A Frightening Friday or a DCA Opportunity?

BTC slumped to 26K in one night, crashing the whole market. Some cry, some DCA while SEI and Shibarium locked their Discord chat. Find out what happened during the past chaotic week in this M3TA Recap

Despite the conspicuous ranking of price gain among projects, M3TA only chooses to analyze those that pass our Authenticity Test of:

being listed on multiple centralized exchanges

having a market cap larger than $90M

hosting a 24H volume of at least $500K

reputable backers

teams with consistent and proven track records

Explore our Market Mover Report now on m3talab.io!

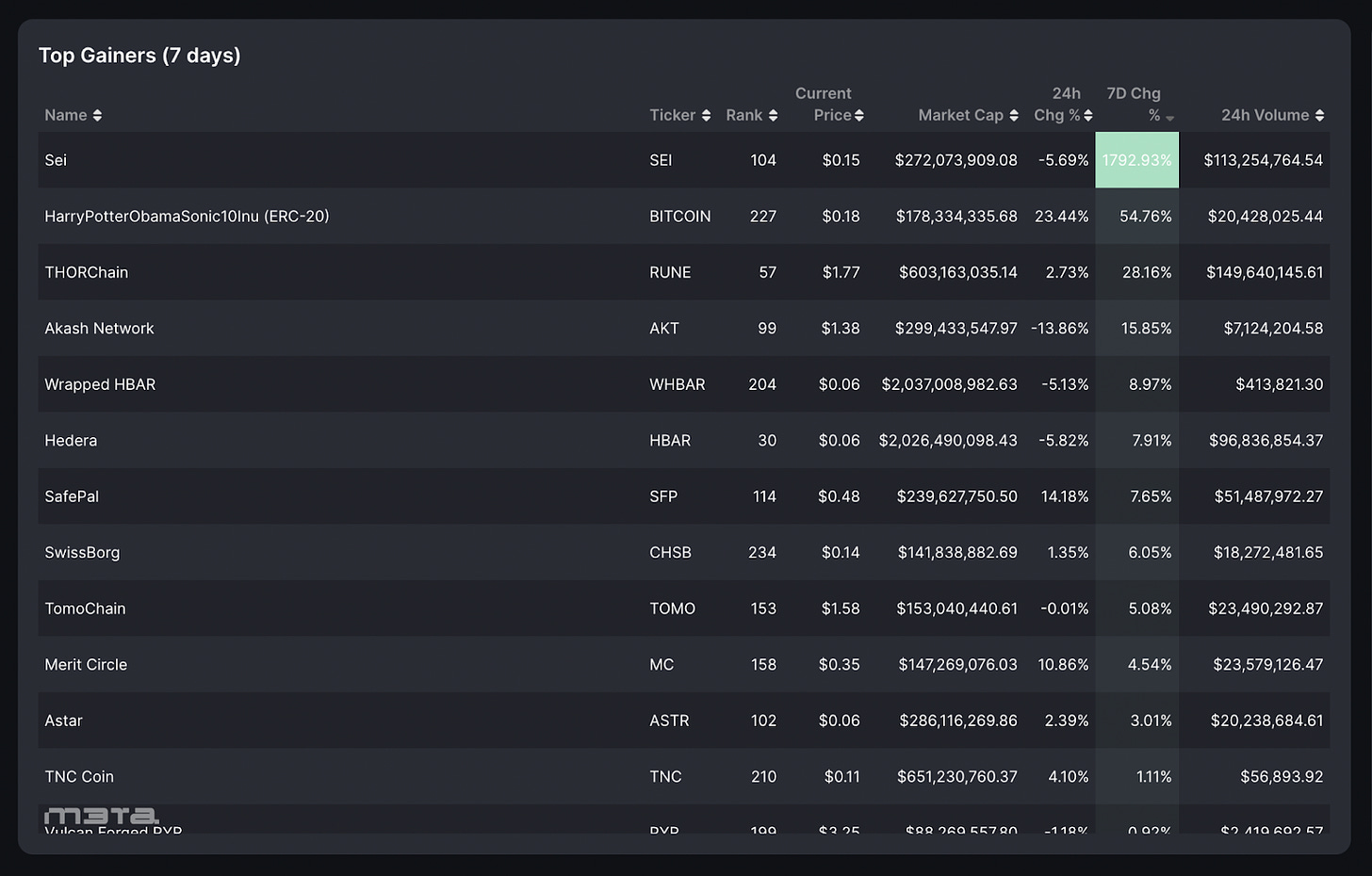

Top performers (7D)

