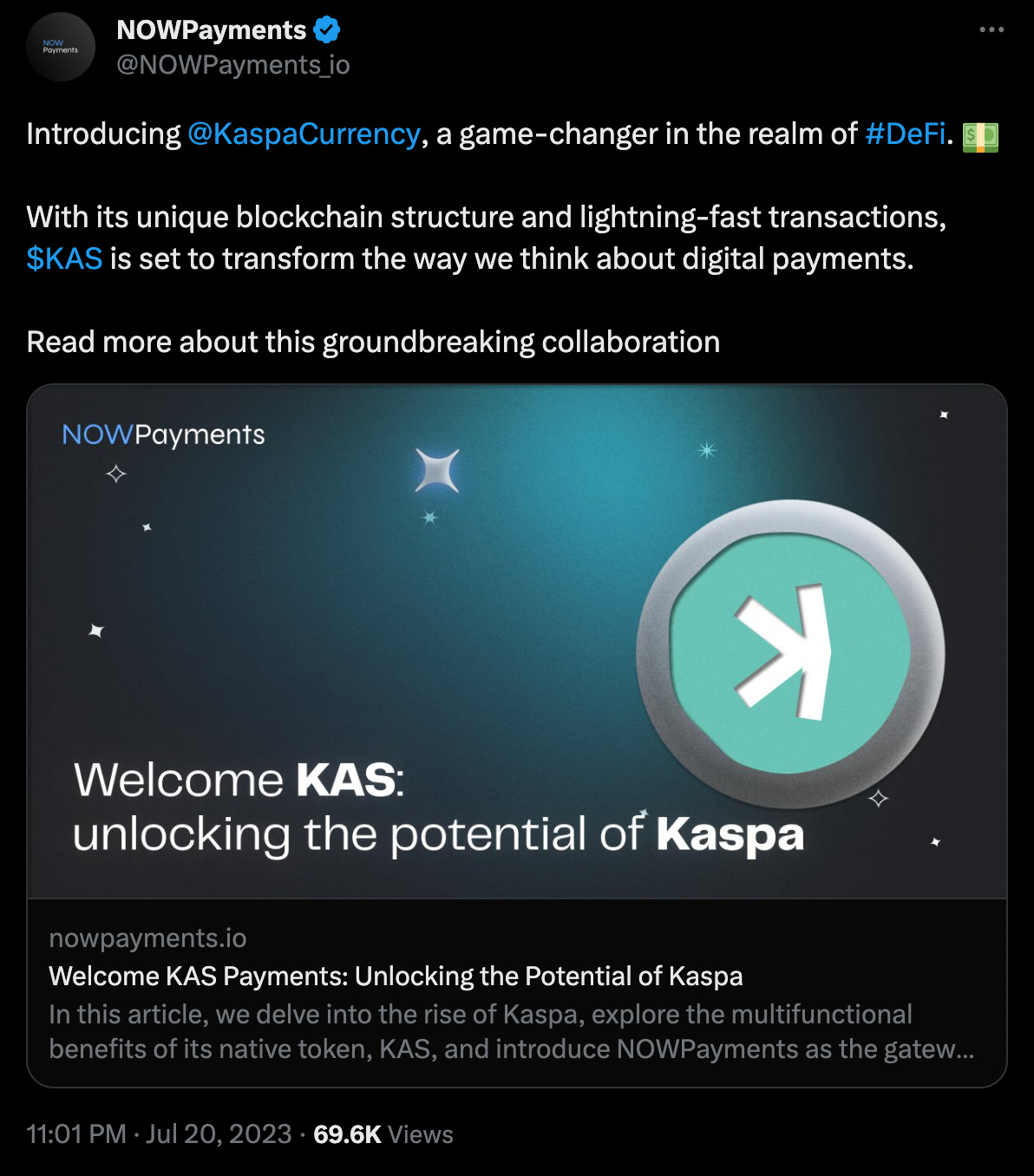

Kaspa - $KAS: +38.38%

Price as of time of writing: KAS/USD - $0.04

Kaspa is a PoW cryptocurrency that uses the GHOSTDAG protocol, whose way of working could be loosely compared to sharding. Thanks to GHOSTDAG protocol, transactions can take place concurrently across different chains, unlike traditional blockchains which usually facilitate one by one.

NOWPayments, a payment gateway for cryptocurrencies, has started accepting $KAS as a payment option, leading to a significant increase in the price of Kaspa.