Despite Sei Network's ($SEI) strong performance, we're not selecting it due to community concerns about its poorly executed airdrop distribution. Details are below.

Thorchain - $RUNE: +28.16%

Price as of time of writing: RUNE/USD - $1.77

THORChain operates as an independent Layer 1 cross-chain decentralized exchange (DEX) built on the Cosmos SDK.

In early August, the project plans to implement an open lending and borrowing system within the THORChain ecosystem. This system will involve the burning of the RUNE token during the opening and closing of positions. This mechanism might contribute to a potential price increase for $RUNE.

Akash Network - $AKT: +15.85%

Price as of time of writing: AKT/USD - $1.38

Akash Network is a decentralized marketplace for cloud computing that offers a speedy, efficient, and cost-effective solution for deploying dApps.

The price of $AKT continues its upward trend following the launch of "akash-a-thon”.

Akash led the Top Performer list 2 weeks ago.

Hedera - $HBAR: +7.91%

Price as of time of writing: HBAR/USD - $0.06

Hedera is a blockchain that employs the Hashgraph consensus system, a form of Proof of Stake (POS). Within the Hedera hashgraph network, technologies such as Sharding, Staking, and smart contracts are utilized to enhance transaction speed in comparison to other blockchain systems.

The price surged as on August 14th when the Dropp micropayments platform, constructed on the Hedera Hashgraph network, was chosen as a service provider for the United States Federal Reserve's instant payments system, FedNow. Dropp facilitates micropayments for minor-value transactions using HBAR, USDC, and US dollars.

SafePal - $SFP: +7.65%

Price as of time of writing: SFP/USD - $0.48

SafePal is a cryptocurrency wallet introduced in 2018 and invested in by Binance. SafePal offers a range of products, including a software wallet, a hardware wallet, the SafePal app for managing both software and hardware wallets, and several other applications. It also supports various digital assets on different blockchain networks..

The update of SafePal wallet app version 4.1.0 could potentially impact the buying sentiment.

TomoChain - $TOMO: +5.08%

Price as of time of writing: TOMO/USD - $1.58

TomoChain is a Layer 1 based in Vietnam that supports all smart contracts, protocols, and seamless token transfers across different chains that are compatible with the Ethereum Virtual Machine (EVM).

The price experienced a minor increase in response to the announcement of Tomo, Coin98, and Dagora (an NFT marketplace) co-hosting Coinfest Asia on August 23, 2023, in Bali.