CoinFlex - $FLEX: +27.57%

Price as of time of writing: FLEX/USD - $3.93

CoinFLEX (Coin Futures and Lending Exchange) is a cryptocurrency exchange that focuses on futures and perpetual contracts. Unlike other exchanges that offer spot trading, CoinFLEX also offers an Automated Market Maker (AMM+) feature that allows users to earn yield without dedicating much time or effort to actively trade.

The recent surge in price could potentially be attributed to price manipulation, considering CoinFLEX is currently in the process of transitioning from FLEX to OX.

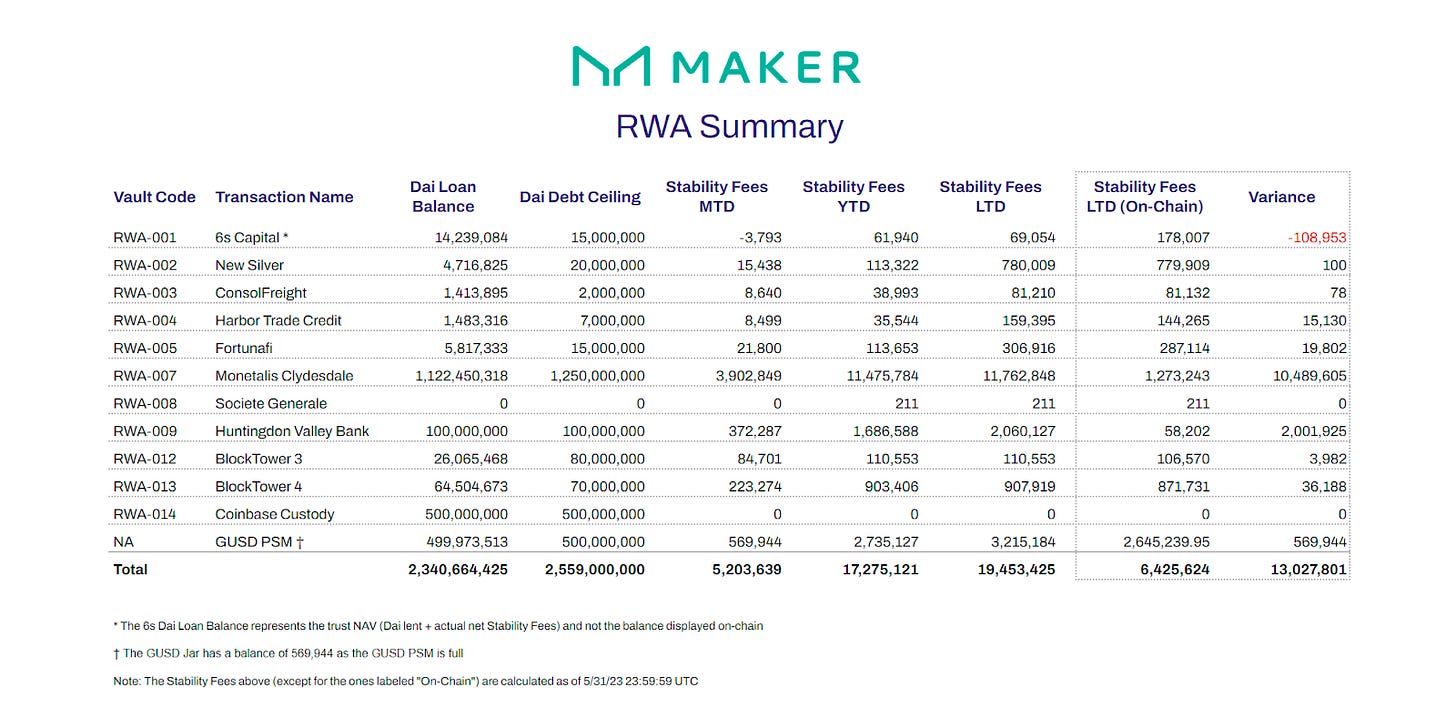

Maker - $MKR: +24.79%

Price as of time of writing: MKR/USD - $1,110.36

Maker is a Collateralized Debt Positions (CDP) platform built on Ethereum that allows users to issue and manage the stablecoin DAI.

On July 12, the project celebrated a significant milestone as its Real-World Assets (RWA) portfolio reached an impressive 2.34 billion DAI. A mere two days later, they presented proposals to enhance Maker's operations, receiving a positive response from the community. This favorable reception contributed to an increase in MKR price.