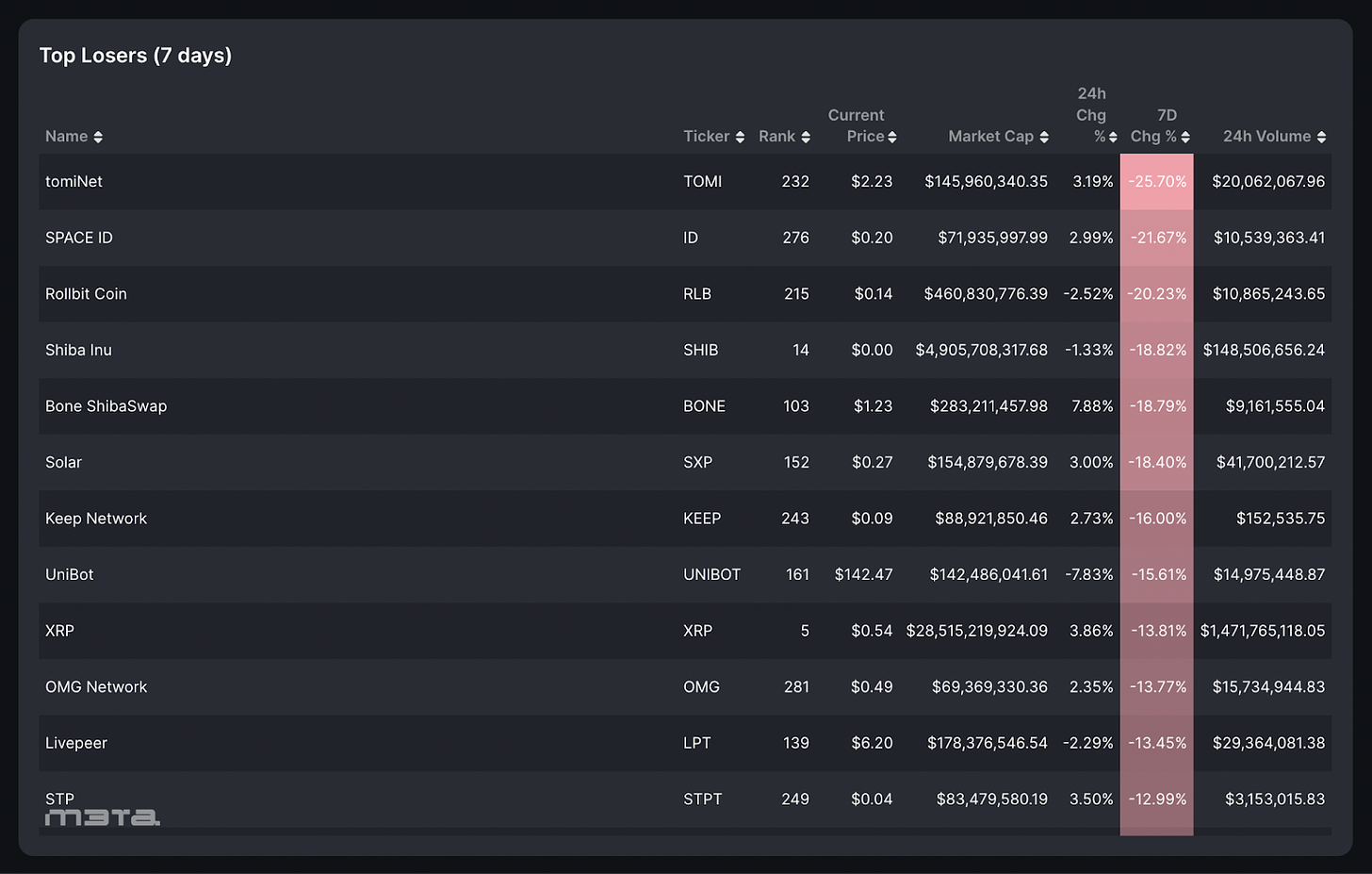

Top losers (7D)

tomiNet - $TOMI: -25.7%

Price as of time of writing: TOMI/USD - $2.23

tomi is a web3 company that leverages decentralized DNS, including high-performance computing technology, a multi-chain wallet, and a unique browser to enhance the decentralization of digital assets and cloud services. Their ultimate goal is to establish a web3 internet infrastructure that optimizes decentralization.

SpaceID- $ID: -21.67%

Price as of time of writing: ID/USD - $0.2

Space ID is a network that helps you name your web3 domain on different blockchains like Ethereum (ENS domain), BNB Chain and Arbitrum.

The plummeting price of SpaceID causes its market cap to be lower than $90M.

Rollbit - $RLB: -20.23%

Price as of time of writing: RLB/USD - $0.14

Rollbit serves as a hub for lotteries and various betting options, alongside offering Futures trading with leverage reaching up to 1000x for over 20 prominent trading pairs. Those participating in the lottery commit a specific quantity of RLB tokens, earning them 20% of Rollbit casino's revenue as incentives.

RLB was among the Top Performers 2 weeks ago.