Top losers (7D)

Centrifuge - $CFG: -16.2%

Price as of time of writing: CFG/USD - $0.29

Centrifuge is a DeFi lending protocol on Polkadot blockchain making credit accessible to small businesses while offering stable yields to investors by opening liquidity to traditional finance. Its dApp, Tinlake, is a marketplace for tokenized real-world assets, enabling companies to use NFTs as collateral for loans and access funds from individual investors, and linking users to liquidity pools on Ethereum.

Pendle - $PENDLE: -13.98%

Price as of time of writing: PENDLE/USD - $0.76

Pendle Finance is a yield trading protocol that facilitates the exchange of tokenized future yield within an AMM system. Pendle also has a mechanism that allows users to avoid Impermanent loss.

PENDLE was among the Top Performers 4 weeks ago.

Verge - $XVG: -13.01%

Price as of time of writing: XVG/USD - $0.01

Verge offers user-friendly software that allows people to make secure payments using blockchain technology. They have created a payment app called Vergepay, which includes the Tor network to protect the privacy and enhance the speed of Bitcoin transactions.

XVG is on a 2-week streak of losing value.

Solana - $SOL: -10.43%

Price as of time of writing: SOL/USD - $24.54

Solana is a protocol that operates on a single chain and uses a delegated proof of stake (PoS) mechanism. The Solana blockchain has a high processing capacity and is designed using a combination of proof of history (PoH) and proof of stake (PoS) technologies.

PENDLE was among the Top Performers 3 weeks ago.

AAVE - $AAVE: -9.17%

Price as of time of writing: AAVE/USD - $71.69

Aave is an open-source protocol that enables the creation of non-custodial liquidity markets, allowing users to earn interest by supplying and borrowing assets with variable or stable coins.

The sideways momentum of BTC is gradually diminishing, likely contributing to the decline in these tokens.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Retail Sales - which track consumer demand for finished goods over time by measuring purchases of durable and non-durable goods.

Retail sales in the US recorded a modest 0.2% month-over-month increase. This followed a revised upward growth of 0.5% in May. However, the figure fell short of the projected 0.5% rise as per forecasts.

The report did not alter expectations that the Federal Reserve would resume raising interest rates this month after maintaining them unchanged in June.

Micro

Decrypt - Jul 18, 2023

Chainlink’s CCIP (Chainlink Cross-Chain Interoperability Protocol) has officially been launched on Avalanche, Ethereum, Optimism, and Polygon, and is now adopted by Aave and Synthetix.

Chainlink CCIP enables secure cross-chain functionality for dApps and web3 entrepreneurs, encompassing token transfers and messaging via a user-friendly interface.

Chainlink has already partnered with major players in traditional finance such as Swift, BNY Mellon, Citigroup, and BNP Parabens to enable these institutions to access real-world asset tokens.

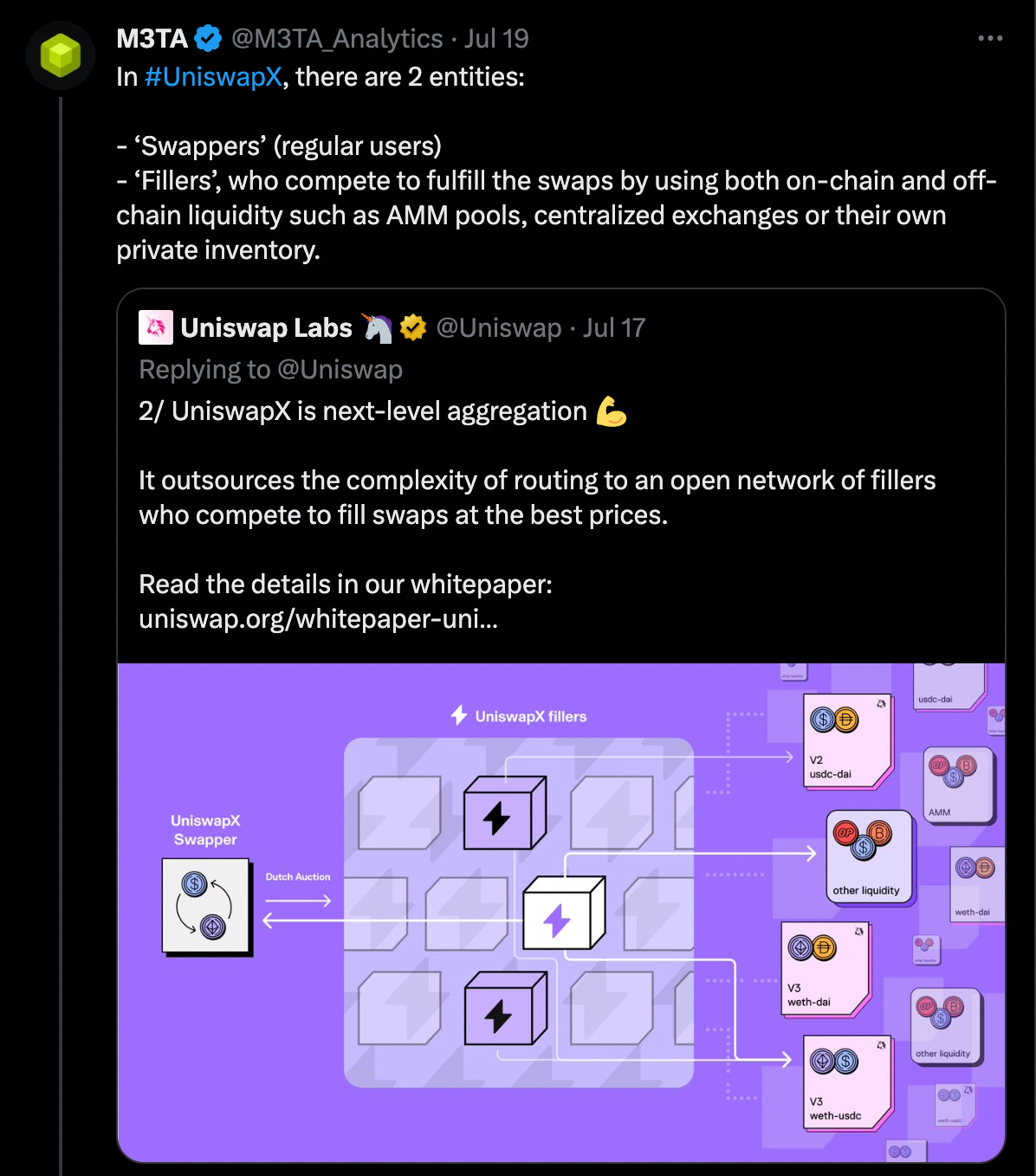

Uniswap - Jul 17, 2023

Uniswap launched a beta version of UniswapX, a permissionless, open-source, Dutch auction-based protocol for efficient trading across AMMs and liquidity sources.

In UniswapX, Swappers interact with third-party Fillers (MEV searchers, market makers, etc.) instead of LP pools for token swaps.

News Highlight

Yahoo Finance - Jul 20, 2023

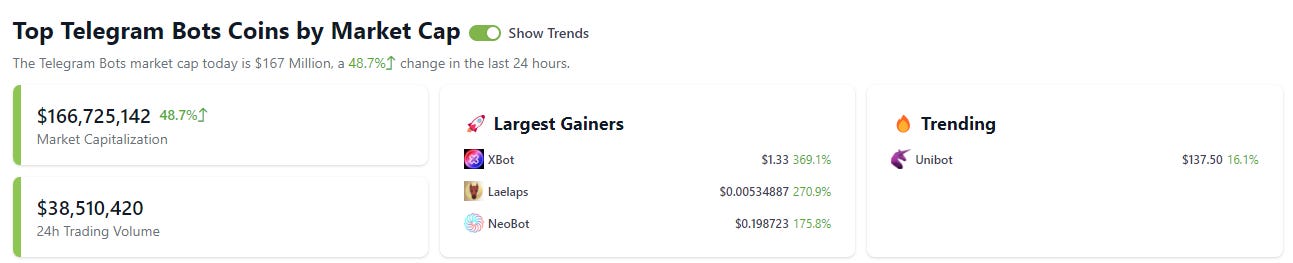

Telegram bot tokens reached a market cap of over $166 million as of time of writing.

Telegram bots for decentralized applications are automated programs that facilitate on-chain trading or farming strategies via the messaging app. Users can link wallets to the bots or create new Ethereum wallets within them.

Unibot is the most popular Telegram bot in the niche, offering automated trading on the Uniswap decentralized exchange (DEX). It features snipping for instant token purchases after listing and revenue sharing, simplifying trading processes.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.