Shiba Inu- $SHIB: -18.82%

Price as of time of writing: SHIB/USD - $0.00000827

Shiba Inu is an Ethereum layer-2 that offers speedy and affordable transactions, with a focus on finance, metaverse & gaming while also serving as a cost-effective platform for DeFi projects.

$SHIB was a meme token themed after the Shiba Inu dog breed and inspired by Dogecoin $DOGE.

ShibaSwap - $BONE: -18.79%

Price as of time of writing: BONE/USD - $1.23

ShibaSwap is a decentralized exchange (DEX) project within the Shiba ecosystem that helps Shiba holders earn profits by providing Liquidity Pool and Staking on ShibaSwap. Currently, the project is still in the testnet phase.

BONE was among the Top Performers 8 weeks ago.

The market didn't perform well last week following the crash of BTC last Friday, leading to a decline in most tokens. SEI and SHIB had two strong marketing launches, but they encountered deployment issues, which will be discussed below.

Macro

Our U.S. Market Macro Report keeps track of the following metrics in the past week:

Retail Sales - which track consumer demand for finished goods over time by measuring purchases of durable and non-durable goods.

In July, retail sales in the US surged by 0.7%, surpassing the expected 0.4% increase. This figure comes after June, where sales saw a 0.3% uptick (revised from 0.2%).

Liz Miller, the Founder and President of Summit Place Financial Advisors, has expressed that the robust U.S. retail sales data in July, while positive, might prompt the Federal Reserve to consider further interest rate hikes as part of their strategy to control inflation.

Micro

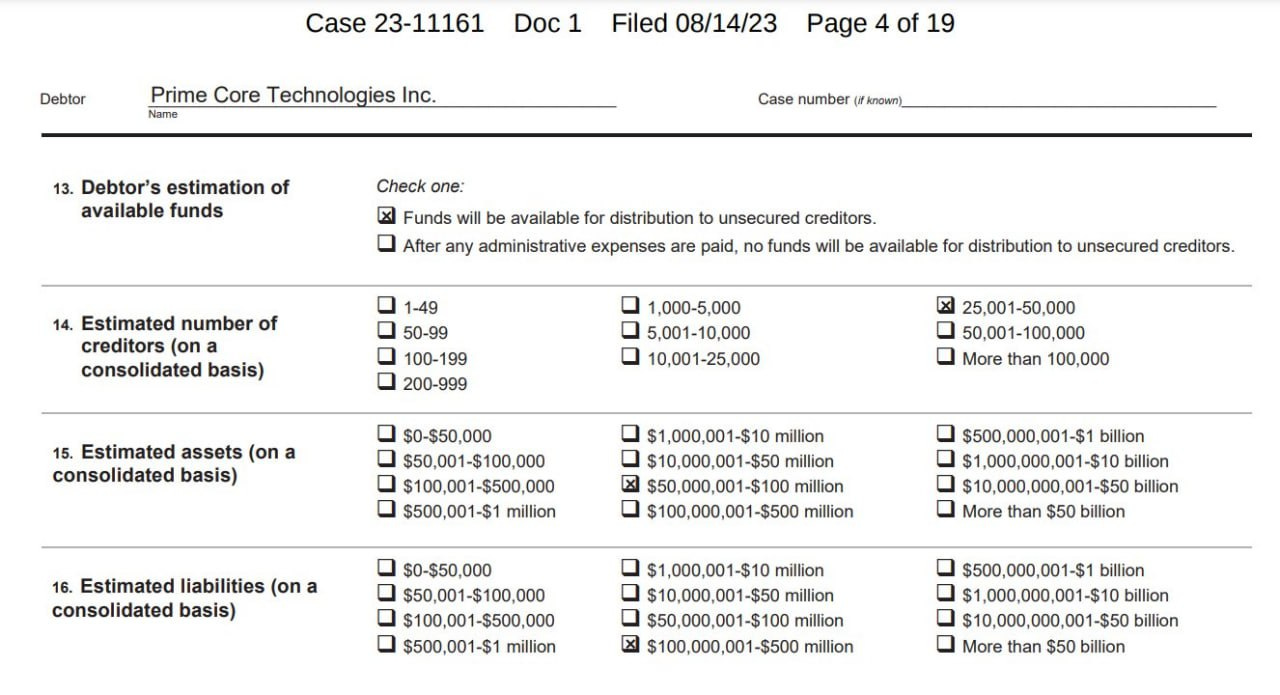

M3TA Analytics - Aug 15, 2023

Prime Trust is a financial infrastructure provider and crypto custodian focused on providing banking access for the crypto industry.

According to a document filed on August 15:

The company owes money to 25,000 to 50,000 creditors.

The owed amount ranges from $100 million to $500 million.

The company's assets are valued at approximately $50 million to $100 million.

The company is considering selling parts of itself and aims to continue paying its employees.

Top creditors are requesting around $105 million in total, with the largest claim at $55 million.

After facing legal issues that restricted its operations, the company sought protection through Chapter 11 relief.

Prime Trust owed customers over $85 million and had liabilities of about $69.5 million tied up in digital currencies.

M3TA Analytics - Aug 17, 2023

Jacobi Asset Management launched Europe's first spot Bitcoin ETF on Euronext Amsterdam stock exchange on August 15.

The ETF is named Jacobi FT Wilshere Bitcoin ETF and operates under the regulation of the Guernsey Financial Services Commission (GFSC).

It is traded with the ticker symbol "BCOIN."

Custodial services for the fund are provided by Fidelity Digital Assets. Custodial services for the fund are offered by Fidelity Digital Assets, a platform that offers top-tier security, trading, and investment management for digital assets, and trading firm Flow Trading serves as the market maker.

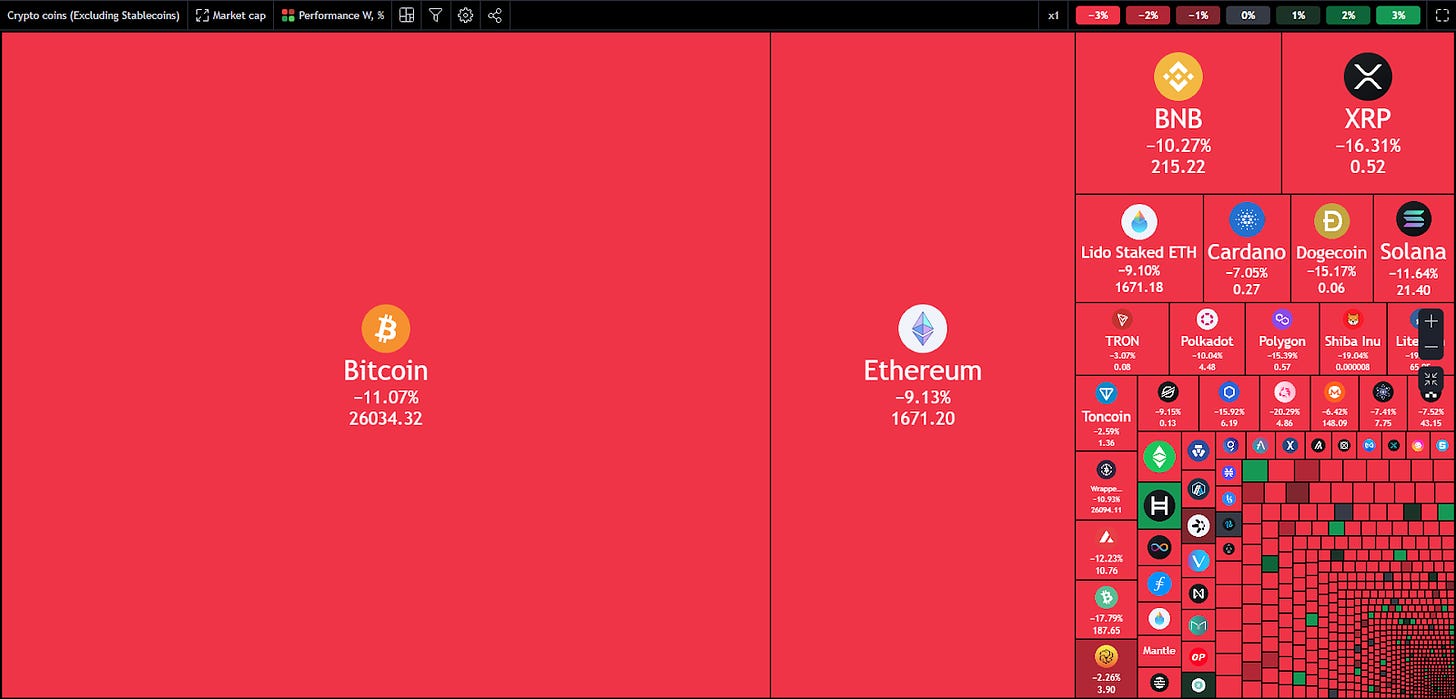

The Market Goes Down

M3TA Analytics - Aug 20, 2023

BTC experienced a rapid decline of over 10% in just one week, falling from 29k to 26k, affecting the entire market.

Even whales were observed selling BTC and ETH during this market crash, according to Whale Alert.

The fear and greed index shifted to a reading of 37, indicating a prevailing sense of uncertainty and caution in the market.

Potential reasons for this decline include rumors of SpaceX selling BTC and concerns surrounding Evergrande (the Chinese giant property developer)'s bankruptcy.

SpaceX reportedly sold $373 million worth of bitcoin in 2021 and 2022, while Tesla liquidated over 30,000 bitcoins valued at $936 million in Q2 2022, according to WSJ.

Evergrande filed for Chapter 15 bankruptcy protection after a debt default in 2021, leading to concerns about its impact on the market.

News Highlight

M3TA Analytics - Aug 17, 2023

Sei Labs, the creators of Sei Blockchain, launched the network's mainnet on August 15, 2023, following a testnet phase involving 7.5 million unique wallets and over 400 million transactions.

The launch faced challenges and backlash due to certain issues:

Users were unable to claim the airdrop even after the token launch.

Lack of clear criteria for the airdrop caused confusion among users.

The hashtag #seiscam trended on X and Discord as users expressed their discontent.

In response to the negative feedback, Sei Labs disabled language channels on Discord to manage the situation.

CoinTelegraph - Aug 17, 2023

On August 16th, Shiba Inu launched the Shibarium mainnet, a scaling solution on Ethereum's layer-2 technology.

Shiba Inu's main developer, known as Shytoshi Kusama, highlighted the attention Shibarium had received from new projects before the mainnet release with over 100 companies utilizing Shibarium technology for development.

Despite the anticipation, Shiba Inu (SHIB) tokens dropped by 9% within 24 hours of the Shibarium mainnet launch.

Why?

Bridging issues were widely reported after the launch, leading to the token's decline.

The Shibarium cross-chain bridge is facing a problem where $1.73 million worth of 964.46 ETH is locked and unrecoverable.

What happened after that?

Shib's Discord channel blocked users from messaging after reports of the issues emerged.

On the date of Aug 17, Shytoshi Kusama said that the technical difficulties on Shibarium was caused by a substantial surge in transactions and user activity.

Disclaimer

The views expressed herein are for informational purposes only and should not be considered as investment advice. They may not necessarily represent the opinions of M3TA. As every investment and trading opportunity carries risk, you should conduct your own research before making any decisions. M3TA assumes no responsibility for our users' investment activities or their profits or losses. The articles, data, and content provided by M3TA should not be relied upon for any investment-related decisions. We do not advise investing funds you cannot afford to lose.

This article, encompassing text, data, content, images, videos, audio, and graphics, is presented for informational purposes only and is not intended for trading purposes. M3TA cannot guarantee the accuracy, comprehensiveness, or timeliness of the content, documents, data, materials, or website pages accessible through any service, and neither M3TA nor any of its affiliates, agents, or partners shall be liable to you or anyone else for any loss or injury caused in whole. The content available through this website is the property of M3TA and is safeguarded by copyright and other intellectual property laws. Failing to provide proper citation may result in being accused of plagiarism.